U.S. stocks withstand the risk of data absence and hit new highs, Chinese concept stocks outperform the market, gold and silver retreat, Bitcoin breaks through the 120,000 mark

The three major U.S. stock indices briefly turned negative during the session, marking their first simultaneous record highs of the week; chip stocks supported the market, with Nvidia hitting a three-day high and AMD rising over 3%; Tesla initially rose 2.5% before closing down over 5%; Occidental Petroleum fell over 7%; Alibaba rose over 3%. Federal Reserve officials called for cautious interest rate cuts, the U.S. dollar hit a new daily high, and gold futures, which had set intraday highs for four consecutive days, fell over 1%, while silver futures had previously dropped over 4%. U.S. unemployment data was not released as scheduled, and U.S. Treasury yields hit new daily highs. Crude oil reached a four-month low, dropping over 2% during the session

The U.S. government shutdown has begun to disrupt the economic data schedule, and Federal Reserve officials have poured cold water on the possibility of an interest rate cut this month. Major U.S. stock indices briefly turned negative during the session, and gold fell from record highs. The crucial non-farm payroll report is expected to be released this Friday as scheduled, and the three major U.S. stock indices managed to shake off the downward trend, collectively closing at new highs. After OpenAI signed a supply agreement with storage chip giants and its latest valuation was exposed, chip stocks became a major driver of the upward movement in U.S. stocks.

The market continues to focus on the impact of the U.S. government shutdown and whether there are signs of avoiding a prolonged shutdown. In the absence of some economic data, speeches from Federal Reserve officials like Logan, which indicate their stance, have garnered more attention.

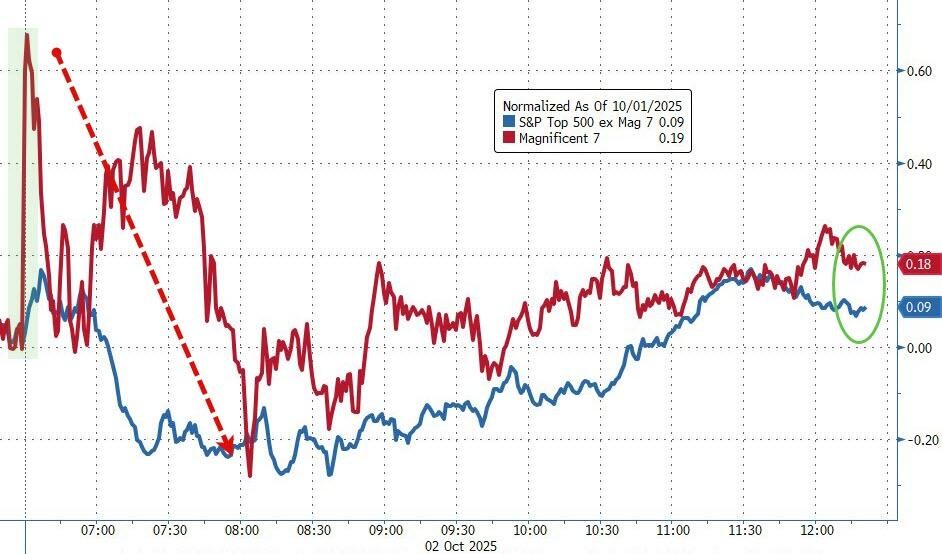

As the U.S. government shutdown enters its second day, U.S. stocks pre-market, the weekly unemployment claims and August durable goods orders originally scheduled for release on Thursday were not published as expected. After the scheduled release time, U.S. Treasury yields hit a daily high. The three major U.S. stock indices continued to open higher collectively, with the Nasdaq and S&P 500 both reaching intraday record highs at the beginning of the session, but later the Dow and S&P turned negative, with the Nasdaq briefly turning negative as well.

In the early U.S. stock market, Federal Reserve FOMC voting member Logan reiterated inflation risks, stating that interest rate cuts need to be "particularly cautious" to avoid excessive easing that would force the Fed to tighten monetary policy, suggesting he does not support a rate cut this month. Following Logan's speech, the U.S. dollar index hit a daily high, and gold and silver prices fell further, with New York gold dropping over 1% and silver briefly falling over 4%.

In the U.S. stock market at noon, media reports indicated that an assistant from the Senate Banking Committee revealed that the Bureau of Labor Statistics (BLS) may be preparing to release the September labor data as scheduled on Friday. The three major U.S. stock indices rose together during the session.

