Don't believe in the "false dawn"? U.S. small-cap stocks hit new highs, investors busy cashing in

U.S. small-cap stocks have performed strongly recently, with investors profiting and quickly cashing out. Although small-cap stocks have suffered losses over the past four years, investor confidence has rebounded with the Federal Reserve's interest rate cuts and improved economic growth expectations. Despite a slight improvement in fund inflows in September, it has not been enough to offset the outflows for the year. Bloomberg analysts point out that the performance of small-cap stocks may not last long, and investors remain cautious about their future

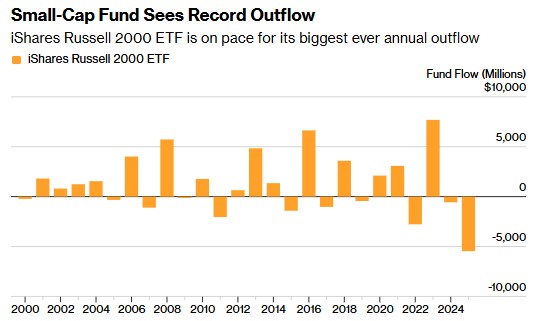

According to the Zhitong Finance APP, the most risky sector in the U.S. stock market has performed strongly in recent weeks, with investors who have suffered multiple losses from small-cap stocks over the past four years cashing in on these paper gains. From the fund flow of the largest exchange-traded fund (ETF) tracking the Russell 2000 Index, investors are rapidly taking profits, and their profit-taking speed is almost synchronized with the withdrawal speed. Approximately $5.4 billion has been withdrawn from the iShares Russell 2000 ETF this year, while the index has also climbed to a historic high.

Since the pandemic, small-cap stocks have underperformed large-cap stocks. They were severely hit during the bear market in 2022 and did not rebound quickly in the subsequent broad bull market. This sector tends to perform better during economic booms and when interest rates are relatively low, as many companies are not profitable and need to borrow to sustain operations.

Only now has the Federal Reserve cut interest rates for the first time in a year, and the U.S. economy is moving towards achieving growth rates exceeding 3% for two consecutive quarters. At this point, small-cap stock investors seem to be gaining some confidence in whether this group can keep pace with large-cap stocks. The fund inflow situation improved in September, but it has not yet reached a level sufficient to offset the outflows for the year.

Bloomberg analyst Athanasios Psarofagis stated that the "false dawn" phenomenon in this sector over the years has damaged investor confidence. Psarofagis said, "It seems they might just be taking the opportunity to cash in, as this outstanding performance never seems to last long compared to large enterprises."

The Russell 2000 Index is the last of the major U.S. stock indices to return to a historic high after the recent bear market, taking four years to achieve this feat. During this period, the Nasdaq 100 Index, driven by the AI boom, rose by about 50%, continuously setting new records.

Recently, small-cap stocks have achieved the longest consecutive weekly gains in nearly five years, as investors expect multiple rate cuts to maintain economic stability. According to Michael Bailey, head of research at Fulton Breakefield Broenniman, this situation has changed market sentiment.

However, unease in the market is quite common. From small-cap stocks to cryptocurrencies, and to tech companies with no profit prospects, the prices of these high-risk assets have begun to appear overvalued, leading investors to take profits.

Sameer Samana, head of global equities and real assets at Wells Fargo Investment Institute, said, "Unfortunately, the pace of this rate cut will be slow and deliberate, and the fundamental outlook for corporate earnings remains bleak, which is why investors are cashing out." Ned Davis Research points out that the breakout of the Russell Index has not been met with a synchronous response from the S&P SmallCap 600 Index, which has excluded some of the worst-performing stocks from the index.

Meanwhile, the Wells Fargo analyst team led by Ohsung Kwon stated that the small-cap trading surrounding interest rate cuts has "ended," and suggested that investors shift their focus back to AI-related stocks.

For Bailey, the discrepancy between the gains in the Russell 2000 Index and the outflows from the ETF is "somewhat surprising." Bailey speculated, "This may simply be a phenomenon of fund rotation, where investors are generally more optimistic about large-cap stocks, leading to a significant flow of funds into the large-cap sector, while the small-cap sector is thus affected by the diversion of funds."

Bailey added, "It may take 'a few more months, or even a year or longer, for small-cap performance to catch up with, or even outperform, large-cap stocks' before investors will redirect funds into small-cap stocks."

Todd Stankiewicz, president and chief investment officer of SYKON Capital, stated, "Some investors may profit from a higher-risk market sector and then turn to even riskier areas in search of higher returns. They might think, 'What should I put in there? If I can get higher returns with the same volatility, what should I invest in?' People start chasing risk investment tools like cryptocurrency ETFs."

Stankiewicz added, "Investors must confirm that small businesses will not be severely impacted by tariff policies to encourage sustained inflows into ETFs tracking that sector. If a more favorable business environment can be created, small businesses will see more significant gains compared to large enterprises. This will lead to a shift in the flow of funds."