"Storage Duopoly" Samsung and SK Hynix stocks surge after reaching a preliminary supply agreement with OpenAI on "Stargate"

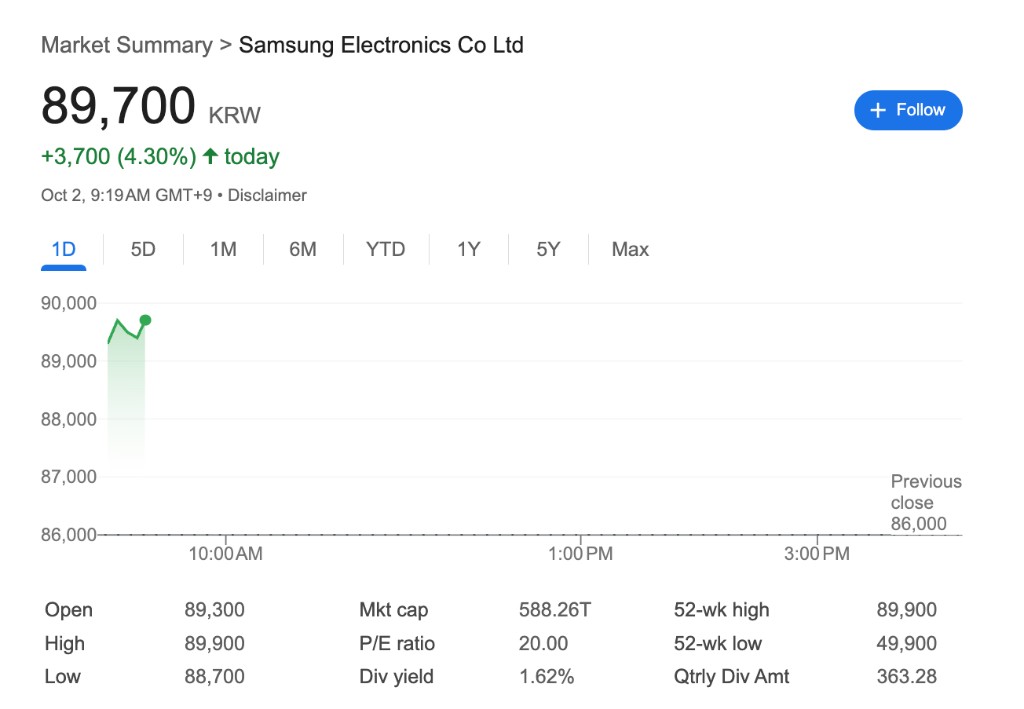

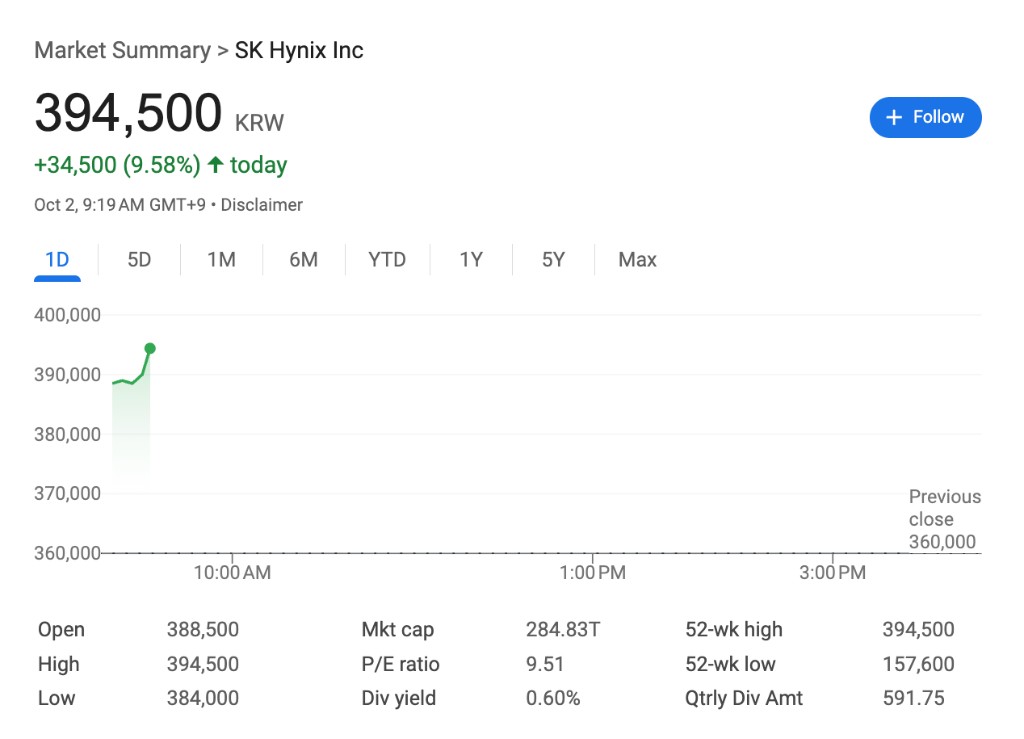

Samsung's stock price rose by 4.5%, while SK Hynix's stock price increased by 9.7%, both marking the largest intraday gains since April. According to a joint statement, as the Stargate project expands globally, total demand from OpenAI could reach 900,000 wafers per month

After the two major South Korean memory chip manufacturers, Samsung Electronics and SK Hynix, reached a preliminary supply agreement with OpenAI, their stock prices surged.

On Thursday, October 2, Samsung's stock price rose by 4.5%, while SK Hynix's stock price increased by 9.7%, marking the largest intraday gain since April.

Wallstreetcn previously mentioned that according to a statement released by Samsung and Hynix on Wednesday, OpenAI CEO Sam Altman signed a letter of intent in Seoul. The agreement aims to incorporate these two dominant companies in the storage chip field into the Stargate data center construction plan, which also involves giants like Nvidia and Oracle.

The potential scale of this cooperation is enormous. According to the statement, as the Stargate project expands globally, the total demand from OpenAI could reach 900,000 wafers per month. SK Group emphasized in the statement that this projected demand is more than double the current global capacity for high bandwidth memory (HBM).

Storage chips may welcome "a four-year upcycle"

The Stargate project represents the highest level of current AI infrastructure construction, bringing together top companies across the entire industry chain from chip manufacturing to cloud computing services. The global expansion plan of this project demonstrates a huge demand for high-performance memory chips.

J.P. Morgan analysts Jay Kwon, Sangsik Lee, and others have previously stated that driven by the enormous demand for high-performance memory in AI computing, the "memory hunger" trend is pushing the entire industry into a structural growth phase, with its impact rapidly extending from high-end high bandwidth memory (HBM) to traditional DRAM and NAND flash.

Market dynamics indicate that suppliers may struggle to meet all demand in the next 12 months, thereby supporting sustained price increases. The DRAM market is entering an "unprecedented four-year pricing upcycle" from 2024 to 2027.

Based on this, J.P. Morgan has significantly raised its global storage market size forecast, increasing the total addressable market (TAM) forecast for the global storage market from 2025 to 2026 by 6% to 24%, and expects the market size to reach nearly $300 billion by 2027.