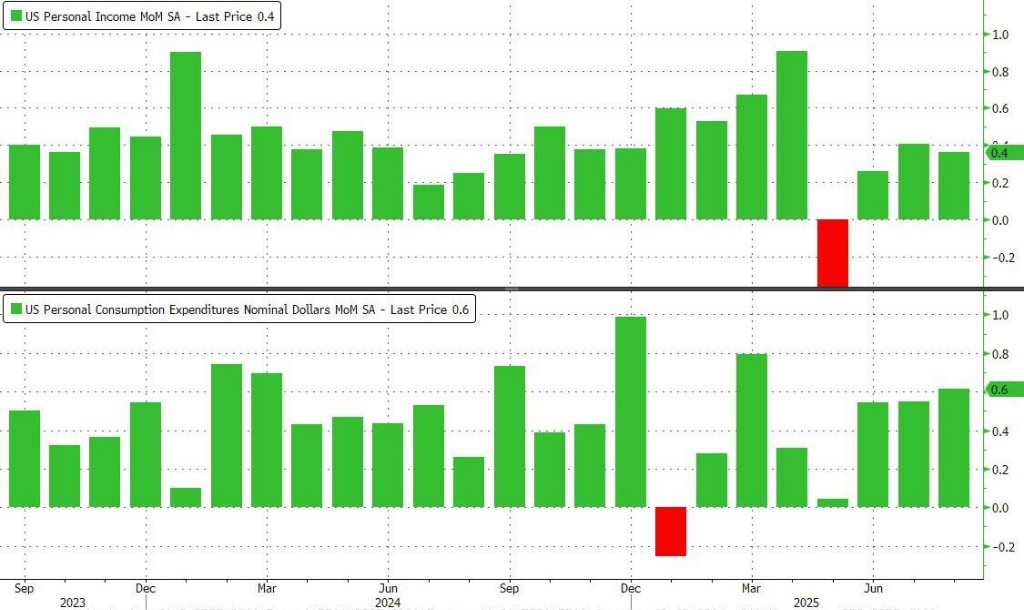

In August, the core PCE price index in the United States increased by 0.2% month-on-month, in line with expectations, while consumer spending grew moderately by 0.4%

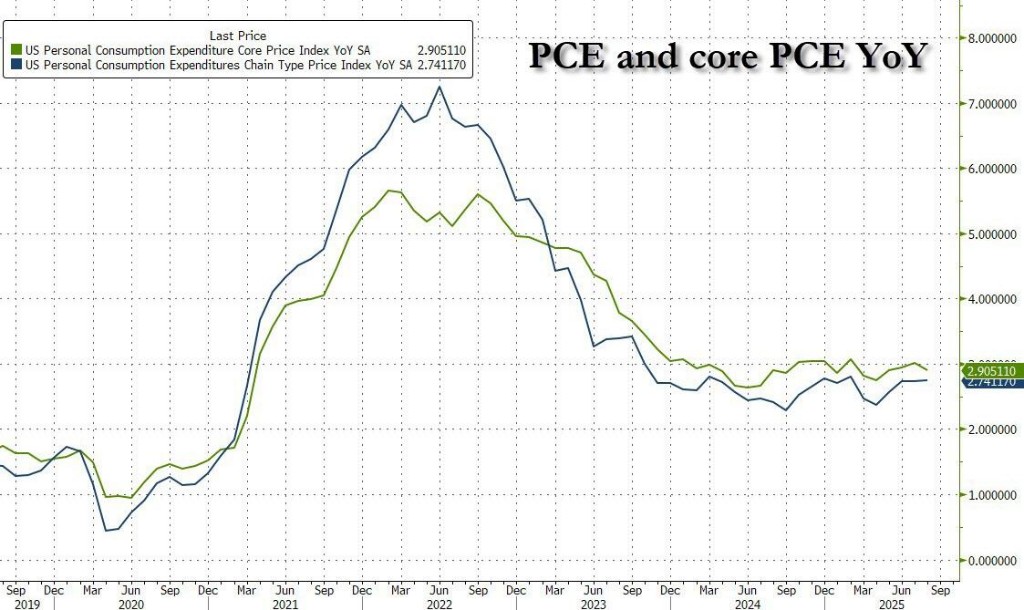

U.S. consumer spending in August saw strong growth for the second consecutive month, increasing by 0.4% after adjusting for inflation, surpassing the expected 0.2%, indicating consumer resilience. Meanwhile, the core personal consumption expenditures price index favored by the Federal Reserve (excluding food and energy) rose by 0.2% month-on-month, but the year-on-year increase remained high at 2.9%, well above the Federal Reserve's 2% target

In August, U.S. consumer spending experienced strong growth for the second consecutive month, increasing by 0.4% after adjusting for inflation, surpassing the expected 0.2%, indicating consumer resilience. Meanwhile, the core personal consumption expenditures price index favored by the Federal Reserve (excluding food and energy) rose by 0.2% month-on-month, but the year-on-year increase remained high at 2.9%, far exceeding the Fed's 2% target.

