Minsheng Securities: Market interest rate cut expectations are "overheated," and the Federal Reserve may cool optimistic expectations

民生證券發佈研報指出,市場對美聯儲降息的預期過於激進,忽視了潛在的波動風險。儘管不排除四季度至明年初降息的可能,但一旦出現反向信號,市場波動將加劇。報告強調,非農數據的持續走弱促使美聯儲重新審視就業風險,降息節奏可能比市場預期更為複雜。

智通財經 APP 獲悉,民生證券發佈研報稱,對降息預期需繼續保持觀察的態度。儘管不排除四季度至明年初美聯儲連續降息的可能(出現明顯的失業率等上行信號),但當前市場對降息的押注貌似有些過於激進,忽視了潛在波動風險。即便美聯儲內部官員分歧猶存,但市場定價卻呈現罕見的 “一致性樂觀”。

這也意味着,一旦出現任何的反向信號(通脹快速上行和非農反向修正等)導致預期糾偏,市場的波動將再次放大:美債利率反彈,對降息相對敏感的美股板塊(成長股和週期股)被波及,金融屬性較強的金屬上漲速度放緩(金銀銅)。近期鮑威爾的表態便頗具深意——強調 “利率仍具適度限制性”、“股票估值偏高”,或正是有意為過熱的樂觀預期降温。

民生證券主要觀點如下:

7月以來非農的劇烈下滑持續牽動美聯儲與市場的神經。儘管失業率、薪資等其他就業核心指標未顯著惡化,但沒有分歧的是,新增非農的持續走弱是迫使美聯儲重新審視就業風險、在九月進行 “風控型降息” 的 “罪魁禍首”。

但我們認為,聯儲降息節奏可能比市場預期的線性降息路徑要曲折。我們在前期報告中持續提示,在四季度潛在通脹風險將成為連續寬鬆政策的 “攔路虎”。

在這篇報告中,我們將聚焦另一關鍵變量——就業,其是否存在向上修正的可能,從而反向壓制已計入定價的降息預期。

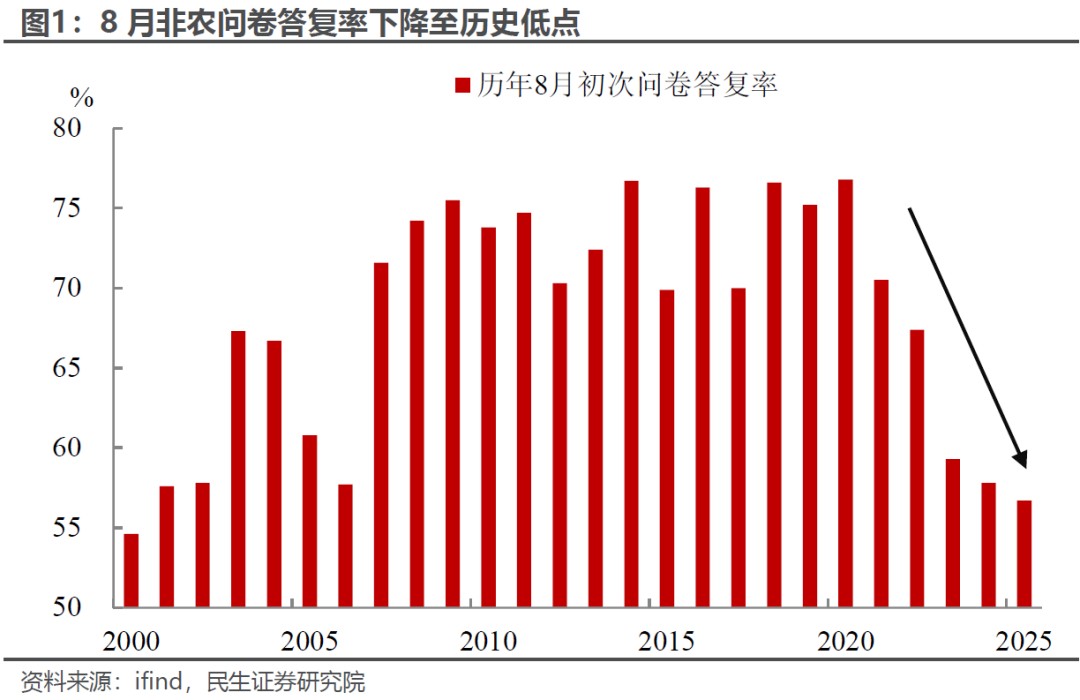

今年非農數據的 “噪音” 愈發突出:問卷答覆率大幅回落、聯儲裁員拖累數據採集質量等,均導致其準確性 “備受懷疑”。但作為就業市場最核心的官方指標,無論市場還是美聯儲,仍不得不依賴其變動進行定價與決策。

