U.S. Stock Outlook | The three major stock index futures are mixed. The number of layoffs in the U.S. decreased in September, but the total number of layoffs from the beginning of the year is higher than the total for the entire year of 2024

U.S. stock index futures were mixed, with ADP employment data unexpectedly decreasing by 32,000, reinforcing market expectations for a rate cut by the Federal Reserve this year. The U.S. manufacturing PMI for September contracted for the seventh consecutive month, indicating weak industry demand

- As of October 2nd (Thursday) before the US stock market opens, the three major US stock index futures showed mixed results. As of the time of writing, Dow futures were down 0.02%, S&P 500 futures were up 0.25%, and Nasdaq futures were up 0.49%.

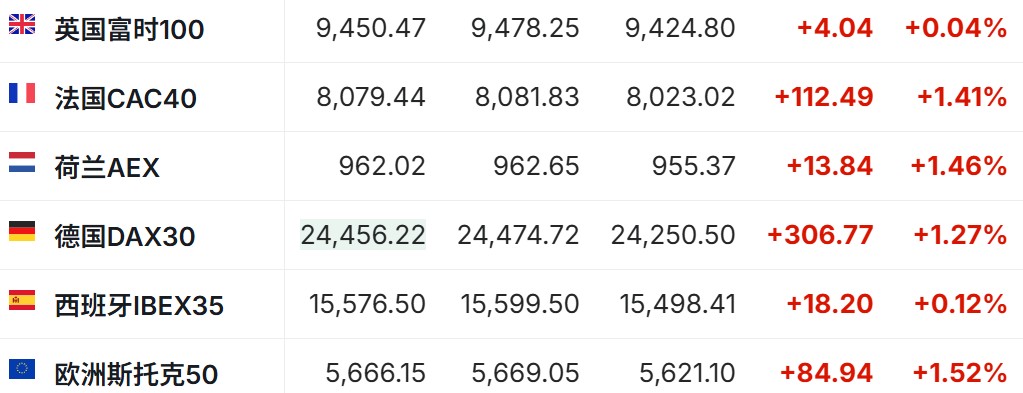

- As of the time of writing, the German DAX index was up 1.27%, the UK FTSE 100 index was up 0.04%, the French CAC40 index was up 1.41%, and the European Stoxx 50 index was up 0.52%.

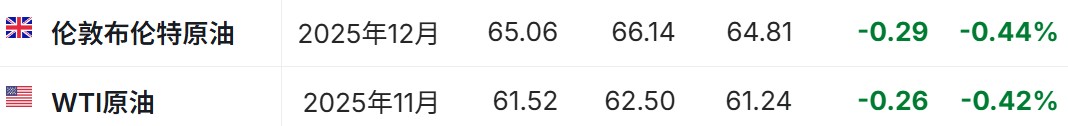

- As of the time of writing, WTI crude oil was down 0.42%, priced at $61.52 per barrel. Brent crude oil was down 0.44%, priced at $65.06 per barrel.

Market News

US ADP employment data unexpectedly recorded a negative value, investors bet on two more rate cuts by the Federal Reserve this year. The ADP report released on Wednesday showed that private sector employment in September unexpectedly decreased by 32,000, far below Wall Street's expectation of an increase of 45,000. This "surprising" data was interpreted by the market as the latest signal of significant deterioration in the US labor market, reinforcing investors' expectations for the Federal Reserve to implement two more 25 basis point rate cuts before the end of the year. Amid a partial government shutdown due to a budget impasse, the ADP data, which is usually seen as a "leading indicator" for non-farm payrolls, has received unusually greater attention. With the Bureau of Labor Statistics (BLS) canceling the September non-farm payroll report originally scheduled for release this Friday due to the government shutdown, the market has to rely on ADP data in the short term to assess employment conditions.

US manufacturing PMI contracted for the seventh consecutive month in September, with price pressures still evident. Data released by the Institute for Supply Management (ISM) on Wednesday showed that US manufacturing continued to be in contraction territory in September, reflecting weak industry demand and ongoing pressure on factory activity from external uncertainties. The latest manufacturing PMI recorded 49.1, up from 48.7 in August, but still below the neutral line of 50, indicating that manufacturing has contracted for seven consecutive months. Among the sub-indices, the output index returned to the expansion range at 51, a significant rebound of 3.2 percentage points from August; however, the new orders index fell to 48.9, ending last month's brief expansion. The export orders index dropped to 43, down 4.6 percentage points from August, indicating continued weakness in external demand. The inventory index decreased to 47.7, reflecting increased pressure on companies to reduce inventory.

The number of layoffs in the US decreased by 37% in September, with the total number of layoffs so far this year exceeding the total for all of 2024. Global reemployment company Challenger, Gray & Data released by Christmas on Thursday showed that U.S. employers announced layoffs of 54,064 in September, a decrease of 37% from August and a reduction of 26% from 72,821 in the same period last year. So far in 2025, companies have announced layoffs of 946,426, the highest cumulative number from the beginning of the year since the pandemic in 2020 (when industries like leisure and hospitality were nearly shut down, leading to 2.08 million layoffs). This figure is also the fifth highest cumulative total from the beginning of the year in the company's 36-year statistics. The total number of layoffs year-to-date has increased by 55% compared to the same period last year and is 24% higher than the total for all of 2024.

