What does the warning of risks from Federal Reserve Chairman Powell, from Greenspan's "irrational exuberance" to Powell's "high valuations in the U.S. stock market," mean for the market?

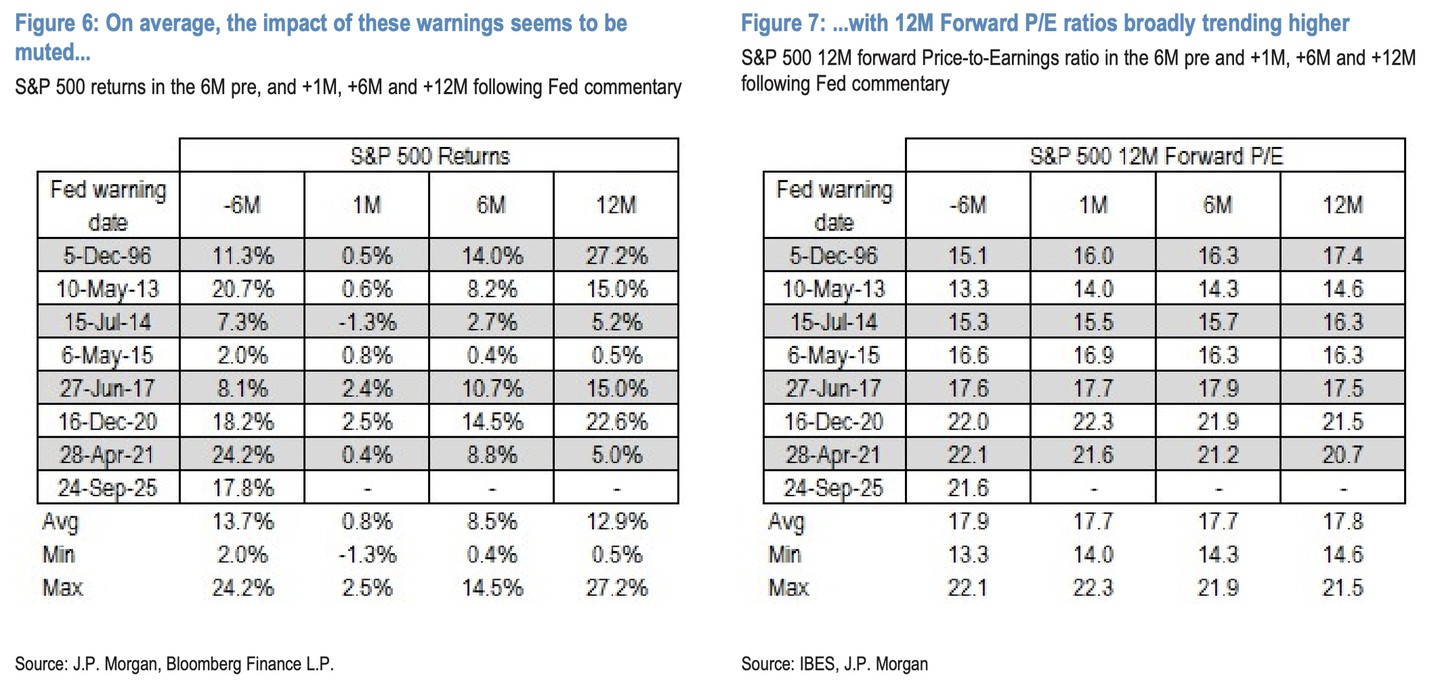

摩根大通分析顯示,歷史上美聯儲主席的估值擔憂並未引發顯著市場調整。自 1996 年以來的歷次美聯儲主席估值警告後,標普 500 指數在隨後 1 個月、6 個月和 12 個月內均未出現負收益。平均而言,警告後 12 個月的正收益僅略低於警告前 6 個月的表現,市場增長放緩但仍保持上漲趨勢。

