"Mag 7" is outdated? Wall Street wants AI!

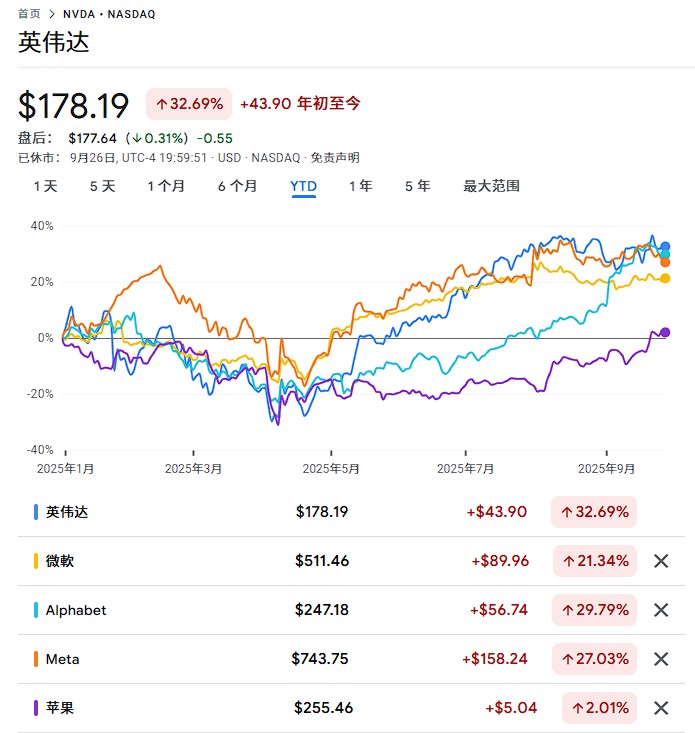

“Mag 7” 內部分化明顯,蘋果、特斯拉前景不明,而英偉達、微軟等仍被看好。隨着 AI 投資主題擴展,甲骨文、博通、Palantir 等新興 AI 受益股表現突出,甲骨文漲超 75%,Palantir 漲 135%。華爾街提出” Big Six”、” Elite 8”、” Magnificent 10” 等新組合概念。

華爾街最具影響力的股票組合"Magnificent Seven"正面臨重新定義,投資者開始尋找更全面反映 AI 革命受益者的新組合。

自 OpenAI 的 ChatGPT 引發全球 AI 熱潮近三年來,由英偉達、微軟、蘋果、Alphabet、亞馬遜、Meta 和特斯拉組成的"Mag 7"主導了美股漲勢,但 AI 投資主題已擴展至更廣泛的公司範圍。

AI 投資主題的演進催生了新的市場領導者,博通(Broadcom)、甲骨文(Oracle)和 Palantir 等公司在 AI 領域的突出表現使其成為無法忽視的力量。甲骨文今年股價漲幅超過 75%,Palantir 更是納斯達克 100 指數中的最佳表現者,漲幅達 135%。

華爾街正提出多種新的股票組合概念來捕捉真正的 AI 贏家。從"Fab Four"到"Elite 8",各種變體試圖更準確地反映 AI 時代的投資機會,芝加哥期權交易所甚至推出了包含十隻股票的"Magnificent 10"指數。

傳統科技巨頭地位生變

數據顯示,"Mag 7"仍佔標普 500 指數近 35% 權重,預計 2026 年收益將增長 15% 以上。不過,組合內部分化日趨明顯:

英偉達、Alphabet、Meta 和微軟被視為 AI 時代的受益者,而蘋果、亞馬遜和特斯拉的前景則相對不明朗。

管理 24 億美元資產的 Artisan Partners 投資組合經理 Chris Smith 表示,"僅僅因為'Mag 7'在移動互聯網、電商等過往科技週期中獲勝,並不意味着它們在 AI 時代也會勝出。"

蘋果面臨增長放緩且在 AI 領域落後的雙重壓力,特斯拉的電動汽車業務則因銷量下滑和競爭加劇承受重壓。

儘管如此,兩家公司仍有大量擁躉,押注蘋果 iPhone 將成為消費者使用 AI 的主要設備,特斯拉則寄希望於自動駕駛和人形機器人業務。

Fidelity Investments 全球宏觀總監 Jurrien Timmer 指出:

"一家公司可能會變得大到無法忽視。隨着 AI 故事的發展,新贏家可能取代舊贏家的位置。"

華爾街重新定義 AI 受益股組合

AI 投資機會已擴展至傳統"Mag 7"之外的多個領域。

甲骨文憑藉 AI 相關雲計算業務的強勁增長,股價表現超越了大多數"Mag 7"成員。Palantir 作為少數幾家 AI 軟件贏家之一,在傳統軟件領導者如 Salesforce 和 Adobe 面臨被邊緣化擔憂時脱穎而出。

AI 產業鏈的擴展為更多公司帶來投資機會。

台積電被視為 AI 生態系統的關鍵組成部分,而通信設備公司 Arista Networks、存儲芯片製造商美光科技等存儲公司也從 AI 基礎設施建設中獲益。

面對 AI 投資主題的擴展,華爾街分析師提出了多種新的股票組合概念。

Seaport Research 首席股票策略師 Jonathan Golub 建議剔除特斯拉,創建"Big Six"組合。Melius Research 的 Ben Reitzes 則偏好包含芯片製造商博通在內的"Elite 8"組合。

芝加哥期權交易所推出的"Magnificent 10"指數包含原有七家公司以及博通、Palantir 和 AMD。該交易所表示,成分股選擇基於"流動性、市值、交易量以及在人工智能和數字化轉型等領域的領導地位"。

管理約 347 億美元資產的 Janus Henderson 投資組合經理 Nick Schommer 表示:

"我們確實需要將討論範圍擴大到'Mag 7'之外,甲骨文現在絕對是其中一部分,博通也是如此。"