U.S. Stock Outlook | Futures for the three major indices rise together, Trump swings the "tariff big stick" towards furniture, heavy trucks, and pharmaceuticals, PCE data arrives tonight

美股三大股指期貨齊漲,市場關注今晚即將公佈的 PCE 通脹數據。特朗普宣佈自 10 月 1 日起對多種進口產品徵收高額關税,包括對傢俱、重型卡車和藥品的關税。預計 8 月份 PCE 年率將錄得 2.7%,核心 PCE 年率為 2.9%。

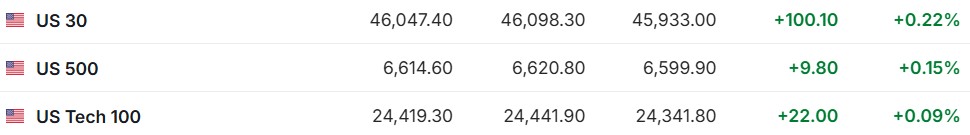

1. 9 月 26 日 (週五) 美股盤前,美股三大股指期貨齊漲。截至發稿,道指期貨漲 0.22%,標普 500 指數期貨漲 0.15%,納指期貨漲 0.09%。

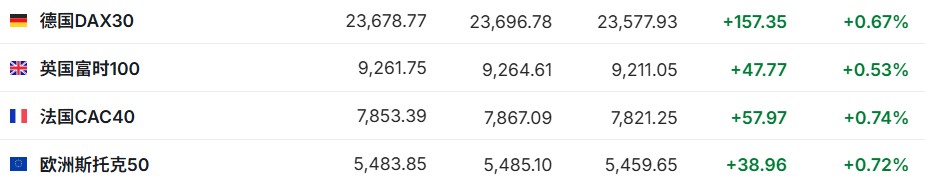

2. 截至發稿,德國 DAX 指數漲 0.67%,英國富時 100 指數漲 0.53%,法國 CAC40 指數漲 0.74%,歐洲斯托克 50 指數漲 0.72%。

3. 截至發稿,WTI 原油跌 0.15%,報 64.88 美元/桶。布倫特原油跌 0.14%,報 69.66 美元/桶。

市場消息

今晚美聯儲最青睞的通脹指標——PCE 數據來襲。在近期數據顯示經濟在面對關税時比預期更具韌性之後,將於北京時間週五晚 8 點 30 分公佈的關鍵 PCE 通脹報告變得尤為重要,儘管市場普遍預計這一美聯儲最青睞的通脹指標不會顯示非常令人擔憂的上升,但投資者想知道細節中是否有任何魔鬼。預測人士預計,這份報告將顯示,以個人消費支出 (PCE) 衡量的 8 月份物價年率將錄得 2.7%,高於 7 月份 2.6%,月率將錄得 0.3%,高於上個月的 0.2%;剔除了波動的食品和能源行業的核心 PCE 預計在過去一年中上漲了 2.9%,與 7 月相同,月率則較上月的 0.3% 小幅回落至 0.2%。

最高 100%!特朗普 “關税大棒” 揮向傢俱、重卡與藥品。美國總統唐納德·特朗普週四宣佈,自 10 月 1 日起,美國將對多種進口產品徵收高額關税。具體包括:對廚櫃、浴室梳妝枱及相關產品徵收 50% 關税,對進口傢俱徵收 30% 關税;對進口重型卡車加徵 25% 關税;並對專利及品牌藥品加徵 100% 關税。特朗普週四晚間在 Truth Social 帖子中寫道:“自 2025 年 10 月 1 日起,我們將對所有廚櫃、浴室梳妝枱及相關產品徵收 50% 的關税。此外,我們還將對軟墊傢俱徵收 30% 的關税。” 特朗普實施的各類關税在過去一年裏已大幅推高了傢俱價格。美國勞工統計局的數據顯示,上個月傢俱價格比 2024 年 8 月上漲了 4.7%。

米蘭呼籲快速大幅降息!小摩潑冷水:論點缺乏説服力,難獲美聯儲內部支持。美聯儲新任理事米蘭週一表示目前利率水平過高,並呼籲未來數月應大幅、快速降息,以避免勞動力市場出現不必要的裁員潮。這是米蘭進入美聯儲理事會以來首次就政策立場公開發表講話。米蘭指出,中性利率正顯著下降。過去這一利率可能被系統性高估,而近期關税、移民限制以及國內税收政策的變化,又進一步壓低了中性利率。因此,為避免對經濟造成損害,利率需要大幅下調。他在紐約經濟俱樂部的講稿稱:“簡而言之,貨幣政策已深入限制性區間。將短期利率維持在比中性水平高約兩個百分點的位置,可能導致不必要的裁員和更高的失業率。”

流動性警報拉響!美國銀行業準備金連續七週暴跌,失守 3 萬億美元關口。由於流動性持續從金融體系中流失,美國銀行體系的準備金已連續第七週大幅下降,至 3 萬億美元以下。銀行準備金是關乎美聯儲繼續縮減資產負債表決策的一個關鍵因素。根據美聯儲週四公佈的數據,截至 9 月 24 日當週,銀行準備金下降約 210 億美元,至 29997 億美元。這是自 1 月 1 日當週以來的最低水平。此次下跌正值美國財政部在 7 月份提高債務上限後,加大債券發行力度以重建現金餘額之際。這抽走了美聯儲賬簿上其他負債的流動性,例如隔夜逆回購工具 (RRP) 和銀行準備金。但隨着所謂的 RRP 接近枯竭,商業銀行存放美聯儲的準備金一直在下降。

