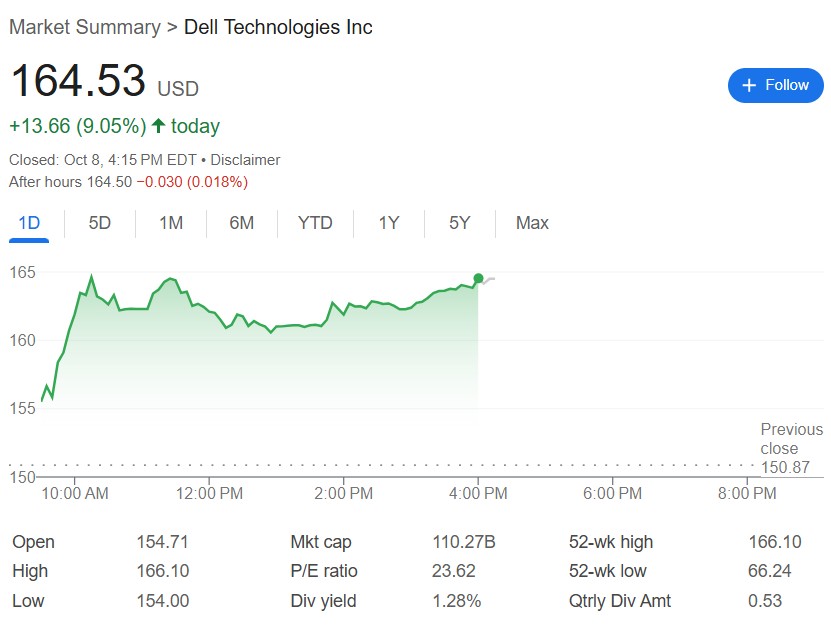

Investment banks collectively bullish, Dell's stock price target raised consecutively, stock price surged 9% in a single day

週三,瑞銀集團將戴爾目標價從 155 美元大幅上調至 186 美元,漲幅達 20%,同時維持買入評級。此前,瑞穗證券也將目標價從 160 美元上調至 170 美元,Melius Research 更是給出 200 美元的目標價。這些調整反映出分析師普遍認為,戴爾在企業級 AI 領域的領導地位將轉化為可持續的收入和利潤增長。

戴爾科技股價近日持續走強,多家投行紛紛上調其目標價,反映出分析師對該公司 AI 業務增長前景的強烈信心。

週三,瑞銀集團將戴爾目標價從 155 美元大幅上調至 186 美元,漲幅達 20%,同時維持買入評級。此前,瑞穗證券也將目標價從 160 美元上調至 170 美元,Melius Research 更是給出 200 美元的目標價。

這些調整反映出分析師普遍認為,戴爾在企業級 AI 領域的領導地位將轉化為可持續的收入和利潤增長。戴爾股價週三收漲超 9%,市值漲至 1100 億美元,過去六個月已累漲 110%。

(戴爾科技日內股價走勢)

(戴爾科技日內股價走勢)

華爾街見聞此前提及,戴爾大幅上調未來四年業績指引,同時承諾將通過持續的股息增長回報股東,還成功完成了 45 億美元的優先票據發行,為其未來發展提供了充足的資金支持。

財務目標大幅上調,AI 服務器成增長引擎

戴爾已正式上調其 2026 至 2030 財年的長期財務指引,向市場傳遞了明確的增長信號。公司預計:

- 年均複合收入增長率(CAGR)將達到 7-9%,遠高於此前 3-4% 的預測。

- 將年度非公認會計准則(non-GAAP)稀釋後每股收益(EPS)的增長目標提升近一倍,至 15% 或更高。

除了收入和利潤增長,戴爾還承諾將年度自由現金流的大約 80% 用於回報股東。公司還計劃在 2030 財年之前,保持季度股息每年至少 10% 的增長。

為支撐其財務戰略,戴爾近期完成了四批發行的總計 45 億美元優先票據,到期日分佈在 2029 年至 2036 年之間,此舉進一步優化了其資本結構。

戴爾業績增長的核心動力來自於其基礎設施解決方案集團(ISG),尤其是 AI 服務器業務。

公司預計,ISG 部門的年均複合增長率將達到 11-14%,而 AI 服務器細分市場的增速將更為驚人,預計達到 20-25%。

瑞穗分析師指出,鑑於戴爾在企業 AI 市場的領先地位,以及預計未來兩年約 85% 的客户將在本地部署生成式 AI,這一預測甚至可能偏於保守。

相較之下,戴爾的客户端解決方案集團(CSG)預計將實現 2-3% 的平穩年增長。

據報道,該部門的增長策略將側重於在高端商用 PC 市場獲取更多份額。

在利潤率方面,戴爾預計 ISG 部門的長期營業利潤率將在 10-14% 之間,與當前季度約 11.5% 的預估水平保持一致或有所提升。

投行紛紛看好

戴爾在 AI 領域的強勁表現和上調的財務指引,引來了投資銀行的一致看好。具體來看:

瑞銀

- 將目標價上調 20% 至 186 美元,理由是預計戴爾的 AI 服務器收入能實現 20%-25% 的可持續增長,且不會導致營業利潤率大幅下降。

- 該行還將戴爾的長期 EPS 複合年增長率預測從 7% 上調至至少 12%。

Melius Research

- 將目標價從 172 美元上調至 200 美元,認為企業對 AI 的採用將推動戴爾實現快於預期的 EPS 增長。

瑞穗

- 將目標價由 160 美元上調至 170 美元,並維持 “跑贏大盤”(Outperform)評級,其報告強調了戴爾在企業級和主權 AI(Sovereign AI)領域的強勁勢頭。

Raymond James

- 維持其 “跑贏大盤” 評級和 152 美元的目標價,指出公司在分析師會議上披露的 AI 相關業務活動已顯著超出預期。