美聯儲主席對股市估值的警告歷來備受市場關注,但據摩根大通最新研究顯示,此類警示對市場的實際影響往往有限。

鮑威爾本週在講話中明確表示,儘管股票價格"估值相當高",但這並非金融穩定風險升高的時期。他強調,進一步政策正常化的路徑並非毫無風險。這一表態延續了美聯儲主席對資產價格估值發出警示的傳統。

據追風交易台,摩根大通分析顯示,從 1996 年格林斯潘的"非理性繁榮"到本週鮑威爾表示股價"估值相當高",美聯儲主席的估值擔憂並未引發顯著市場調整。

據摩根大通,自 1996 年以來的歷次美聯儲主席估值警告後,標普 500 指數在隨後 1 個月、6 個月和 12 個月內均未出現負收益。平均而言,警告後 12 個月的正收益僅略低於警告前 6 個月的表現,市場增長放緩但仍保持上漲趨勢。

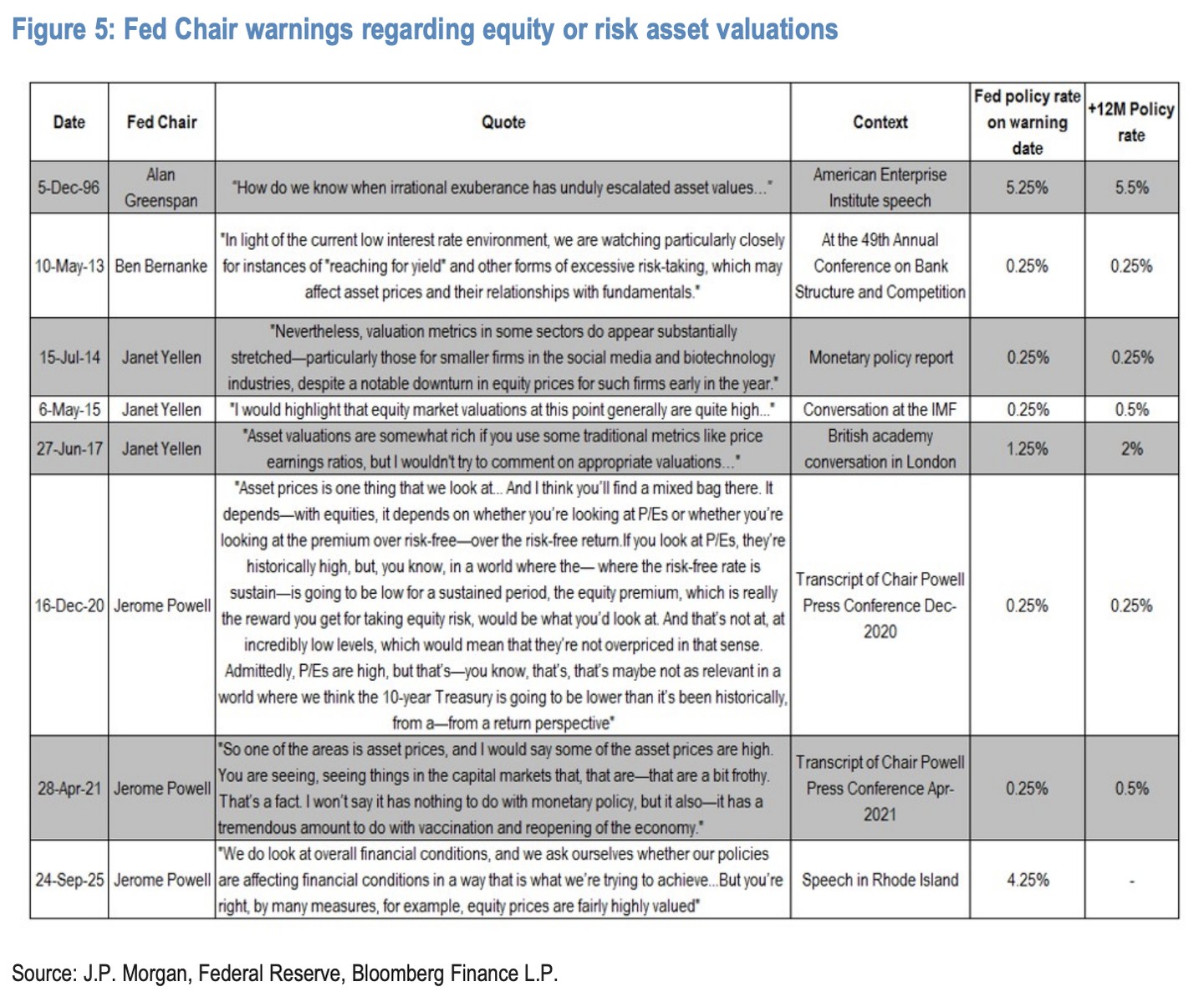

歷史上的美聯儲主席估值警告

摩根大通梳理了自 1996 年 12 月格林斯潘警告"非理性繁榮不當推高資產價值"以來的歷次美聯儲主席估值警告。這些警告涵蓋了不同的宏觀經濟環境,但大多數發生在寬鬆貨幣政策時期。

伯南克曾在 2013 年 5 月警告過度風險承擔,耶倫在 2014 年 7 月和 2015 年 5 月分別對特定行業和整體市場的高估值表達擔憂。鮑威爾在疫情期間曾以相對術語討論估值問題,並在 2021 年 4 月將資產價格的泡沫化歸因於疫苗接種和經濟重啓的影響。

據摩根大通統計,在這些警告前的 6 個月內,市場平均漲幅約 14%,區間從 2015 年 5 月的 2% 到 2021 年 5 月的超過 24%。

市場反應模式:警告效果有限

摩根大通的研究揭示了三個關鍵觀察結果。

首先,美聯儲主席的估值警告並未引發隨後 1 個月、6 個月和 12 個月內的負股票回報。即時影響相當温和,1 個月內標普 500 指數略有正收益,國際股市表現持平至略負。

