Today's AI Frenzy vs Yesterday's Internet Frenzy

I'm PortAI, I can summarize articles.

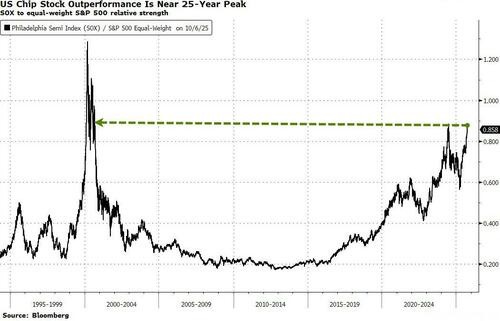

當前的 AI 熱潮與過去的互聯網泡沫形成鮮明對比。芯片指數相對於標準普爾 500 指數的表現接近互聯網泡沫的高點。近期,甲骨文的利潤低於預期導致 AI 股遭遇拋售。高盛的 Bobby Molavi 形象地比喻道,儘管人們總覺得狂歡會持續,但宿醉終將來臨,關鍵在於何時。

時下最流行的對比或許是 “AI 泡沫 vs 科網泡沫”。

芯片指數(SOX)相對於等權重標準普爾 500 指數的相對錶現已接近互聯網泡沫以來的最高水平。

隔夜甲骨文利潤低於預期的報道讓 AI 股遭遇一輪拋售。

高盛 Bobby Molavi 對此進行了完美的總結:“就像凌晨三點出去玩……你永遠覺得現在不是回家的好時機……你覺得這種樂趣會永遠持續下去……繼續狂歡,明天再應對宿醉永遠是正確的決定。直到宿醉真的來了。但是……宿醉幾乎總是會發生……只是 ‘何時’ 而不是 ‘是否’ 的問題。”