It is reported that Buffett is acquiring OxyChem for $10 billion, which would be Berkshire Hathaway's largest transaction since 2022

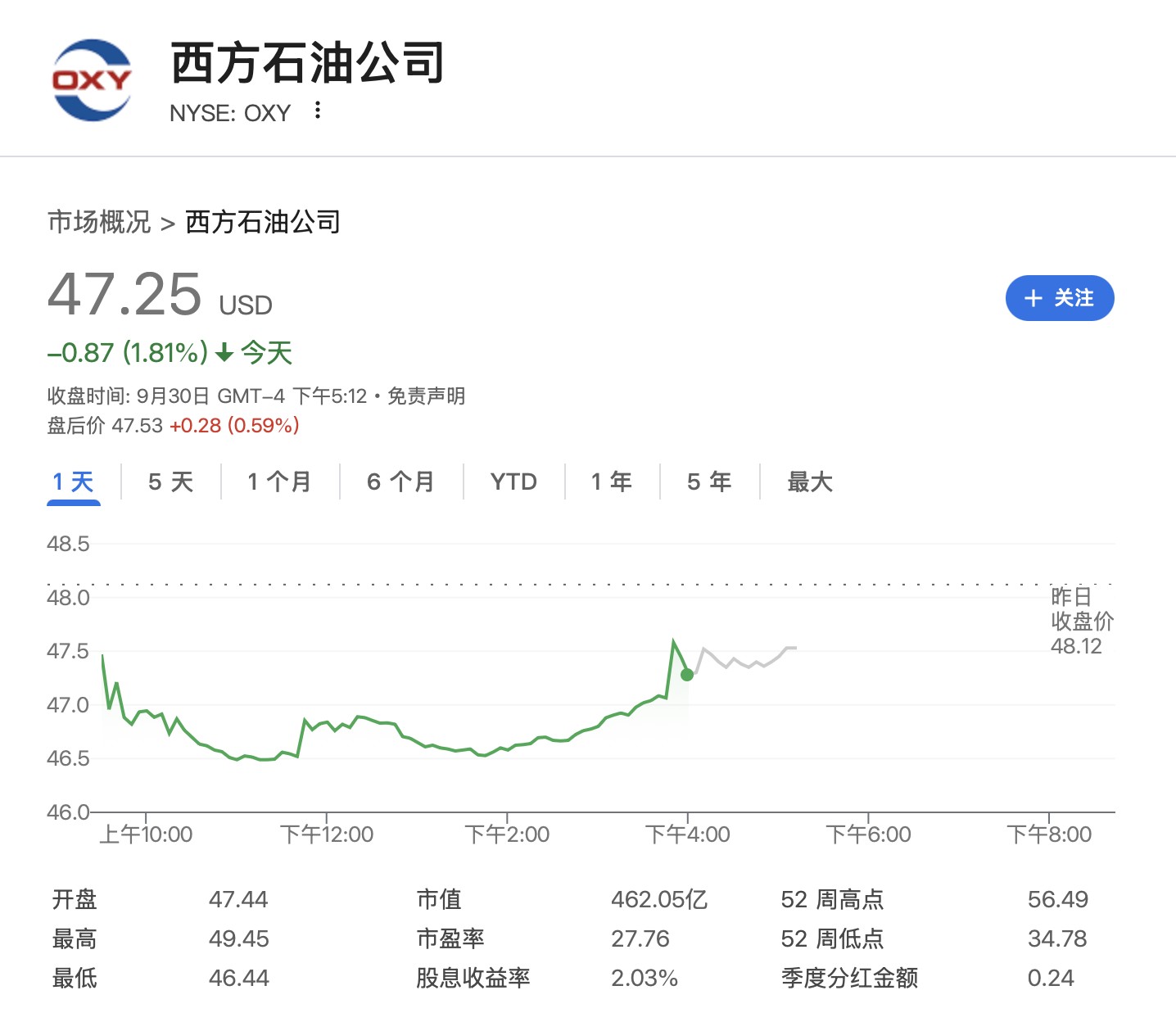

According to media reports, Berkshire Hathaway, led by Warren Buffett, is in talks to acquire Occidental Petroleum's petrochemical division OxyChem for approximately $10 billion. If the deal goes through, it will be Berkshire's largest acquisition since 2022 and Buffett's second major bet on the chemical industry. Berkshire already holds a 28.2% stake in Occidental Petroleum, valued at over $11 billion. Occidental Petroleum's stock price fell 1.81% on Tuesday, closing at $47.25, and rose 0.59% in after-hours trading

According to sources familiar with the matter, Warren Buffett's Berkshire Hathaway is in talks to acquire Occidental Petroleum's petrochemical business OxyChem for approximately $10 billion.

Media reports indicate that if the deal is finalized, it will become Berkshire's largest acquisition since 2022 and could be concluded within days.

Occidental Petroleum, headquartered in Houston, is primarily known for its oil and gas business, with a current market capitalization of about $46 billion. Berkshire is already its largest shareholder, holding over $11 billion in Occidental stock, representing a 28.2% stake. Buffett has previously stated that he would not seek to fully control the company founded by legendary oil tycoon Armand Hammer.

Occidental's petrochemical division, OxyChem, produces and sells a variety of chemical products, which are used in applications such as water chlorination, battery recycling, and papermaking. For the 12 months ending in June, the division achieved sales of nearly $5 billion.

Occidental's stock price fell 1.81% on Tuesday, closing at $47.25, and rose 0.59% in after-hours trading.

If negotiations go smoothly, this would mark Buffett's second major bet on the chemical industry. Back in 2011, Berkshire acquired specialty chemicals manufacturer Lubrizol for nearly $10 billion (including debt).

Berkshire's most recent large acquisition was in 2022, when it agreed to acquire insurance company Alleghany for $11.6 billion. The deal was announced in March of that year and completed in October.

Investment Started in 2019

The 95-year-old Buffett began investing in Occidental Petroleum in 2019. At that time, CEO Vicki Hollub was trying to outbid Chevron with a $38 billion offer for Anadarko Petroleum.

With the help of Bank of America CEO Brian Moynihan, Hollub visited Buffett in Nebraska, and ultimately, Berkshire agreed to purchase $10 billion in Occidental preferred stock to help her complete the acquisition.

Since then, Occidental's fortunes have fluctuated. The acquisition burdened the company with heavy debt and drew criticism from activist investor Carl Icahn, who eventually exited his investment.

In early 2022, Buffett began buying Occidental common stock on the open market. He decided to act after reading the transcripts of the company's earnings call and took advantage of the market volatility during the COVID-19 pandemic to purchase shares at a discount. However, recently, with falling oil prices, Occidental's stock price has come under pressure again To repay its debts, Occidental Petroleum has been selling non-core assets. As of August, the company stated that it has repaid $7.5 billion in debt. In addition, Occidental Petroleum also pays a 2% dividend yield and actively invests in carbon capture businesses.

Sitting on a massive cash pile, still inclined to acquire companies

On the other hand, Berkshire Hathaway is sitting on a huge cash reserve. As of the end of June, the company's cash and U.S. Treasury holdings reached a record $344 billion, attracting widespread attention from investors.

Buffett stated that the company still prefers to acquire businesses rather than hold cash. He wrote earlier this year:

"Berkshire will never place the ownership of good businesses above holding cash equivalents, whether that ownership is controlling or partial."

Buffett plans to retire at the end of this year, stepping down as CEO, with Greg Abel taking over. However, Buffett will continue to serve as the company's chairman