U.S. Supreme Court rejects Trump's immediate removal of Federal Reserve Governor Cook, will officially hear arguments in January. The U.S. Supreme Court on Wednesday rejected President Trump's request for the immediate removal of Federal Reserve Governor Cook. This ruling means that Cook will remain in office until the Supreme Court officially hears arguments and makes a final decision in January. Cook has held the position since August of last year, when Trump announced his dismissal on "mortgage fraud" charges. Cook's side has clearly denied the relevant allegations. Lower courts previously found that Cook was "likely to prevail" in the lawsuit and granted a temporary injunction to prevent her from being dismissed before the case is resolved. The Department of Justice subsequently appealed, but the Supreme Court stated it would pause action, with no justices dissenting.

FOMC voting member Goolsbee: Government shutdown leads to data gaps, complicating Fed decision-making. In a statement on Wednesday, 2025 FOMC voting member and Chicago Fed President Goolsbee said that the lack of official data during the U.S. government shutdown will make it more difficult for Federal Reserve officials to interpret economic conditions. Goolsbee reiterated concerns about the recent rise in service sector inflation, suggesting that this could mean persistent price pressures in economic areas least affected by tariffs. He noted that while there are many non-government sources of labor market data, inflation statistics are not among them.

EU plans to significantly raise steel import tariffs to 50% to protect domestic steel industry. A draft proposal indicates that the EU plans to raise steel import tariffs to 50%. This move would align the EU's tariff levels with those of the U.S., which is seeking to address the issue of overcapacity in Asia. The EU currently has a temporary mechanism to protect its steel industry, which imposes a 25% tariff on most imported steel once quotas are exhausted. This mechanism is set to expire in June, and the EU has been working to replace it with a more permanent regulation, which is expected to be announced next week. According to the draft, the European Commission, which handles EU trade matters, plans to raise the tariff rate to 50% "to minimize the risk of trade diversion." This higher rate will apply once imports exceed a specific quota.

Goldman Sachs: Strong interest from private investors indicates that the gold rally is far from over. Goldman Sachs, which has a long-term bullish outlook on gold, stated that due to strong interest from private investors, gold prices still have room for further increases, potentially exceeding the bank's expectations. Analysts at Goldman Sachs, including Daan Struyven, noted that the inflow of funds into gold ETFs has been unexpectedly strong, surpassing previous model predictions. The likelihood of private investors heavily investing in gold presents "significant upside risks" to analysts' forecasts They originally expected gold prices to reach $4,000 per ounce by mid-2026 and $4,300 per ounce by the end of next year.

Individual Stock News

It is reported that Advanced Micro Devices (AMD.US) is in talks with Intel (INTC.US) for foundry cooperation. Sources indicate that Intel (INTC.US) is in preliminary discussions with Advanced Micro Devices (AMD.US) to explore the possibility of Intel manufacturing some AMD chips. This news spurred Intel's stock price to soar 7% on Wednesday, while AMD's stock price also rose over 1%. If the cooperation is successful, it would mark a significant breakthrough for Intel's foundry business. Analysts point out that the addition of major clients will not only help Intel increase investment in advanced process research and development but will also signal to the entire semiconductor industry that it is capable of handling top-tier customer orders. Currently, AMD's chips are mainly manufactured by Taiwan Semiconductor Manufacturing Company (TSMC.US).

Berkshire Hathaway to acquire OxyChem, a chemical division of Occidental Petroleum (OXY.US), for $9.7 billion. Warren Buffett's Berkshire Hathaway announced on Thursday its largest deal in years: Berkshire (BRK.A.US, BRK.B.US) will acquire Occidental Petroleum's chemical division OxyChem for $9.7 billion. This acquisition of OxyChem may be Buffett's last major deal before he hands over the CEO position to Vice Chairman Greg Abel in January. Warren Buffett plans to continue serving as chairman of Berkshire and will remain involved in decisions regarding the use of the group's over $344 billion in cash.

Stellantis (STLA.US) reports a 6% increase in third-quarter sales to 324,825 vehicles. Stellantis sold 324,825 vehicles in the U.S. in the third quarter, a 6% increase from the same period last year, achieving the highest monthly market share in the past 15 months in September. By brand, Jeep sales increased by 11%, Chrysler sales rose by 45%, offsetting a 2% decline in Dodge and a 5% decline in the Ram brand. Fiat's sales grew by 2% this quarter, while Alfa Romeo's sales fell by 21%, totaling only 1,614 vehicles.

Important Economic Data and Event Forecasts

Beijing time 22:00: U.S. durable goods orders excluding defense month-on-month

Beijing time 22:00: U.S. factory orders month-on-month

Beijing time 22:30: U.S. EIA natural gas inventory