On Friday, the Bureau of Economic Analysis released data showing:

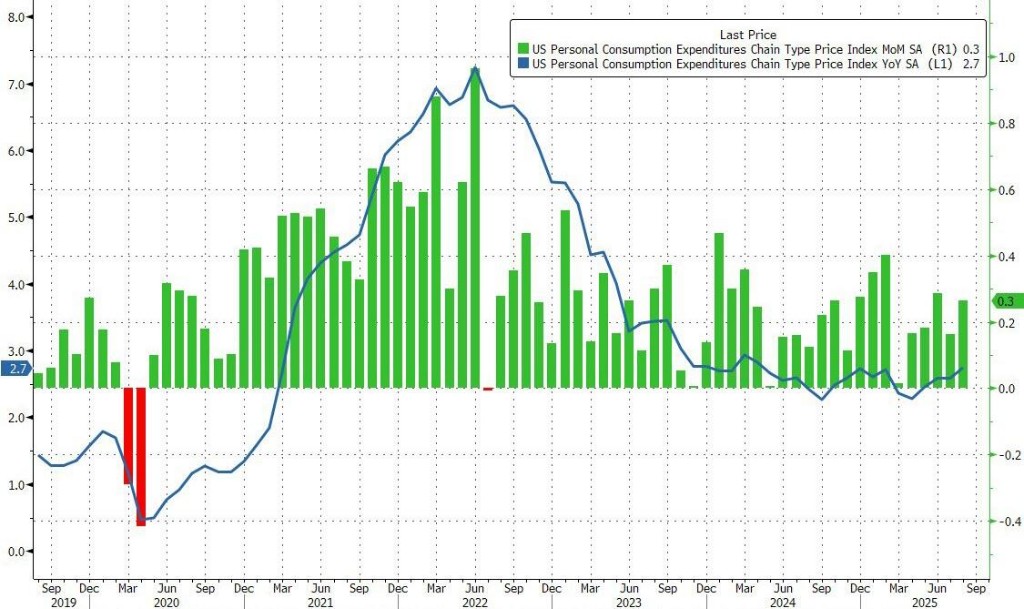

- The U.S. August PCE price index increased by 2.7% year-on-year, in line with expectations of 2.7%, and up from a previous value of 2.6%; month-on-month, it rose by 0.3%, meeting market expectations.

- The U.S. August core PCE price index increased by 2.9% year-on-year, matching expectations of 2.9% and the previous value of 2.9%; the month-on-month increase of 0.2% met expectations and remained unchanged from July, indicating relatively stable monthly inflation pressure.

Goods Consumption Leads, Service Spending Moderate

In August, real consumer spending increased by 0.4% for the second consecutive month, significantly exceeding the market expectation of 0.2%. This strong performance provides robust support for economic growth in the current quarter, continuing the momentum of unexpected growth from previous quarters.

From the expenditure structure, the consumption growth in August was primarily driven by goods consumption. Data shows that goods spending rose by 0.7% month-on-month, reflecting strong consumer willingness to purchase non-essential items such as furniture, clothing, and entertainment products. Previous data also indicated that U.S. retail sales had increased for the third consecutive month, partly boosted by the back-to-school shopping season.

In contrast, the growth pace of service spending was more moderate. There are signs that, despite tariffs potentially raising prices on some goods, consumers, especially high-income groups, continue to spend.

Persistent Inflation Pressure, Uncertain Prospects for Fed Rate Cuts

Despite strong consumption, persistent inflation remains a major challenge for the Federal Reserve. The year-on-year increase in the core PCE in August stabilized at 2.9%, well above the Fed's 2% policy target.

