美国政府关门冲击市场,黄金升破 3900 美元再创新高,美股期货、日欧股市下跌

市場避險情緒升温,美股指數期貨普跌,納指期貨跌 1%,日經 225 指數跌超 1%,歐股多數低開。COMEX 黃金升破 3900 美元/盎司,再創紀錄新高。美元、美債、原油價格波動不大。

美國政府時隔七年再度關門,全球金融市場正面臨新的不確定性。

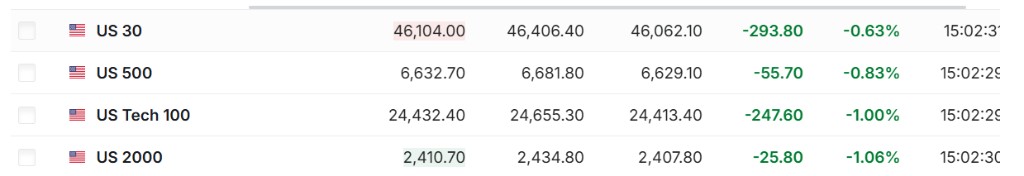

今日盤中,美股股指期貨集體走低,納指期貨跌幅擴大至 1%,標普 500 指數期貨跌 0.8%。

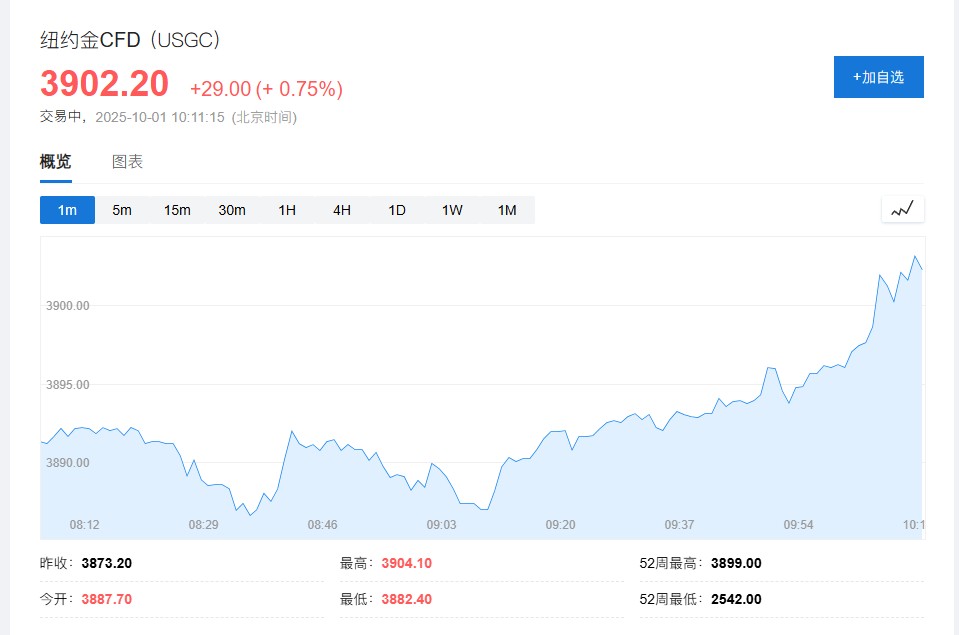

避險情緒推動 COMEX 黃金升破 3900 美元/盎司,再創紀錄新高。現貨黃金站上 3880 美元/盎司,日內漲 0.58%,再創歷史新高。

最新的動態是,在美國東部時間週二午夜(23:59)的最後期限過後,政府將正式關門。由於國會未能通過一項臨時撥款法案,美國聯邦政府機構已開始執行 “有序停擺”。

此次政府停擺最直接的影響之一,是原定於週五發佈的非農就業報告等數據將被推遲,這使得投資者和政策制定者失去了一個評估經濟健康狀況的關鍵指標。受此影響,市場對美聯 - 儲在 10 月降息的預期概率已從一天前的 90% 攀升至 96%。

