Cui Dongshu: Tesla's market value exceeds 10 trillion, with a price-to-earnings ratio as high as 200 times, while traditional international automakers have relatively low valuations

崔東樹指出,特斯拉市值突破 10 萬億,市盈率高達 200 倍,而國際傳統車企估值相對較低。9 月整車市值變化顯示新能源仍是主要增長動力,燃油車企的市值改善趨勢明顯。美股國際車企表現一般,港股內資企業表現優異。整體來看,港股汽車股市值從 2024 年 1 月的 1 萬億元增至 2025 年 9 月的 2.97 萬億元,A 股市場則從 5800 億元增至 8400 億元,增幅較平緩。

智通財經 APP 獲悉,10 月 5 日,崔東樹發文稱,汽車整車上市公司市值不僅是資本市場對企業當前經營成果的定價,更是反映汽車行業趨勢、技術變革與政策導向的 “晴雨表”。很多整車企業都把市值管理作為重要的工作,因此跟蹤市值變化也是行業研究的重要領域。9 月的整車市值變化依舊延續新能源為核心增長動力的體現,但燃油車企穩帶來的市值改善也是很好的趨勢。國際車企的市值分化,美股的大部分國際公司表現較一般,港股的內資企業表現優秀。

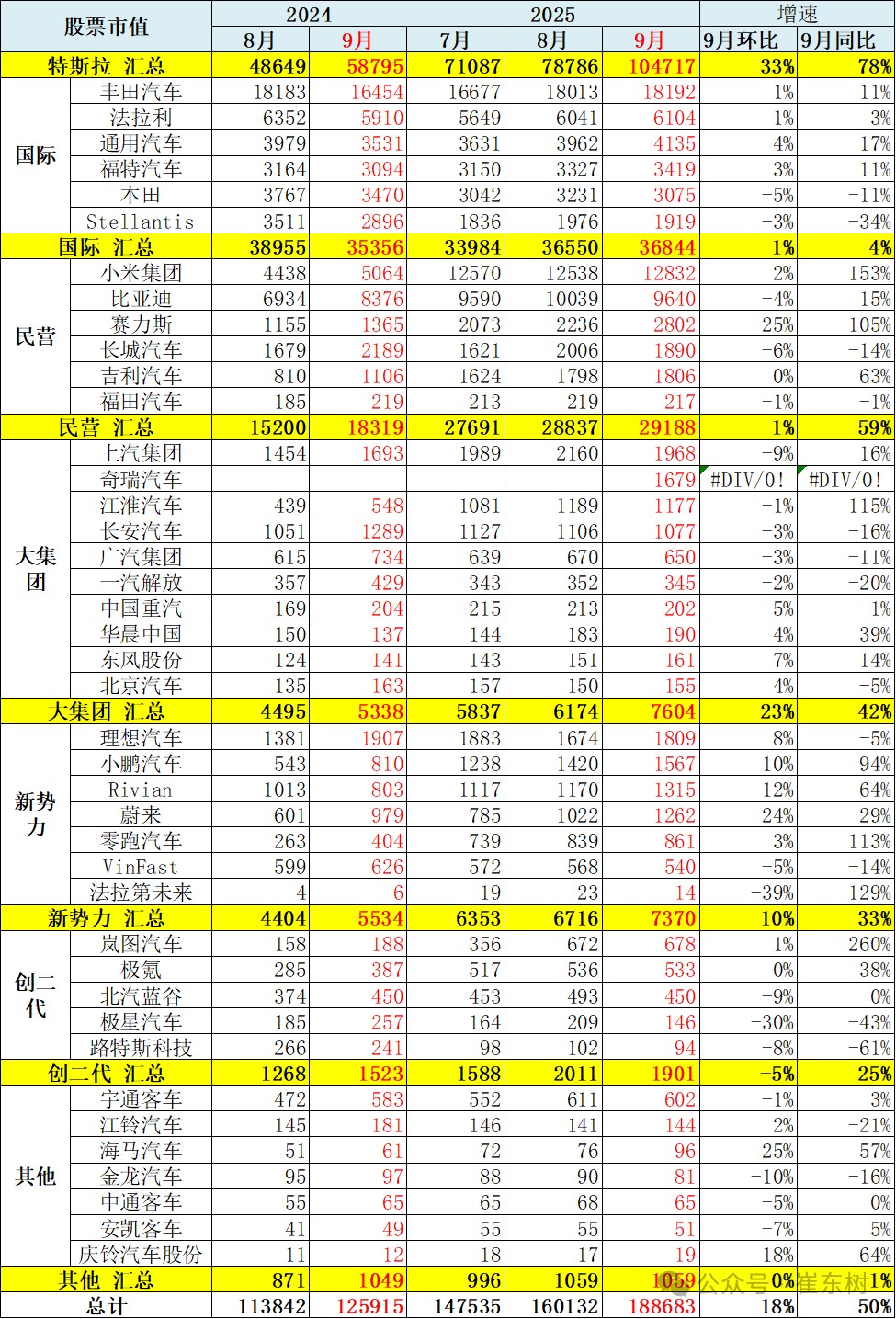

1、整車股票市值

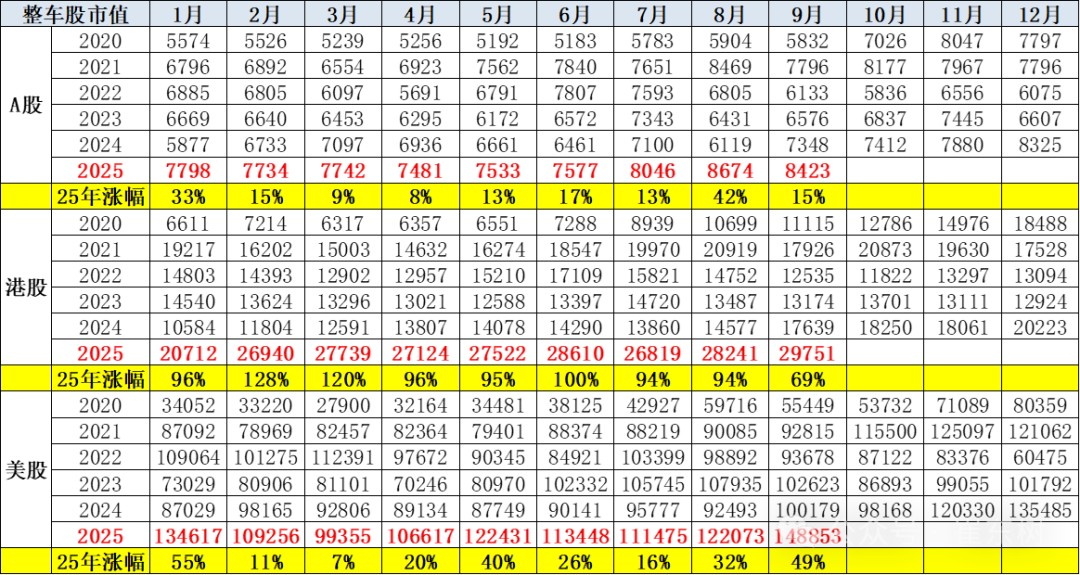

汽車整車類上市公司主要是在美國股票市場和香港股票市場,以及國內 A 股市場三大市場進行研究。歐洲市場由於相對比較分散,暫時不做研究。世界整車企業市值中,美股市場的規模最大,2025 年 9 月份達到 14.8 萬億元的規模,而港股市場也達到了 3 萬億元的規模,國內 A 股市場達到 8400 億元的規模,在這裏我們把 A 股港股中有些多地上市的公司市值會按第一上市地做側重,A 股相對來説比較簡單一點。

