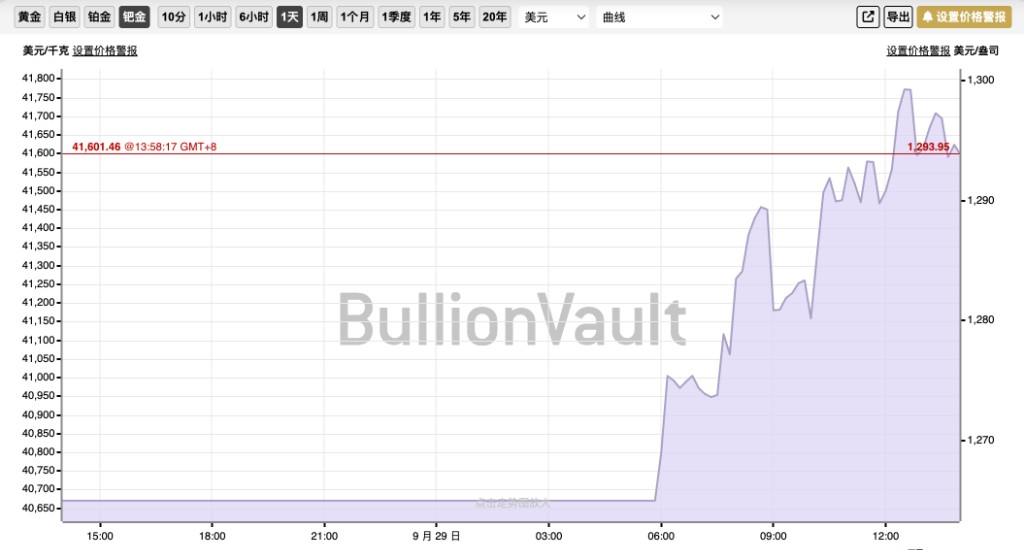

Most Asian stock markets closed higher, the threat of a government shutdown weighed on the dollar, and spot gold broke through $3,800

