The Federal Reserve's favored inflation indicator remains stable, and the "Goldilocks" narrative begins to dominate the market

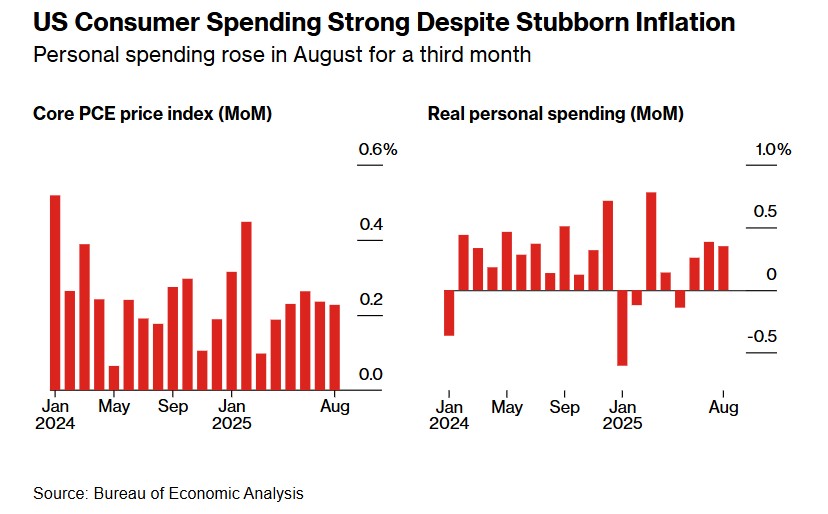

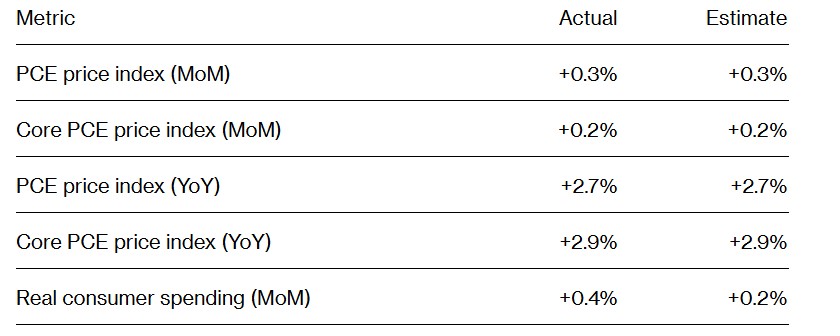

In August, personal spending in the United States increased for the third consecutive month, indicating that consumers are still driving economic expansion despite rising inflation. The core personal consumption expenditures price index rose 0.2% month-on-month and remained at 2.9% year-on-year. Overall PCE inflation increased by 0.3% month-on-month and 2.7% year-on-year. This series of data has boosted market optimism regarding a "Goldilocks" soft landing for the U.S. economy, suggesting that growth is robust and inflation is not overheating, with market expectations for a Federal Reserve interest rate cut remaining largely unchanged

According to the Zhitong Finance APP, the latest U.S. economic data released on Friday has begun to dominate the trading logic of global financial markets with the so-called optimistic sentiment of a "Goldilocks-style soft landing" for the U.S. economy. The latest data shows that in August, "U.S. personal consumption," which plays a crucial role in the calculation of U.S. GDP and accounts for nearly 70% of overall GDP, has expanded steadily for three consecutive months, indicating that despite stubborn inflation, American consumers are still driving the economy.

According to data released on Friday by the U.S. Bureau of Economic Analysis (BEA), inflation-adjusted consumer spending increased by 0.4% last month, better than the general expectation of economists for a 0.2% increase, consistent with the revised previous value. The inflation indicator most favored by Federal Reserve officials—the so-called core personal consumption expenditures (core PCE) price index (which excludes food and energy and is the Fed's preferred inflation measure)—rose by 0.2% month-on-month compared to July, in line with economists' expectations and the revised previous value. Compared to the same period last year, this core inflation indicator stubbornly remained at 2.9%, also consistent with expectations and the previous value.

