The absence of non-farm payroll data cannot stop the "traffic light" from flashing: it has become a consensus that the U.S. labor market is slowing down

The U.S. labor market has entered a sluggish state, particularly with weak hiring activity in the private sector and slowing wage growth. Although the non-farm payroll report was not released due to the government shutdown, investors can still observe this trend through private sector indicators. The ADP report shows an unexpected decrease of 32,000 jobs, while the market remains optimistic about future economic expectations, hoping for a "Goldilocks-style soft landing."

According to Zhitong Finance APP, although the highly anticipated U.S. non-farm payroll report has not been released on schedule due to the U.S. government shutdown, investors can still see that the U.S. labor market has shifted to a lower growth phase without the official government employment statistics report.

Even in the absence of the crucial non-farm data from the U.S. Bureau of Labor Statistics (BLS) (which could not be released on time this Friday due to the government shutdown, with the specific data release time pending), a series of recently released private sector statistical indicators point to further weakness in overall hiring activities by U.S. companies in September, limited layoffs, moderate wage growth, and a slowdown in demand for labor.

The U.S. government shutdown has caused the release of key economic data to come to a halt, coinciding with a particularly sensitive period for the U.S. labor market, where any degree of change in the labor market could significantly impact expectations for Federal Reserve interest rate cuts, thereby threatening the upward momentum of global stock and bond markets. The unemployment claims data and September non-farm payroll report originally scheduled for release this Thursday and Friday have both been postponed, and the future monthly CPI inflation data from the Labor Department may also be further delayed. The U.S. Secretary of Labor stated that once the government reopens, the September non-farm payroll data will be released immediately.

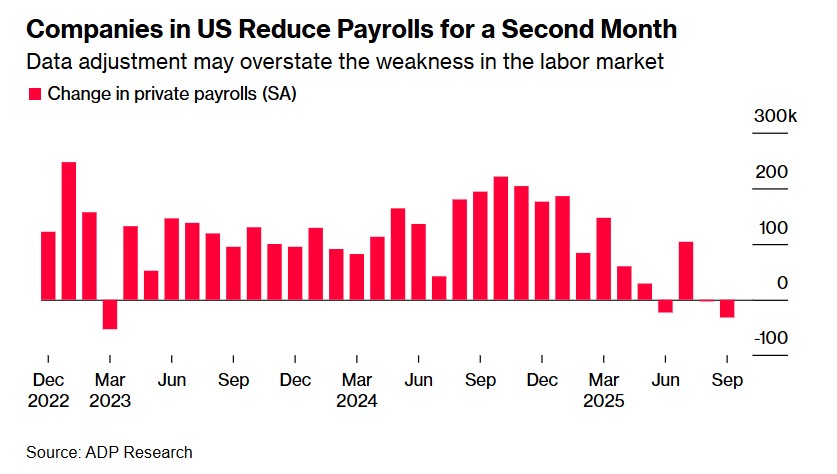

This "important statistical information vacuum" that investors rely on forces the market and the Federal Reserve to depend on alternative statistical indicators, among which the "small non-farm" ADP monthly private sector employment report released on Wednesday is particularly noteworthy. The data released on Wednesday showed that ADP employment unexpectedly decreased by 32,000, with the previous value revised down by 3,000, while the market had generally expected an increase of 51,000.

