This is not Internet Bubble 2.0! Citigroup significantly raises AI capital expenditure forecasts, stating that AI infrastructure deployment is "accelerating rapidly."

Citigroup believes that investment in AI infrastructure is accelerating sharply, raising AI capital expenditures for 2026 to $49 billion. The key difference from the 2000 internet bubble is that this round of investment has real enterprise-level demand as a "出口" for value validation. Massive collaboration projects with NVIDIA and OpenAI, along with the exponential growth in AI computing power demand, are driving the investment frenzy

Citigroup's latest research believes that investment and deployment in artificial intelligence infrastructure are "accelerating sharply" at a pace far exceeding expectations. This is not a replay of the 2000 internet bubble; the key difference is that the real enterprise-level demand provides an "outlet" for this wave of investment, forming a closed loop of value validation.

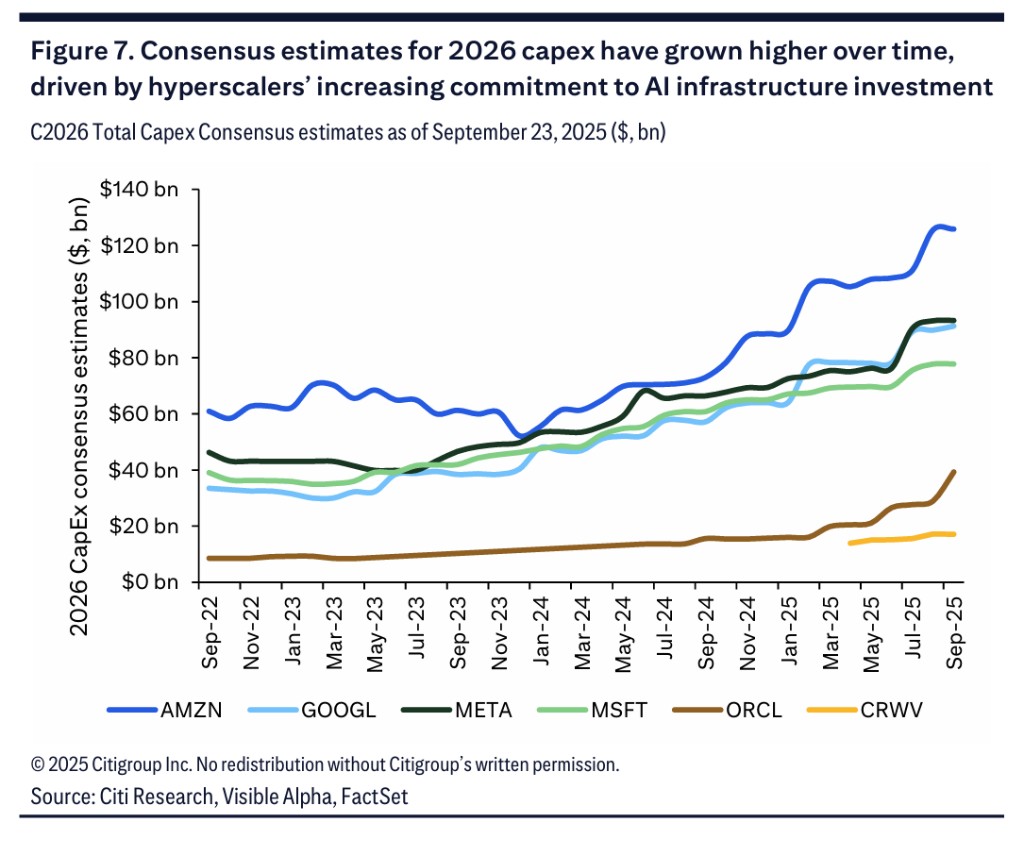

According to news from the Chasing Wind Trading Desk, based on this judgment, Citigroup analysts have significantly raised their AI capital expenditure forecasts for tech giants, increasing the 2026 AI capital expenditure forecast from $420 billion to $490 billion. At the same time, the cumulative capital expenditure forecast for 2029 has also been raised from $2.3 trillion to $2.8 trillion.

Citigroup pointed out that the revised capital expenditure growth expectation for 2026 is 24%, significantly higher than the current market consensus of 20%. The report expects major tech giants to reflect this incremental expenditure in their third-quarter earnings guidance, and the entire AI infrastructure supply chain, including semiconductors, hardware, and other infrastructure suppliers, will benefit from this wave of accelerated investment.

