Market Debate on "AI Bubble," Deutsche Bank Advises Investors: Don't Try to "Time the Market," Long-Term Holding is the Best Strategy

Despite the fact that tech giants have invested hundreds of billions of dollars in building AI infrastructure, Bain & Company predicts that AI revenue may fall short by $800 billion by 2030. However, Deutsche Bank emphasizes that identifying bubbles is nearly impossible, and attempting to time the market precisely is extremely difficult. Historical data shows that missing the best trading days can significantly reduce investment returns, and the best and worst trading days often occur next to each other. It is recommended to adopt a long-term holding strategy to achieve the best returns

The AI investment boom has become a market focus, with Deutsche Bank's latest research showing that discussions about the "AI bubble" have cooled down, suggesting abandoning timing strategies and sticking to long-term holdings for the best returns.

Tech giants are spending hundreds of billions of dollars to build AI infrastructure, and this unprecedented scale of investment has raised market concerns about bubble risks. From OpenAI's $500 billion Stargate plan to Meta's commitment to invest hundreds of billions in building data centers, capital expenditures in the AI sector have reached astonishing levels.

Bain & Company predicts that by 2030, AI companies will need $2 trillion in annual revenue to support the required computing power, but actual revenue may fall short by $800 billion. This significant gap has intensified market doubts about the sustainability of the current AI investment boom.

According to a previous article by Jianwen, Amazon founder Jeff Bezos recently stated that the current AI investment is a "good bubble," which will bring long-term benefits to society even if it eventually bursts. Meanwhile, Goldman Sachs CEO David Solomon warned that the massive influx of capital into the AI sector may not yield the expected returns.

Deutsche Bank's latest research report believes that while there are bubble risks in the market, attempting to time the market accurately is extremely difficult, and a long-term investment strategy is more feasible. Historical data shows that missing the best trading days will significantly reduce investment returns.

Aggressive Investments by Tech Giants Raise Bubble Concerns

Since the beginning of this year, tech giants have frequently announced AI infrastructure investments in the hundreds of billions of dollars.

OpenAI CEO Sam Altman announced a $500 billion AI infrastructure plan called "Stargate" in January, followed by Meta's Mark Zuckerberg committing to invest hundreds of billions in building data centers, with Altman further stating that OpenAI expects to spend "trillions of dollars" on AI infrastructure.

The construction of AI infrastructure is giving rise to unprecedented financing arrangements. NVIDIA has agreed to invest up to $100 billion in OpenAI's data center construction, raising questions among analysts about whether the chip manufacturer is supporting its customers to maintain demand for its products.

OpenAI is also considering debt financing instead of continuing to rely on partners like Microsoft and Oracle. According to tech media The Information, OpenAI is expected to consume $115 billion in cash by 2029.

Other tech giants are increasingly relying on debt to support their unprecedented expenditures.

Meta secured $26 billion in financing to build a data center campus in Louisiana, while JPMorgan Chase and Mitsubishi UFJ Financial Group led a loan of over $22 billion to Vantage Data Centers.

Some unproven companies are also trying to ride the wave of the data center gold rush

The Amsterdam cloud service provider Nebius, spun off from the Russian internet giant Yandex, has signed a $19.4 billion infrastructure agreement with Microsoft.

The UK data center company Nscale, which previously focused on cryptocurrency mining, is now collaborating with NVIDIA, OpenAI, and Microsoft to build data centers in Europe.

A study by MIT found that 95% of organizations have not received any return on their AI investments.

Meanwhile, researchers from Harvard and Stanford pointed out that "work garbage" created by employees using AI could cost large organizations millions of dollars in productivity each year.

Technological Development Faces Bottlenecks

AI technology itself is also facing challenges. Developers like OpenAI and Anthropic have relied on the "law of scaling" for years, believing that more computing power, data, and larger models would lead to leaps in AI capabilities. However, the returns on these efforts have diminished over the past year.

OpenAI CEO Sam Altman admitted in August that "we still lack some very important things" to achieve general artificial intelligence. The much-anticipated release of the GPT-5 model received a lukewarm response and failed to meet previous promotional expectations.

