Citigroup significantly raised its capital expenditure forecast for Alphabet - C to USD 111 billion, as strong demand for AI may continue to drive up capital expenditures

花旗最新研报称,随着生成式 AI 和云业务需求持续高涨,谷歌正加速基础设施扩张,预计 2026 年资本开支将达 1110 亿美元,同比增长 29%,五年复合增速达 26%。研报表示,Gemini 产品使用量、谷歌云客户与积压订单均大幅增长,或将推动谷歌资本开支长期维持高位。

花旗在周二的最新研报中表示,随着生成式人工智能需求持续超过供给,以及谷歌产品迭代加速,该行上调了对谷歌 2026 年及之后的资本开支预测。

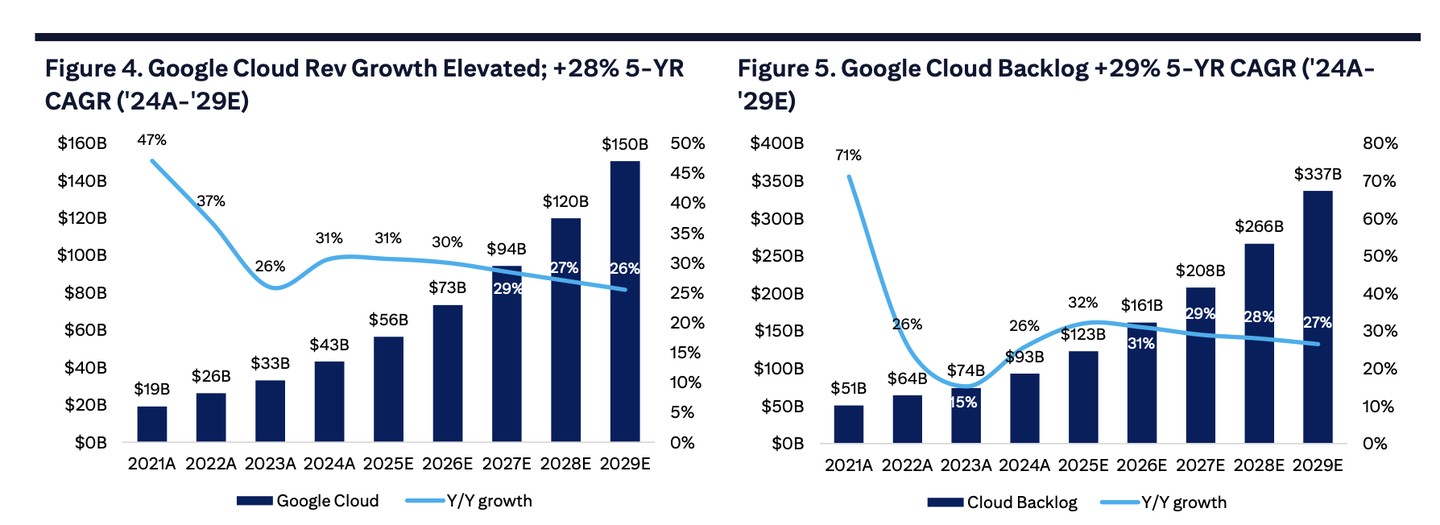

花旗预计,谷歌 2026 年资本开支将达到约 1110 亿美元,高于 2025 年的 860 亿美元。根据最新测算,2024 至 2029 年的资本开支复合年增长率(CAGR)将达 26%。

