Success or failure depends on non-farm payrolls?

Since July, non-farm payroll data has continued to decline, affecting the Federal Reserve's decision-making. Although the unemployment rate and wages have not significantly worsened, the weakness in new non-farm payrolls has prompted the Federal Reserve to reassess employment risks, potentially leading to an interest rate cut in September. The report indicates that the accuracy of non-farm payroll data is in question, as the seasonal adjustment mechanism amplifies short-term fluctuations. Historical data shows that August non-farm payroll data has a high probability of being revised upward in October, which may influence interest rate cut expectations. Overall, the potential upward revision of August non-farm payrolls has a significant impact on market expectations

The sharp decline in non-farm payrolls since July continues to affect the nerves of the Federal Reserve and the market. Although other core employment indicators such as the unemployment rate and wages have not significantly deteriorated, there is no disagreement that the continued weakness in new non-farm payrolls is the "culprit" forcing the Federal Reserve to reassess employment risks and implement a "risk-control rate cut" in September.

However, we believe that the pace of rate cuts by the Fed may be more convoluted than the market's expected linear rate cut path. We have continuously pointed out in previous reports that potential inflation risks in the fourth quarter will become a "roadblock" to continuous easing policies. Currently, discussions about inflation have been quite thorough.

In this report, we will focus on another key variable—employment, and whether there is a possibility of upward revision, which could inversely suppress the rate cut expectations already priced in.

The "noise" in this year's non-farm data has become increasingly prominent: The response rate to surveys has significantly declined, and layoffs by the Federal Reserve have affected the quality of data collection, leading to its accuracy being "highly questioned." However, as the most core official indicator of the labor market, both the market and the Federal Reserve still have to rely on its fluctuations for pricing and decision-making.

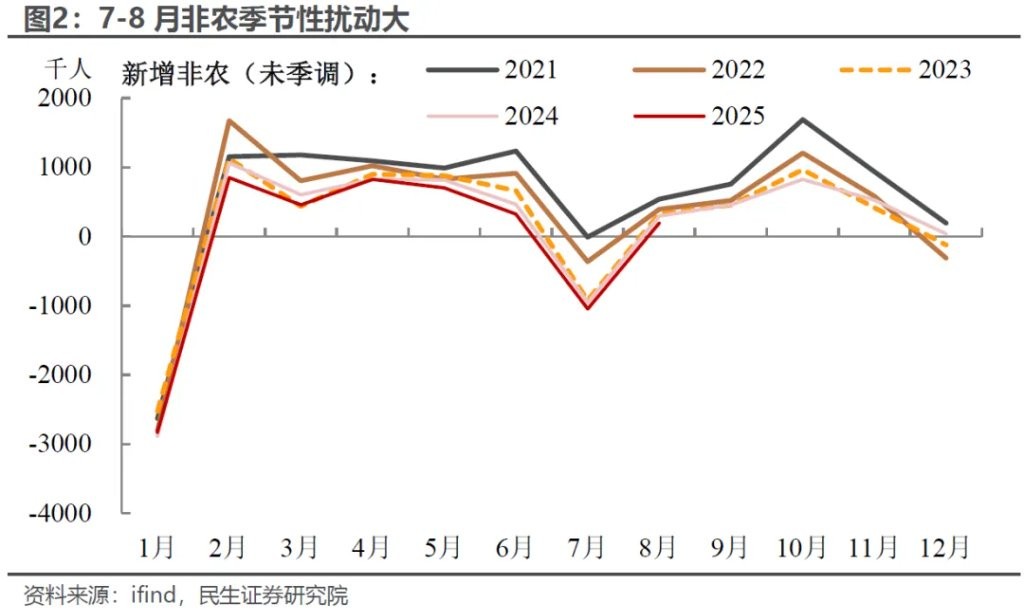

On the other hand, the seasonal adjustment mechanism and model characteristics of non-farm payrolls have also amplified the short-term volatility of the data. Since the Department of Labor incorporates the newly released data into the seasonal adjustment model each month to generate new seasonal adjustment factors and retroactively revise the non-farm employment data for the past three months, the period of July to August is often a peak season for seasonal fluctuations in the labor market. After being included in the model, the dynamic adjustment of seasonal factors may increase the short-term disturbances in the data for the past three months, leading to consecutive large downward revisions in non-farm payrolls.