小心美股 “波動十月”!高盛預警:歷史顯示比其他月份更動盪。市場正密切關注美聯儲接下來的利率調整舉措,同時一個重要的財報季也即將來臨,而美國政府停擺的威脅也愈發嚴峻。在這種背景下,美股將迎來另一個風險因素。據高盛衍生品團隊稱,10 月份標普 500 指數的歷史價格波動幅度比其他月份高出約 20%。高盛團隊傾向於在有催化劑的交易日購買短期期權,同時避免在非事件時段購買波動率合約,以利用這個財報季的動盪行情。高盛衍生品團隊表示,自 1928 年以來,標普 500 指數在 10 月份的歷史價格波動幅度比其他月份高出約 20%。而在近幾十年裏,這一數值甚至更高,因為第四季度通常會迎來大量企業利好消息。

個股消息

消費者需求穩定,開市客 (COST.US) Q4 業績超預期。開市客第四財季盈利超出預期,這表明消費者優先購買必需品並尋求優惠商品,消費支出依然健康。數據顯示,開市客截至 8 月底的第四財季總營收為 861.56 億美元,同比增長 8%,好於市場預期;淨利潤為 26.10 億美元,上年同期為 23.54 億美元;攤薄後每股收益為 5.87 美元,高於市場預期,上年同期為 5.29 美元。開市客 Q4 會員費收入為 17.24 億美元,上年同期為 15.12 億美元。

英特爾 (INTC.US) 成市場新寵!投資者搶購看漲期權押注漲勢延續。投資者正大舉押注英特爾,認為隨着這家芯片製造商尋求進一步合作,在美國政府、英偉達 (NVDA.US) 和其他公司的一系列投資之後,該股持續數週的漲勢將繼續。自 9 月 17 日以來,英特爾股價已累計上漲 37%,至 33.99 美元。數據顯示,英特爾三個月期權的隱含波動率本週飆升至自今年 4 月初因關税引發美股拋售以來的最高水平,但投資者並非在尋求對沖下跌風險,而是買入能從進一步上漲中獲利的看漲期權。與此同時,英特爾看漲期權相對於看跌期權的溢價本週躍升至自 2013 年以來的最高水平。大量交易集中於短期合約,週五到期的期權交易量佔總量的三分之一以上。

TikTok 美國業務擬議交易作價僅 140 億,甲骨文 (ORCL.US)、銀湖、MGX 或持股 45% 獲董事席位。美國總統特朗普已批准一項允許 TikTok 繼續在美運營的提案,副總統萬斯表示,這筆交易將對 TikTok 美國業務作價約 140 億美元。根據提案,TikTok 美國業務將由美國投資集團控股,甲骨文擔任 TikTok 安全服務提供商。投資集團具體成員尚未最終確定。特朗普行政令規定交易需在 120 天內完成,中方是否會批准該方案尚不明朗。據知情人士透露,甲骨文公司、銀湖資本與阿聯酋 MGX 正洽談投資 TikTok 美國業務並獲取董事會席位。其中一名消息人士稱特朗普政府近期鼓勵 MGX 加入非中資控股聯盟。字節跳動在 TikTok 美國的持股比例將低於 20%。

繼 34.5 億美元罰單後,谷歌 (GOOGL.US) 或因搜索業務再受歐盟重罰。谷歌未來數月可能因違反歐盟具有里程碑意義的科技法規,面臨歐盟的第二次罰款,目前歐盟委員會正起草相關裁決。本月早些時候,歐盟委員會已在一樁與在線廣告技術相關的案件中,對這家科技巨頭處以 34.5 億美元 (約合 29.5 億歐元) 罰款。這筆新罰款與今年 3 月提出的指控相關——當時指控稱,谷歌偏袒自家的垂直搜索引擎 (如谷歌購物、谷歌航班、谷歌酒店),而非競爭對手的同類產品。針對谷歌的這些案件均依據歐盟《數字市場法》(Digital Markets Act) 提起。消息人士向該媒體透露,若谷歌能提出一份改進後的解決方案,或可避免此次罰款。

重要經濟數據和事件預告

北京時間 20:30:美國 8 月個人支出月率 (%)、美國 8 月 PCE 物價指數年率 (%)。

北京時間 22:00:美國 9 月密歇根大學消費者信心指數終值。

次日北京時間凌晨 01:00:美國截至 9 月 26 日當週全美鑽井總數 (口)。

北京時間 21:00:2027 年 FOMC 票委、里奇蒙聯儲主席巴爾金髮表講話。

北京時間 22:00:美聯儲理事鮑曼發表講話。

次日北京時間凌晨 01:00:美聯儲理事鮑曼參加一場有關貨幣政策決策方法的對話。

次日北京時間凌晨 03:30:CFTC 公佈周度持倉報告。