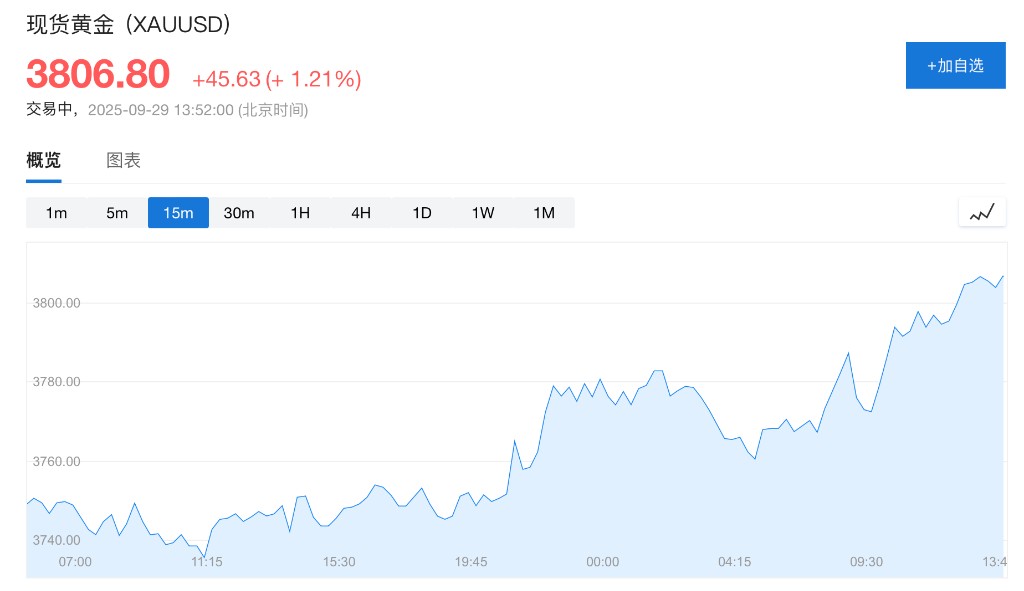

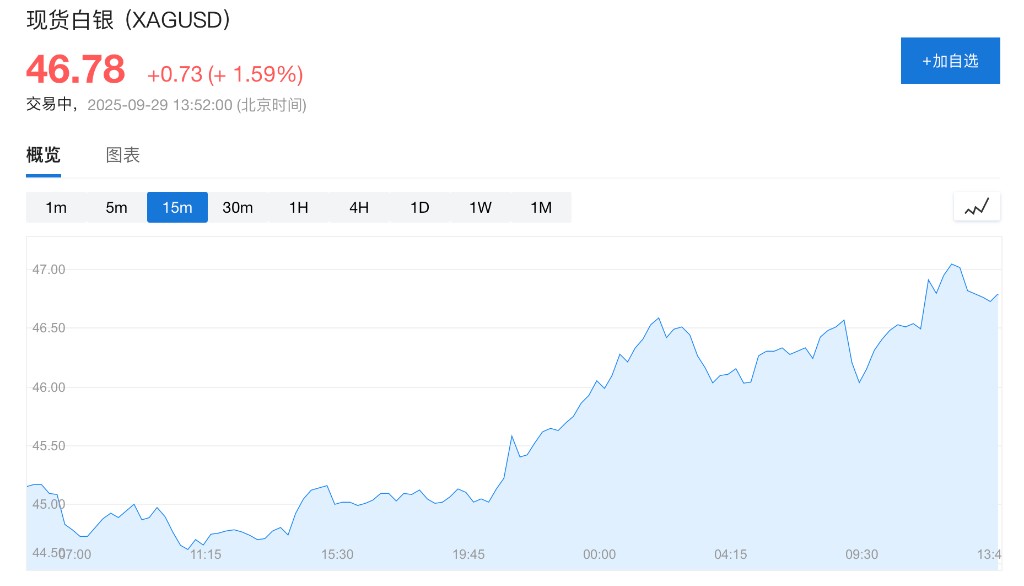

On September 29, due to the potential government shutdown in the United States, the dollar fell, and gold prices broke through $3,800 per ounce for the first time. Most Asian stock markets rose, with the Nikkei 225 down 0.89% and the KOSPI up 1.49%. European stocks opened higher collectively, with the Euro Stoxx 50 index rising 0.33%. Spot gold reached $3,805.88 per ounce, and spot silver rose over 2% to $46 per ounce, hitting a fourteen-year high

On Monday, September 29, the US dollar fell due to the risk factors of a potential government shutdown. Driven by the weakening dollar and expectations of further interest rate cuts by the Federal Reserve, gold prices broke through the key level of $3,800 per ounce for the first time. European stocks opened higher collectively, and most Asian stock markets rose.

The Euro Stoxx 50 index opened up 0.33%, the UK FTSE 100 index rose 0.34%, the French CAC 40 index increased by 0.36%, and the German DAX index was up 0.41%.

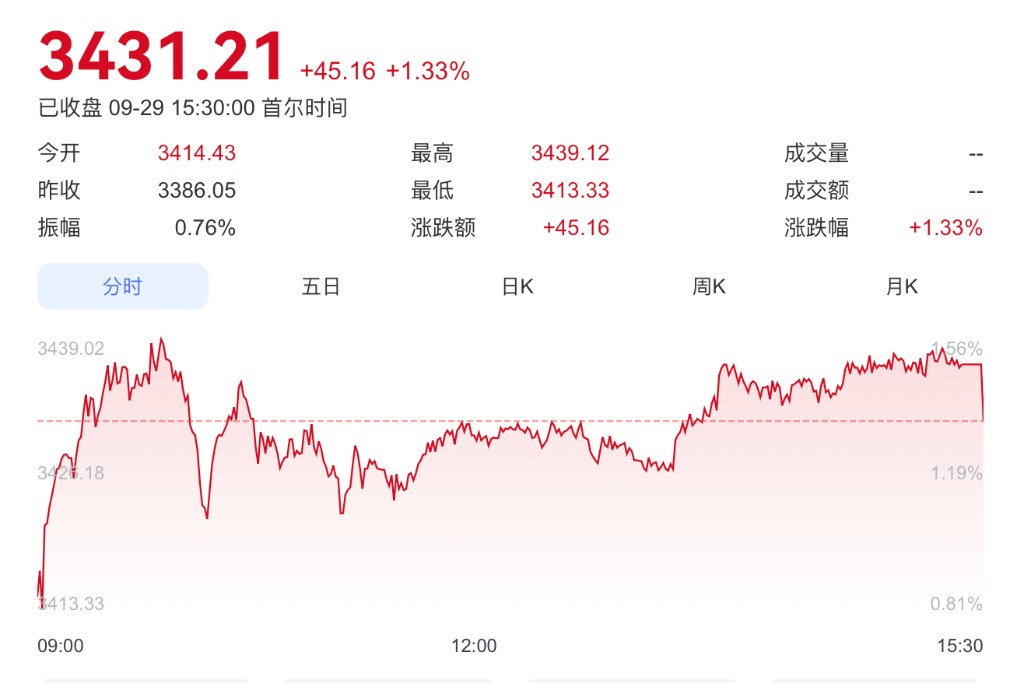

In the Asian stock market, the Nikkei 225 fell by 0.89%, closing at 44,940.87, while the South Korean Composite Index rose by 1.49%, closing at 3,436.99. The FTSE Straits Index increased by 0.23%, closing at 4,274.9.

The US dollar index fell nearly 0.26%, closing at 97.94. Metal commodities strengthened, with spot gold reaching a historic high of $3,805.88 per ounce, and spot silver surged over 2% to $46 per ounce, hitting a fourteen-year high. Platinum and palladium both rose, while Brent crude oil slightly declined, down 0.03%.