In the U.S. stock market at noon, Federal Reserve FOMC voting member Goolsbee expressed a desire to remain cautious about premature interest rate cuts, and the U.S. dollar and gold and silver reacted relatively calmly.

After announcing a supply agreement with OpenAI on Wednesday, South Korea's "storage giants" Samsung and SK Hynix rose 3.5% and 9.9%, respectively. In the U.S. stock market pre-market, media reported that OpenAI employees valued the company at $500 billion in a share sale transaction, making OpenAI the highest-valued startup globally. Nvidia briefly rose over 2%, closing at a record high for three consecutive days, while its competitors AMD and Broadcom both rose over 4%.

In the U.S. stock market pre-market, Tesla announced a third-quarter delivery volume of 497,000, setting a record for a single quarter, significantly exceeding analyst expectations, benefiting from U.S. consumers rushing to purchase before government tax credits expire. At the beginning of the session, Tesla rose over 2%, but quickly turned negative, with losses expanding to over 5% by the end of the session.

Tesla initially rose 2.5% but closed down over 5%

All three major U.S. stock indices turned negative in early trading, then turned positive at midday, collectively reaching new historical highs for the first time this week. Chip stocks supported the market, with Nvidia continuing to hit new highs. After announcing quarterly delivery volumes that greatly exceeded expectations, Tesla initially rose but quickly turned sharply lower. The leading pharmaceutical stocks that had risen in the previous two days retreated. Following a surge in cryptocurrencies, blockchain and related concept stocks rose. Chinese concept stocks generally outperformed the market, with Alibaba briefly rising over 5%.

U.S. stock benchmark indices:

- The S&P 500 closed up 0.06% at 6715.35 points, marking a new high for two consecutive days. The Dow Jones Industrial Average rose 78.62 points, or 0.17%, to close at 46519.72 points, setting a new closing historical high for three consecutive days. The Nasdaq rose 0.39% to 22844.051 points, refreshing the record set on September 22 last week.

- The small-cap index Russell 2000 rose 0.66% to 2458.49 points; the tech-heavy Nasdaq 100 index rose 0.37% to 24892.764 points, setting a new record for two consecutive days; the Nasdaq Composite Index rose 0.77% to 2273.55 points, refreshing the record set last Monday, marking five consecutive gains.

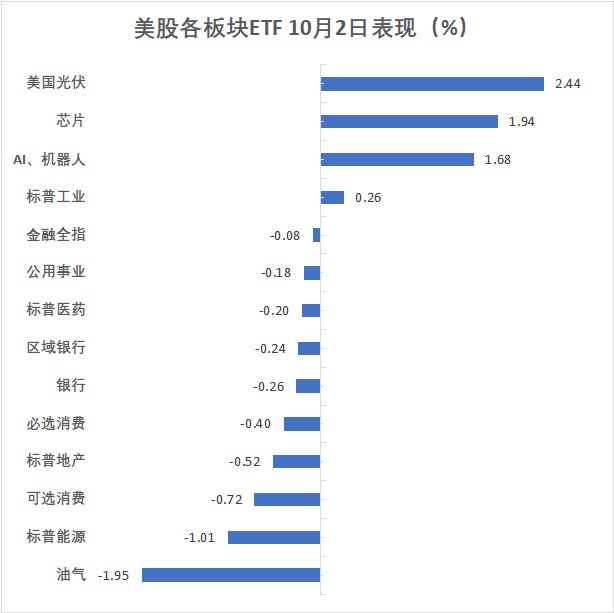

U.S. stock sector ETFs:

- The photovoltaic stock ETF rose over 2%, the semiconductor ETF rose nearly 2%, continuing to lead in gains, while the pharmaceutical ETF, which rose over 3% on Wednesday, fell 0.2%, and the oil and gas ETF, dragged down by falling crude oil prices, fell nearly 2%.

The Magnificent Seven in Technology:

- The index of the seven major U.S. tech stocks (Magnificent 7) rose 0.08% to 201.37 points.

- Meta rose 1.35%, Nvidia, Apple, and Google A rose up to 0.88%, with Nvidia rising for six consecutive days, setting a new historical high for three consecutive days, while Microsoft fell 0.76%, and Tesla, which initially rose 2.5%, closed down 5.11%.

