Pessimists are smart while optimists make money! Goldman Sachs traders: The AI debate will take several more quarters to yield results, don't go against capital expenditures

Related data forecasts that by 2029, the capital expenditure of "hyperscale computing companies" alone will reach USD 2.8 trillion, while the total global related capital expenditure during the same period will soar to USD 5.5 trillion. Senior traders at Goldman Sachs believe that the momentum of this capital investment is like a giant ship, requiring time to start and stop, and cannot be turned around overnight. Before the long-term narrative of AI takes shape, resisting the capital flood it brings is futile

In a market filled with "noise," maintaining optimism often yields better returns than the seemingly smart pessimistic rhetoric.

Recently, Bobby Molavi, Managing Director and Senior Trader at Goldman Sachs, wrote that despite the market being rife with signs of bubbles, the core pillars driving this long bull run—especially the massive capital expenditures triggered by AI—are clear. He believes that resisting the capital influx brought about by AI before its long-term narrative materializes is futile.

For investors, recognizing signals, ignoring noise, and understanding that the ultimate success or failure of AI cannot be determined in the short term may be the most critical survival rule at present. The current "epic" rebound led by tech stocks is severely punishing market pessimists.

Recently, the U.S. stock market has been rewriting history with astonishing resilience, with the S&P 500 and Nasdaq indices operating above their 50-day moving averages for over 100 consecutive trading days, continuously setting new historical highs.

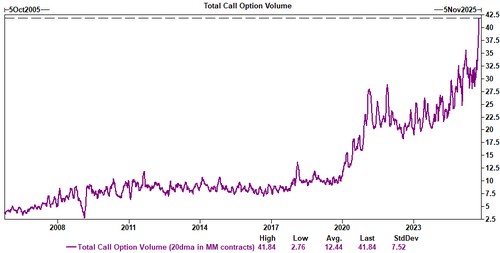

At the same time, the market's euphoric sentiment is evident, with retail investors having net bought in 21 out of the past 24 weeks, ETFs seeing net inflows on 183 out of the past 185 trading days, and the trading volume of call options reaching historical peaks, averaging 40 million contracts per day.

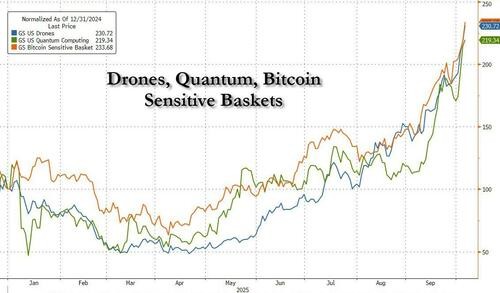

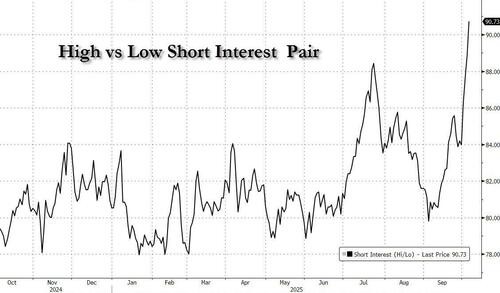

Sectors such as "most shorted" and "unprofitable tech stocks" have recently surged, while many fields, including nuclear energy, quantum, drones, and artificial intelligence, have also performed brilliantly.

An index compiled by Goldman Sachs measuring high and low short interest (GSPUWSHI) has experienced the most intense short squeeze since the "Meme stock craze" of 2021.

The AI Debate is Still Unresolved, Following Trillions in Capital Expenditures

The debate over whether AI is a revolution or a bubble may take several quarters or even longer to resolve. However, Bobby Molavi points out an undeniable reality: the massive capital expenditures behind it.

Molavi mentions a research report predicting that by 2029, capital expenditures from "hyperscale computing companies" alone will reach $2.8 trillion, while the total global related capital expenditures during the same period will soar to $5.5 trillion.

Molavi believes that the momentum of this capital investment is like a giant ship; it takes time to start and stop, and it cannot turn overnight. Therefore, in the investment cycle over the next five years, the performance of a single quarter is almost irrelevant. He compared this logic to the old market adage of "don't fight the Federal Reserve," pointing out:

"It's hard to go against capital expenditures right now; if you are too early to turn bearish or misjudge, it will be difficult to survive."

Interest Rates, Profits, and Employment Bring Three Tailwinds

In addition to AI, Molavi also pointed out three other key drivers supporting the market.

First is interest rates. He believes that a decline in U.S. interest rates is highly probable, whether due to inflation normalization, economic slowdown, or potential political pressure. This will undoubtedly provide another tailwind for the capital markets.

Second is corporate profits. The proliferation of AI will support corporate profit margins in two ways: either AI directly reduces costs by enhancing efficiency and productivity; or, under the "halo" of AI, companies will be forced to more rigorously improve output efficiency to showcase their investments and results in AI, thereby indirectly achieving cost reductions.

Finally, employment. In contrast to the resilience of corporate profits, the unemployment rate may rise due to efficiency gains driven by AI. This again confirms the divergence between market performance and the real economy (especially the underlying economy), where the market is pricing productivity prospects rather than overall employment conditions.

Market Indicators Have Entered Euphoria

Current market euphoria indicators have reached extreme levels.

Goldman Sachs data shows that over the past 20 days, the average daily trading volume of call options reached 40 million contracts, setting a historical record and doubling that of three years ago. Last Wednesday, the proportion of call options in total options trading volume once reached 65%. More notably, the S&P 500 Index and the Nasdaq Index both hit historical highs that day, while 57% and 51% of their respective constituent stocks fell.

Technology and technology-related stocks currently account for 56% of the total market capitalization of the U.S. stock market, while defensive stocks have dropped to 16%, the lowest level on record. Molavi likened this scene to a late-night party:

"You never feel it's time to go home... you always think the revelry will last forever."

He warned that while a hangover may be delayed, it is almost never absent.

The "Illusion" Under Dollar Depreciation: What Are Assets Being Valued In?

From another perspective, this bull market also reflects the "devaluation trade" of fiat currencies.

Since the pandemic, the Nasdaq Index has risen by 165% in dollar terms, and the S&P 500 Index has risen by 102%. However, if measured in a different unit, the conclusions are vastly different: when priced in gold, the Nasdaq Index has only risen by 7%, and the S&P 500 Index has even fallen by 18%; when priced in Bitcoin, both have plummeted by 78% and 84%, respectively.

Molavi pointed out that this indicates that since the pandemic, assets with non-dollar exposure have appreciated the fastest. This reminds investors that when assessing asset returns, the choice of which "currency" to use as a benchmark is crucial. This also explains why assets like Bitcoin and gold have gained popularity outside traditional asset classes