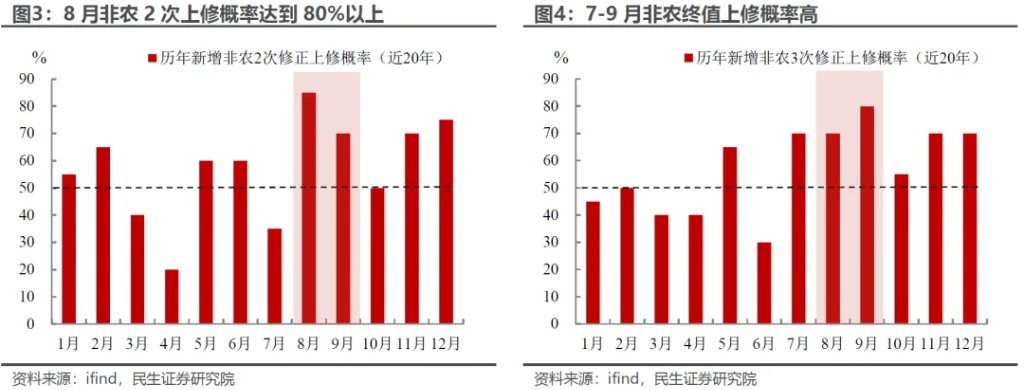

However, historical experience shows that the initial value of non-farm payrolls for August, released in September, often undergoes seasonal upward revisions in October. Referring to data from the past 20 years (2005-2024), the probability of upward revision for August non-farm payrolls in the two revisions in October exceeds 80%, the highest for any month, while the probability of the final value released in November being revised upward is also around 70%.

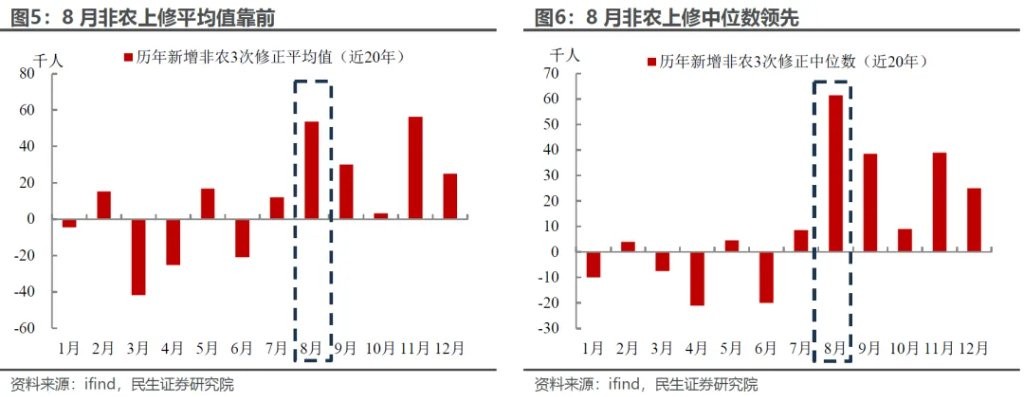

The overall upward revision magnitude should not be underestimated, as both the median and average upward revisions for August non-farm payrolls rank among the highest for the year. Given that there have already been signs of upward revision in July's non-farm payrolls, combined with the hint from White House economic advisor Hassett that "the employment report may be revised upward by nearly 70,000 jobs," the potential upward revision of August's non-farm payrolls cannot be ignored in its impact on rate cut expectations

We believe the reasons for the seasonal upward revision of the August non-farm payrolls may be:

