Investors bet that the impact of a U.S. government shutdown will be limited as the S&P 500 index breaks through 6,700 points. Wall Street legendary investors issue a warning of a market crash

美國股市週三創下歷史新高,標普 500 指數上漲 0.34%,收於 6711.20 點,顯示投資者對政府關門的擔憂有限。儘管共和黨未能通過臨時撥款法案,導致政府關門,75 萬名聯邦僱員無薪休假,市場仍保持樂觀。分析師 Louis Navellier 指出,市場動能積極。與此同時,ADP 就業數據顯示私營部門就業人數減少,市場預期美聯儲將降息。部分投資人對市場前景發出警告。

智通財經 APP 獲悉,美國股市週三再度創下歷史新高,顯示投資者對聯邦政府關門的擔憂有限,並寄望停擺時間短暫、對經濟影響可控。標普 500 指數收漲 0.34%,報 6,711.20 點,盤中一度觸及歷史新高;納斯達克綜合指數上漲 0.42%,收於 22,755.16 點;道瓊斯工業平均指數微升 43.21 點,至 46,441.10 點。

當日早盤,標普 500 一度下跌 0.5%,但在醫療保健板塊反彈帶動下實現逆轉,再生元製藥公司 (REGN.US) 與 Moderna(MRNA.US) 股價走高。整個 9 月,標普 500 已累計上漲逾 3.5%,延續強勁動能。Navellier & Associates 創始人 Louis Navellier 表示:“市場看似毫不擔憂,動能依然積極。”

儘管市場表現亮眼,華盛頓政治僵局加劇了不確定性。共和黨掌控的參議院未能通過臨時撥款法案,政府正式關門,約 75 萬名聯邦僱員被迫無薪休假。國會預算辦公室估算,停擺將顯著拖累短期經濟活動。特朗普更威脅若停擺延長,將 “永久性解僱” 部分聯邦僱員。副總統萬斯則表示,不排除裁員,但認為停擺 “不會持續太久”。

市場關注的焦點在於停擺持續時間。此次停擺導致勞工部等政府機構停止運作,9 月非農就業報告將無法按時公佈,令美聯儲在 10 月底議息會議前陷入 “數據真空”。與此同時,週三公佈的 ADP 就業數據顯示,美國私營部門就業人數減少 3.2 萬,遠低於市場預期的增加 4.5 萬,創下自 2023 年 3 月以來最大降幅。這使得市場更預期美聯儲本月將實施年內第二次降息,並可能在 12 月再次降息。

市場氣氛雖偏樂觀,但部分知名投資人已發出警告。華爾街傳奇投資人庫珀曼指出,目前市場情緒與上世紀末科技泡沫時期類似,人工智能相關股票估值 “高得離譜”。他引用巴菲特 1999 年的話稱:“一旦人人無論用什麼方法都能賺錢,市場便會吸引純粹因為害怕錯過而入場的投資者,這往往是牛市終結的前兆。”

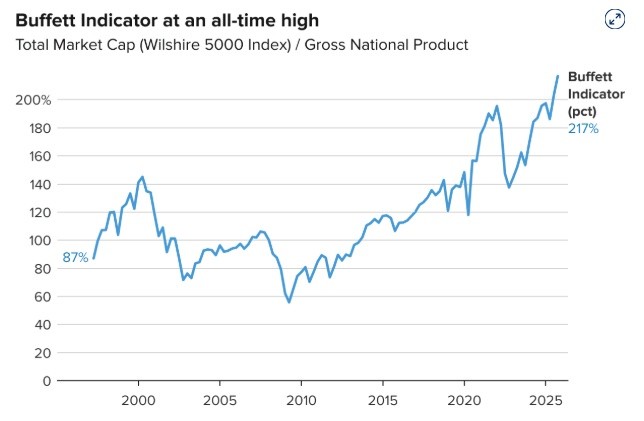

數據顯示,標普 500 自 4 月低點以來已反彈近 40%,由大型科技公司主導。與此同時,“巴菲特指標”(總市值與 GDP 之比) 已飆升至 217%,遠高於互聯網泡沫與 2021 年新冠疫情期間的高點。巴菲特曾稱該水平是 “玩火”。

儘管警告聲不斷,庫珀曼仍認為在高通脹背景下,股票風險可能低於債券,因為債券名義利率固定,實際回報易被通脹侵蝕。