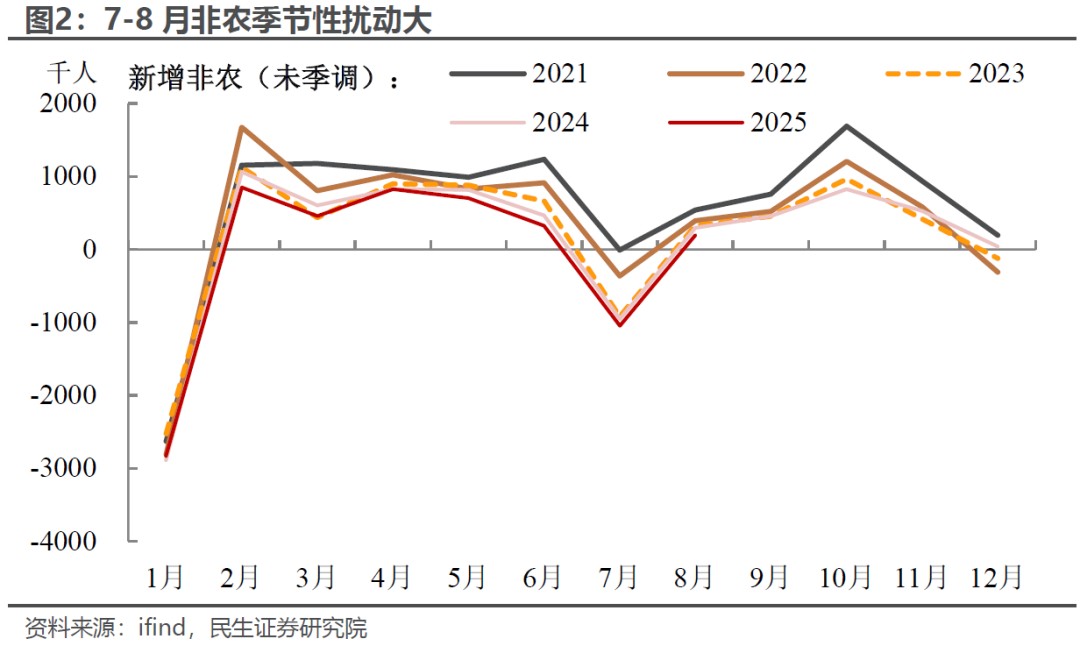

另一方面,非農的季調機制與模型特性也放大了數據的短期波動。由於勞工部每月會將當月新公佈數據納入季調模型,生成新季調因子,並回溯修正最近三個月的非農就業數據。而 7-8 月往往是就業市場季節性波動的高發期,納入模型後在季調因子的動態調整下,可能會加大近三月數據的短期擾動,導致非農出現連續的大幅下修。

