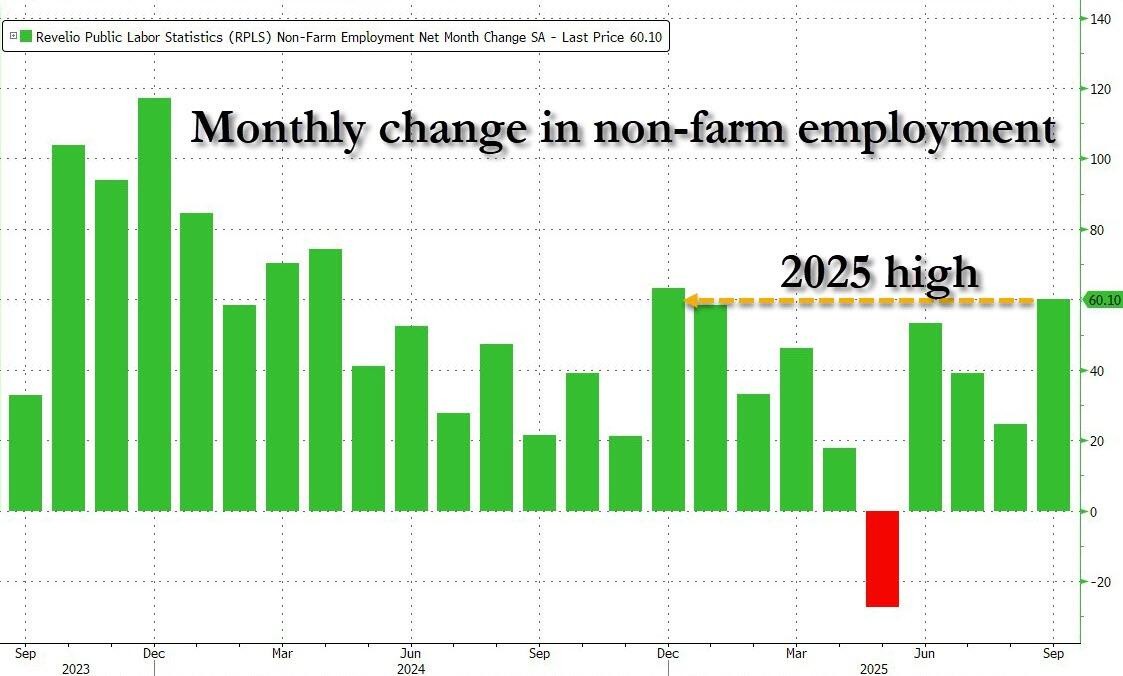

Concerns about labor force decline ease: The U.S. "private non-farm" added 60,000 jobs in September, exceeding expectations and marking the best performance this year

Data from Revelio Labs shows that September's job growth was "slightly above expectations," primarily driven by the education, healthcare services, and retail trade sectors. The labor market continues to slow rather than collapse, supporting the market narrative that the Federal Reserve is responding to an economic slowdown rather than a recession, providing policy space for the central bank to offset the economic slowdown through interest rate cuts

As the U.S. government shutdown leads to the Labor Statistics Bureau suspending the release of non-farm employment data, private data provider Revelio Labs (RPLS) reports that the U.S. added 60,000 jobs in September, the best figure for 2025. This data far exceeds the previous ADP report of a loss of 32,000 jobs, effectively alleviating market concerns about a labor downturn.

Revelio Labs' data shows that September's job growth was "slightly above expectations," primarily driven by the education, healthcare services, and retail trade sectors. The agency's chief economist, Lisa Simon, stated that although job growth is relatively modest, combined with hiring and wage data, it indicates a continued slowdown in the labor market rather than a collapse.

