Success or failure depends on non-farm payrolls?

民生证券认为,历史经验显示,9 月公布的 8 月新增非农初值往往会在 10 月季节性上修,8 月非农在 10 月的 2 次修正中上修的概率达 80% 以上。这意味着,一旦出现任何的反向信号比如非农反向修正导致预期纠偏,市场的波动将再次放大:美债利率反弹,对降息相对敏感的美股板块被波及,金融属性较强的金属上涨速度放缓。

7 月以来非农的剧烈下滑持续牵动美联储与市场的神经。尽管失业率、薪资等其他就业核心指标未显著恶化,但没有分歧的是,新增非农的持续走弱是迫使美联储重新审视就业风险、在九月进行 “风控型降息” 的 “罪魁祸首”。

但我们认为,联储降息节奏可能比市场预期的线性降息路径要曲折。我们在前期报告中持续提示,在四季度潜在通胀风险将成为连续宽松政策的 “拦路虎”。目前关于通胀的讨论已较为充分。

在这篇报告中,我们将聚焦另一关键变量——就业,其是否存在向上修正的可能,从而反向压制已计入定价的降息预期。

今年非农数据的 “噪音” 愈发突出:问卷答复率大幅回落、联储裁员拖累数据采集质量等,均导致其准确性 “备受怀疑”。但作为就业市场最核心的官方指标,无论市场还是美联储,仍不得不依赖其变动进行定价与决策。

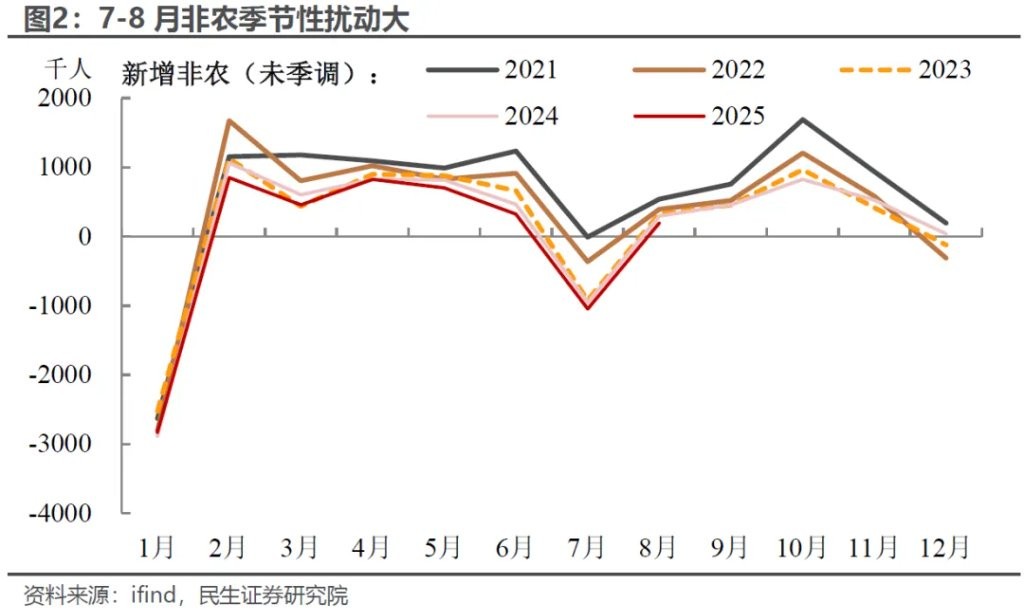

另一方面,非农的季调机制与模型特性也放大了数据的短期波动。由于劳工部每月会将当月新公布数据纳入季调模型,生成新季调因子,并回溯修正最近三个月的非农就业数据。而 7-8 月往往是就业市场季节性波动的高发期,纳入模型后在季调因子的动态调整下,可能会加大近三月数据的短期扰动,导致非农出现连续的大幅下修。