In January of this year, the release of a low-cost AI model by DeepSeek triggered a trillion-dollar sell-off in tech stocks, with NVIDIA plummeting 17% in a single day. Although the stock price rebounded afterward, this incident highlighted the potential risks of AI investment.

Additionally, the massive data center construction in the AI industry is also constrained by the reality of a strained national power grid. The significantly increased power consumption may be hindered by infrastructure limitations.

However, AI industry leaders remain optimistic. Altman acknowledged that investors might be "overly excited," but insisted that AI is "the most important thing in a long time." Zuckerberg stated that an AI bubble "likely" exists, but he is more concerned about underinvestment.

Market Debates AI Bubble

Currently, the AI investment bubble has sparked increasing debate.

David Einhorn, founder of hedge fund Greenlight Capital, stated:

"The numbers being thrown around are so extreme that it's really hard to understand. I'm sure it's not zero, but there's a reasonable possibility that a lot of capital will be destroyed in this cycle."

Bret Taylor, chairman of OpenAI and CEO of the $10 billion AI startup Sierra, believes there are many similarities to the internet bubble.

"It's true that AI will change the economy, and I think it will create tremendous economic value in the future, just like the internet. I think we are also in a bubble, and many people will lose a lot of money."

According to a report by Jianwen, Bezos stated at a recent event that the current AI craze should be viewed as an "industrial bubble" rather than a "financial bubble." He explained that even if an industrial bubble bursts, it can leave a valuable legacy, just as the investments in fiber optic cables during the internet bubble laid the foundation for later developments.

Bezos recalled that during the internet bubble, Amazon's stock price fell from $113 to $6, but the company's business remained strong. He emphasized, "AI is real, and it will change every industry." Goldman Sachs CEO David Solomon takes a more cautious stance. While acknowledging the potential of AI to enhance productivity, he warns that the substantial capital currently invested in AI may ultimately "fail to generate returns."

Solomon expressed uncertainty about whether a bubble has formed and anticipates a market correction in the next 12-24 months.

Deutsche Bank's latest research report shows that the volume of online searches regarding the "AI bubble" has significantly decreased from a peak on August 21 to 15%. Analysts at the bank noted that the discussion surrounding this "AI bubble" reflects a typical pattern seen in past bubbles.

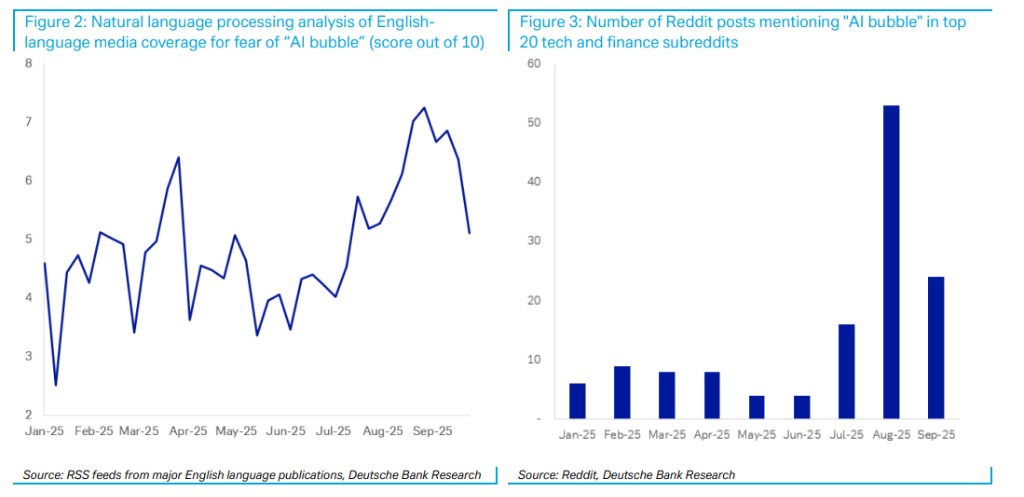

Through natural language processing analysis, Deutsche Bank found that concerns in English media regarding AI investments have dropped from 7.3 points (out of 10) in the last week of August to the current 5.1 points. Discussions on Reddit also show a similar trend.