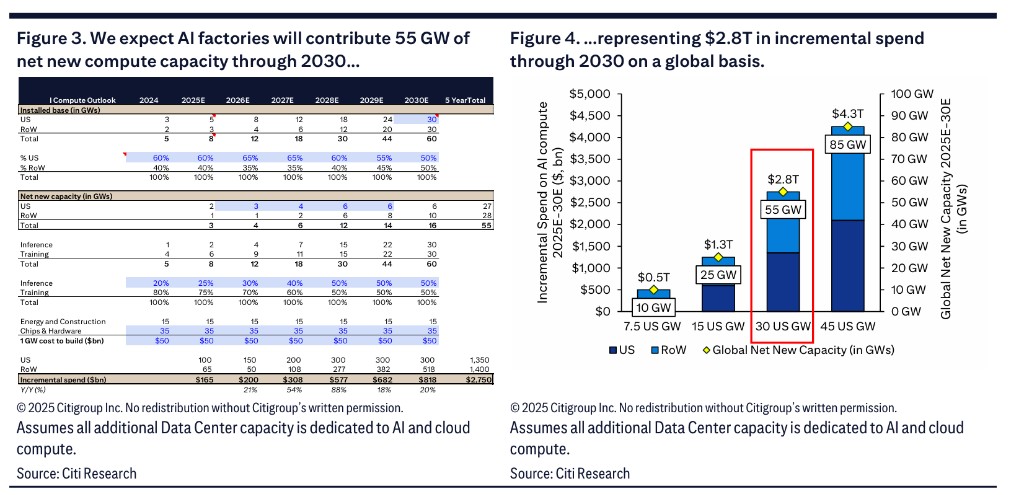

At the same time, Citigroup emphasized that this wave of AI investment is fundamentally different from the internet bubble. The rapid growth of enterprise demand for AI services currently provides "clear external validation" for investment, creating a critical "outlet" for the investment cycle. Citigroup estimates that by 2030, the demand for AI computing power will add 55GW of global power capacity, resulting in $2.8 trillion in incremental AI computing power expenditure.

Major Collaborative Projects Emerge, Investment Frenzy Accelerates

The Citigroup report noted that in the past few weeks, the actions of industry giants have highlighted that the scale and speed of AI infrastructure construction are increasing. Since Oracle disclosed a $300 billion deal with OpenAI in early September, the market has witnessed a series of major collaborations, including:

- NVIDIA and OpenAI announced a $100 billion partnership to deploy 10 gigawatts (GW) of NVIDIA systems;

- CoreWeave's cooperation agreement with OpenAI expanded from an initial $12 billion to $22.4 billion;

- Microsoft's collaboration with OpenAI on the "Stargate" project continues to expand;

- Alibaba expects its data center capacity to grow tenfold and is fully integrating its PAI software stack with NVIDIA.

Citigroup believes that these developments clearly indicate that the pace of infrastructure investment is accelerating sharply to support enterprise-level AI service demand and the training capabilities of AI laboratories.

AI Infrastructure Demand Exhibits Exponential Growth

The Citigroup report shows that AI infrastructure construction is entering an acceleration phase. According to Epoch AI data, since 2010, the computing power for training cutting-edge models has grown at a rate of 4.6 times per year, exceeding twice the growth rate of Moore's Law. Although the computing performance and density of GPU clusters continue to improve, hardware and algorithm efficiency improvements have not kept pace with this growth, leading to an exponential increase in hardware costs for leading AI supercomputers (1.9 times per year), and training power consumption demands are also rapidly rising (2.1 times per year) Citi believes that the acceleration of infrastructure investment is essentially driven by end-customer demand. This trend has already been reflected in the latest earnings reports of tech giants, whose backlog order data indicates strong demand. Citi expects that as AI projects from companies like AthenaHealth, Hitachi, Eli Lilly, and Wolters Kluwer move from the proof-of-concept stage to actual production deployment, this trend will be further confirmed in the third quarter's performance and guidance.

Additionally, according to the report's estimates, global demand for AI computing power will add 55 gigawatts of power capacity by 2030, translating into up to $2.8 trillion in incremental AI computing power spending, with the U.S. market accounting for $1.4 trillion.

Not a Repetition of the Internet Bubble

In the face of such fervent investment, the market is generally concerned whether this will replay the internet bubble of the early century, especially the phenomenon of funds "circulating" among giants, such as NVIDIA investing in OpenAI, while OpenAI is also a major customer of NVIDIA and Oracle.

Citi's report directly addresses this concern, arguing that the current AI investment boom has "key differences" from that time. The report acknowledges that the vendor financing model has similarities to the transactions between internet startups and network equipment vendors (like Nortel and Cisco) around 2000.

However, the report emphasizes that this round of AI investment has a clear "off-ramp," driven by the growing external demand from enterprises adopting AI services. The report points out that many internet companies at that time spent huge amounts of money on advertising to compete for a "customer that ultimately did not exist," whereas today's AI companies have "clear and reliable demand levels." The actual application benefits in areas such as knowledge retrieval, customer service, and healthcare provide "clear external value validation" for this round of investment.

Even so, the report also cautions that while companies see AI benefits, they are equally concerned about the risks associated with large-scale adoption