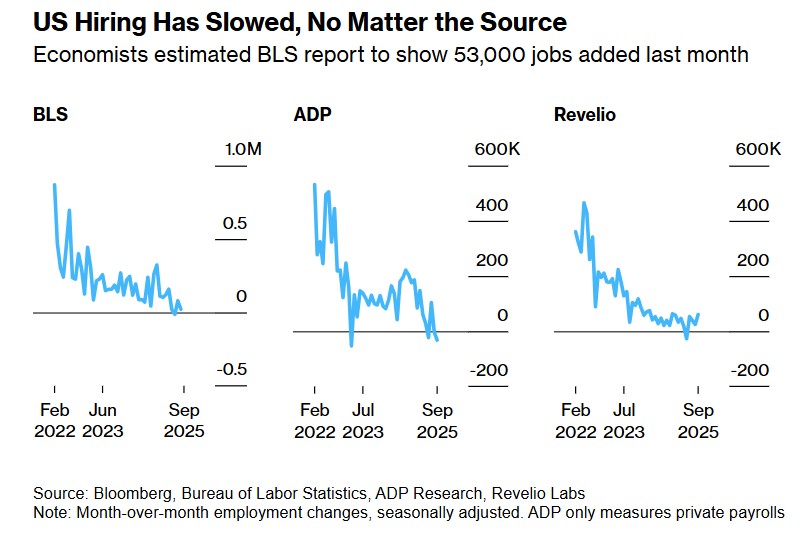

As the chart above shows, whether from ADP or Revelio employment statistics, it indicates that U.S. corporate hiring activities have slowed down. However, both these statistical agencies and major Wall Street firms like Goldman Sachs still expect the U.S. economy to achieve a "Goldilocks-style soft landing." Economists generally expect the BLS non-farm payroll report to show that only 53,000 non-farm jobs were added last month, highlighting that the U.S. labor market has fully shifted to a lower growth phase but has not yet entered a prolonged negative growth phase.

The market continues to expect the "Goldilocks narrative"

These data are generally consistent with the "low hiring, low layoffs" state of the U.S. labor market observed before the government statistical data "went dark." If this situation persists until the end of this month, it could be enough to prompt the Federal Reserve to cut interest rates again—this is also the general expectation among investors, who still bet that the Federal Reserve will announce interest rate cuts consecutively in October and December. For the recently strong U.S. short-term Treasury bonds, as well as the record-high U.S. stock market and even the global stock investment market, whether this expectation of interest rate cuts from the Federal Reserve can continue to heat up or maintain a strong momentum will largely determine whether the recent bullish trend in stocks and bonds can continue the "bull market bullish trajectory." From the perspective of retail investors, institutional investors, and speculative forces, the continuation of the global "strong stocks and strong bonds" trend largely depends on the market's reaffirmation and warming of the Federal Reserve's interest rate cut path—especially whether key data such as employment/inflation continues to support the "Goldilocks" narrative of "moderate growth + moderate inflation."

The economic data released last week showed that the inflation indicator most favored by Federal Reserve officials—the so-called core Personal Consumption Expenditures Price Index (core PCE, which excludes food and energy and is the Fed's preferred inflation measure)—rose by 0.2% month-on-month compared to July, consistent with economists' expectations and the revised previous value. Year-on-year, this core inflation indicator stubbornly remained at 2.9%, also in line with expectations and the previous value. Additionally, the PCE inflation report indicated that "U.S. Personal Consumption Expenditures" rose steadily for three consecutive months in August.

The recent combination of rising consumer spending + PCE meeting expected curves + last Thursday's upward revision of GDP, along with recent initial jobless claims data showing that the labor market has not significantly deteriorated further, coupled with the market's continued warming expectations for three consecutive interest rate cuts by the Federal Reserve, indeed raises the subjective probability of the "Goldilocks" macro scenario: that is, growth is not weak, inflation is not overheating, and market expectations are more "biased towards rate cuts" in a low-interest-rate trajectory.

The so-called "Goldilocks" U.S. macroeconomic environment refers to the U.S. economy being neither too cold nor too hot, just right, maintaining moderate growth in GDP and consumer spending along with a long-term stable trend of moderate inflation, while the benchmark interest rate is on a downward trajectory.

Goldman Sachs' latest view on the U.S. economy resonates with the recent market's optimistic expectation of a "Goldilocks-style soft landing" for the U.S. economy. David Solomon, CEO of the Wall Street financial giant Goldman Sachs Group, predicted in a recent interview that the U.S. economy will accelerate into 2026, primarily due to the ongoing monetary and fiscal stimulus measures and the "super tailwind factor" of large-scale technology spending led by AI, which will fully outweigh the relatively weak non-farm labor market and the negative impacts of geopolitical turmoil.

Despite the impact of Trump's tariff policies and the slowdown in the U.S. non-farm employment market, the Goldman Sachs CEO stated that the U.S. government's strong spending and "all infrastructure construction processes related to artificial intelligence" mean that the overall U.S. economy "is still on a fairly good growth trajectory."

"Without the non-farm employment report, we can still form an impressionistic grasp of the state of the U.S. labor market," said Michael Feroli, Chief U.S. Market Economist at JP Morgan. "From everything we see, I think they (the Federal Reserve) can confidently announce another rate cut later this month."