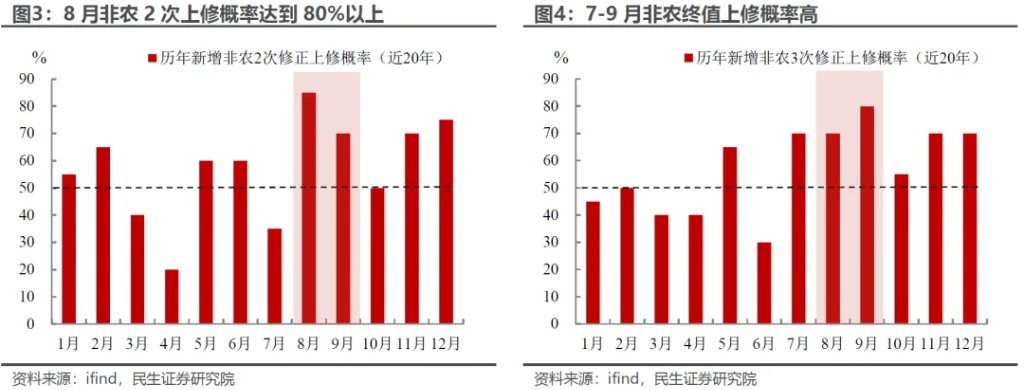

但历史经验显示,9 月公布的 8 月新增非农初值往往会在 10 月季节性上修。我们参考过去 20 年的数据来看(2005-2024 年),8 月非农在 10 月的 2 次修正中上修的概率达到 80% 以上,为历月最高,而 11 月公布的终值最终上修的概率也达到 70% 左右。

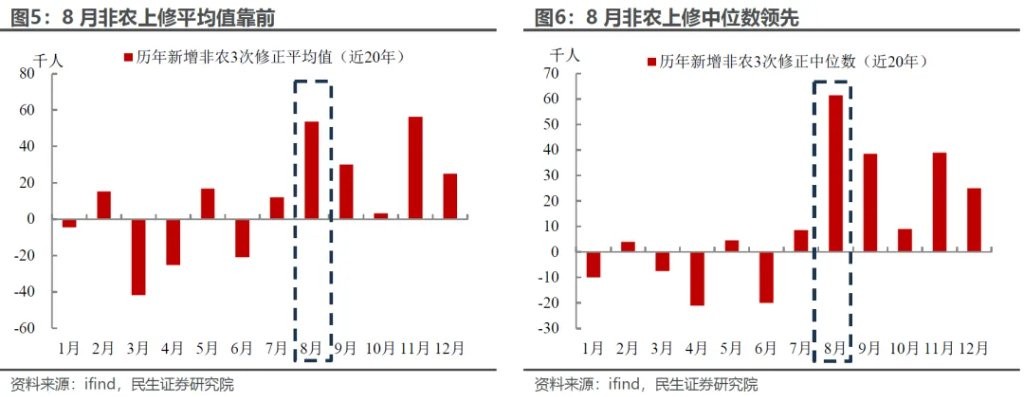

整体上修幅度也不容小觑,无论从中位数还是平均值来看,8 月非农后续上修幅度均位居全年前列。鉴于 7 月非农已出现上修迹象,结合白宫经济顾问哈塞特 “就业报告或向上修正近 7 万个岗位” 的暗示,8 月非农潜在上修对降息预期的影响不容忽视。

我们认为导致 8 月非农季节性上修的原因可能在于:

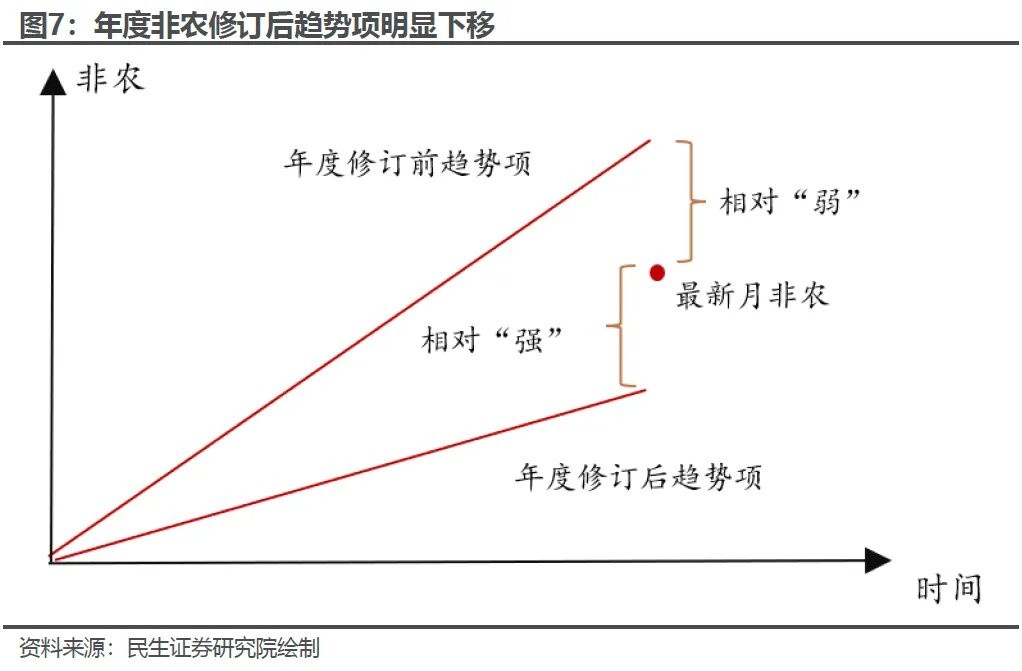

一方面,自 9 月年度基准大幅修订后,CES 模型中的非农整体趋势项已经明显下移(趋势项可以理解为非农季调数据的参考系,下移后让原本相对 “弱” 的数据反而变成相对 “强”),因此 10 月公布的 8 月非农 2 次修正数据没有太多下修的空间;

另一方面,由于 8 月非农未季调数据往往季节性明显抬升,但初值公布时并未纳入所有的问卷调查(尤其是当前问卷答复率大幅下降),后续回收的问卷可能反映出更乐观的就业倾向。