其次,警告後 12 個月的平均正收益略弱於警告前 6 個月的表現,表明市場增長放緩但仍保持韌性。

在排除互聯網泡沫和疫情時期後,美國股市在警告後通常跑贏國際市場。不過也有例外,如 2013 年和 2014 年警告後,德國股市受低利率和量化寬鬆預期推動,表現優於美股。

第三,廣泛的估值評估往往基於歷史數據,掩蓋了行業構成變化和人工智能等結構性突破的影響。12 個月遠期市盈率在警告後基本保持穩定,表明股市表現主要由盈利改善驅動而非估值擴張。

相比高估值和集中度,宏觀疲軟更可能是市場調整催化劑

儘管高估值和極端的市場集中度引發了市場與上世紀 90 年代末科網泡沫時期的比較,但兩者之間存在顯著差異。

摩根大通強調,當前成長股的估值建立在堅實的基本面之上。與科網泡沫時期依賴 “曲棍球棒式” 盈利預測和市場狂熱不同,如今的龍頭成長型公司正在實現強勁的兩位數有機增長,擁有約 25% 的穩固利潤率,並通過股票回購等方式將資本返還給股東。

報告認為,“優質” 和成長” 的特性是支撐當前估值的關鍵支柱。因此,儘管估值高企和交易擁擠可能暗示市場存在脆弱性,但僅憑估值本身不太可能成為市場回調的直接催化劑。

摩根大通認為,對於投資者而言,與其緊盯估值水平,不如將更多注意力放在宏觀經濟基本面上。高估值本身並非引爆點,但它會降低市場在遭遇衝擊時的抵禦能力。一次顯著的市場回調,更有可能由宏觀經濟的疲軟所引發,例如勞動力市場的惡化。

此外,分析也指出,傳統的估值評估往往基於歷史數據,這可能掩蓋了經濟結構的變化,例如行業構成的變遷以及人工智能(AI)等結構性突破帶來的影響。這些新因素可能會重塑市場的估值邏輯。

展望 2026 年,摩根大通預計市場將迎來反彈。支撐因素包括人工智能投資週期的擴大、穩健的資本支出活動、寬鬆的貨幣政策以及家庭和企業部門堅實的資產負債表。