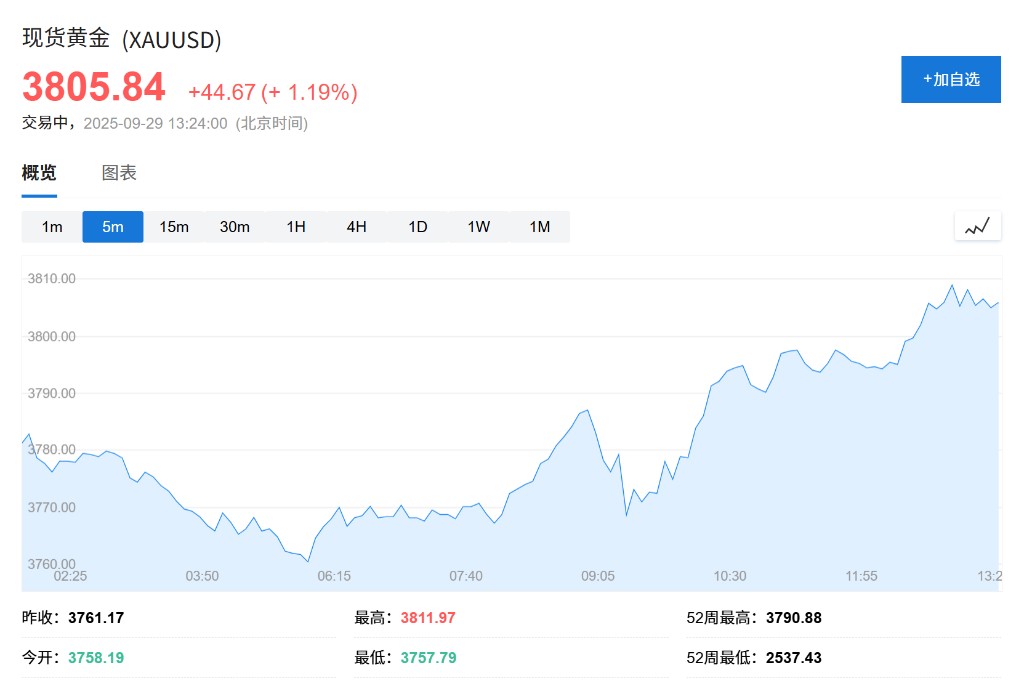

The shadow of a U.S. government shutdown boosts risk aversion, with spot gold breaking through the $3,800 mark and silver continuing to hit a fourteen-year high

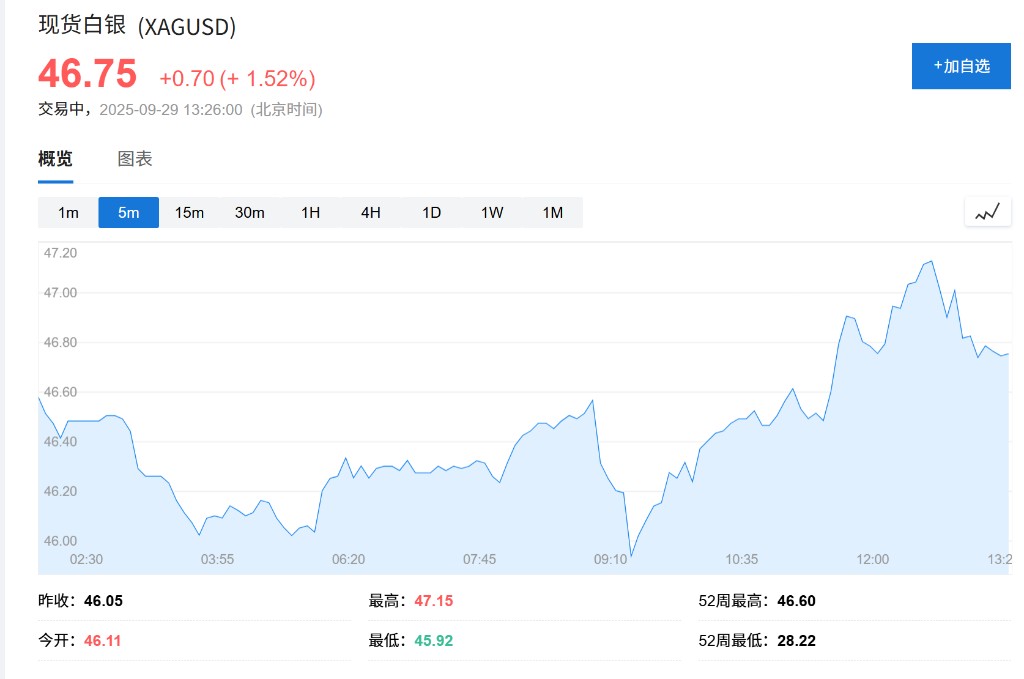

The shadow of a U.S. government shutdown and rising expectations for a Federal Reserve interest rate cut have jointly triggered a surge in safe-haven demand for precious metals. Spot gold soared 1.19% on Monday, reaching a historic high of $3,805.88 per ounce, marking its sixth consecutive increase. Spot silver also surged over 2% to $47 per ounce, continuing to hit new highs since May 2011. The market expects a 90% probability of a Federal Reserve rate cut in October, supporting the continued rise of gold and silver

