New Stock News | JINGDONG Industrials updates prospectus and has become the largest participant in China's MRO procurement service market

JINGDONG Industrials, Inc. has submitted a listing application to the Hong Kong Stock Exchange, becoming the largest participant in China's MRO procurement service market. The company provides a wide range of industrial product supply and services through digital transformation, with revenue expected to increase from 14.1 billion yuan in 2022 to 20.4 billion yuan in 2024, representing a compound annual growth rate of 20.1%

According to the Hong Kong Stock Exchange's disclosure on September 28, JINGDONG Industrials, Inc. (referred to as: JINGDONG Industrials) has submitted a listing application to the main board of the Hong Kong Stock Exchange, with Bank of America Securities, Goldman Sachs, Haitong International, and UBS as joint sponsors.

According to the prospectus, JINGDONG Industrials is a leading industrial supply chain technology and service provider in China. By implementing transformative digital and intelligent transformation of the industrial supply chain, the company helps clients ensure supply, reduce costs, increase efficiency, and maintain compliance.

The company provides a wide range of industrial product supply and digital supply chain services through its "Tai Pu" full-link digital and intelligent industrial supply chain solution, which combines digital (intelligent) and physical (goods) elements to meet diverse customer needs. Tai Pu is built on the company's end-to-end digital supply chain infrastructure, covering goods, procurement, fulfillment, and operations. The company primarily generates revenue by selling industrial products and providing related services to customers.

The company began focusing on supply chain technology and service business for MRO procurement services in 2017. After years of development, it has become the largest participant in China's MRO procurement service market. According to data from ZhiShi Consulting, the company ranks first in terms of transaction volume in 2024, with a scale nearly three times that of the second-largest competitor. The same data shows that as it expands into the broader industrial supply chain market, the company is also the largest service provider in China's industrial supply chain technology and service market, with a market share of 4.1% based on transaction volume in 2024. The continuous growth of the company's scale fully demonstrates the efficiency of its business model. From 2022 to 2024, the company's revenue increased from approximately RMB 14.1 billion to RMB 20.4 billion, with a compound annual growth rate of 20.1%.

According to data from ZhiShi Consulting, the company has the widest customer coverage in China's industrial supply chain technology and service market in 2024. In the twelve months leading up to June 30, 2025, the company served approximately 11,100 key enterprise customers. In the first half of 2025, key enterprise customers included about 60% of China's Fortune 500 companies and over 40% of the global Fortune 500 companies operating in China.

According to data from ZhiShi Consulting, as of December 31, 2024, the company provides the widest range of industrial products in China based on the number of SKUs. As of June 30, 2025, the company had provided approximately 81.1 million SKUs across 80 product categories. In the twelve months leading up to June 30, 2025, the product supply came from a broad and nationwide industrial product supply network consisting of approximately 158,000 manufacturers, distributors, and agents.

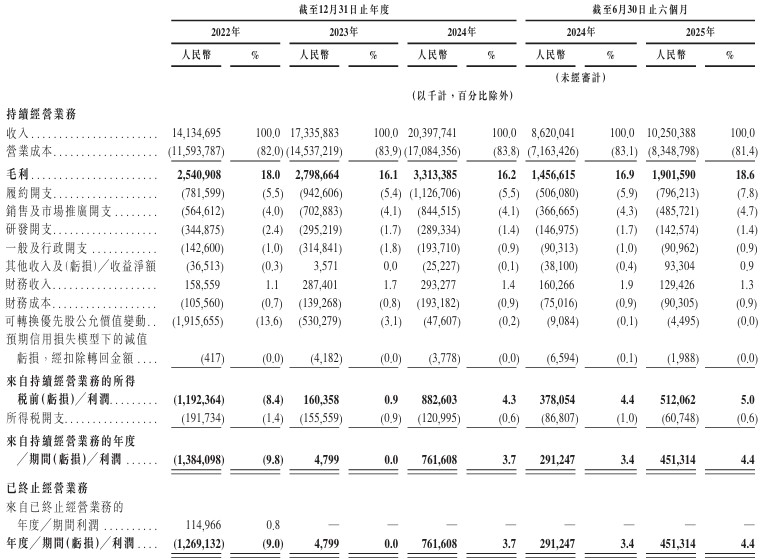

In terms of performance, for the six months ending June 30 in 2023, 2024, and 2025, the company achieved revenues of approximately RMB 17.336 billion, RMB 20.398 billion, and RMB 10.250 billion, respectively; during the same period, the annual/profit for the period was approximately RMB 4.799 million, RMB 762 million, and RMB 451 million