Although there was panic buying at the opening, the impact of the "Magnificent Seven" on the market on Thursday was not significant compared to the other 492 S&P 500 component stocks.

Chip stocks:

- The Philadelphia Semiconductor Index closed up 1.94% at 6626.382 points, setting a new closing historical high for three consecutive days.

- AMD rose 3.49%, Intel rose 3.78%, Broadcom rose 1.44%, while TSMC's U.S. stock closed down 0.12%.

Pharmaceutical stocks:

- AstraZeneca's U.S. stock (AZN), which rose 9.92% on Wednesday, closed down over 0.8%, while Eli Lilly (LLY), which rose 8.2% on Wednesday, and Merck (MRK), which rose 7.4% and led the Dow components, both closed down nearly 0.7%. Pfizer (PFE), which rose 6.8% on Wednesday, closed down nearly 0.5%

Blockchain, Cryptocurrency, and Treasury Concept Stocks:

- BAkkt rose 28.61%, Circle rose 16.04%, Ebang International ADR rose 15.87%, MFH rose 15.78%, Bullish rose 11.68%, Cipher Mining rose 9.60%, Coinbase rose 7.48%, Robinhood rose 4.71%, and "Bitcoin holder" Strategy (MSTR) rose 4.11%.

Chinese Concept Stocks:

- The Nasdaq Golden Dragon China Index closed up 1.06% at 8852.95 points, rising more than 1% for two consecutive days, reaching its highest level since December 2021.

- WeRide rose 9.2%, Pony.ai rose 4.5%, Alibaba rose about 3.6%, Nio, Manbang, and Lexin rose over 3%, Baidu rose about 2%, and Li Auto rose over 1%.

Other Stocks:

- After Berkshire Hathaway, led by Warren Buffett, confirmed the acquisition of its petrochemical business for $9.7 billion in cash, Occidental Petroleum (OXY) turned down in early trading, closing down 7.3%.

- Fair Isaac (FICO) closed up about 18%. The credit analysis company launched a new system that allows other companies to directly use its mortgage applicant credit scoring system, bypassing traditional credit reporting agencies. Credit reporting companies Equifax (EFX) and TransUnion (TRU) closed down about 8.5% and 10.6%, respectively.

- Lithium Americas (LAC) closed down 2.4%. Canaccord Genuity downgraded the rating of this lithium mining stock to sell, believing that the benefits from the U.S. Department of Energy's investment and revised loan agreements may be limited.

- After investor Khrom Capital urged the company to explore strategic transformation options, Acadia Healthcare (ACHC) closed up 8.4%.

- After announcing a slight increase in quarterly cash dividends, Starbucks (SBUX) closed up nearly 2.8%.

