Gold breaks records again! Government shutdown and Federal Reserve uncertainty become the best drivers

週一,黃金價格創下歷史新高,達到每盎司 3798.73 美元,因市場關注美國政府停擺危機及美聯儲貨幣政策的不確定性。白銀、鉑金和鈀金價格也大幅上漲,受益於市場供應緊張和資金流入 ETF。若政府停擺,關鍵就業數據發佈可能延遲,進一步影響美聯儲的利率決策。分析師指出,黃金成為優質對沖資產。

智通財經 APP 獲悉,週一,貴金屬價格全線飆升,黃金攀升至歷史新高。目前,交易員正密切關注美國政府可能出現的停擺危機——若危機爆發,本週關鍵就業數據的發佈或將延遲,進而可能令美聯儲的貨幣政策路徑變得不明朗。

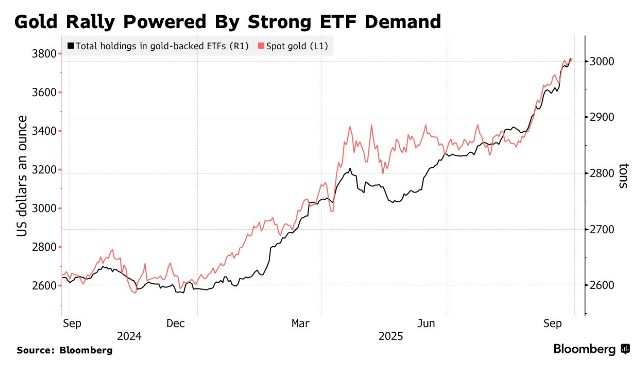

在實現連續六週上漲後,黃金價格再漲 1%,創下每盎司 3798.73 美元的歷史新高,超越了上週二創下的峯值。白銀價格漲幅一度達 1.2%,在上週自 14 年來首次突破 45 美元后進一步攀升 2011 年以來的最高水平,鉑金與鈀金也均大幅走高。支撐這些貴金屬上漲的因素包括持續的市場供應緊張,以及資金不斷流入以這些金屬為標的的 ETF。

美國國會高層領導人與總統特朗普計劃於週一舉行會晤,而若無法就短期支出法案達成協議,聯邦政府資金將於次日到期。政府停擺將可能影響多項關鍵數據的發佈,其中就包括週五的非農就業報告——經濟學家預計該報告將顯示 9 月美國就業增長放緩。

若就業數據表現疲軟,將為美聯儲在 10 月下次利率決議中採取寬鬆政策提供更多依據。在此情景下,不產生利息的貴金屬吸引力將進一步上升。不過,美聯儲降息週期的前景仍存在高度不確定性:一方面,美聯儲官員對貨幣政策的看法存在分歧;另一方面,部分經濟數據的表現好於預期。

此外,交易員仍在持續評估美聯儲獨立性面臨的威脅。此前在週四,美聯儲理事莉薩・庫克的律師已敦促最高法院允許其在應對特朗普解僱企圖期間繼續履職。

巴克萊銀行策略師 Themistoklis Fiotakis 與 Lefteris Farmakis 在週日發佈的報告中指出,考慮到美聯儲可能喪失獨立性這一風險的性質,美元與美國國債 “理應包含一定程度的美聯儲相關溢價”,而相較之下,黃金價格並未顯得高估。他們補充稱:“這使得黃金成為一種意外優質的對沖資產。”

今年以來,金價已飆升逾 40%,在各大央行購金需求以及美聯儲重啓降息的推動下,金價接連創下歷史峯值。下週金價有望實現連續第三個季度上漲,目前黃金 ETF 的持倉量已升至 2022 年以來的最高水平。高盛、德意志銀行等機構均表示,預計金價漲勢將持續。

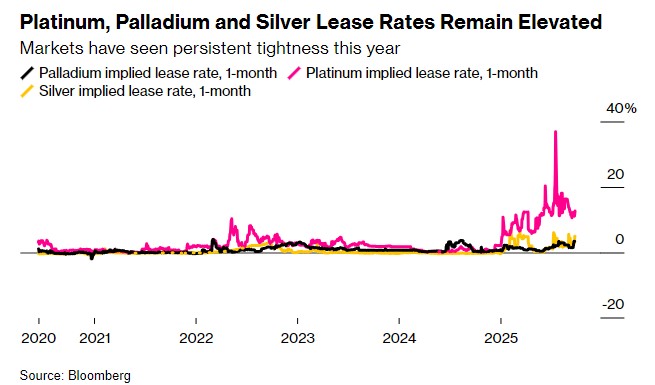

與此同時,其他貴金屬今年也出現了前所未有的供應緊張局面。由於連續數年的供應短缺問題日益凸顯,倫敦市場可自由流通的貴金屬庫存不斷減少,市場對此的擔憂也進一步加劇。白銀、鉑金與鈀金的租賃利率 (反映短期借入金屬的成本) 均大幅攀升,遠超接近零的正常水平。

以 Max Layton 為首的花旗分析師團隊表示,市場擔憂特朗普政府可能將鉑族金屬納入 “232 條款” 關鍵礦產調查範圍,這一新增擔憂進一步加劇了市場供應緊張。花旗在 9 月 19 日發佈的報告中指出,預計相關審查結果將於 10 月晚些時候公佈,在此之前,鈀金面臨美國潛在進口關税的可能性有所上升。週一,鈀金觸及 7 月以來的最高水平。