Goldman Sachs: Upgrades global stock market rating to "Overweight," expected to continue upward trend before the end of the year

Goldman Sachs has upgraded its global stock market rating to "Overweight," expecting the upward trend to continue before the end of the year, mainly benefiting from the resilience of the U.S. economy, valuation support, and the Federal Reserve's dovish signals. The strategy team recommends buying during stock market pullbacks, while the credit asset allocation rating has been downgraded to "Underweight" in the short term, but remains bullish on stocks in the medium to long term. It is expected that the S&P 500 index will rise another 2% in the next three months, reaching 6,800 points. Analysts warn to pay attention to the risks of growth falling short of expectations or interest rate fluctuations

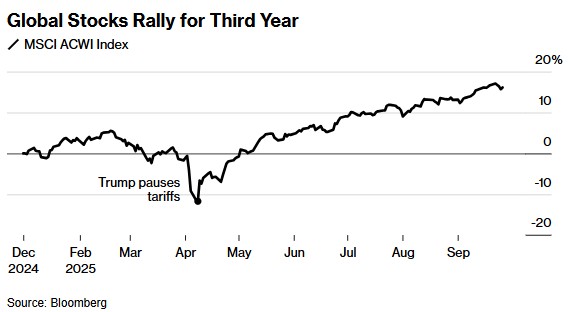

According to the Zhitong Finance APP, strategists at Goldman Sachs have pointed out that global stock markets are likely to continue their upward trend until the end of the year, thanks to the resilience of the U.S. economy, supportive valuations, and the Federal Reserve signaling a dovish shift. Led by Christian Mueller-Glissmann, the strategy team has upgraded their stock allocation rating for the next three months to "overweight." They stated that assets like stocks typically perform well in the later stages of an economic cycle with strong policy support.

The team wrote in their report: "Strong earnings growth, the Federal Reserve's easing policy in the absence of a recession, and global fiscal policy easing will continue to support the stock market. Given that recession risks are at a stable and controllable level, we recommend buying on market pullbacks before the end of the year."

In the short term, they downgraded the credit asset allocation rating from "neutral" to "underweight"; however, they maintain a "bullish" recommendation for stocks in the medium to long term (12-month horizon). Although stock valuations may break through current levels, this factor constrains credit assets. Nevertheless, considering the relatively low recession risk and favorable supply-demand dynamics, the team is no longer as pessimistic about credit assets over a 12-month horizon.

Currently, the market has optimistic expectations that the Federal Reserve will timely initiate interest rate cuts to avoid a recession, driving global stock markets to reach historic highs. Meanwhile, the renewed enthusiasm in the artificial intelligence sector has injected growth momentum into tech giants, prompting many U.S. institutions to raise their expectations for the S&P 500 index.

Earlier this month, Goldman Sachs' U.S. strategists also raised their target level for the S&P 500 index, predicting that the index will rise another 2% in the next three months, reaching 6,800 points.

However, as the U.S. labor market begins to cool, market focus will shift to the next round of corporate earnings season to look for clues on the impact of global tariff policies. Data compiled by Bloomberg Intelligence shows that analysts expect the year-on-year earnings growth for S&P 500 constituents in the third quarter to be 7.1%, which would be the smallest increase in two years.

The Goldman Sachs team also warned that short-term vigilance is still needed against the risks of growth falling short of expectations or fluctuations in interest rates. In terms of regional allocation, they maintain a "neutral" stance and reiterate the recommendation to "diversify risks through international asset allocation."