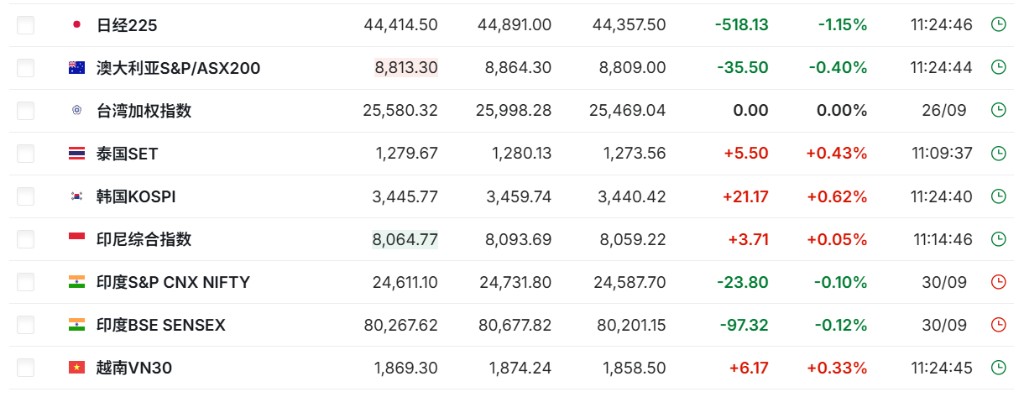

亞洲市場表現分化,歐股多數低開

美國政府關門的消息在全球市場引發了連鎖反應,避險情緒明顯升温。

歐洲主要股指開盤多數下跌。歐洲斯托克 50 指數跌 0.36%,英國富時 100 指數漲 0.14%,法國 CAC40 指數跌 0.02%,德國 DAX30 指數跌 0.42%。

日本日經 225 指數在經歷了前一個季度的強勁上漲後,今日一度下跌 1%,東證指數也下跌 1.69%。澳大利亞 S&P/ASX 200 指數小幅下滑 0.4%。

不過,亞洲市場表現並非全線下挫。韓國綜合股價指數 (Kospi) 上漲 0.7%,延續了上一季度 11.5% 的漲勢。數據顯示,韓國 9 月份出口額創下 14 個月來的最快增速,為市場提供了支撐。