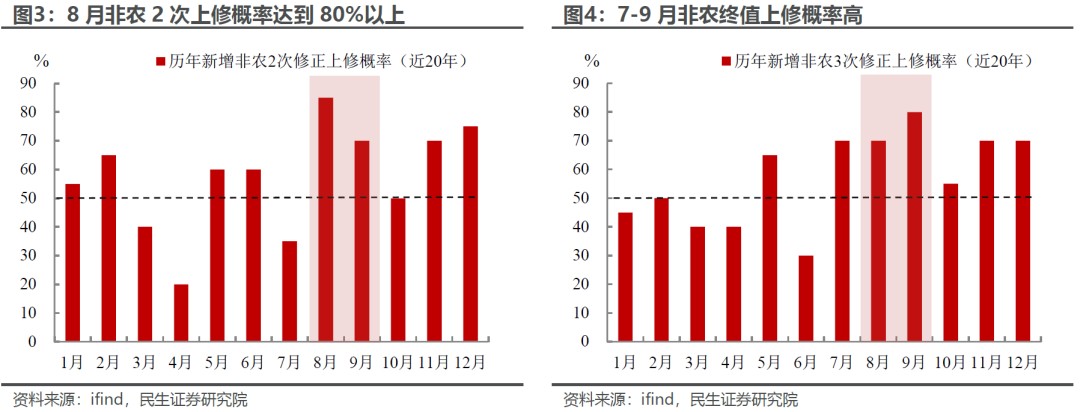

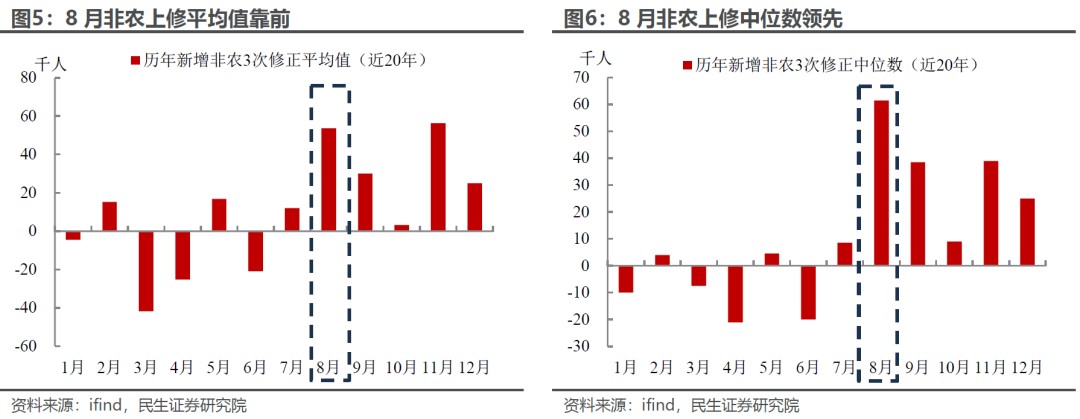

但歷史經驗顯示,9 月公佈的 8 月新增非農初值往往會在 10 月季節性上修。我們參考過去 20 年的數據來看(2005-2024 年),8 月非農在 10 月的 2 次修正中上修的概率達到 80% 以上,為歷月最高,而 11 月公佈的終值最終上修的概率也達到 70% 左右。

整體上修幅度也不容小覷,無論從中位數還是平均值來看,8 月非農後續上修幅度均位居全年前列。鑑於 7 月非農已出現上修跡象,結合白宮經濟顧問哈塞特 “就業報告或向上修正近 7 萬個崗位” 的暗示,8 月非農潛在上修對降息預期的影響不容忽視。

我們認為導致 8 月非農季節性上修的原因可能在於:

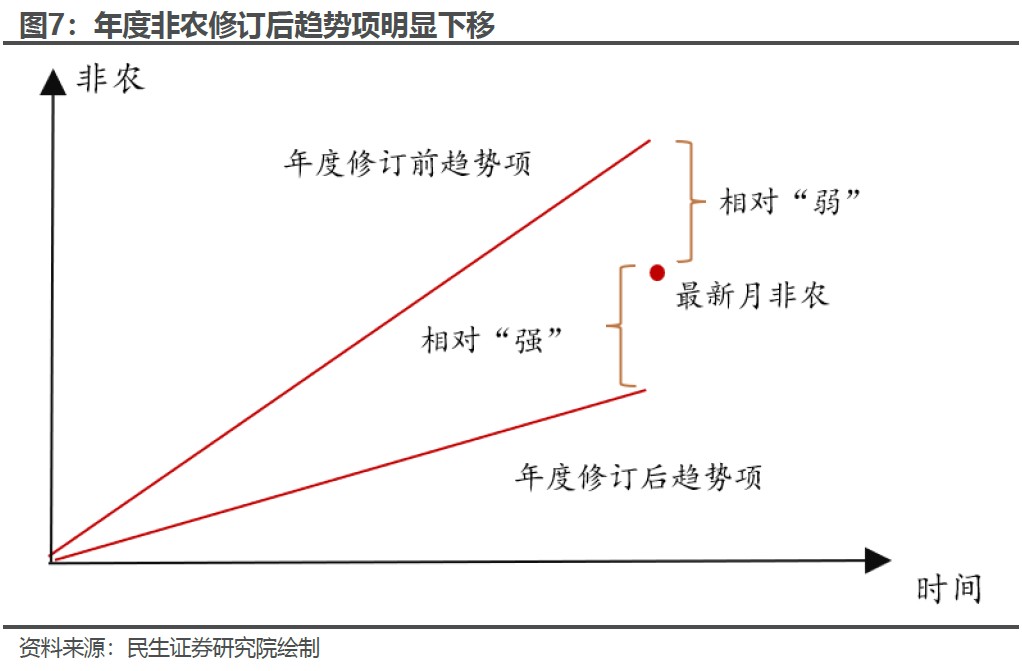

一方面,自 9 月年度基準大幅修訂後,CES 模型中的非農整體趨勢項已經明顯下移(趨勢項可以理解為非農季調數據的參考系,下移後讓原本相對 “弱” 的數據反而變成相對 “強”),因此 10 月公佈的 8 月非農 2 次修正數據沒有太多下修的空間;