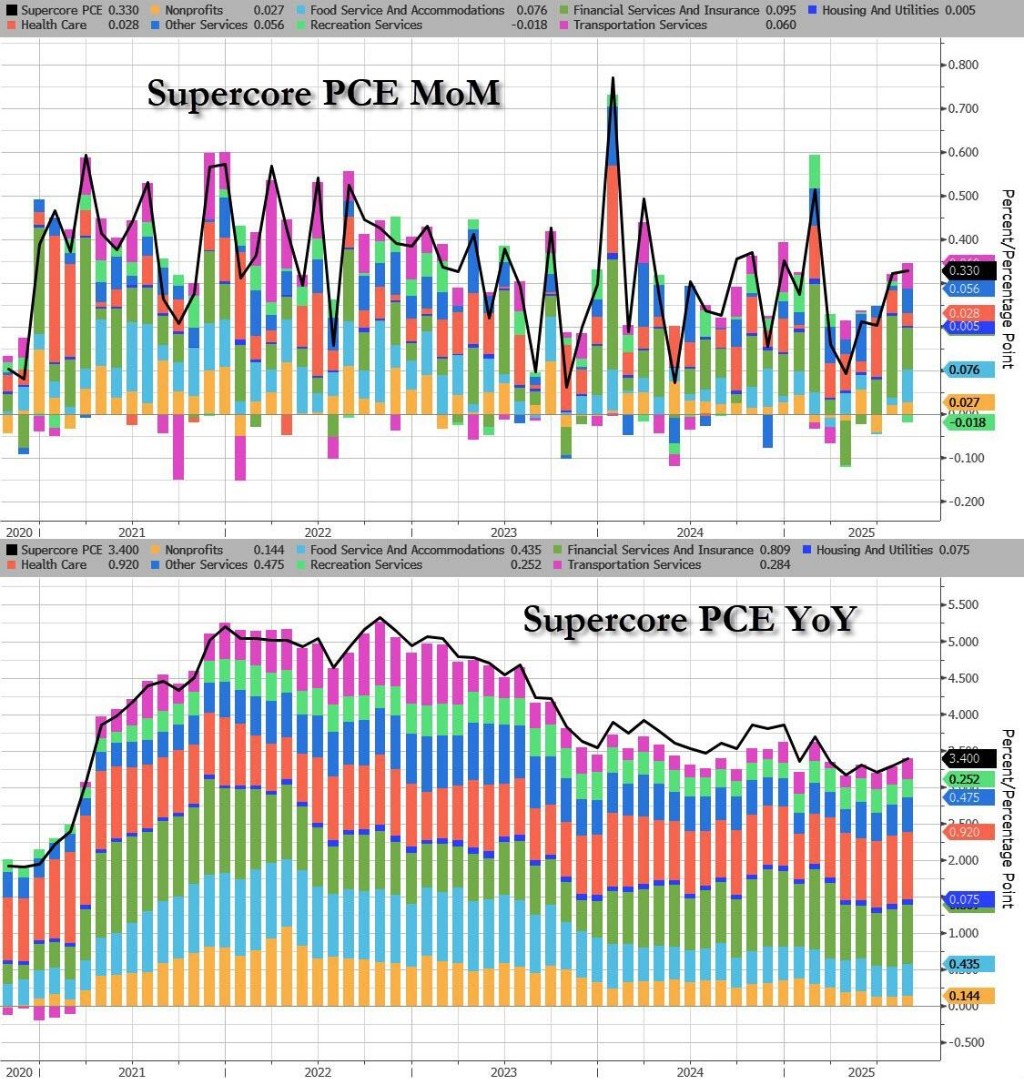

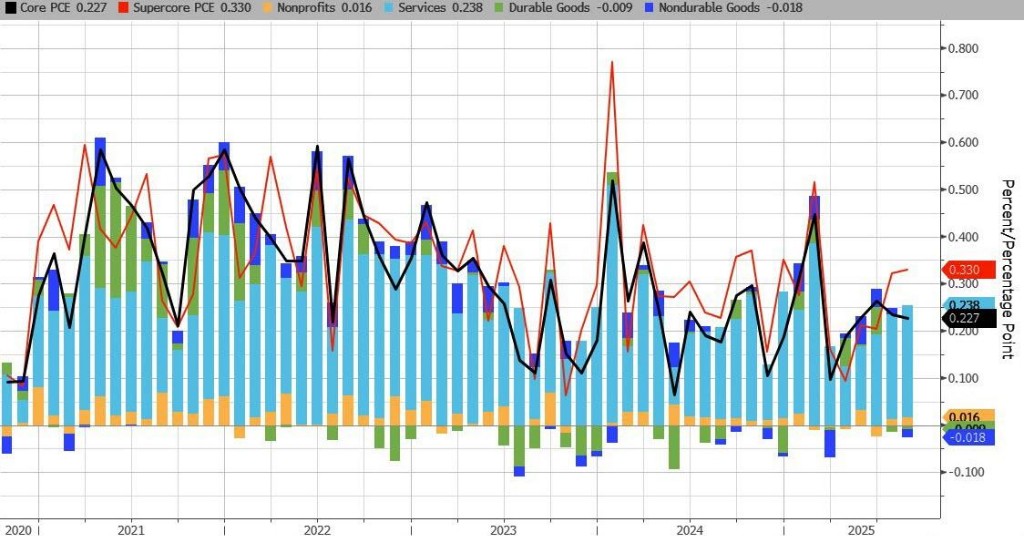

From a breakdown perspective, service costs are the main factor driving overall price increases. Among them, the primary drivers of "super core inflation" (service inflation excluding housing) come from financial services, dining services, and transportation costs. The report noted that the rise in financial service costs is related to the boom in the stock market and its associated services, with no direct connection to tariffs.

In stark contrast to the strength of the service sector, commodity prices remain persistently weak. Data shows that the anticipated rebound in durable goods inflation did not materialize, with prices actually declining again in August At the same time, the prices of non-durable goods are also showing a downward trend.

In August, personal income increased by 0.4% month-on-month, higher than the expected value of 0.3%; personal spending increased by 0.6% month-on-month, also exceeding the expected 0.5%.

