Economic resilience reduces recession risks, Goldman Sachs says US stocks should "buy on dips" until the end of the year

高盛策略师将美股评级在三个月期限内上调至增持,理由包括良好的盈利增长、美联储在无衰退情况下的宽松政策以及全球财政政策放松。策略师认为,在政策支持强劲的后周期经济放缓阶段,股票资产通常表现良好,“将在年底前逢低买入美股”。

高盛策略师团队基于美国经济韧性、支撑性估值水平以及美联储鸽派转向,预计全球股市有望在年末前延续涨势,并建议投资者对股票采取"逢跌买入"策略。

在最新发布的报告中,策略师将美股评级在三个月期限内上调至增持,理由包括良好的盈利增长、美联储在无衰退情况下的宽松政策以及全球财政政策放松。高盛策略师认为,在政策支持强劲的后周期经济放缓阶段,股票资产通常表现良好。

这一看涨立场呼应了当前的市场乐观情绪。得益于市场对美联储及时降息以避免经济衰退的预期,以及人工智能热潮对科技巨头的提振,全球股市此前已攀升至历史新高。

与此同时,高盛将信贷评级从中性下调至减持,但保持对股票 12 个月的看涨建议。该机构认为,虽然股票估值可能超出当前水平,但这对信贷构成约束。

宽松政策支撑看涨前景

高盛策略师认为,当前正处于一个对股市有利的宏观环境。他们分析称,在经济衰退风险可控的背景下,政策支持是推动股市上涨的关键动力。

“良好的盈利增长、美联储在不引发衰退情况下的宽松政策,以及全球性的财政宽松,将继续支持股市,鉴于衰退风险稳定,我们将在年底前逢低买入股票。”

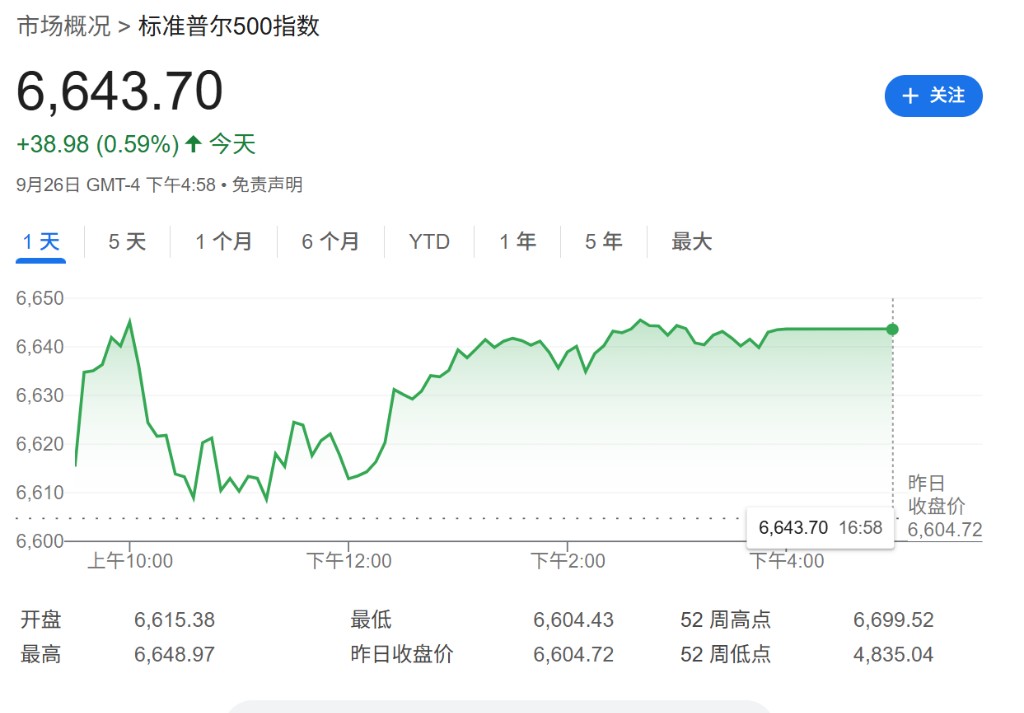

此前,高盛的美国策略师已将标普 500 指数的三个月目标位上调至 6800 点,预计还有约 2% 的上涨空间。

此外,该团队还维持了对股票未来 12 个月的看涨建议。对于信贷资产,高盛则认为,尽管短期承压,但从 12 个月的维度看,由于衰退风险相对较低以及有利的供需格局,其悲观程度有所降低。

风险犹存,强调多元化配置

尽管发布了看涨的短期建议,但高盛团队也警告称,市场并非没有风险。他们指出,短期内经济增长或利率出现意外冲击的风险依然存在,投资者需保持警惕。

随着美国劳动力市场开始降温,以及全球关税可能带来的影响,即将到来的企业财报季将为市场提供重要线索。据彭博汇编的数据显示,分析师预计标普 500 指数成分股公司第三季度的盈利同比增长 7.1%,这将是两年来最小的增幅,或对市场预期构成考验。

为应对潜在风险,该团队强调了多元化配置的重要性。报告重申了对国际市场进行多元化投资的偏好,并且在不同区域之间保持中性立场,避免将所有风险敞口集中于单一市场。