Every six months, there is a wave of "AI bubble theory." When will the "wolf really come"?

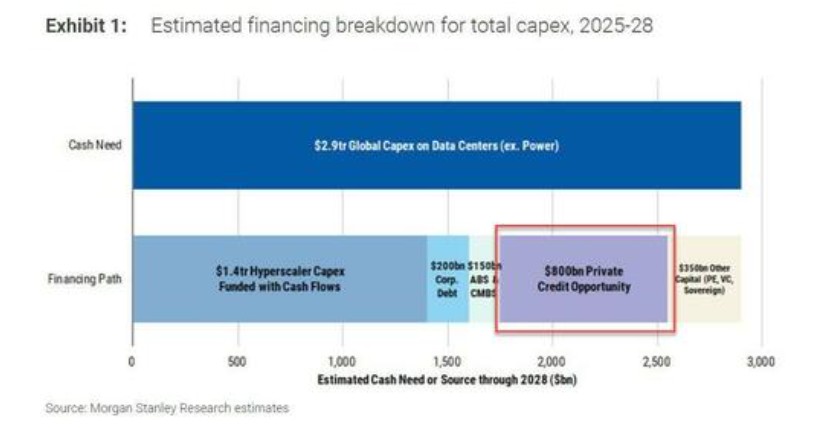

每隔半年,“泡沫論” 便如期而至,引發市場一陣恐慌與調整,隨後又在狂熱中繼續高歌猛進。而這場盛宴還能持續多久?危險的信號似乎已經浮現——AI 資本開支正從 “自我造血” 轉向 “債務驅動”。大摩預計,到 2028 年全球數據中心支出將高達 2.9 萬億美元,其中約 1.5 萬億美元存在資金缺口,需要依靠債務填補。

就像時鐘一樣,每六個月,相似的劇情就會上演一次。“AI 泡沫論” 總會準時出現,引發市場短暫的恐慌,然後又迅速被新一輪的狂熱所淹沒。

從高盛質疑其商業回報,到中國推出性價比極高的模型,再到甲骨文與 OpenAI 拋出震撼市場的 3000 億美元 “未來合約”,AI 的質疑與狂歡交替上演。

然而,Zerohedge 文章分析,在這場週期性辯論的背後,一個更深層次的結構性風險正在浮現:AI 基礎設施的競賽正從一場由科技巨頭內部現金流支撐的馬拉松,演變為一場依賴外部債務的 “軍備競賽”。

當一個高達 1.5 萬億美元的資金缺口需要由本已承壓的私市信貸市場來填補時,人們不禁要問:那隻終將到來的 “狼”,究竟還有多遠?

“AI 泡沫論” 準時上演

第一次大規模的擔憂潮湧現在 2024 年 6 月。當時,高盛發佈報告,直指生成式 AI 是否是 “投入太多,獲益太少” 的資本無底洞,即一個可能永遠無法為投資者帶來長期正回報的巨坑。這一質疑在科技界投下了一枚震撼彈。

然而,六個月過去了,在又燒掉了 1000 億美元 “完善” 這個星球上最昂貴的聊天機器人後,清晰的盈利模式似乎仍未在美國出現。相反,中國推出了名聲大噪的 DeepSeek 大模型,它不僅是開源的,而且比美國的同類產品便宜得多,運行所需的設備也遠不如最新的英偉達超級顯卡昂貴。

與此同時,有報道稱微軟、谷歌和 Meta 等公司正悄悄縮減資本支出。這些因素疊加,又引發了下一輪 AI 概念股拋售潮,這場拋售從 1 月底開始,持續到 4 月。

歷史似乎總在重複。這不禁讓人回想起第一次互聯網泡沫時期的景象,那些曾紅極一時的公司,最終也難逃破產的命運。

“無限金錢漏洞”:當融資從現金轉向債務

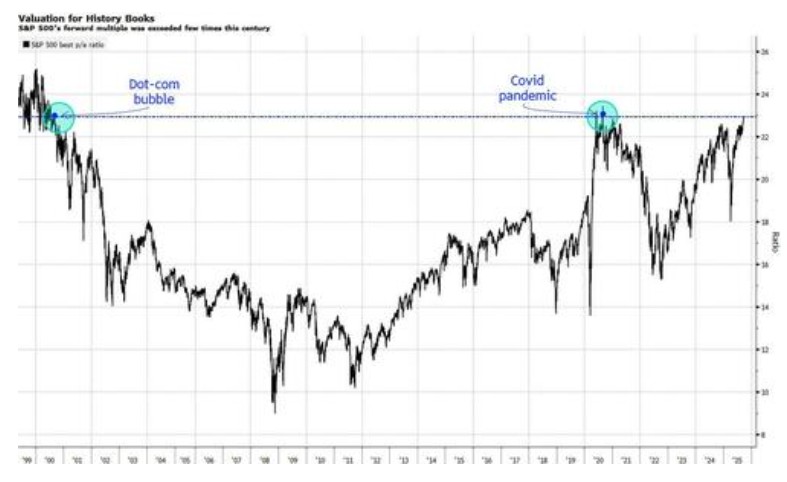

時間來到 2025 年 9 月,AI 泡沫在全速膨脹,並獨自將股市推至互聯網泡沫以來的最高估值水平……

然而,甲骨文在 9 月 10 日以極其莽撞的姿態,砸碎了這場狂歡的寧靜。據《華爾街日報》當時報道,它宣佈與 OpenAI 達成一項為期五年、總值 3000 億美元的雲計算協議。這被視為史上最巨大的“供應商融資”(Vendor Financing)交易之一。