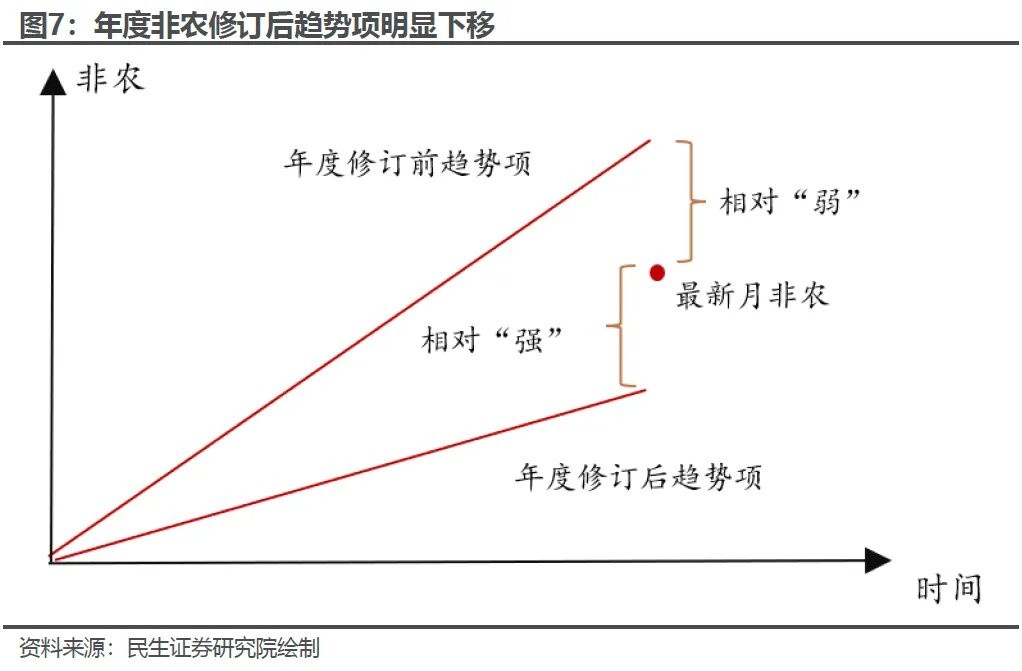

On one hand, after the significant revision of the annual benchmark in September, the overall trend component of non-farm payrolls in the CES model has clearly shifted downward (the trend component can be understood as the reference frame for non-farm seasonally adjusted data, and the downward shift makes the originally relatively "weak" data appear relatively "strong"), therefore, the two revised data points for August non-farm payrolls published in October have little room for downward adjustment;

On the other hand, the unadjusted data for August non-farm payrolls often shows a significant seasonal increase, but the initial value did not incorporate all the survey responses at the time of publication (especially since the current response rate has significantly declined), and the subsequent recovered surveys may reflect a more optimistic employment tendency.

