"U.S. Government Shutdown" Trading Guide: Duration is Key, Gold and Silver are More Defensive

花旗认为,美国政府停摆时间的长短是决定资产表现的关键,而市场目前对此次停摆的定价可能过于乐观。历史数据显示,在超过五天的 “长期停摆” 事件中,美股往往提前抛售,在停摆开始后 10 至 15 个交易日触底反弹,与政府有直接或间接收入往来的公司个股更承压,黄金、白银的避险需求高涨。

美国联邦政府时隔近七年再度 “停摆”,金融市场迎接新的不确定性。

据知名预测市场 Polymarket 的数据,近 70% 的用户认为政府关门结束的时点最早也要到 10 月 10 日,更是有 41% 的用户认为至少持续到 10 月下旬。

据追风交易台消息,花旗分析师 Vinh Vo 及其团队在其最新研报中指出,停摆时间的长短是决定资产表现的关键,而市场目前对此次停摆的定价可能过于乐观,忽视了长期僵局可能带来的显著冲击。

历史数据显示,长期停摆将引发股票与债券走势的明显分化,并推升市场波动性,在此类情景下,黄金和白银等贵金属是比美元更可靠的避险工具。

报告还指出,此次停摆的一个新变量是,特朗普政府已指示各机构考虑永久性裁员,这可能比以往仅让政府雇员休假并事后补发薪水的做法带来更具破坏性的经济影响,尽管具体细节尚不明确。

尽管政府停摆带来了种种不确定性,但花旗认为,这一事件不太可能逆转当前美股和美债的整体势头。报告称,围绕人工智能的 “强烈乐观情绪”,叠加美联储更加宽松的货币政策背景,是支撑市场的关键力量。

