Japan's wage growth suddenly stalls as Takako High takes office, facing a "cold reality"

Japan's wage growth has fallen to its lowest level in three months, with real wages continuing to decline, posing challenges for the newly elected ruling party leader, Sanae Takaichi. In August, nominal wages increased by 1.5% year-on-year, lower than expected, while real cash income decreased by 1.4%. Despite moderate overall wage growth, market expectations for a Bank of Japan interest rate hike have cooled. Takaichi is expected to be elected Prime Minister next week and hopes the central bank will adopt a more cautious policy

According to the Zhitong Finance APP, Japan's wage growth has fallen to its lowest level in three months, while real wages continue to decline. This phenomenon highlights the challenges faced by the newly elected ruling party leader, Sanae Takaichi, who has previously promised to address the rising cost of living.

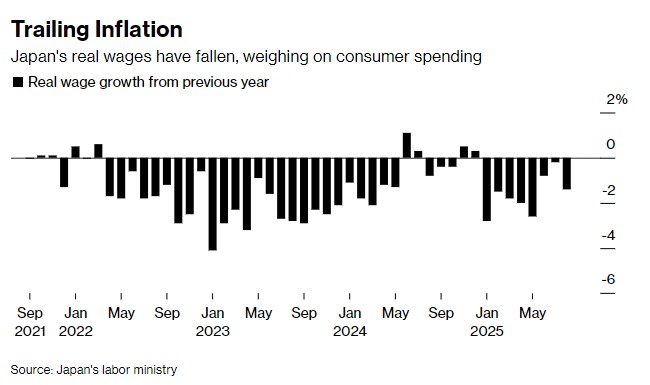

A report released by Japan's Ministry of Health, Labour and Welfare on Wednesday showed that nominal wages in August increased by 1.5% year-on-year, a significant slowdown from the previous month's growth of 3.4%, and below economists' expectations. During the same period, real cash income decreased by 1.4%, marking the eighth consecutive month of decline, also performing weaker than expected.

Economists had previously predicted that the nominal wage increase in August would be 2.7%. They believed that after a spike in wages due to bonus payments in the previous month, the growth rate of bonuses would decline in August. The Ministry of Health, Labour and Welfare's data also confirmed this: due to a decrease in the number of companies issuing extra bonuses in August, bonuses fell by 10.5% year-on-year. However, a more stable indicator of wage levels (which excludes sampling issues and does not include bonuses and overtime pay) showed that the income of ordinary workers in August increased by 2.4% year-on-year, unchanged from the growth rate in July.

Despite the August wage data falling short of expectations, the overall trend of moderate wage growth suggests that the Bank of Japan is still likely to gradually raise interest rates as planned. However, after Sanae Takaichi was elected as the ruling party leader, market expectations for the Bank of Japan to raise interest rates later this month have significantly cooled. Takaichi is expected to be elected as Japan's Prime Minister next week, and she has previously stated her desire for the Bank of Japan to adopt a more cautious policy stance.

Ryosuke Katagi, an economist at Mizuho Securities, stated: "My first impression is that, aside from bonuses, the overall wage pattern has not changed much; it has neither strengthened nor weakened. If wages maintain the current growth rate, real wages may struggle to achieve a significant increase. It is still difficult to conclude whether real wages can turn positive by the end of this year."

The Bank of Japan will announce its next monetary policy decision on October 30, and traders currently estimate the probability of a rate hike at about 25%, far below the approximately 68% level at the beginning of last week. Takaichi has always been a staunch supporter of loose monetary policy, and her victory in the ruling Liberal Democratic Party leadership election last Saturday surprised market participants.

Taro Kimura, an economist at Bloomberg, stated: "Japan's cash income in August was unexpectedly weak, but the details show that wage growth momentum remains robust, which supports core inflation. The overall slowdown in wage growth is due to the high base effect from the same period last year, and the temporary boost effect from summer bonuses has faded. From July to August, the growth pace of base wages remained stable."

The Liberal Democratic Party has historically lost elections primarily due to its failure to address the high cost of living faced by families: on one hand, prices of key commodities like rice have surged; on the other hand, wage growth has not kept pace with rising prices. Since April 2022, Japan's real wages have only seen month-on-month growth in four months Koshi Saimai is expected to introduce a new round of economic measures to help households cope with inflationary pressures, including lowering gasoline and diesel taxes. She also mentioned further increasing the tax-free income threshold but downplayed previous statements about considering a reduction in consumption tax.

Bank of Japan Governor Kazuo Ueda has repeatedly stated that if there is sufficient confidence in the realization of the economic outlook, the Bank of Japan will initiate interest rate hikes. He emphasized that the impact of U.S. tariffs on Japanese corporate profits and the outlook for wage growth are two key factors that need to be closely monitored in the future.

Toru Suehiro, Chief Economist at Daiwa Securities, stated: "For Koshi Saimai, the data released today confirms her view that the current Japanese economy is not very strong and still requires a loose monetary environment. However, if she overemphasizes this point, the yen may further depreciate, so she must act cautiously."