In addition, as the impact of President Trump's tariff policy gradually permeates all levels of the economy, inflation risks still exist. Observations show that many companies initially delayed price increases by consuming inventory, but if they cannot pass on some of the increased costs, their profit margins will face risks. The upcoming September employment report will be a key reference for the Federal Reserve's next policy meeting, but it remains uncertain whether officials will be able to obtain this data in a timely manner given the potential government shutdown.

Market Reaction

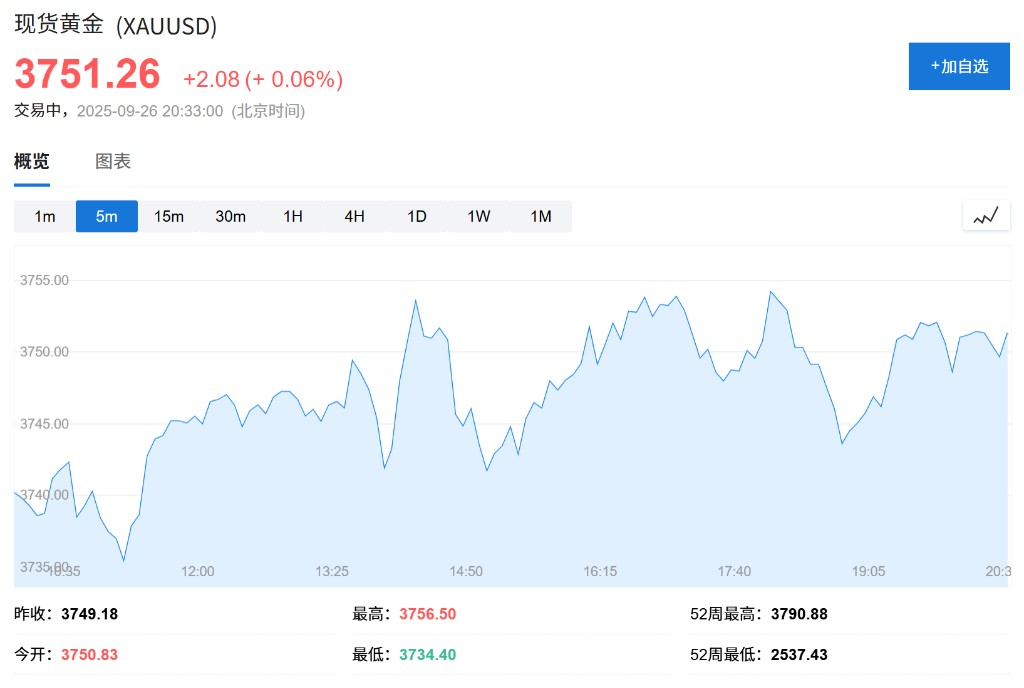

After the data was released, U.S. stock futures showed little short-term volatility, with the Nasdaq 100 index futures maintaining an increase of about 0.3%. The U.S. dollar index slightly dipped in the short term, currently reported at 98.33.

The yield on the U.S. 10-year Treasury bond fell slightly in the short term, currently reported at 4.158%. Spot gold rose about $6 in the short term, currently reported at $3755.53 per ounce.

More news will be continuously updated