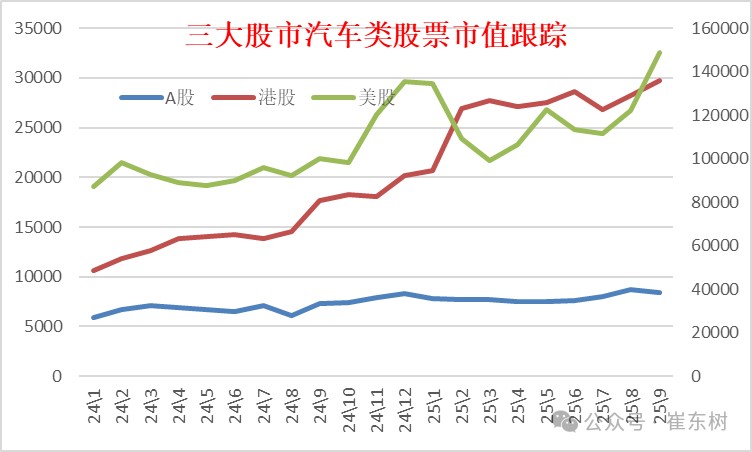

從 A 股和港股、美股的汽車整車企業股市值走勢來看,今年港股的市值走勢表現相對較強,相對於美股的市值走勢,港股市值走勢的上市趨勢是比較明顯的,從 2024 年 1 月份的港股的整車企業市值合計 1 萬億元規模,到 2025 年的 9 月份達到 2.97 萬億元,也就是從 1 萬億元到 3 萬億元的規模,港股的汽車股的規模實現了市值大幅增長的特徵,其中有新股上市的因素,也有股票市值的增值因素。

而國內 A 股市場總體來看,從 2023 年 1 月份的 5800 億元到 2025 年 9 月份的 8400 億元,總體增長相對比較平緩。而美股市場從 87000 億元上升到 148000 億元,增長幅度也相對較大。