长期停摆前夕,美股跌、美债涨

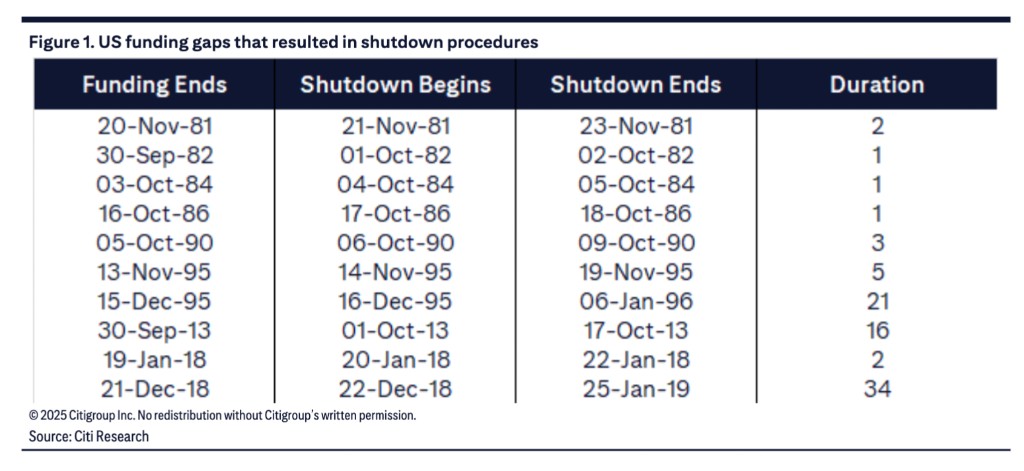

花旗的研究通过复盘历史上的 10 次政府停摆事件发现,停摆时间的长短是决定资产表现的关键。

报告将持续时间少于五天的归为 “短期事件”(6 次),超过五天的归为 “长期事件”(4 次)。

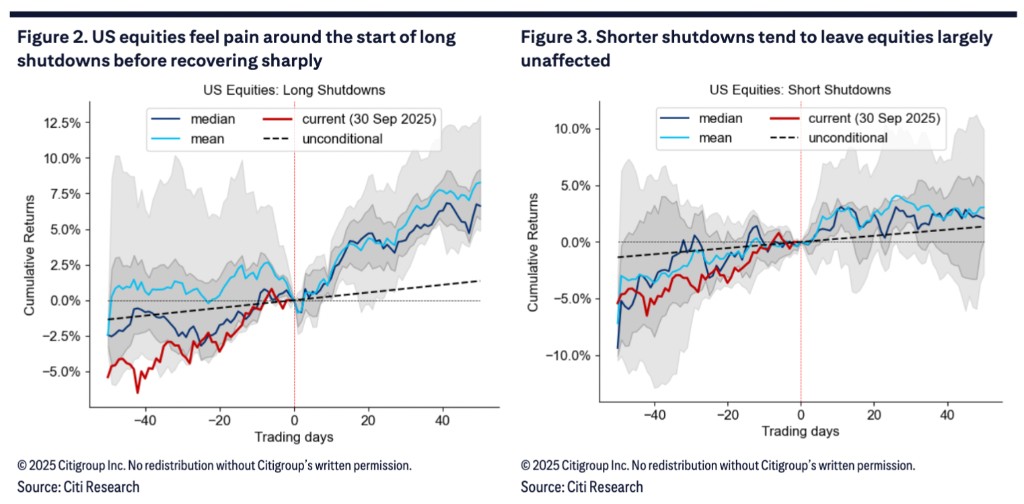

历史数据显示,在长期停摆期间,美国股市通常在事件发生前就已开始抛售,并在停摆开始后 10 至 15 个交易日触底反弹。

而美国国债则表现出相反的走势,在事件前出现明显的避险性上涨。

相比之下,短期停摆对股市的影响不甚显著,美债也仅在停摆前后出现小幅波动。花旗指出,当前的市场走势更符合短期停摆的预期。

波动性攀升,风险敞口个股承压

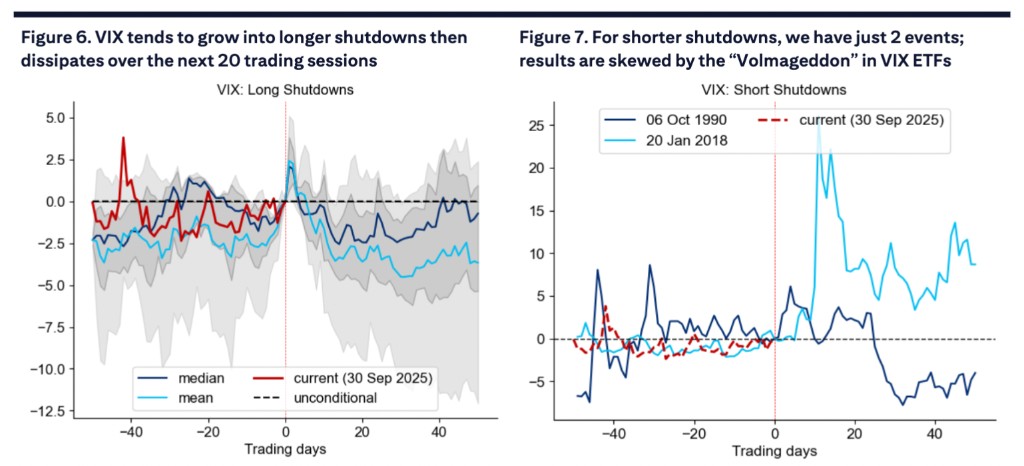

政府停摆几乎总会伴随着市场波动性的上升。报告显示,在长期停摆事件中,衡量股市波动性的 VIX 指数会稳步攀升,并在停摆后缓慢消散。相比之下,债市波动性的上升时间则更短。