更具衝擊力的是,甲骨文幾乎同時提醒了所有人——它實際上並沒有足夠的自有現金來支付這場預計將持續到 2030 年代的支出狂歡。那麼,錢從哪裏來?借。

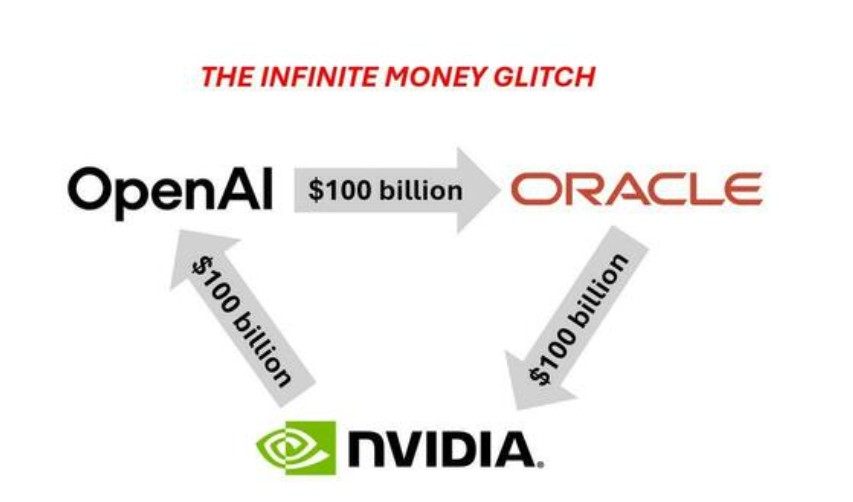

摩根大通分析師 Michael Cembalest 在他最新的《市場觀察》報告中,精闢地描述了這種被許多同行稱為“無限金錢漏洞”(infinite money glitch)的 AI 循環經濟。

他用一個簡單的循環圖解釋了這一現象:AI 公司承諾未來支付鉅額資金給雲服務商 → 雲服務商借此故事舉債建設基礎設施 → 基礎設施再租給 AI 公司。

Cembalest 指出,自 2022 年 11 月 ChatGPT 推出以來,AI 相關股票貢獻了標普 500 指數 75% 的回報、80% 的盈利增長和 90% 的資本支出增長。數據中心的電力消耗正在推高電價,例如在 PJM 地區,去年電價上漲的 70% 可歸因於數據中心的需求。

而甲骨文與 OpenAI 的交易,正是這個 “漏洞” 的完美體現。投資通訊《製造的知識》的 Doug O'Laughlin 評論道:

甲骨文根本無法用現金流支付這一切,他們必須發行股票或舉債來實現其野心……一個穩定的寡頭壟斷格局正在破裂……原本由現金流資助的、有紀律的競賽,可能現在會變成一場債務驅動的軍備競賽。

1.5 萬億美元的融資缺口,私人信貸能填上嗎?

甲骨文的案例揭示了一個更深層次的問題:AI 基礎設施的建設成本正在失控,並已遠超科技巨頭自身的造血能力。摩根士丹利的一份報告描繪了這幅令人震驚的圖景:預計到 2028 年,全球數據中心相關支出總額將達到約 2.9 萬億美元。

報告指出,儘管大型科技公司的內部現金流仍是主要資金來源,但在計入股東回報等因素後,它們最多隻能自籌約 1.4 萬億美元。這意味着,市場將面臨一個高達 1.5 萬億美元的巨大融資缺口。

摩根士丹利認為,要彌合這一缺口,信貸市場將扮演越來越重要的角色。

在所有信貸渠道中,私募信貸被寄予厚望。該行預計,在彌補缺口的各類資本中,私募信貸(尤其是資產融資)將貢獻約 8000 億美元,成為最重要的外部資金來源。諮詢公司貝恩(Bain)隨後也得出了相似的結論。

AI 的未來,似乎已與私募信貸的錢袋子深度綁定。

私募信貸:AI 的 “救星” 還是 “阿喀琉斯之踵”?