In terms of the overall PCE inflation indicator, the overall PCE increased by 0.3% month-on-month in August, in line with general economist expectations, slightly higher than the previous value of 0.2% month-on-month; the overall PCE year-on-year in August increased by 2.7%, consistent with general economist expectations, and slightly warmed compared to the previous value of 2.6%. This combination of rising consumer spending + PCE meeting expectations + GDP revision indeed increases the subjective probability of the "Goldilocks" macro scenario: that is, growth is not weak, inflation is not overheating, and market expectations are more "tilted towards rate cuts" on a low-interest-rate trajectory.

The perfectly aligned PCE inflation data, combined with the unexpectedly revised U.S. Q2 GDP data, and recent initial jobless claims data showing that the labor market has not further deteriorated, have suddenly made the market very optimistic about the U.S. economic growth outlook, especially as expectations for a "Goldilocks" style soft landing for the U.S. economy have clearly warmed. Meanwhile, market expectations for Fed rate cuts have not significantly cooled, still betting that the Fed will continue to cut rates by 25 basis points in October and December.

It is worth noting that although core PCE has met expectations for several consecutive months without showing an upward trajectory, Americans are still grappling with long-term stubborn inflation. As the tariff measures led by U.S. President Donald Trump gradually transmit through the U.S. economy, there is a risk that inflation will remain relatively high in the long term.

Despite many U.S. retail companies initially choosing to hold back and not raise prices while digesting the large inventories accumulated before the tariffs, and their concerns that rising prices threaten healthy consumer demand growth, unless companies pass on some of the higher costs, the profit margins of these companies will face risks Due to inflation remaining persistently above the Federal Reserve's 2% anchor inflation target, several Federal Open Market Committee (FOMC) policymakers remain cautious about further interest rate cuts. The September non-farm payroll report will be an important data point for the Fed's next monetary policy meeting, but it remains unclear whether the FOMC policymakers will receive this data in time as a government shutdown looms.

Following the release of the PCE inflation data report, the three major U.S. stock index futures turned upward, while U.S. short-term Treasury yields remained low.

In August, U.S. consumer spending unexpectedly rose by 0.7% month-on-month, reflecting an increase in purchases of discretionary items such as furniture, clothing, and leisure goods. Service spending grew at a more moderate pace.

Despite evidence that tariffs have pushed up prices for some goods and signs of a cooling labor market, consumers—especially high-income groups—continue to spend, and an increasing number of professionals, including Fed officials, believe that the inflation caused by Trump's tariffs will be "transitory." The recently released U.S. retail sales data for August showed a third consecutive month of growth, partly boosted by back-to-school shopping.

Given that signs of a slowdown have emerged in the labor market, it remains unclear how long U.S. consumers can continue to spend at this pace. Real disposable income has barely grown, and the growth rate of wages and salaries, unadjusted for inflation, has slowed compared to the previous month. Meanwhile, the savings rate has dropped to 4.6%, the lowest level this year.

The service sector is the driving force behind the persistently high PCE inflation, while commodity prices have been more moderate. In particular, prices for entertainment goods, automobiles, large appliances, and household items have all declined, indicating that recent discounts have helped stimulate spending in these categories. The closely watched core service inflation indicator (excluding energy and housing) rose by 0.3% month-on-month for two consecutive months.

GDP unexpectedly revised upward and the labor market has not further deteriorated, suddenly making the U.S. economic outlook more optimistic

The continuous strong growth in U.S. consumer spending adds evidence that the economy is maintaining robust and unexpectedly strong expansion this quarter, building on a higher level of economic growth than previously estimated in the prior quarter. However, sustaining this growth momentum largely depends on the labor market, which has shown signs of relative weakness, including a slowdown in hiring and more moderate wage growth. However, the latest initial jobless claims report indicates that the labor market has not further deteriorated and shows signs that the U.S. non-farm labor market, although clearly slowing, is still leaning towards upward expansion.