Here are important snapshot statistics regarding the latest data on the U.S. labor market:

Corporate Hiring

In the absence of the non-farm employment report, the ADP private sector employment data is the most watched release regarding the labor market this week. Although economists typically hold reservations about ADP data because it does not always align with government statistics, the latest reading has been "muddied" by a statistical adjustment, making it more difficult to interpret the labor market data from the government and ADP The ADP report states that in September, the number of employees on U.S. company payrolls decreased by 32,000, while the previous month was revised to a decrease of 3,000. Although this may exaggerate the weakness of the labor market, ADP indicated that it has not changed the recent trends in corporate hiring, with job creation continuing to lose momentum across most industries.

U.S. companies have reduced payrolls for two consecutive months—however, data adjustments may exaggerate the extent of labor market weakness.

Private institutions like ADP do not necessarily position themselves as leading indicators for BLS non-farm data, but some investors assess them based on their alignment with official data. Revelio Labs—whose database covers over 100 million U.S. job profiles matching the entire U.S. workforce, accounting for two-thirds of all employed individuals—reported that U.S. employers added about 60,000 jobs last month, which undoubtedly boosted market optimism regarding a "Goldilocks" soft landing for the U.S. economy.

Economists typically do not forecast Revelio's numbers, but they do predict government indicators, with the median estimate for new non-farm employment being 53,000. The labor intelligence company stated that its model predicts the BLS will report an increase of 38,000 jobs in September.

"Overall, the evidence points to a labor market that is still expanding but is at a 'standstill' in terms of speed," Revelio stated in its report. "Currently, the non-farm employment market appears stable but fragile."

Meanwhile, according to data from the Institute for Supply Management (ISM), U.S. manufacturing employment has contracted in all months except for three since the beginning of 2023. ISM data released on Friday also showed that the number of employees in service-providing sectors has declined for four consecutive months.

Veronica Clark, an economist at Citigroup, stated in a report: "Constrained by still restrictive policy rates, tariff costs squeezing profits, government funding and corporate layoffs, as well as weakened labor demand due to slowed immigration, this year's hiring data may further decline."

Data from Homebase, which provides workforce management software for U.S. small businesses, indicates that non-farm employment "may show decent growth data" in September, around 150,000.

U.S. Labor Secretary Lori Chavez-DeRemer stated on Fox Business Channel on Friday that she expects the non-farm employment data for September to be released "as soon as the government reopens."

Job Vacancy Statistics

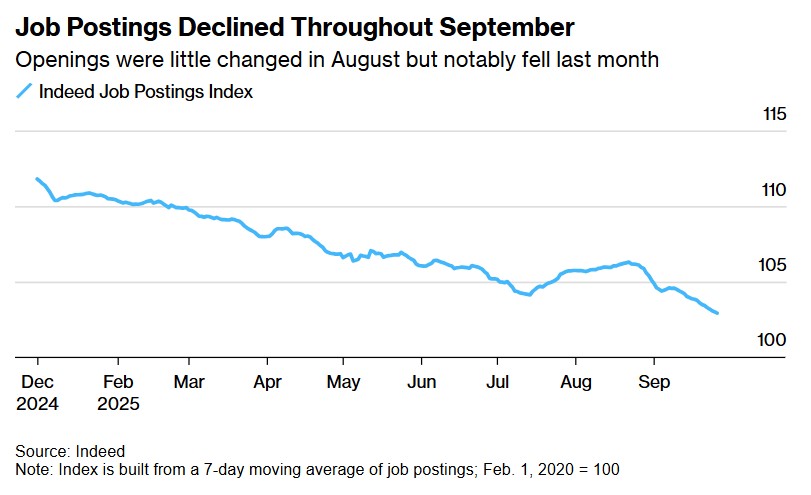

Overall, U.S. job vacancies peaked in 2022, then steadily declined and have stabilized over the past year. The latest indicators released by the BLS before the government shutdown showed little change in job vacancies in August, while hiring remains sluggish, indicating that companies' demand for labor is gradually receding Despite government data being the most trusted, job vacancy surveys are often criticized by the market for low response rates and significant revisions. Another daily benchmark index from the job site Indeed shows that job vacancies changed little in August, while the decline in September was more pronounced.

Job postings continued to decline in September; job vacancies changed little in August, but saw a significant drop last month.

"The job market has been nearly frozen for a year, and it seems to have gotten worse for job seekers," wrote Heather Long, chief economist at Navy Federal Credit Union, in a report to clients. "Americans feel trapped in this slowing economic environment."