Deutsche Bank Warns of Timing Risks, Recommends Long-Term Holding Strategy

Deutsche Bank emphasizes that identifying a bubble is nearly impossible, as there is no consensus on the exact definition of "asset prices significantly above intrinsic value." Historical experience shows that bubbles do not follow a linear process and typically develop through several rounds of ups and downs.

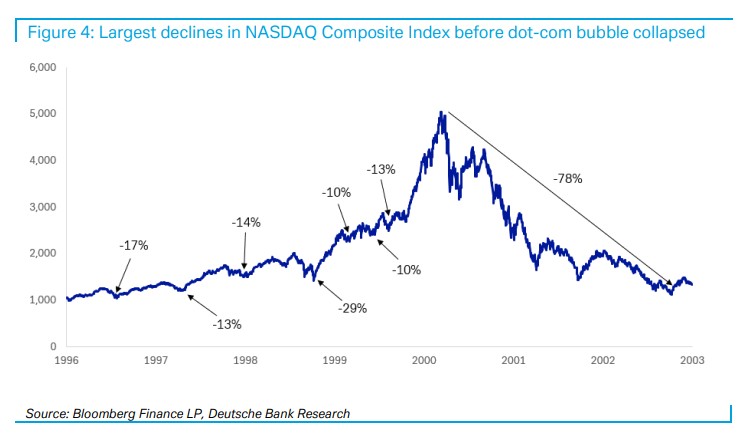

Deutsche Bank cites the internet bubble as an example, noting that the Nasdaq experienced seven significant corrections of over 10% during the five years leading up to its peak on March 10, 2000. More importantly, even after discussions of a bubble become widespread, the market may continue to rise for a long time.

On November 19, 1998, when the Nasdaq index was below 2000 points, Michael Murphy of Murphy Investment Management warned that "this is a serious bubble," but the market continued to rise for another 16 months before peaking above 5000 points.

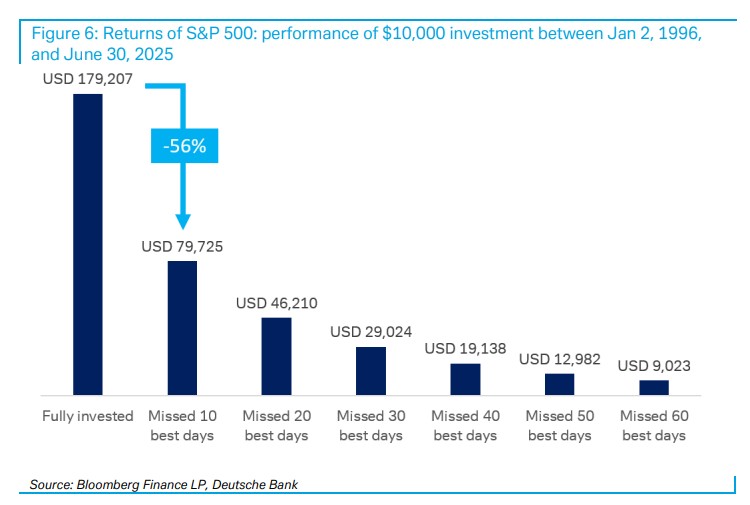

Deutsche Bank's core advice is to avoid trying to time the market. Data from the bank shows that if an investor had invested $10,000 at the beginning of 1996 and held it until June of this year, it would be worth over $170,000. However, if they missed the best 10 trading days, their return would be halved; missing the best 20 trading days would reduce the return to just a quarter.

Crucially, the best and worst trading days often occur in close proximity. Of the best 10 trading days from 1996 to June of this year, five occurred within a week of the worst 10 trading days. This indicates that precise timing is extremely difficult.

Deutsche Bank concludes that the market may remain "irrational" for longer than investors can maintain their solvency. The bank advises investors to adopt a long-term holding strategy to capture the risk premium needed to compensate for equity investment risks