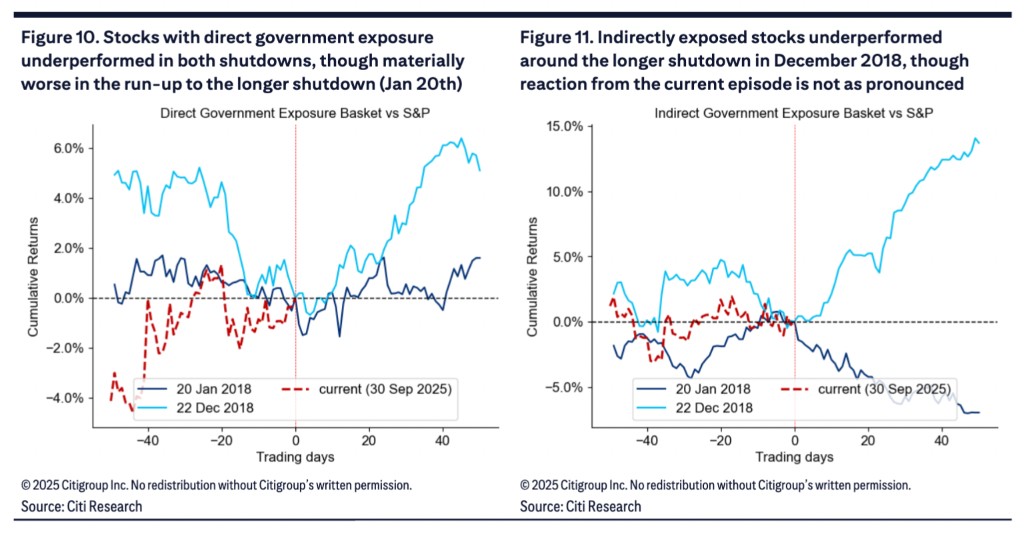

对于特定股票而言,与政府有直接或间接收入往来的公司将面临更大压力。历史分析表明,在过去的停摆事件中,特别是 2018 年 12 月的长期停摆中,直接面向政府业务的股票篮子表现显著弱于标普 500 指数,直到僵局解决后才出现修复性反弹。