According to reports, economic data released on Thursday showed that benefiting from stronger U.S. consumer spending data, the U.S. economy achieved its fastest growth rate in nearly two years in the second quarter, with inflation-adjusted U.S. second-quarter GDP revised to a year-on-year growth rate of 3.8%, higher than the previously estimated 3.3%. Economic indicators released simultaneously on Thursday for August showed strong growth in business equipment orders, a larger-than-expected narrowing of the goods trade deficit, and a surprising drop in initial jobless claims to the lowest level since mid-July Tony Pasquariello, a partner in Goldman Sachs' Global Markets Division and head of the hedge fund business, mentioned in an internal memo to clients that while the growth of the U.S. labor market has sharply slowed and occasionally shown negative growth, this is by no means a signal that the U.S. labor market is trapped in a prolonged state of stagnation and negative growth.

"Looking at the employment data, it's hard not to worry about certain trends, especially with the deepening development of artificial intelligence. While I do not dismiss these concerns, a historical review reveals an interesting story: the U.S. experienced several negative employment reports from the mid to late 1990s—1995, 1996, 1998, and 1999—and that was certainly not a bearish time for the stock market," added Tony Pasquariello, head of Goldman Sachs' hedge fund business.

Overall, the specific pricing power of U.S. companies remains uncertain. Some economists suggest that businesses may raise prices slightly, as there are concerns that excessive price increases could lead to a significant reduction in demand. If price increases only result in a mild and temporary rise in inflation in the second half of the year, while consumer spending remains strong and the labor market shows resilience, it means that the U.S. economy is getting closer to a "Goldilocks" macroeconomic environment. This is why the previously strong U.S. GDP data, retail sales figures, and this unexpectedly high consumer spending, along with the stable PCE release, have led to increased market expectations for a return to a Goldilocks macro environment in the U.S. economy.

The so-called "Goldilocks" U.S. macroeconomic environment refers to an economy that is neither too hot nor too cold, maintaining moderate growth in GDP and consumer spending, along with a long-term stable trend of mild inflation, while the benchmark interest rate is on a downward trajectory.

Under the "Goldilocks" and interest rate cut expectations, the "bull market narrative logic" of the U.S. stock market and even global stock markets remains strong.

After the latest consumer spending and PCE inflation data reports were released, Wall Street analysts began interpreting this data as leaning towards a "Goldilocks-style soft landing"—indicating that growth resilience is rising, inflation has not worsened, and month-on-month changes remain mild. At the same time, the Federal Reserve's interest rate expectations have also shifted to a marginal downward trend, leading to a more optimistic sentiment in the market regarding the U.S. stock market.

Tony Pasquariello, head of the hedge fund business at Wall Street financial giant Goldman Sachs, recently released a research report stating that as the benchmark U.S. stock index—the S&P 500—and the global stock index benchmark—the MSCI Global Index—continue to soar to historical highs driven by large technology giants and AI leaders with significant weight, investors should not fight against the unprecedented AI investment boom that is dominating the hot global bull market. There is stronger bullish momentum in the market, and a "responsible and prudent bullish strategy" should be adopted.

Goldman Sachs, known as the "flag bearer of the stock market bull market," has an investment attitude towards the U.S. stock market and global stock markets that aligns with the generally optimistic stance recently adopted by Wall Street peers. With unexpectedly strong consumer spending, corporate earnings growth data, and the market's renewed enthusiasm for artificial intelligence driving the U.S. stock market's strong rise since April, which has recently set multiple historical highs, top analysts from Wall Street are competing to raise their year-end and next-year outlooks for the S&P 500 index Not only are analysts with bullish positions continuously "tearing up research reports" to raise their targets, but those who have been bearish on U.S. stocks for a long time this year are also constantly "tearing up research reports"—updating their S&P 500 index target multiple times this year to keep pace with their peers' bullish expectations and the epic bull market in U.S. stocks.

Overall, these top analysts on Wall Street generally expect the overall earnings of S&P 500 constituent stocks and the investment returns of this benchmark index to expand in 2025 and 2026, with 7,000 points already becoming the "new anchor" for the S&P 500 index—most analysts predict that the index could significantly rise to around 7,000 points by the end of this year or early next year