The lessons from the "AI frenzy": The rise and fall fate of the "capital expenditure bull market"

I'm PortAI, I can summarize articles.

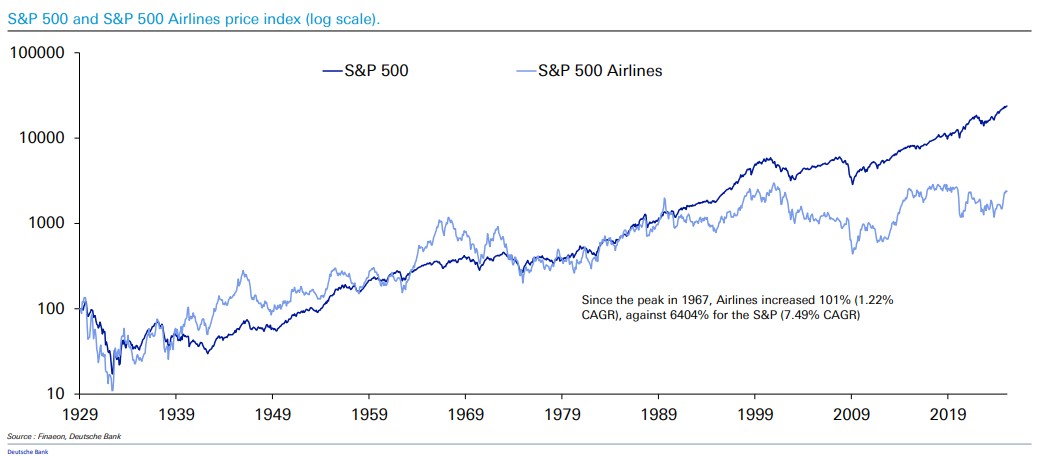

德銀指出,歷史上大規模資本支出驅動的繁榮往往伴隨蕭條,如 18 世紀的運河狂熱和 19 世紀的鐵路投資。儘管航空和電信等技術革命改變了世界,但相關行業的股票長期回報低於市場大盤,投資者未能獲得與技術變革相匹配的收益。這警示當前對 AI 的鉅額投資可能使消費者受益多於生產者。

突破性的科技創新往往帶來投資者的狂熱追逐,催生 “資本支出牛市”。但歷史警示:大規模資本支出驅動的繁榮往往伴隨着蕭條。

德銀:

如 18 世紀的 “運河狂熱” 和 19 世紀的 “鐵路投資”,指出由大規模資本支出驅動的金融市場繁榮,最終幾乎都以泡沫破裂告終。同樣,航空和電信等革命性技術雖然改變了世界,但相關行業的股票長期回報卻遠遜於市場大盤,投資者並未從中獲得與技術變革相匹配的收益。

這警示我們,當前對 AI 的鉅額投資最終可能使消費者受益多於生產者(投資者)。