值得注意的是,中國 A 股及港股市場因國慶中秋假期休市。

避險資產與匯市動態

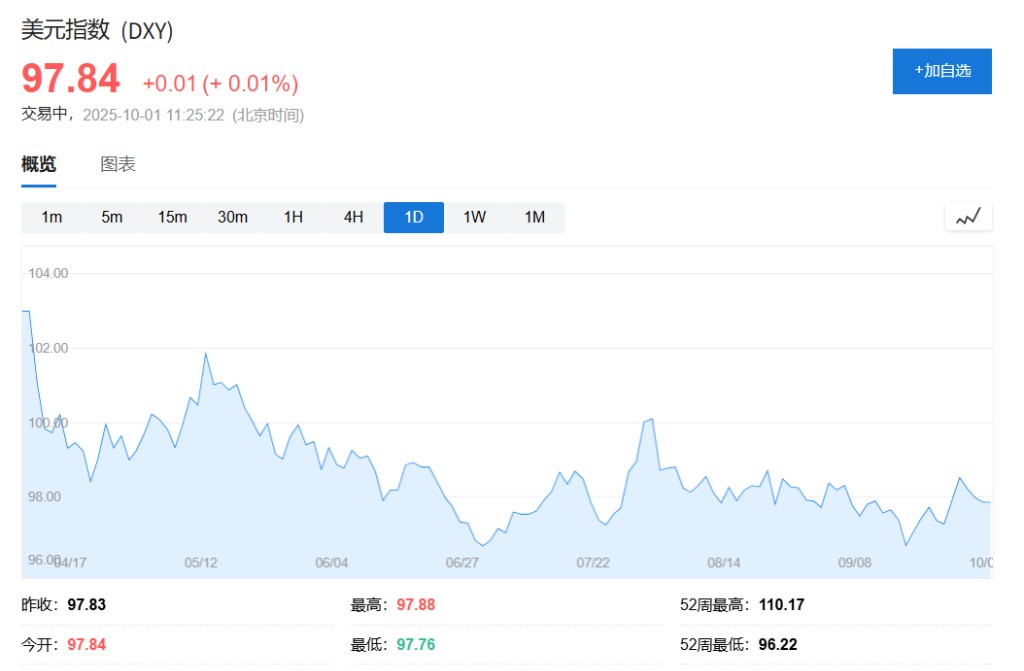

在不確定性上升的背景下,各類資產表現不一。除了黃金價格走強外,美元指數在連續三日下跌後保持穩定,報 97.84。美元兑日元微漲 0.1% 至 148.1,市場對日本央行一項顯示企業通脹預期高於 2% 目標的調查反應平淡。

美國國債市場在亞洲交易時段保持穩定。基準 10 年期美國國債收益率持平於 4.150%。

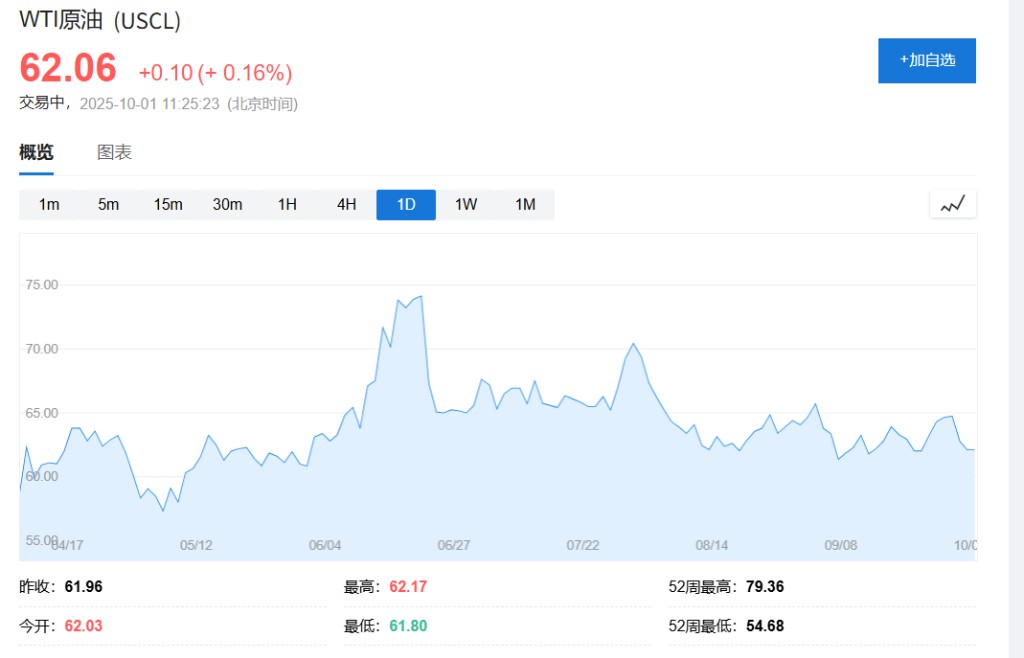

大宗商品方面,油價在連續兩日下跌後趨於穩定。投資者正在權衡 OPEC+ 下月可能加大增產力度的計劃,以及美國原油庫存可能下降的前景。

數據真空與聯儲前景

美國政府關門造成的 “數據真空” 正迫使市場重新評估美聯儲的政策前景。由於非農就業報告缺席,投資者可能會更加關注稍晚公佈的 ADP 全國就業報告,該報告預計將顯示私營部門就業人數温和增加 5 萬人。

Capital.com 高級分析師 Kyle Rodda 指出,通常情況下,政府關門對市場影響不大,例如 2018-2019 年持續一個多月的停擺期間華爾街股市甚至上漲。但他補充説,當前市場面臨兩個問題:一是關鍵就業數據的延遲發佈,二是 “美國總統特朗普威脅要永久性解僱工人,這可能將政府關門演變成一場小型的勞動力市場衝擊”。

這種不確定性顯著推高了市場對美聯儲降息的預期。期貨市場行情顯示,除了 10 月降息概率升至 96% 外,12 月再次降息的可能性也達到了約 74%。