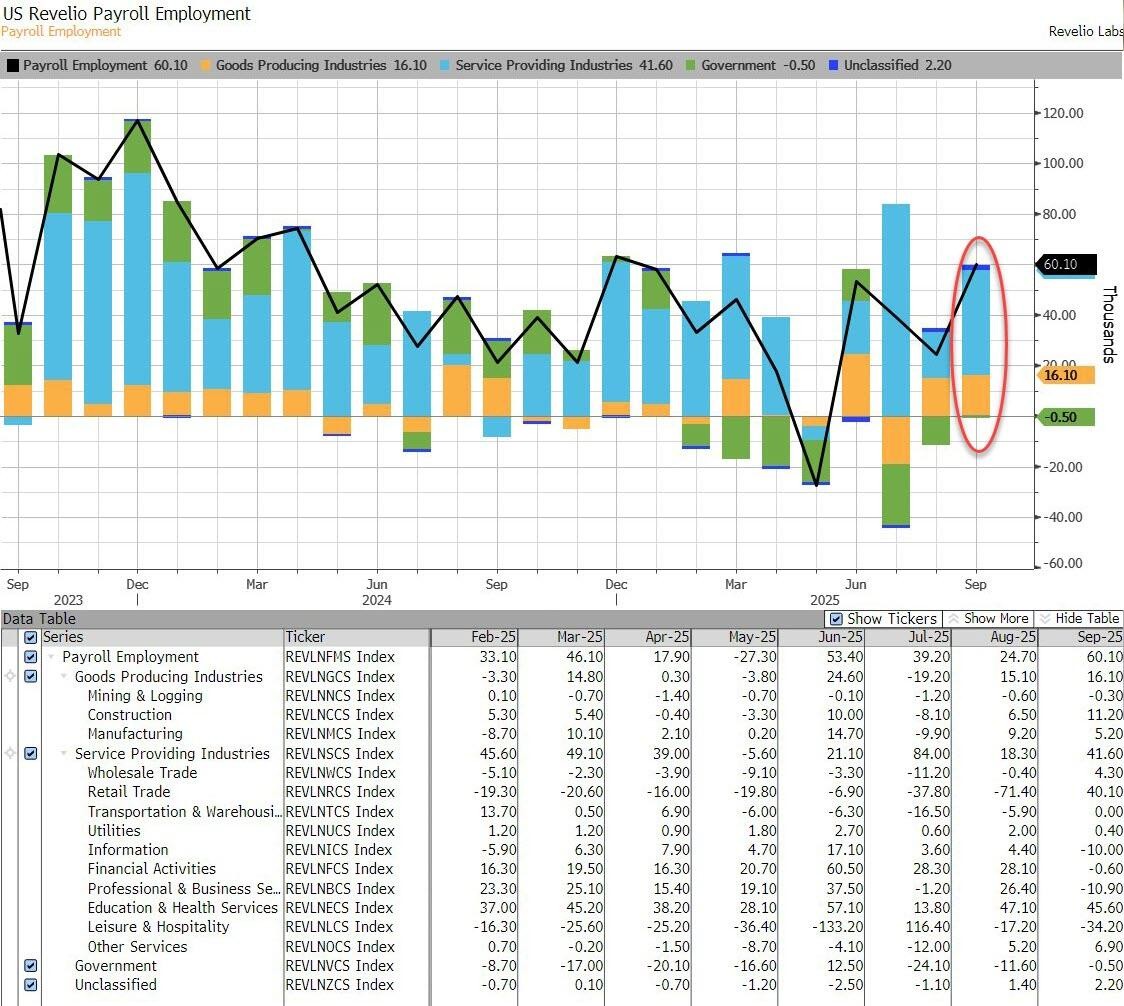

Revelio Data Shows Structural Improvement in Employment

Revelio Public Labor Statistics (RPLS) data for September indicates that job growth is mainly concentrated in high-quality sectors. Education, healthcare services, and retail trade drove job growth, while government agency sectors such as leisure and hospitality and business services saw declines.

Lisa Simon noted that while September's job growth was slightly above expectations, it still represents relatively small growth. Coupled with declines in job advertisements, wage levels, hiring, and employee turnover rates, this data suggests a continued slowdown in the labor market.

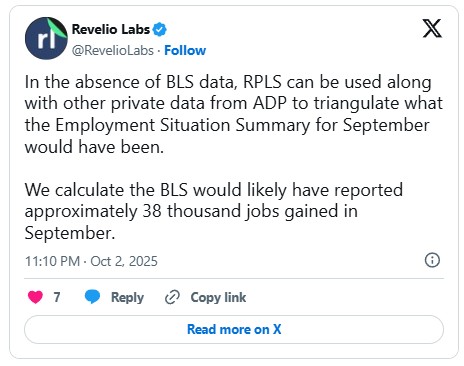

This data is highly sought after among Wall Street traders and economists, and Bloomberg has added it to its ECAN "most popular" dataset database. The regression model built by Revelio Labs using historical correlations indicated that the Labor Statistics Bureau would have originally reported an increase of about 38,000 jobs in September.

