After 7 years, the U.S. government "shuts down" again, and U.S. stock futures respond with a decline

The U.S. federal government has once again shut down on October 1 due to the failure to reach a spending plan, affecting hundreds of thousands of federal workers and public services, and hindering the release of economic data. Following this news, U.S. stock futures fell, with S&P 500 futures down 0.4% and Nasdaq 100 futures down 0.5%. Analysts point out that the shutdown may exacerbate market uncertainty and delay the release of key economic data, with expectations of an increase in the unemployment rate

According to Zhitong Finance APP, at 0:00 local time on October 1, due to the failure of the U.S. Congress to reach an agreement on the spending plan, the U.S. federal government has once again "shut down" after nearly seven years, marking the second "shutdown" during Trump's term. Hundreds of thousands of federal workers are unable to report to work, and some public services may be suspended or delayed, affecting the release of economic data. As a result of this news, U.S. stock index futures fell. As of the time of publication, S&P 500 index futures were down 0.4%, and Nasdaq 100 index futures were down 0.5%.

This government shutdown may disrupt the upward trend of U.S. stocks. U.S. stocks have risen 14% so far this year. Currently, there are signs of weakness in the U.S. stock market, and doubts about the strength of the labor market are increasing. The government shutdown may also delay the release of key economic data, including the employment report scheduled for release on Friday, which could have provided clues about the Federal Reserve's future policies.

Matt Maley, chief market strategist at Miller Tabak + Co, stated that if the employment data is delayed, "this will only further exacerbate the uncertainty brought about by this shutdown. As we enter the new quarter, this should increase market volatility."

Bloomberg's economic department predicts that this government shutdown could cause the U.S. unemployment rate to rise from the current 4.3% to 4.7%. U.S. President Donald Trump has threatened to lay off employees on a large scale rather than impose mandatory leave, which has heightened concerns about an economic slowdown.

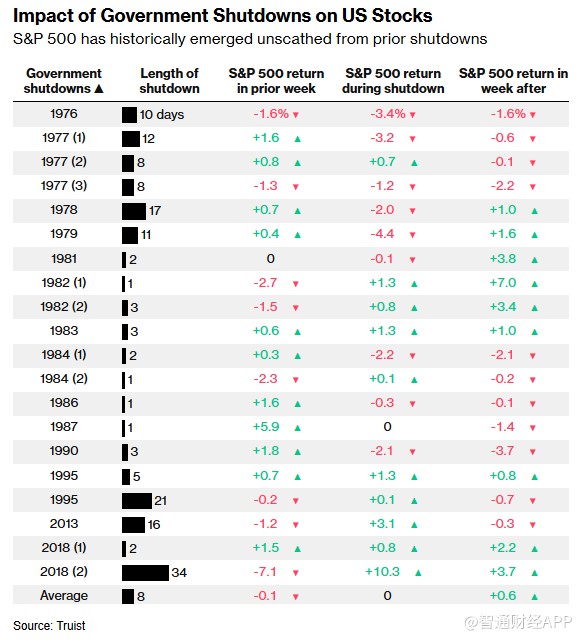

According to data compiled by Truist, the stock market has historically reacted mildly to government shutdowns: on average, the stock market has shown little volatility. In the short term, defense contractors and consulting firms that rely on government revenue, as well as airlines that may suffer losses due to reduced business and leisure travel by federal employees, face the risk of volatility.

Impact of Government Shutdown on U.S. Stock Market

Matt Gertken of BCA Research stated that a prolonged shutdown will trouble industries closely related to economic conditions, such as industrial and financial sectors. This also increases the likelihood of crisis spreading.

Citigroup stated on Tuesday: "The duration of the government shutdown is crucial. As the government shutdown extends, the stock market tends to weaken, while interest rates tend to rise."