Core market trends are as follows:

- Euro Stoxx 50 index opened up 0.33%.

- UK FTSE 100 index rose 0.34%.

- French CAC 40 index increased by 0.36%.

- German DAX index was up 0.41%.

- Nikkei 225 index fell by 0.8%.

- South Korean Composite Index rose 1.49%, closing at 3,436.99, with a monthly increase of 7.8%.

- FTSE Straits Index increased by 0.23%, closing at 4,274.9.

- US dollar index fell nearly 0.26%, closing at 97.94%.

- Spot gold rose 1.2% to $3,806.8 per ounce.

- Spot silver increased by 1.59% to $46.78 per ounce.

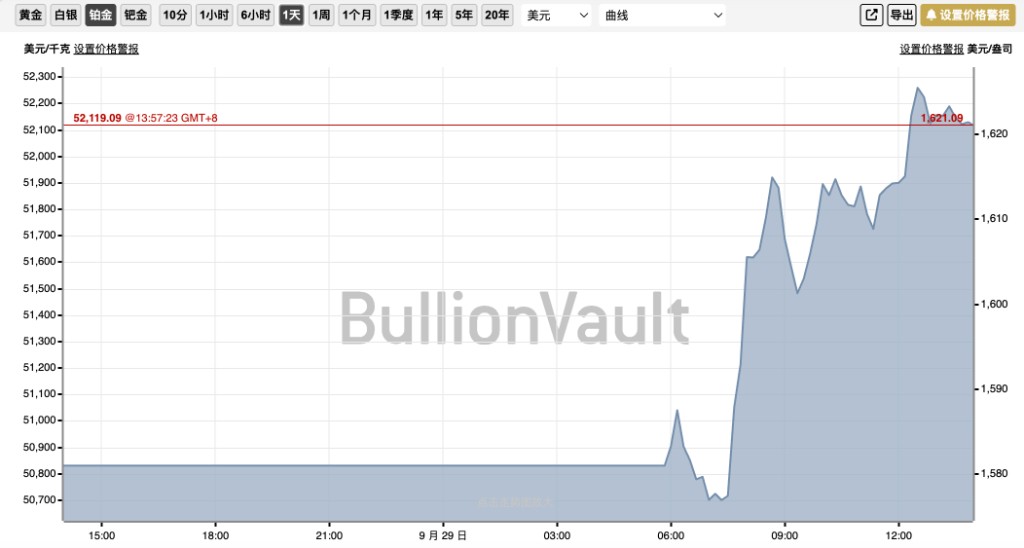

- Platinum rose 3.4% to $1,622.04 per ounce.

- Palladium increased by 2.2% to $1,297.67 per ounce.

- Brent crude oil slightly declined, down 0.03% to $68.53 per barrel.

Affected by the potential US government shutdown, the Euro Stoxx 50 index opened up 0.33%.

The UK FTSE 100 index rose 0.34%.

The French CAC 40 index increased by 0.36%.

The German DAX index rose by 0.41%.

The German DAX index rose by 0.41%.

The Nikkei 225 index fell by 0.8%, as investors are awaiting the results of the Liberal Democratic Party leadership election this weekend, which will impact fiscal and monetary policy.

The South Korean Composite Index rose by 1.49%, closing at 3436.99, with a monthly increase of 7.8%.

The FTSE Straits Index rose by 0.23%, closing at 4274.9.

The US dollar index fell nearly 0.26% to 97.94, influenced by the potential government shutdown. A government shutdown could delay the release of key employment data and cast a shadow over the Federal Reserve's monetary policy path. Later on Monday, Trump will discuss extending government funding with senior leaders from both the Democratic and Republican parties. If an agreement is not reached, the government will shut down starting Wednesday.

The potential US government shutdown and inflation data reinforcing expectations for Federal Reserve rate cuts resonate, boosting safe-haven sentiment and the low-interest-rate environment, lifting gold prices, with spot gold rising by 1.2% to $3,806.8 per ounce.

US economic data released last Friday showed that the 12-month Personal Consumption Expenditures (PCE) price index rose from 2.6% to 2.7% in August, while the core inflation rate remained stable at 2.9%, in line with market expectations. The market anticipates a 90% chance of a Federal Reserve rate cut in October, with a 65% chance of another cut in December.

Spot silver rose by 1.59% to $46.78 per ounce.

Platinum rose 3.4% to USD 1,622.04 per ounce.

Platinum rose 3.4% to USD 1,622.04 per ounce.

Palladium rose 2.2% to USD 1,297.67 per ounce.

Brent crude oil slightly declined, down 0.03%.

Risk Warning and Disclaimer

The market has risks, and investment requires caution. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial conditions, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article are suitable for their specific circumstances. Investment based on this is at one's own risk