Sentiment indicators also reflect this—The New York Fed's measure of job seekers' outlook hit a historic low in August, while The Conference Board's survey of consumers showed that American consumers were similarly pessimistic about job prospects in September. The employee confidence index measured by the job site Glassdoor saw a slight rebound last month but remains far below the peak in 2022.

Unemployment and Layoffs

One "good news" in the current labor market is that weak hiring has not yet translated into larger-scale layoff data. The national unemployment rate is expected to remain at 4.3% last month, higher than at the beginning of the year but still near historical lows.

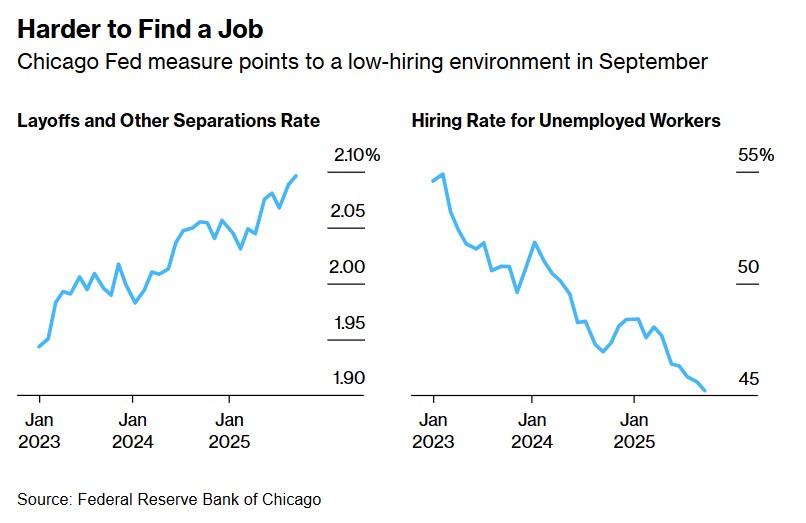

The real-time unemployment rate forecast compiled by the Chicago Fed (partly relying on BLS data) gives similar unemployment rate figures. Austan Goolsbee, president of the Chicago Fed, stated on Wednesday when introducing this indicator that the lack of official statistics during the U.S. government shutdown "is problematic for the FOMC monetary policy decision-makers at the Federal Reserve."

It's harder to find a job in the U.S.—the Chicago Fed's indicator shows a low hiring environment in September.

According to employment placement agency Challenger, Gray & Christmas, the scale of layoffs announced by employers is indeed decreasing, while they have also lowered hiring plans to the weakest September level since 2011.

Wage Growth Rate

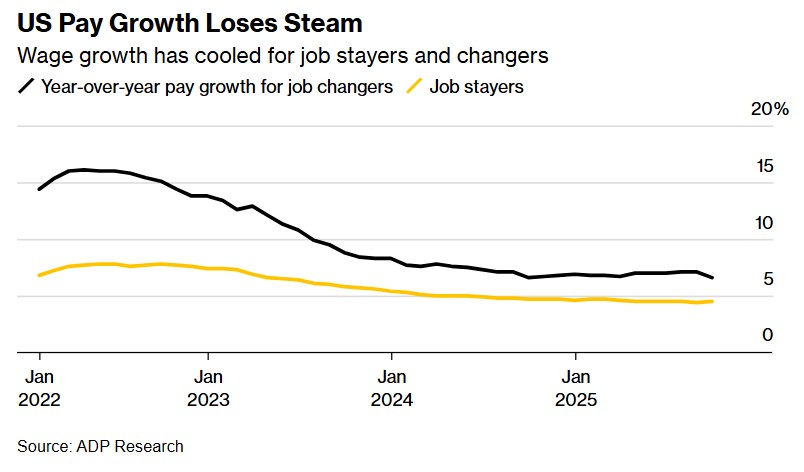

Meanwhile, the wage growth rate continues to advance, but the pace has significantly slowed. BLS statistics show that since mid-2023, wage increases have generally outpaced inflation, but the recent advantage has narrowed. ADP's employment report indicates that wage growth for job changers continues to slow, while wages for "stayers" have remained largely unchanged

U.S. wage growth loses strong momentum—salary increases for both job switchers and stayers have significantly cooled down.

Revelio's statistics depict a more pessimistic wage picture, and this statistical report on the substantial slowdown in wage growth undoubtedly contributes to the ongoing hot expectations for interest rate cuts. The company's data shows that salaries in newly posted jobs in September even decreased by 0.3% compared to the previous month, marking the first significant decline since March