Under the shadow of the potential government shutdown in the United States, investors are increasingly uncertain about the Federal Reserve's monetary policy path and are flocking to precious metals for safety, pushing gold prices to a historic high on Monday, with spot silver also rising.

Spot gold rose 1.19% in early Asian trading on Monday, reaching a historic high of $3,805.88 per ounce, marking the sixth consecutive week of gains. U.S. December gold futures also rose 0.6% to $3,831.90.

Spot silver rose more than 2% during the day, reaching $47 per ounce, continuing to hit a new high since May 2011. The U.S. dollar index weakened by 0.2%, making dollar-denominated gold more attractive to overseas buyers.

The direct catalyst for this round of gains is the imminent political deadlock in Washington. If the White House and Congressional Democrats cannot reach an agreement on a short-term spending bill before Tuesday's deadline, the U.S. government will face a shutdown. This move could delay the release of this week's key non-farm payroll report, preventing both the market and the Federal Reserve from obtaining critical indicators to assess economic health.

For investors, this means that the Federal Reserve's decision at the October meeting will be shrouded in even greater uncertainty. The market generally expects that weak employment data will provide justification for further rate cuts by the Federal Reserve, and rate cuts will lower the opportunity cost of holding non-yielding assets like gold. In the context of unclear economic and policy prospects, gold's safe-haven attributes are once again highlighted.

Expectations for Federal Reserve Rate Cuts Rise

Beyond the risk of a government shutdown, recent data and analysis are also reinforcing market expectations for further easing of monetary policy by the Federal Reserve. Last Friday, the U.S. Department of Commerce released the Personal Consumption Expenditures (PCE) price index, which met expectations, showing that inflation remains stable. The research team at Sucden Financial noted in a commentary that this data solidifies market expectations that the Federal Reserve will continue to ease policy.

Kyle Rodda, an analyst at Capital.com, stated:

“The moderate inflation data in the U.S. gives the market reason to believe that the Federal Reserve will further cut rates in October and December.”

This expectation is directly reflected in the futures market. According to the CME Group's FedWatch tool, traders currently expect a 90% chance of a rate cut by the Federal Reserve in October, with a probability of about 65% for another cut in December. However, some analysts have also pointed out the risks. Kyle Rodda added:

"Market sentiment is very bullish, and gold prices are currently in a relatively long position, which may be a reason to remain cautious about future upside potential."

Investors are closely watching the U.S. job openings, private sector employment, ISM manufacturing index, and non-farm payroll report (if released on time) to find more clues about the health of the economy this week.

In addition to economic data and interest rate prospects, the issue of the Federal Reserve's independence is also becoming a new variable for investors to consider. The lawyer for Federal Reserve Governor Lisa Cook requested the Supreme Court's intervention last Thursday to block Trump's attempt to remove her from office. This event has led the market to weigh the risks of central bank independence being eroded.

Barclays strategists Themistoklis Fiotakis and Lefteris Farmakis pointed out in an analysis report on Sunday that gold does not appear overvalued relative to the dollar and U.S. Treasuries. They wrote that considering the "risk of central bank independence potentially being eroded," these markets "should include a certain degree of Fed-related risk premium." Therefore, they believe gold is "an unexpectedly good hedging tool."

Capital Inflows Support Continued Rise in Gold Prices

This year, the gold market has performed exceptionally well. Driven by strong demand from central banks and the Federal Reserve entering a rate-cutting cycle, gold prices have risen more than 40% this year and are on track for a third consecutive quarter of gains.

Capital continues to flow into investment products linked to gold. Data from the world's largest gold ETF—SPDR Gold Trust—show that its holdings increased by 0.89% last Friday, reaching 1,005.72 tons, the highest level since 2022. This influx of funds has also spread to other precious metals, with silver prices rising more than 2% on Monday, briefly reaching $47.08 per ounce, and platinum and palladium also seeing significant gains.

Looking ahead, several investment banks, including Goldman Sachs and Deutsche Bank, expect the upward trend in gold to continue. Supported by multiple favorable factors, gold seems to be entering a new price era, while the market's focus will continue to be on political developments in Washington and the Federal Reserve's next actions