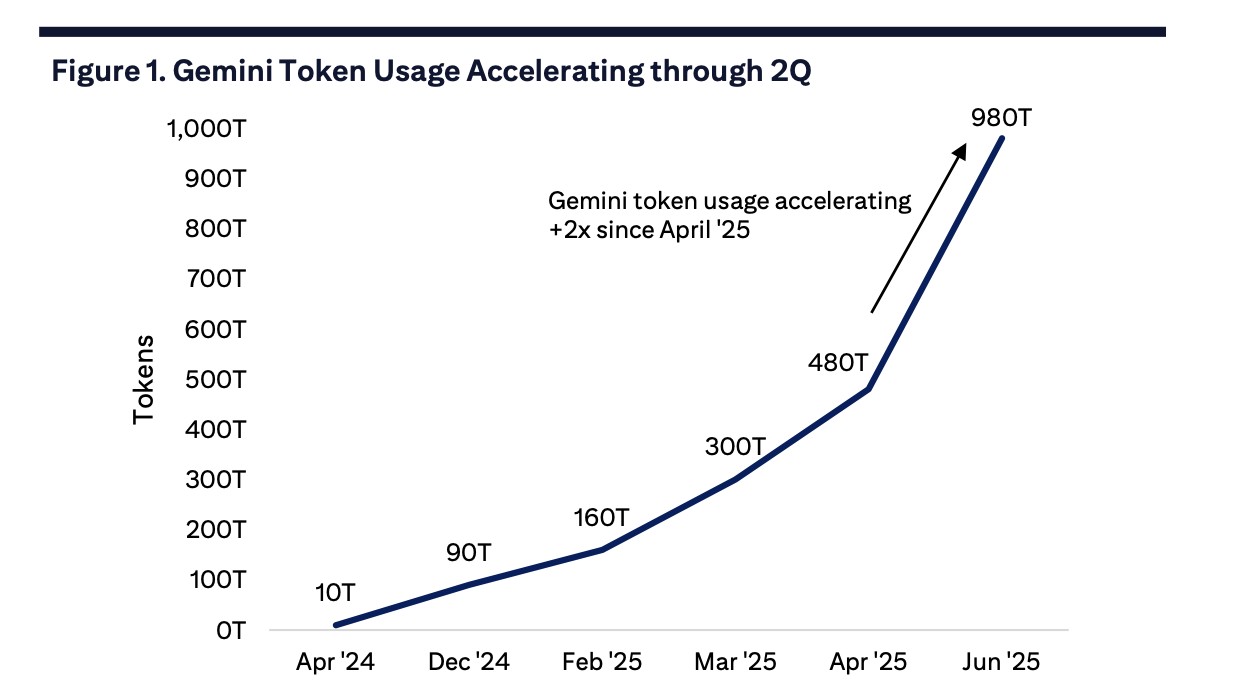

花旗认为,这一增长背后是谷歌人工智能产品和服务在核心搜索和云业务中的更大规模应用。目前,Gemini 的 token 使用量持续飙升,已突破每月 1 万亿次,比今年 4 月翻了一番。谷歌云(GCP)客户数量季度环比增长 28%,积压订单加速增长,Gemini 也正驱动更多谷歌核心产品。

花旗指出,谷歌的资本开支正推动更快的产品开发周期,这将为公司带来持续增长。尽管搜索领域竞争依然激烈,但花旗认为谷歌执行力更强,因此维持 “买入” 评级,目标价 280 美元。

谷歌母公司 Alphabet A 股周二盘中下跌近 1%,报 241.94 美元。

Gemini 与 AI 产品需求加速

根据研报,Gemini 的 token 使用量在 2025 年 6 月已增至每月 980 万亿次,高于 4 月的 480 万亿次。谷歌云需求同步走高,新客户季度环比增长 28%,单笔 2.5 亿美元以上的大额合同同比翻倍,Gemini 月活跃用户数达到 4.5 亿,花旗认为 9 月可能已突破 5 亿。

同时,Gemini 的日均请求量二季度环比增长 50%,AI-Overviews 与 AI-Mode 等新功能的部署迅速。花旗指出,大约 60% 的生成式 AI 初创公司选择了谷歌云,前十大 AI 实验室有九家使用谷歌云。

而且,第三季度这一势头仍在延续。媒体此前报道,谷歌云已与 Meta 签订一份为期 6 年的 AI 基础设施合同,总额 100 亿美元。谷歌云积压订单二季度环比增长 17% 至 158 亿美元;作为比较,亚马逊 AWS 同期增加 60 亿美元。

研报表示,Gemini 正逐渐嵌入谷歌核心产品。例如在 Chrome 浏览器中,AI 模式被直接集成到地址栏;YouTube 推出多项 AI 新功能,包括 Veo 3 快速集成、语音转歌曲以及 Ask Studio;谷歌也在测试 Windows 版 Gemini 应用,允许用户在 Chrome 和搜索之外直接使用 Gemini。花旗认为,Gemini 功能快速扩张,使用量水涨船高。

基础设施扩张

谷歌近期推出了数据共享的 Model Content Protocol (MCP) 服务器,支持 Agent-to-Agent 通信;该公司还发布开源 Agent Development Kit (ADK),方便开发者在多个模型代理之间进行编排,并推出 Agent Platform Protocol (AP2),支持超过 60 家商户和金融机构的自主代理支付。花旗指出,谷歌正在搭建更广泛的智能代理与模型生态的基础设施层。

谷歌近期宣布将在未来几年投资超过 500 亿美元,用于 AI 基础设施建设。其中包括:在美国宾州、新泽西、马里兰的交汇区域投资 250 亿美元;在弗吉尼亚两年内投资 90 亿美元新建数据中心;在俄克拉荷马两年内投资 90 亿美元用于基础设施和技能培训;在爱荷华投资 70 亿美元扩展云与 AI 设施;以及在宾州投资 30 亿美元改造水电设施。

谷歌还宣布了英国等全球项目。花旗认为,这表明随着 OpenAI、Meta 和亚马逊大幅扩张数据中心规模,谷歌也在持续加码。

资本开支或长期保持高位

花旗预计,谷歌 2026 年资本开支将达到 1110 亿美元,同比增长 29%,比上一年多出 250 亿美元。2024 至 2029 年复合增长率预计为 26%。其中约 2/3 将投向服务器,1/3 投向数据中心和网络设备。

研报认为,资本开支已带来显著成果:谷歌云营收同比增长 32%,较一季度的 28% 有所加速。与此同时,AI 效率正在提高。Gemini 文本提示的能耗和碳足迹同比分别下降 33 倍和 44 倍,中位数每次请求耗水量约为 0.26 毫升。花旗强调,需求依然大于供给,谷歌正抓住机会投资。

由于预计 AI 需求持续超越产能,花旗上调了 2026 年及之后的资本开支和折旧摊销(D&A)预测。2026 年资本开支上调 12% 至 1110 亿美元,2027 年上调 15% 至 1310 亿美元。更高的资本开支和折旧摊销使得花旗将 2026 年 GAAP 每股收益预测下调约 2.5% 至 10.56 美元,2027 年下调约 3% 至 11.90 美元。

花旗将谷歌目标价维持在 280 美元,基于 2026 年 GAAP 每股收益 10.56 美元,给予 26.5 倍市盈率(此前为 26 倍)。

研报表示,略高的估值倍数反映了 AI 需求的增长潜力,但也部分被更高的资本开支和折旧抵消。花旗认为,谷歌拥有 15 款月活用户超过 5 亿的产品、7 款超过 20 亿的产品,其 “产品光环” 将推动搜索流量持续增长。

同时,花旗对 Gemini 2.5 Pro 以及 AI Mode 扩展版印象深刻。不过,研报也提醒,搜索和 GenAI 产品的竞争加剧,以及监管风险,仍是不可忽视的不确定性。