2、9 月主力股票市值變化

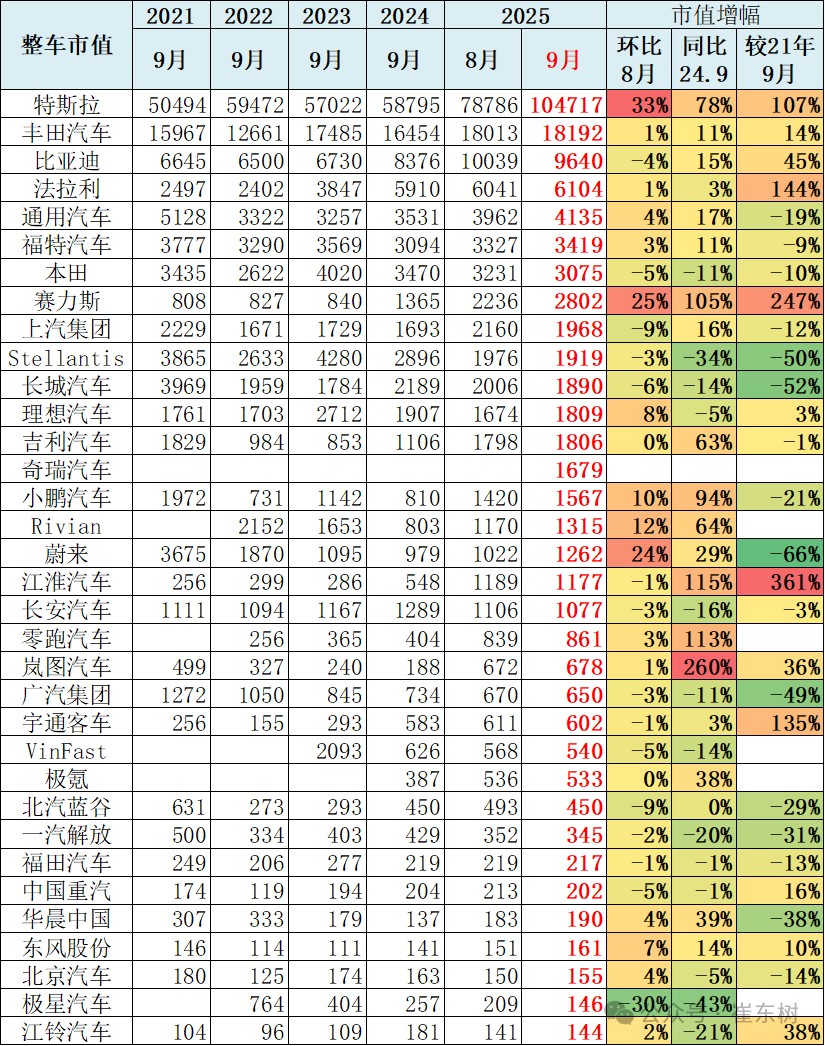

國際整車企業的市值中,特斯拉達到了 10 萬億元人民幣的規模,表現相對較強,,因此單獨列出,2025 年特斯拉同比增長幅度相對較大,同時賽力斯和蔚來的股票市值也是相對於去年 9 月份實現了巨大的增幅,近期東風集團的以嵐圖汽車為代表的股票市值也實現了巨大的增長。

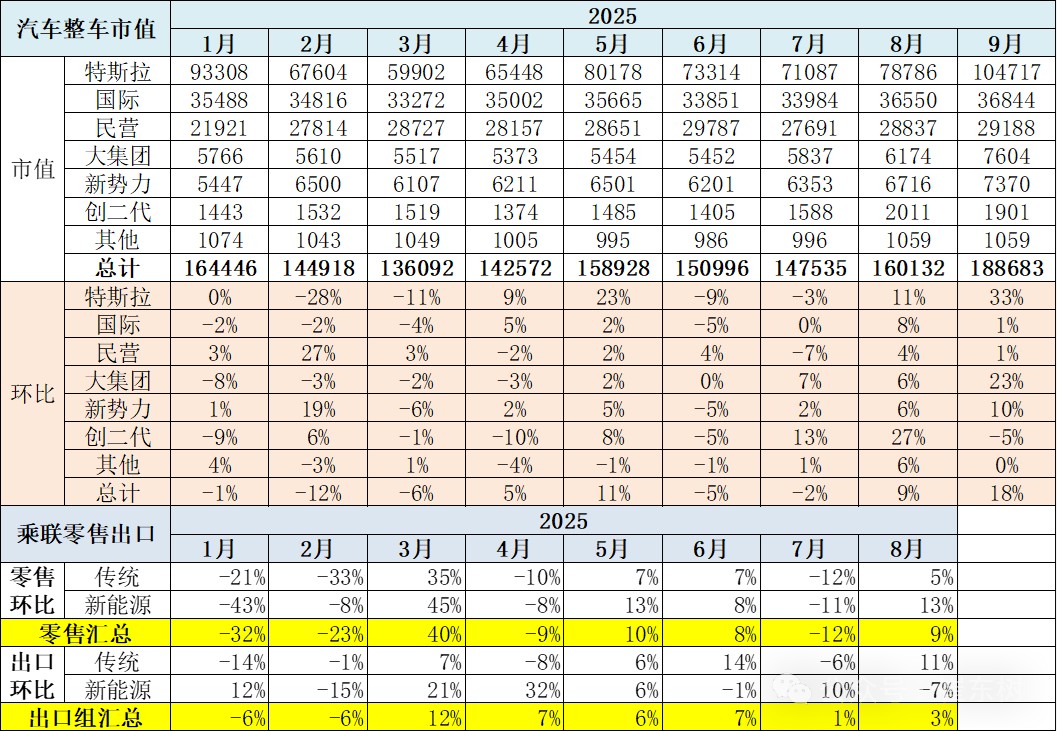

3、各類整車類股票的市值表現

9 月汽車整車企業市值變化相對較大,9 月份相對於 8 月份表現較強的是特斯拉和大集團,大集團市值提升主要是奇瑞上市帶來的增量效果。9 月新勢力表現相對較強。

4、9 月環比 8 月整車企業市值變化

9 月股票市值較 8 月份增長較好的是特斯拉增長 33%,而賽力斯和蔚來表現相對較強。下降比較大的主要是相對傳統車企為主的企業,同時部分新能源車市場表現也相對來説分化較為明顯,而與 2021 年相比,主要也是新能源車企業實現了超強的增長。