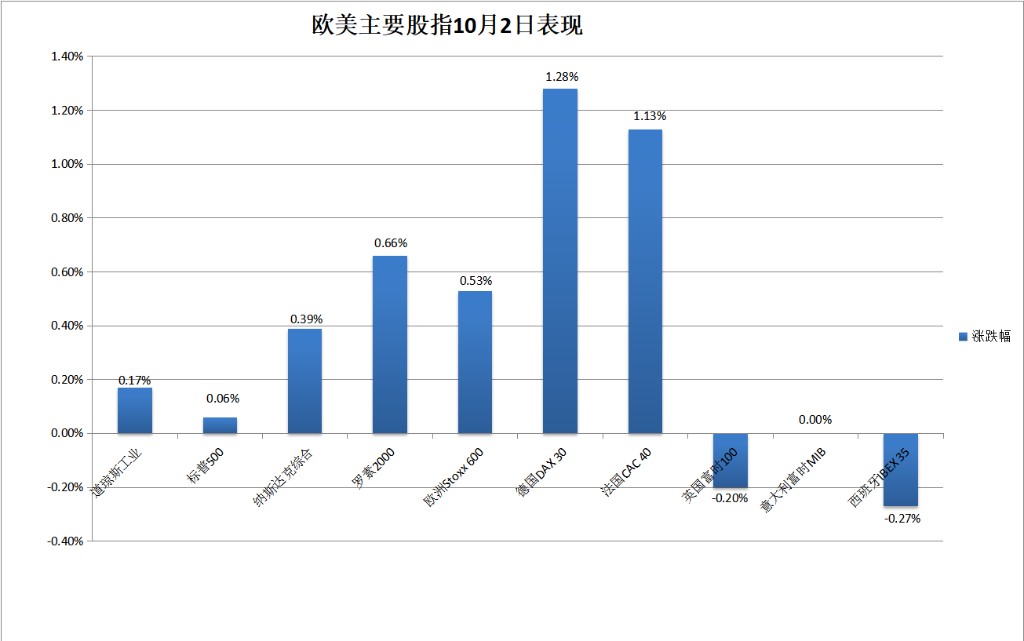

Chip stocks and automotive stocks supported the pan-European index for five consecutive rises, reaching a historic high for two days, with ASML rising over 4% and Stellantis rising over 8%, while UK stocks fell from record highs.

The STOXX Europe 600 Index closed up 0.53% at 567.60 points, rising for five consecutive trading days and setting a closing historical high for two consecutive days.

In the STOXX 600 sectors:

- Technology rose over 2.3%, with the Dutch-listed European highest market capitalization chip stock ASML rising 4.30%, and another chip stock ASM International rising 6.56%.

- The automotive sector rose nearly 2.4%, benefiting from data showing improved new car sales momentum in the U.S. and Italy, with Paris-listed Stellantis rising about 8.3%, and both German BMW and Mercedes rising over 1%;

- The banking sector fell over 0.9%, with component stock Banco Santander of Spain falling 1.80%, Italy's UniCredit falling 2.02%, and Intesa Sanpaolo falling 2.27%

Major European country stock indices showed mixed performance on Thursday. German and French stocks rose for five consecutive days, while the UK stock index, which had risen for four consecutive days, fell from its recently set closing high for two days. The Italian and Spanish stocks, which had risen for two consecutive days, ended flat and down, respectively.

The number of unemployment claims in the United States was not released as scheduled, U.S. Treasury yields hit a daily high, and the yield on the 10-year U.S. Treasury bond later fell to a two-week low, while the yield on the two-year U.S. Treasury bond, which is more sensitive to interest rates, rose for the first time this week.

European Bonds:

European bond prices were mixed, influenced during the day by the delayed release of U.S. economic data. By the end of the bond market, the yield on the UK 10-year benchmark government bond was about 4.71%, up 2 basis points for the day; the yield on the benchmark 10-year German government bond was about 2.70%, down 1 basis point for the day. The yield on European stocks hit a daily low of 2.697%, briefly rising after the scheduled release time of U.S. unemployment figures, and the U.S. stock market pre-opened at a daily high of 2.730%.

U.S. Bonds:

After the scheduled release time of U.S. unemployment claims, the yield on the 10-year U.S. Treasury bond briefly broke 4.12% to hit a daily high, then fluctuated downward, falling below 4.09% during the U.S. stock market's midday session, and testing 4.08% at the end of the session, refreshing the low since September 18 set on Wednesday. By the end of the bond market, it was about 4.08%, down about 2 basis points for the day, marking a decline for two consecutive days.

The yield on the two-year U.S. Treasury bond fell below 3.53% in the Asian market's early session, approaching the low set on September 18. After the unemployment data was not released before the U.S. stock market opened, it briefly broke 3.57% to hit a daily high. After the speech by Federal Reserve's Logan in the early U.S. stock market, it rose close to 3.57%, but later gave back most of the gains, ending the bond market session at about 3.54%, up nearly 1 basis point for the day, rebounding after four consecutive days of decline.

U.S. crude oil inventories increased rather than decreased, and market speculation about OPEC+ continuing to increase production continued to exert pressure, raising concerns about oversupply. Crude oil fell for four consecutive days, hitting a four-month low, with intraday declines exceeding 2%.

Crude Oil:

- During the midday session of the U.S. stock market, U.S. WTI crude oil fell to $60.4, down over 2.2% for the day, while Brent crude oil fell to $64.00, down nearly 2.1% for the day.

- Crude oil has closed lower for four consecutive days. WTI November crude oil futures closed down 2.10% at $60.48 per barrel, refreshing the low since May 30. Brent December crude oil futures closed down 1.90% at $64.10 per barrel, refreshing the low since June 2.

Gasoline and Natural Gas: NYMEX November gasoline futures closed down 1.85% at $1.8510 per gallon, marking four consecutive declines; NYMEX November natural gas futures, which had risen for six consecutive days, closed down 0.98% at $3.4420 per million British thermal units