OpenAI 抱紧英伟达和甲骨文,微软会被边缘化吗?

摩根士丹利認為疑慮多餘,上調微軟為 “首選”,目標價至 625 美元。微軟選擇性 “放手” 是將 GPU 和數據中心等稀缺資源優先服務利潤更高、LTV 更長的企業客户。微軟的增長核心是 Azure 雲服務的強勁增長和企業生產力應用的穩固生態,而非單一依賴 OpenAI,合作關係仍在繼續演進。

在人工智能基礎設施大戰進入新階段之際,OpenAI 與英偉達、甲骨文等多家科技巨頭達成了史無前例的合作。這使得市場對微軟在未來 GenAI(生成式人工智能)領域的主導力產生疑問:微軟會被 OpenAI“邊緣化” 嗎?

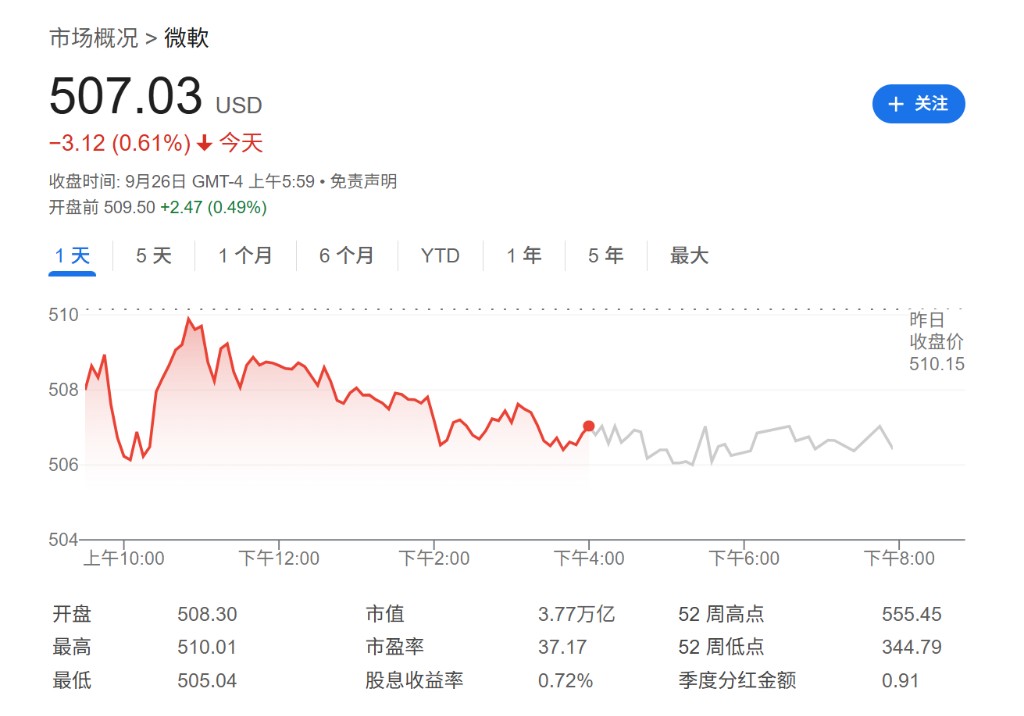

據追風交易台消息,摩根士丹利在一份最新報告中表示,投資者對微軟可能在人工智能浪潮中被邊緣化的疑慮是多餘的,該行反而將微軟股票上調為 “首選”,並將目標價提升至 625 美元。距離現價還有 23% 的上漲空間。

分析師認為,微軟的選擇性 “放手” 恰恰是其戰略成熟和充滿信心的表現。在 GPU 和數據中心等資源有限的環境下,微軟正優先服務於客户集中度更低、利潤空間更大、生命週期價值更高的企業客户。

同時,微軟與 OpenAI 已簽署一份新的非約束性諒解備忘錄(MOU),標誌着雙方的合作將進入下一階段。摩根士丹利強調,微軟的增長動力遠不止於 OpenAI,其 Azure 雲服務的強勁增長、在企業生產力應用領域的穩固護城河,以及被低估的估值水平,共同構成了一個極具吸引力的投資前景。

OpenAI 多方合作加速,微軟的競爭地位挑戰幾何?

