3 months 16 times! "America's hottest meme stock" is a "real estate renovation company"

The directors of this carnival are a group of retail investors who call themselves "Open Army." They have elevated Opendoor to the status of a new "Meme stock" and even successfully "forced the management to step down."

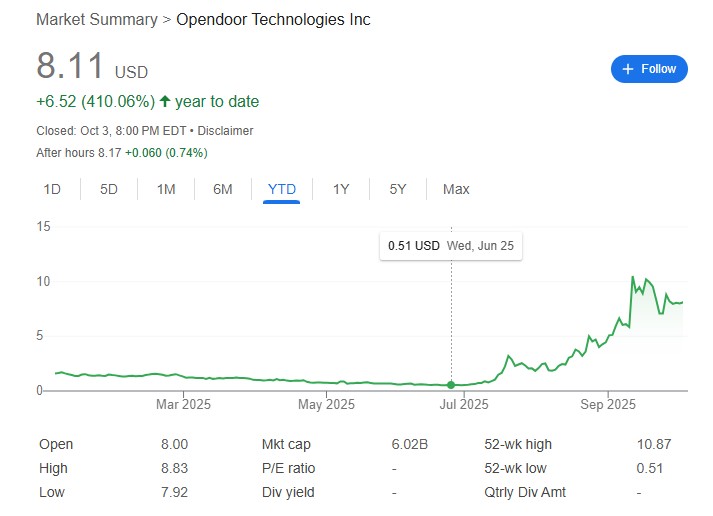

A real estate technology company Opendoor, which has been losing money every year since its establishment, staged a capital frenzy in 2025.

In just three months, its stock price soared from less than $1 to $8.11, an increase of nearly 16 times, with a market capitalization reaching $6 billion, briefly becoming one of the most traded stocks on the U.S. stock market.

The directors of this frenzy are a group of retail investors who call themselves the "Open Army." They have elevated Opendoor to the status of a new "Meme stock," even successfully "forcing" management to act—prompting the CEO to resign in August, welcoming back two co-founders to the board, and hiring Shopify Chief Operating Officer Kaz Nejatian as CEO.

However, regardless of the noise in the capital market, a fundamental issue remains: Opendoor's core business—iBuying (instant home buying, renovation, and resale)—seems fundamentally unable to scale.

The "iBuyer" Model: A Business Difficult to Scale

iBuying refers to the rapid purchase of properties using algorithms, followed by quick resale after light renovations.

However, this model is contrary to a business that can scale well. A scalable business should see revenue growth far outpacing cost growth, but real estate transactions are typically capital and labor-intensive industries. Opendoor operates in about 50 markets, each with vastly different conditions regarding permits, inspections, labor, and material supplies, lacking a universally applicable standardized system.

This business is inherently at odds with the "scalable" logic of the internet. Successful scalable businesses require revenue growth to significantly exceed cost growth, but real estate transactions are typical capital and labor-intensive industries. Opendoor operates in about 50 markets, each with significant differences in permits, inspections, labor, and material supplies, making standardized expansion nearly impossible.

The painful failure of industry giant Zillow serves as a cautionary tale. In 2021, Zillow's home price prediction algorithm suffered a catastrophic failure, leading to its iBuyer business "Zillow Offers" acquiring a large number of homes at high prices, ultimately having to sell them at a loss.

Even in better market years, Zillow Offers had extremely thin profit margins, with profits completely consumed by high operating costs. Before finally shutting down the business in 2021, Zillow had already paused home purchases due to a backlog of renovation work and operational bottlenecks.

In the U.S., the long home ownership cycle means higher maintenance, property taxes, and other costs, further eroding already thin profits, ultimately proving that the business is unsustainable in the face of price fluctuations.

The "Magic" of Financial Reports: Losses Hidden by "Contribution Margin"

Opendoor's financial story is strikingly similar to Zillow's In the first half of 2025, Opendoor's financial report showed revenue of $2.7 billion and a gross profit of $227 million. The company specifically highlighted a non-standard financial metric—recording a "contribution profit" of $123 million.

But this is just "financial report magic." Beneath this seemingly good report card lies a real pre-tax loss of $114 million.

Opendoor's method of calculating "contribution profit" excludes most operating expenses and the interest costs incurred from the $2.2 billion debt the company carries.

This financial reporting approach is strikingly similar to that of Zillow back in the day. In 2019, Zillow's home renovation business showcased a non-standard metric in its financial report called "sales return after deducting interest expenses," indicating an average loss of about $5,000 per home. However, when all operating costs were included, the real pre-tax loss averaged $72,000 per home.

Now, retail investors hope Opendoor will shift to a lighter platform model—connecting buyers and sellers with intermediaries to charge fees. But this is not a new idea; the market is already crowded with competitors, and Opendoor itself launched similar services back in 2022.

Ultimately, real estate is a mature, cyclical industry with many participants. Even if Opendoor someday finds the secret to profitability in the iBuying model, the very low barriers to entry allow competitors to quickly replicate it.

For Opendoor, the most valuable asset at present may be the speculative frenzy itself. The most rational business decision might be to emulate other meme stocks like GameStop, taking the opportunity to issue more shares to secure valuable funds and time for the company's transformation exploration. Because when the hype fades, what ultimately tests a company is always its ability to generate its own revenue