"AI capital expenditure" is shifting from Silicon Valley to Wall Street

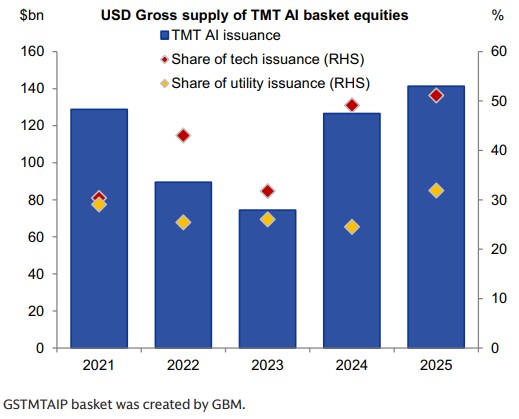

Capital expenditures related to AI are shifting from Silicon Valley to Wall Street, with the role of debt financing becoming increasingly important. From 2025 to date, the total bond issuance by AI companies has reached $141 billion, surpassing the $127 billion in 2024. The cash balances of large technology companies are declining, and capital expenditures are expected to maintain a year-on-year growth rate of 50% by 2025. Although cash flow is currently abundant, the impact of changes in the financing structure on the credit market needs to be continuously monitored

Capital expenditures related to AI are shifting from reliance on balance sheet cash to debt financing. From 2025 to date, the total issuance of corporate bonds related to artificial intelligence has reached a record $141 billion, surpassing the $127 billion for the entire year of 2024.

Initially, large-scale AI-related capital expenditures were primarily supported by the massive cash reserves on the balance sheets of Silicon Valley tech giants. However, recent trends show a significant shift, with the debt capital markets (including data center ABS, public and private credit markets) playing an increasingly important role.

Goldman Sachs believes there are two main reasons behind this shift:

First, the cash balances of large tech companies have significantly declined, and their cash-to-total-assets ratio is approaching the median level of typical non-financial investment-grade issuers.

Second, these companies remain enthusiastic about investing in AI, with capital expenditures expected to maintain a year-on-year growth rate of 50% by 2025. Although these companies currently have ample cash flow and low leverage, which does not raise alarms, this change in financing structure is marginally negative for the credit market and warrants ongoing attention.