另一方面,由於 8 月非農未季調數據往往季節性明顯抬升,但初值公佈時並未納入所有的問卷調查(尤其是當前問卷答覆率大幅下降),後續回收的問卷可能反映出更樂觀的就業傾向。

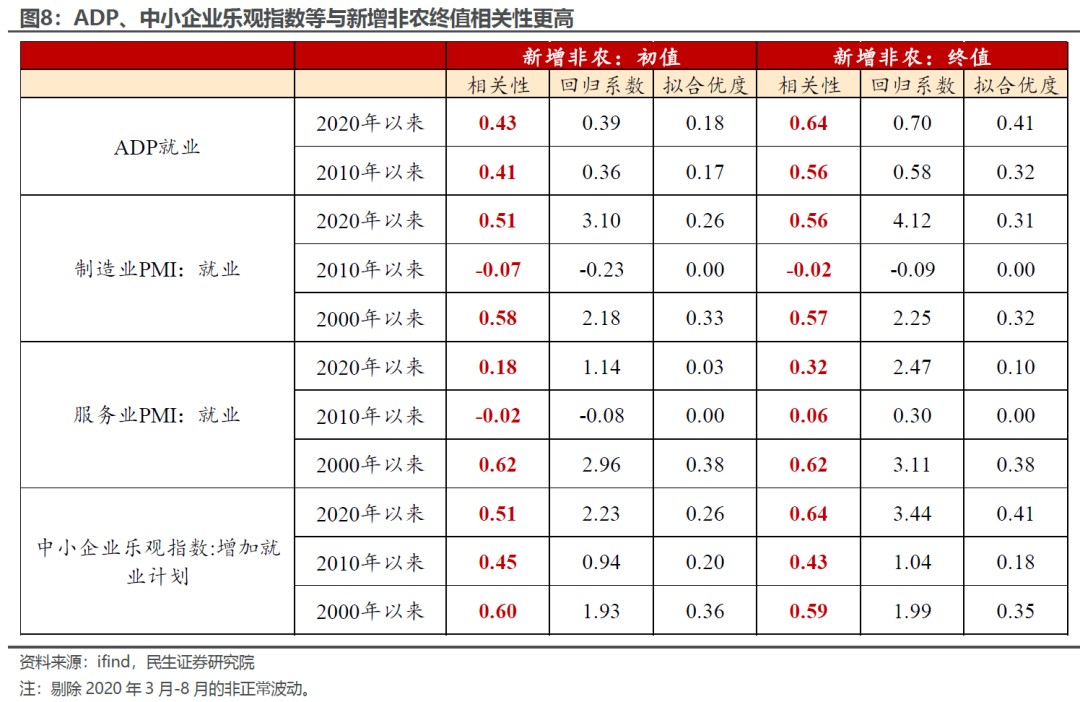

橫向對比其他勞動力市場指標,8 月非農也存在低估概率。ADP 就業、PMI 就業指數、中小企業招聘計劃等指標與非農終值的相關性普遍高於非農初值,而當前這些指標 8 月的下行幅度均可控,並未像非農初值劇烈放緩。這一對比也暗示,8 月非農在後續有一定的上修概率。