近期, OpenAI 與多家科技巨頭簽署了一系列引人注目的基礎設施協議。其中最受關注的是,OpenAI 與甲骨文達成一項價值高達 3000 億美元的五年期合同,並將與英偉達合作部署高達 100 億美元的 AI 算力。此外,CoreWeave、谷歌雲以及軟銀也紛紛加入 OpenAI 的基礎設施供應商行列。

外界對 OpenAI 與其他雲廠商合作的疑慮,核心在於為何微軟會放棄部分高額合同。根據摩根士丹利的分析,這應被視為微軟在資源受限環境下進行利潤最大化的戰略選擇。

報告指出,微軟服務於多元化的企業客户,相比深度綁定單一大型客户(如 OpenAI),具有多重優勢:

- 更低的客户集中度風險:避免對單一夥伴的過度依賴。

- 更高的利潤空間:企業客户的議價能力相對分散,價格折扣較少。

- 更高的客户終身價值(LTV):企業客户傾向於採購數據庫等附加軟件解決方案,以構建持久的企業級應用,從而帶來更穩定和長期的收入流。

因此,微軟選擇將部分 OpenAI 的算力需求轉移給其他供應商,可能恰恰反映了其自身企業客户需求的強勁程度。微軟管理層此前也曾表示,資本支出的增加完全是為了滿足企業客户的需求,公司最近一個季度商業預訂量實現了 35% 的同比增長,也為此提供了佐證。

此外,儘管微軟與 OpenAI 新協議的細節(例如收入分成比例)尚未公佈,但雙方簽署的非約束性諒解備忘錄表明,合作關係仍在繼續演進。摩根士丹利認為,微軟在新談判中會優先確保對 OpenAI 知識產權的長期訪問權,並維護 OpenAI 的長期生存能力,因為一個健康的合作伙伴對其自身利益至關重要。

