The government shutdown crisis approaches, and U.S. Treasury bonds are expected to rise for three consecutive quarters

U.S. Treasury prices are expected to rise for the third consecutive quarter, as a potential government shutdown may suppress economic growth and enhance investors' willingness to buy. Data shows that U.S. Treasury yields have generally declined, with the 10-year Treasury yield at 4.13%. Market expectations of a Federal Reserve interest rate cut have led to an overall increase in Treasury bonds. Investors are focused on the upcoming labor market data to assess the economic situation

According to the Zhitong Finance APP, U.S. Treasury prices are expected to rise for the third consecutive quarter, as a potential government shutdown may suppress economic growth, further enhancing investors' willingness to purchase U.S. Treasuries.

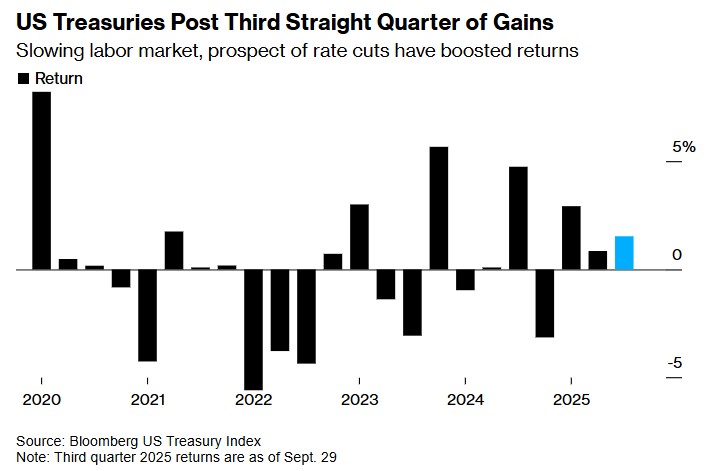

Bloomberg data shows that U.S. Treasury yields generally fell on Tuesday, and so far this quarter, U.S. Treasuries have achieved a return of 1.5%. In the first three quarters of 2025, the return on U.S. Treasuries exceeded 5%, likely marking the best performance since 2020.

Reports indicate that federal government funding will run out at midnight local time on September 30. If the two parties cannot reach an agreement on the relevant appropriations bill by then, some government agencies will face a "shutdown." A shutdown would disrupt the operations of the U.S. government, delay the release of key economic data, and potentially drag down economic growth. In previous instances of U.S. government shutdowns, long-term Treasury prices rose.

U.S. Treasuries are expected to rise for the third consecutive quarter.

The yield on the U.S. 10-year Treasury fell by 1 basis point to 4.13% on Tuesday, after closing down 4 basis points the previous trading day. The 2-year Treasury yield is at 3.60%, close to its lowest level in the past year.

Scott Buchta, head of fixed income strategy at Brean Capital, stated that this week's trend reflects "a slight shift of funds towards quality assets."

He noted, "As a prolonged shutdown could lead to an economic slowdown, more and more people are optimistic about U.S. Treasuries, and the yield curve is flattening."

Due to market expectations that the Federal Reserve will cut interest rates, U.S. Treasuries have generally been on the rise this year. The Federal Reserve lowered rates to the 4%-4.25% range in September but simultaneously indicated a cautious stance on future policy, as inflation remains persistently above target levels.

Recent reports show weakness in the U.S. labor market. Investors will focus on job vacancy data to be released later on Tuesday, as well as non-farm payroll data to be released on Friday, to assess the state of the U.S. labor market.

Interest rate swap trading suggests that the likelihood of the Federal Reserve cutting rates by another 25 basis points in October is about 80%, with a similar possibility in December