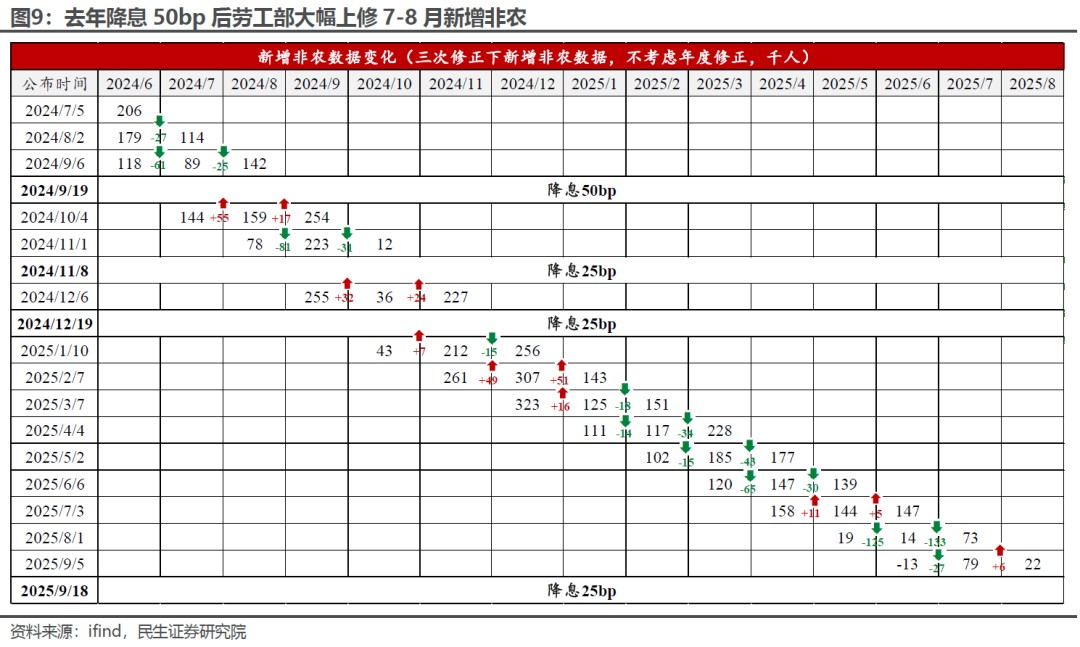

因此,8 月非農對降息預期的指引可能存在擾動,類似情形也曾在去年美聯儲首次降息前後上演:去年 6-7 月非農數據接連下修、失業率上行曾引發市場衰退恐慌,推動美聯儲 9 月降息,市場一度定價 11 月再降 50BP。但 10 月勞工部大幅上修 7-8 月非農數據,導致衰退敍事與 50bp 的激進預期降温。

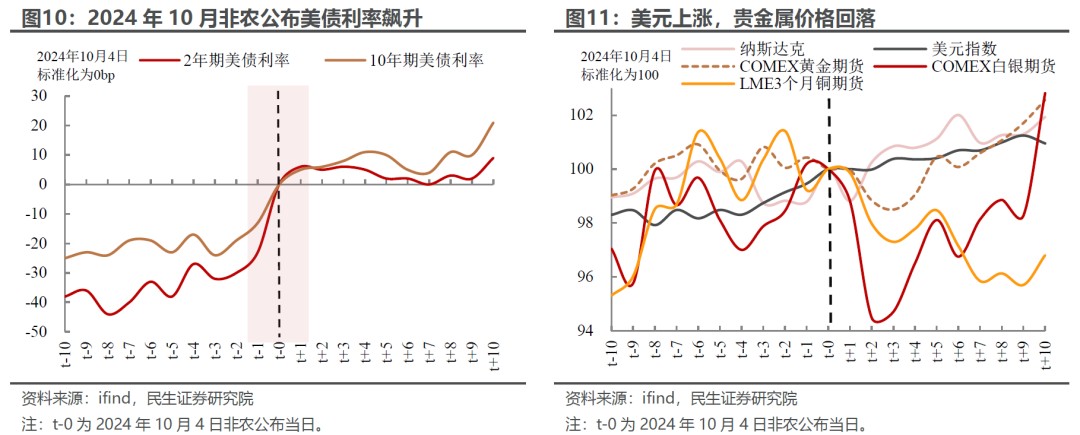

資產反映上,美債利率尤其是短端(2 年期)當日飆升約 20bp;美元上漲,金銀銅等貴金屬價格短期明顯回調;美股短期小幅回落,但最終在衰退敍事的退坡和温和的降息助推下繼續上漲。當然與上次不同的是,本輪資產定價更多來自於降息預期的押注,沒有衰退敍事的參與,這也意味着非農上修對風險資產的負面影響可能更大。

綜上,我們對降息預期需繼續保持觀察的態度。儘管我們不排除四季度至明年初美聯儲連續降息的可能(出現明顯的失業率等上行信號),但當前市場對降息的押注貌似有些過於激進,忽視了潛在波動風險。即便美聯儲內部官員分歧猶存,但市場定價卻呈現罕見的 “一致性樂觀”。

這也意味着,一旦出現任何的反向信號(通脹快速上行和非農反向修正等)導致預期糾偏,市場的波動將再次放大:美債利率反彈,對降息相對敏感的美股板塊(成長股和週期股)被波及,金融屬性較強的金屬上漲速度放緩(金銀銅)。近期鮑威爾的表態便頗具深意——強調 “利率仍具適度限制性”、“股票估值偏高”,或正是有意為過熱的樂觀預期降温。

風險提示:美國經貿政策大幅變動;關税擴散超預期,導致全球經濟超預期放緩、市場調整幅度加大。