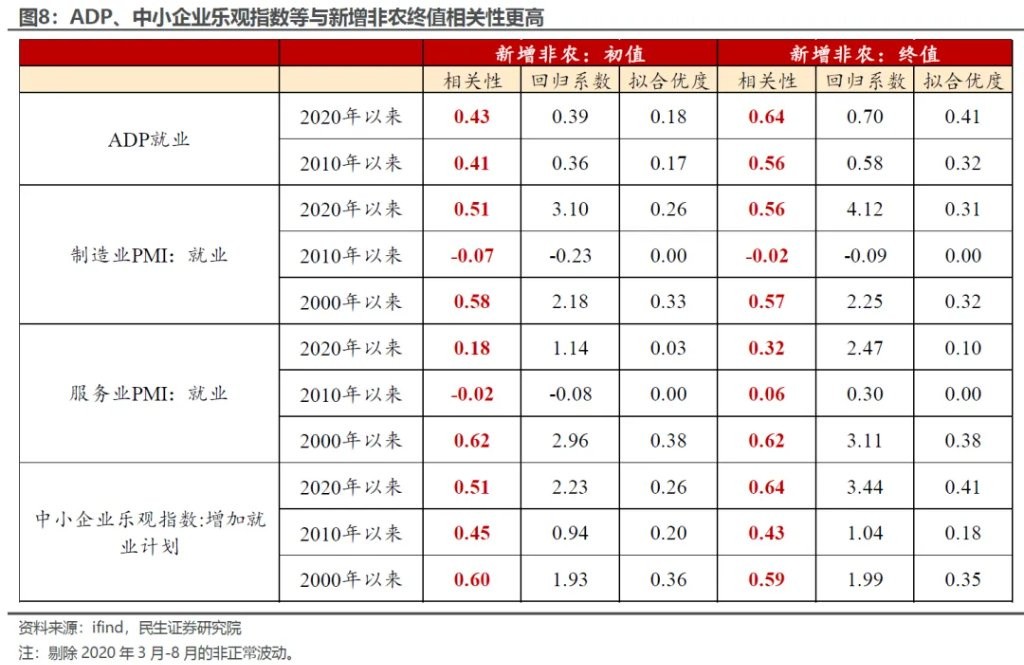

横向对比其他劳动力市场指标,8 月非农也存在低估概率。ADP 就业、PMI 就业指数、中小企业招聘计划等指标与非农终值的相关性普遍高于非农初值,而当前这些指标 8 月的下行幅度均可控,并未像非农初值剧烈放缓。这一对比也暗示,8 月非农在后续有一定的上修概率。

因此,8 月非农对降息预期的指引可能存在扰动,类似情形也曾在去年美联储首次降息前后上演:去年 6-7 月非农数据接连下修、失业率上行曾引发市场衰退恐慌,推动美联储 9 月降息,市场一度定价 11 月再降 50BP。但 10 月劳工部大幅上修 7-8 月非农数据,导致衰退叙事与 50bp 的激进预期降温。

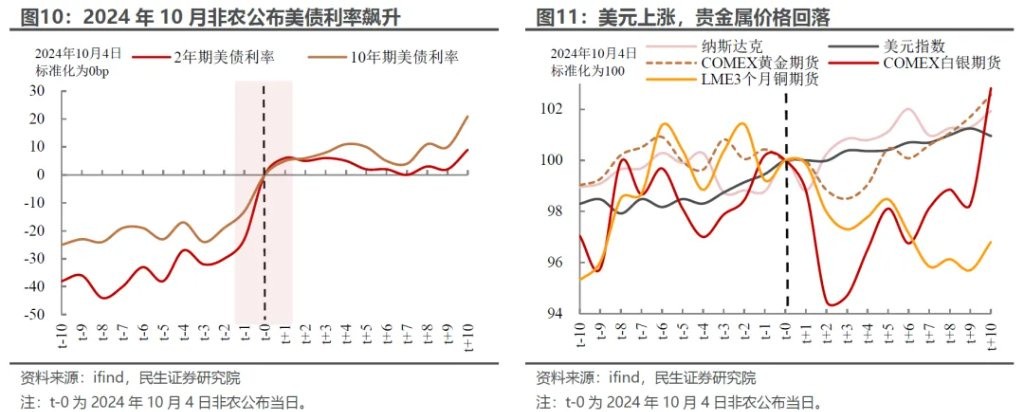

资产反映上,美债利率尤其是短端(2 年期)当日飙升约 20bp;美元上涨,金银铜等贵金属价格短期明显回调;美股短期小幅回落,但最终在衰退叙事的退坡和温和的降息助推下继续上涨。当然与上次不同的是,本轮资产定价更多来自于降息预期的押注,没有衰退叙事的参与,这也意味着非农上修对风险资产的负面影响可能更大。

综上,我们对降息预期需继续保持观察的态度。尽管我们不排除四季度至明年初美联储连续降息的可能(出现明显的失业率等上行信号),但当前市场对降息的押注貌似有些过于激进,忽视了潜在波动风险。即便美联储内部官员分歧犹存,但市场定价却呈现罕见的 “一致性乐观”。

这也意味着,一旦出现任何的反向信号(通胀快速上行和非农反向修正等)导致预期纠偏,市场的波动将再次放大:美债利率反弹,对降息相对敏感的美股板块(成长股和周期股)被波及,金融属性较强的金属上涨速度放缓(金银铜)。近期鲍威尔的表态便颇具深意——强调 “利率仍具适度限制性”、“股票估值偏高”,或正是有意为过热的乐观预期降温。

本文作者:武朔、林彦,来源:川阅全球宏观,原标题:《成也非农,败也非农?》