Data Provides Important Reference for Federal Reserve Policy

The data showing a slowdown in the labor market but not a collapse supports the narrative that the Federal Reserve is dealing with an economic slowdown rather than a recession. This provides policy space for the central bank to offset the economic slowdown through interest rate cuts.

RPLS is built on over 100 million U.S. user profiles, providing a clear view of labor dynamics. This statistical system adopts a format similar to that of the Labor Statistics Bureau, tracking employment levels, wages, and job transitions, surpassing traditional surveys and providing a continuous picture of the labor market.

This dataset aims to bridge the widening information gap, providing unbiased data about the U.S. labor force for policymakers, businesses, and the public. During the shutdown of the Labor Statistics Bureau, independent data sources like RPLS are crucial for providing market transparency The U.S. government shutdown has entered its third day, and the Bureau of Labor Statistics has failed to release the September employment report as scheduled, forcing traders and the Federal Reserve to "fly blind" in the absence of official data.

ADP reported earlier this week a loss of 32,000 jobs in September, raising concerns among the market and economists about the U.S. economy teetering on the brink of a labor recession.

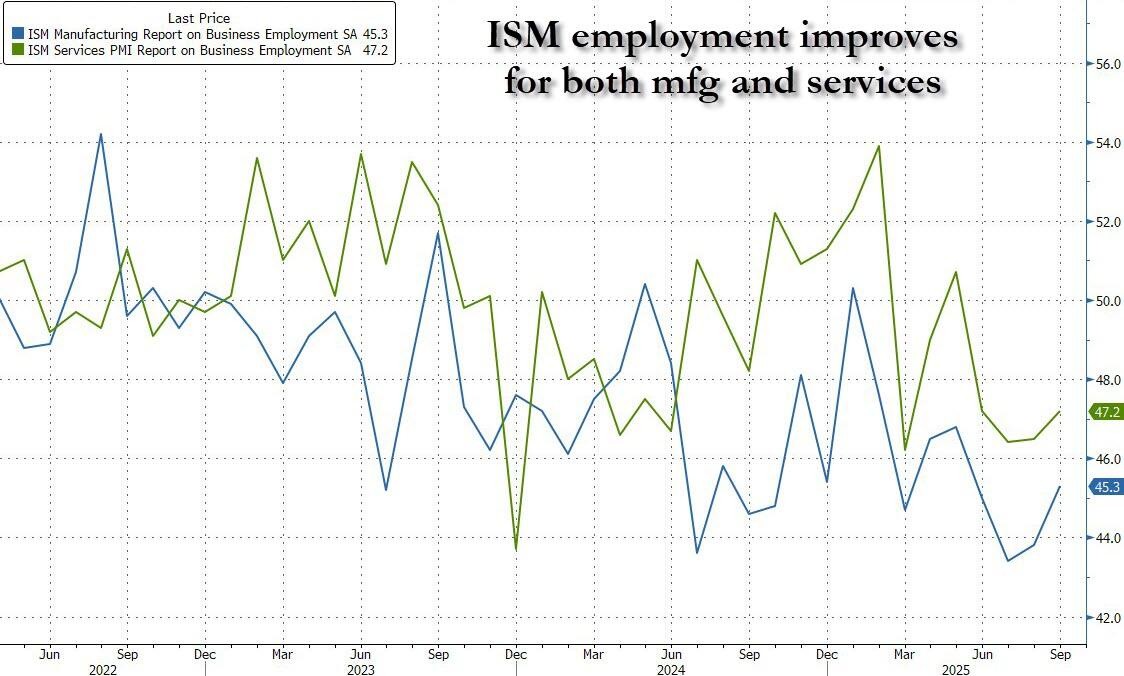

In the absence of official data, alternative data sources from the private sector have become crucial. The Institute for Supply Management found that employment in both manufacturing and services has rebounded moderately from multi-month lows, alleviating the market's worst-case concerns.