在這裏把小米和賽力斯放到了和比亞迪一樣的民營企業中,主要是因為他們的體量太大,而且跟長城、吉利、比亞迪等這些實際上是作為產業競爭者,應該説都有相對的產業的一些特色優勢。

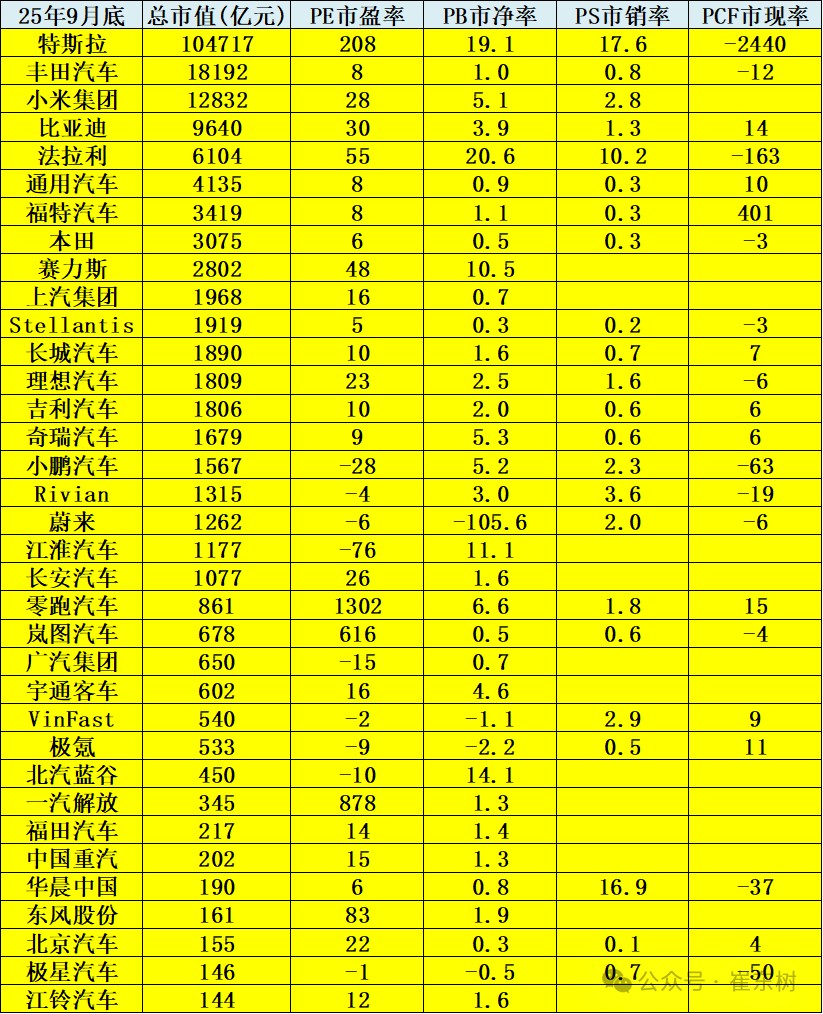

5、整車類上市公司市值與運行狀態分析

汽車整車公司從綜合的市盈率、市淨率的表現來看,應該説特斯拉等新勢力企業的市盈率是相對比較偏高的。尤其是特斯拉 10 萬億元的規模,市盈率達到 200 倍的水平,而像零跑汽車(09863)、藍圖汽車等這些市盈率也是相對較高的情況。

市盈率較低的主要是發展緩慢的國際企業,以豐田、本田,通用、福特、賽特蘭蒂斯等為代表,都在 6~8 倍的市盈率水平,其次國內傳統車企表現相對比較強的,像奇瑞汽車、吉利汽車都是在 8-9 倍的市盈率的水平。

從市淨率來看,部分企業市淨率也跌到了較大的程度,像在斯特蘭蒂斯的市淨率只有 0.3,而本田也只有 0.5 的市淨率的水平,通用福特市淨率也是在 1 的狀態,所以總體來看,應該説目前國際車企的傳統車企的估值是屬於相對較低狀態,而新勢力企業的估值和特斯拉(TSLA.US)等國際企業估值被投資者看好。