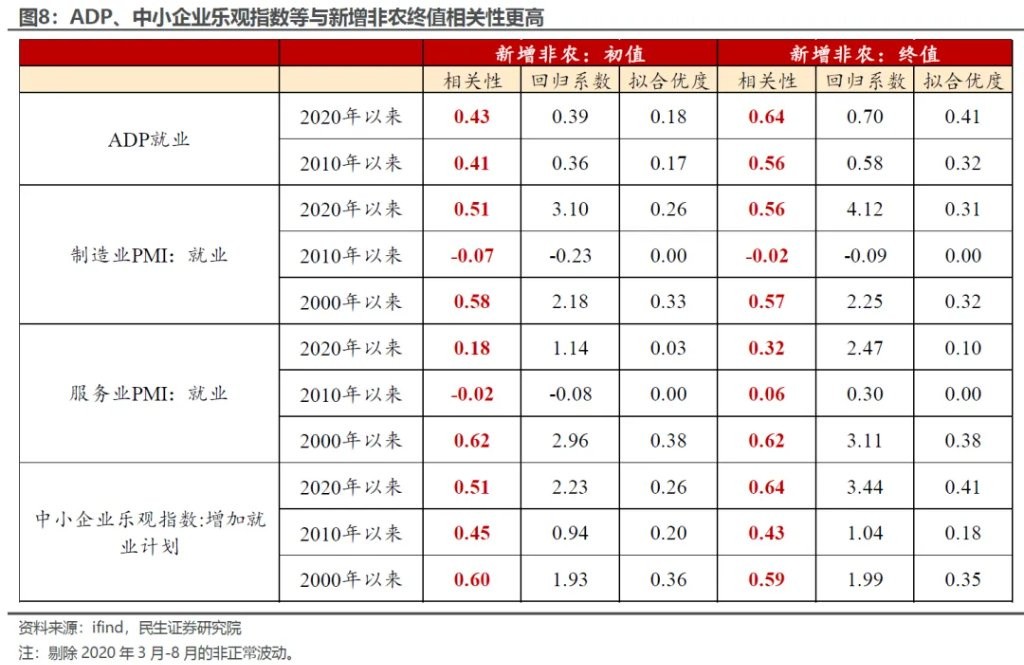

In horizontal comparison with other labor market indicators, there is also a probability of underestimation for August non-farm payrolls. The correlation of ADP employment, PMI employment index, small business hiring plans, and other indicators with the final value of non-farm payrolls is generally higher than that with the initial value, and the current downward trend of these indicators for August is controllable, not showing the sharp slowdown seen in the initial value of non-farm payrolls. This comparison also suggests that there is a certain probability of upward revision for August non-farm payrolls in the future.

Therefore, the guidance of August non-farm payrolls on interest rate cut expectations may be disturbed, a similar situation also occurred around the first interest rate cut by the Federal Reserve last year: In June and July last year, the non-farm payroll data was continuously revised downwards, and the rising unemployment rate triggered market recession fears, prompting the Federal Reserve to cut rates in September, with the market pricing in a further 50 basis points cut in November. However, in October, the Labor Department significantly revised up the July and August non-farm payroll data, leading to a cooling of the recession narrative and the aggressive expectation of a 50 basis point cut.

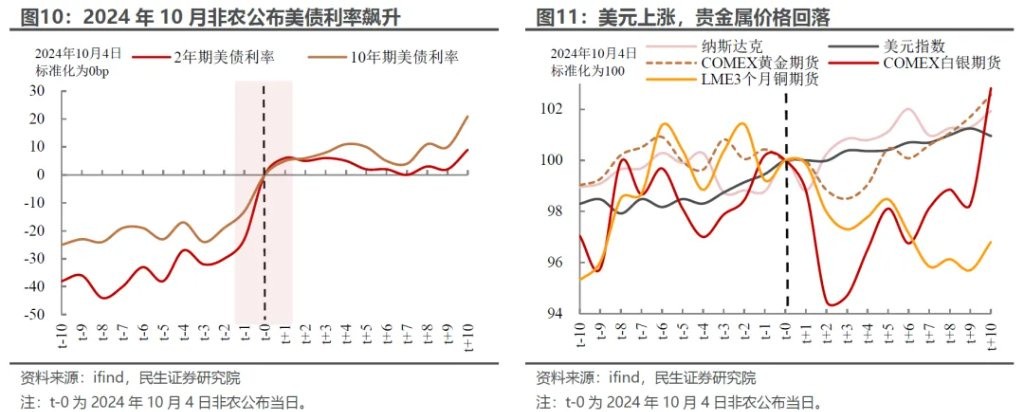

In terms of asset reflection, U.S. Treasury yields, especially at the short end (2-year), surged about 20 basis points on that day; the dollar rose, while the prices of precious metals such as gold, silver, and copper showed a significant short-term correction; U.S. stocks experienced a slight short-term pullback but ultimately continued to rise under the retreat of the recession narrative and the support of moderate interest rate cuts. Of course, unlike last time, the pricing of assets in this round is more driven by bets on interest rate cut expectations, without the participation of the recession narrative, which also means that the upward revision of non-farm payrolls may have a greater negative impact on risk assets

In summary, we need to continue to observe the expectations for interest rate cuts. Although we do not rule out the possibility of the Federal Reserve continuously cutting rates from the fourth quarter to early next year (if there are clear upward signals such as rising unemployment), the current market bets on rate cuts seem somewhat overly aggressive, ignoring potential volatility risks. Even though there are still disagreements among Federal Reserve officials, the market pricing shows a rare "consistent optimism."

This also means that once any reverse signals (such as rapid inflation increases and non-farm payroll revisions) lead to adjustments in expectations, market volatility will be amplified again: U.S. Treasury yields may rebound, and U.S. stock sectors that are relatively sensitive to rate cuts (growth stocks and cyclical stocks) will be affected, while the rise of metals with strong financial attributes (gold, silver, copper) will slow down. Recently, Powell's statements have been quite significant—emphasizing that "rates remain moderately restrictive" and "stock valuations are high," which may be intended to cool down the overheated optimistic expectations.

Risk Warning and Disclaimer

The market has risks, and investment should be cautious. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial conditions, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article align with their specific circumstances. Investing based on this is at one's own risk