报告称,尽管当前相关股票的走势较为震荡,并未出现明显的趋势性下跌,但若停摆时间延长,其下行风险值得关注。

避险资产选择:黄金优于美元

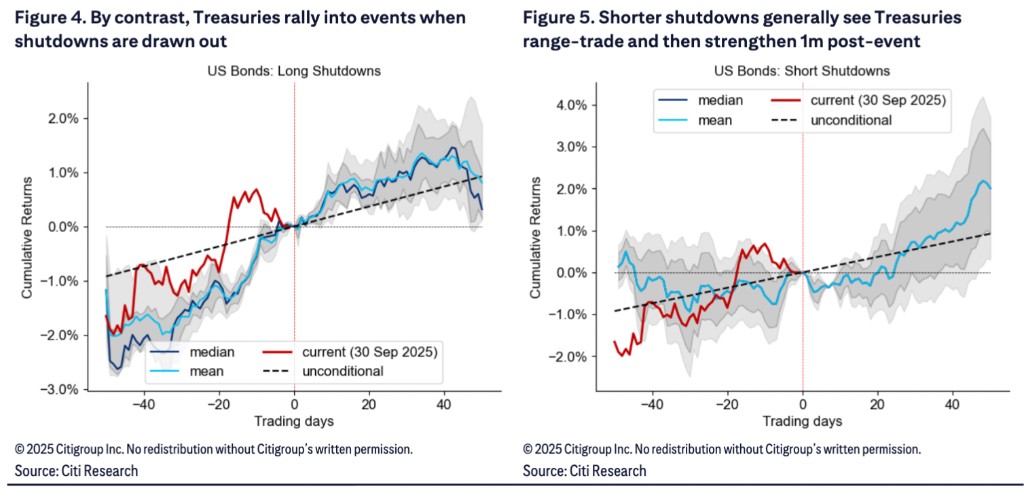

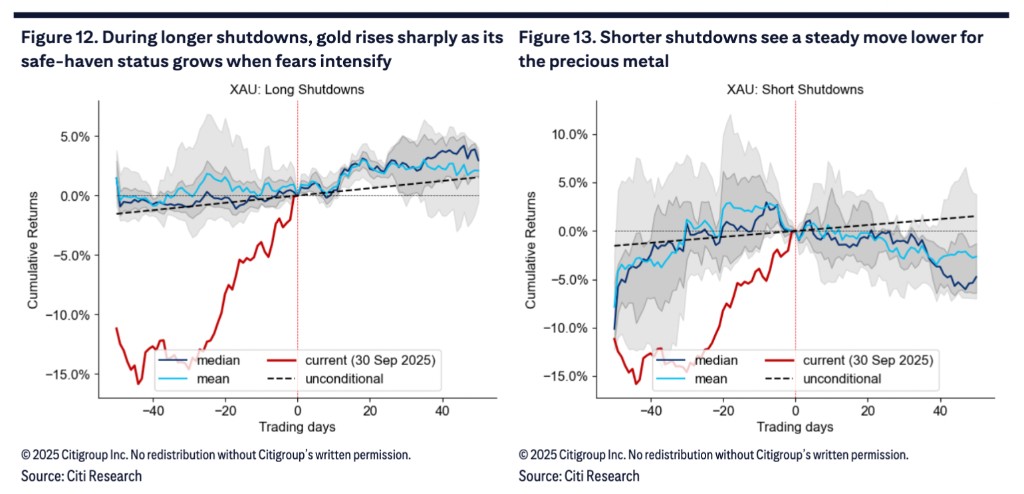

在寻求对冲停摆风险时,投资者的传统选择可能需要重新审视。花旗指出,在长期停摆引发市场担忧加剧时,黄金和白银历史性地被证明是比美元更可靠的对冲工具。

数据显示,在长期停摆期间,随着不确定性增加,黄金通常会获得买盘支撑,平均上涨 2%,并在停摆结束后维持强势。白银也呈现出类似但波动性更高的走势。

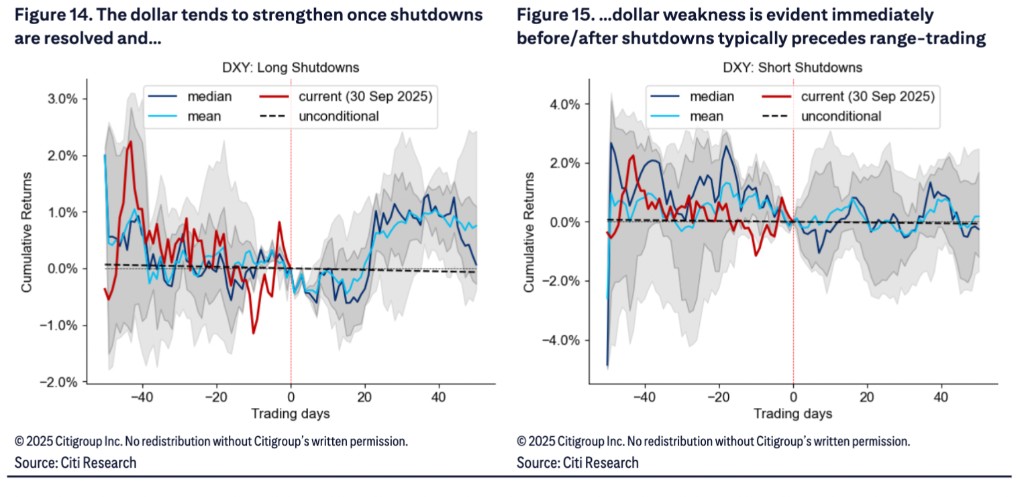

与此形成鲜明对比的是,美元指数在停摆开始前后往往表现疲软,这或许与危机的 “美国中心” 性质有关。只有在长期停摆得到解决后,美元才会扭转颓势。