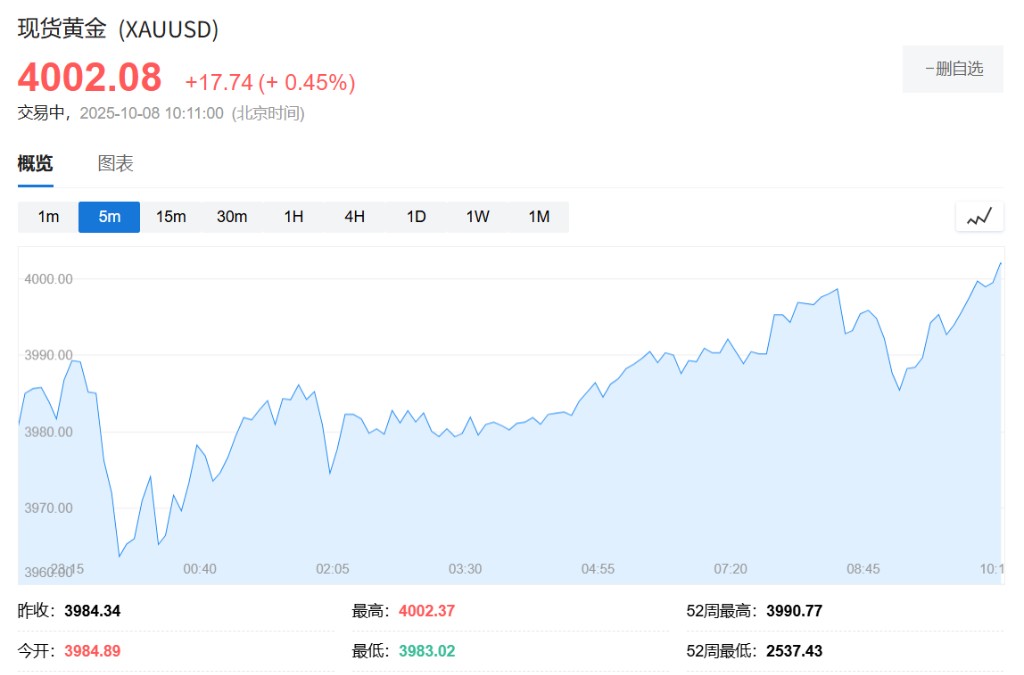

现货黄金历史性突破 4000 美元大关,年内涨幅超 50%

Amid the backdrop of escalating global economic and geopolitical risks, investors are flocking to the gold market with unprecedented enthusiasm in search of refuge

Spot gold has historically broken through the psychological barrier of $4,000 per ounce, driven by a combination of the U.S. government shutdown, a pullback in tech stocks, and global political uncertainty.

On October 8th during the Asia-Pacific session, spot gold rose to the psychological level of $4,000, setting a new historical high.

Amid escalating global economic and geopolitical risks, investors are flooding into the gold market with unprecedented enthusiasm seeking refuge.

The most direct catalyst is the U.S. government shutdown, which has now entered its second week. The suspension of certain federal government operations has led to delays in the release of key economic data, casting a significant shadow over the Federal Reserve's interest rate decision-making path.

In the absence of clear economic indicators, speculation about the Federal Reserve's future moves has intensified, and uncertainty is a natural ally of safe-haven assets like gold.

At the same time, the market's fervor for tech stocks has begun to show cracks. A report on Oracle Corporation's cloud business profit margins has raised investor concerns about whether the AI-driven rally has reached "overheated" levels. Coupled with France's political crisis and leadership changes in Japan, global risk aversion sentiment has rapidly intensified, further reinforcing gold's status as the ultimate safe haven.

So far this year, gold prices have surged over 50%. Hedge fund Bridgewater founder Ray Dalio stated on Tuesday that gold is "undoubtedly" a safer haven than the U.S. dollar, echoing the views of Citadel founder Ken Griffin, who noted that the rise in gold prices reflects deep-seated anxiety in the market regarding the dollar