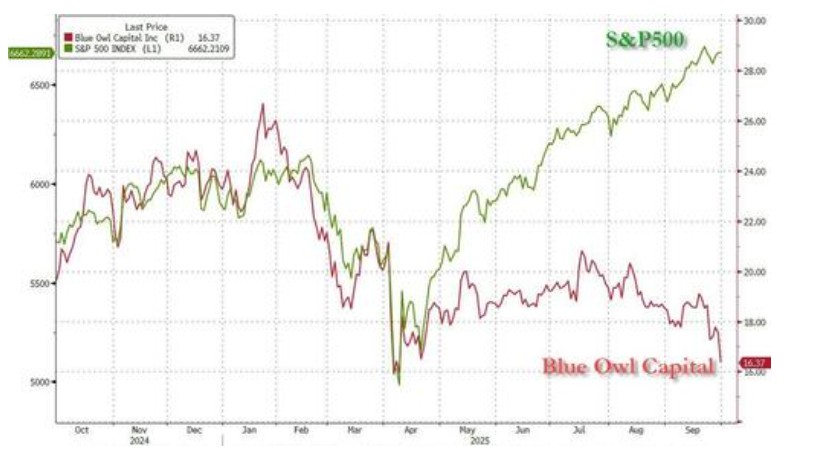

然而,將 AI 的未來押注在私募信貸上,可能是一個危險的賭注。就在市場期待其為 AI“輸血” 之際,該行業自身的健康狀況卻亮起了紅燈。

市場數據顯示,全球最大的私募信貸管理公司之一黑石集團旗下的私募信貸基金 BXSL,其股價已跌至 2025 年新低,表現遠遠落後於標普 500 指數。另一家行業巨頭 Blue Owl 的股價也同樣岌岌可危。據彭博報道,Blue Owl 已經深度參與到 AI 領域的融資活動中。

這些私募信貸巨頭的困境,遠不止為數據中心提供資金那麼簡單。它們已大規模暴露於美國經濟中最薄弱的環節——消費者,尤其是在 “先買後付”(BNPL)領域壞賬率(NPLs)飆升的低收入羣體。

正如《金融評論報》所言,私募行業正 “坐擁 5 萬億美元的生存恐懼”。如果這個被視為 AI 資金後盾的行業自身陷入困境,那麼承諾給 AI 的 8000 億美元又從何而來?

“泡沫” 中的泡沫:當無人再談論泡沫

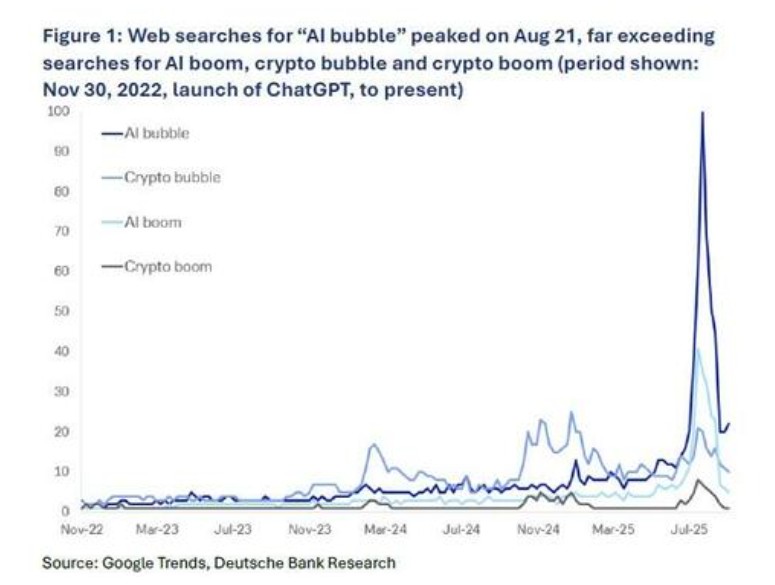

在金融結構性風險日益凸顯的同時,關於 AI 泡沫的公開討論卻在降温。德意志銀行分析師 Adrian Cox 指出,全球範圍內 “AI bubble” 的網絡搜索量已從 2025 年 8 月的高點下降了 85%。換言之,“討論 AI 泡沫的泡沫” 本身已經破裂。

但這並不意味着警報解除。歷史表明,資產泡沫的演進並非線性過程。在 2000 年科網泡沫破裂前的五年裏,納斯達克指數經歷了七次超過 10% 的回調。

更重要的是,在 1998 年 11 月,當投資經理 Michael Murphy 警告 “這是一個嚴重的泡沫” 時,納斯達克指數還不到 2000 點,而它在接下來的 16 個月裏繼續翻倍,衝破 5000 點後才最終崩盤。

狼來何時會來?

每六個月一次的 “狼來了” 喊得多了,市場似乎已感到疲憊。甲骨文的鉅額交易揭示了 AI 繁榮背後從 “實幹” 轉向 “借貸” 的危險信號,而預期的金主——私人信貸——自身已深陷泥潭。

這場由債務和夢想驅動的狂歡,在電力網絡等基礎設施的硬約束下,顯得更加脆弱。

或許,當所有人都不再談論泡沫時,狼才真的悄悄走到了門口。又或者,正如那句古老的市場格言:市場非理性的時間,總能長過你破產的時間。

那麼,我們是否正身處歷史上最大的泡沫之中?它何時會破裂?

坦誠的回答是:沒人知道。就在英偉達股價再創新高、市值飆升至驚人的 4.5 萬億美元之際,市場對 AI 的敍事依然買賬。