Azure 增長多元驅動,AI 生態擴容遠超 “綁定” 邏輯

Azure 雲和 AI 業務的持續高增速並非單靠 OpenAI 驅動,底層投資、企業上雲潮和 GenAI 應用創新共同構建了微軟的基本面韌性。

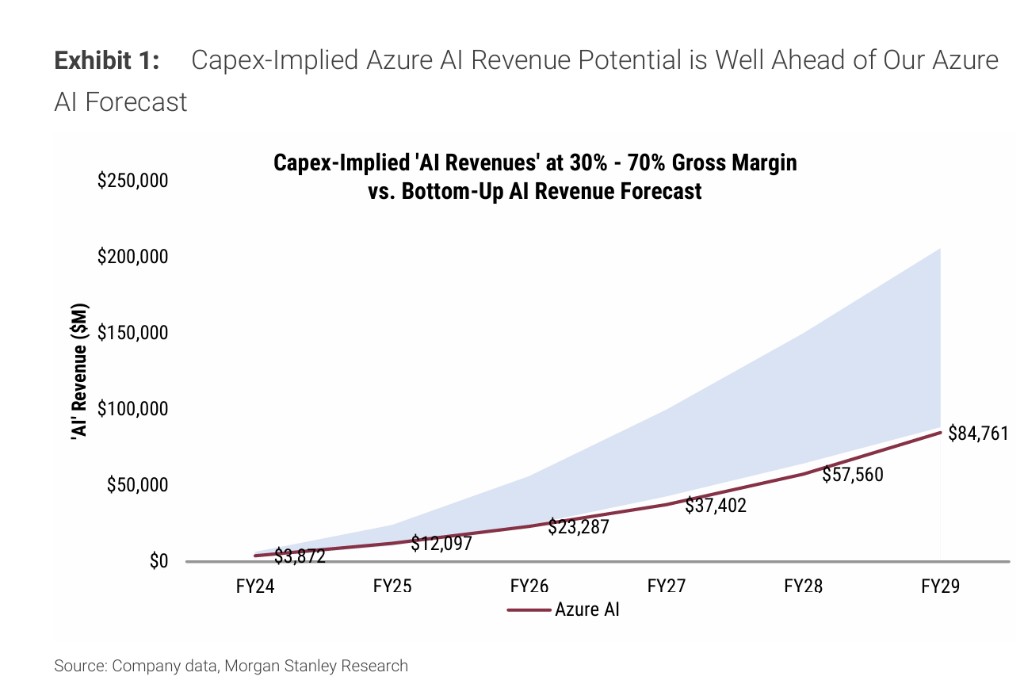

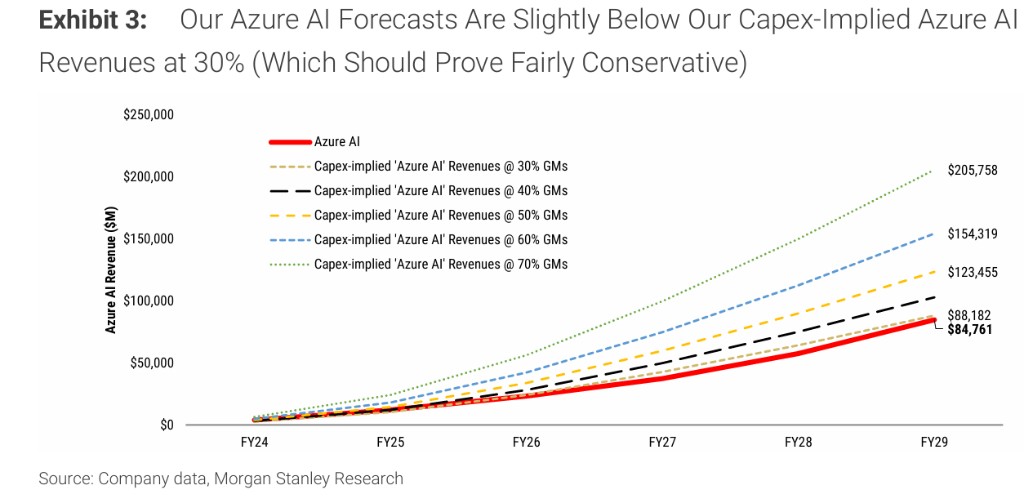

根據摩根士丹利推算,微軟過去幾年和未來的 AI 相關資本開支持續提升,Azure AI 業務有望在 2025 財年達到 104 億美元收入,並在 2029 財年突破 200 億美元水平。計算顯示,即便只考慮 30% 毛利率場景,對應的 Azure AI 收入潛力遠高於當前保守估算。

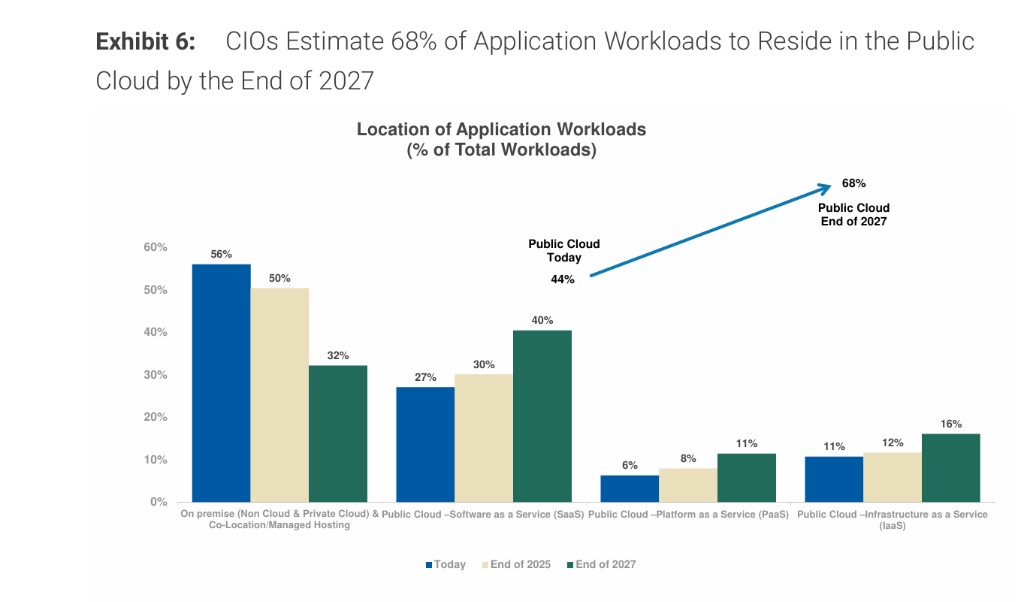

摩根士丹利強調,AI 相關業務增長已經越來越多元化:一方面,微軟在 OpenAI 外部的 AI 雲合同越來越多,收入結構分散化成為趨勢;另一方面,Azure 不僅是 GenAI 主力雲供應商,更是 “企業級” 應用、原生 PaaS 與 IaaS 創新的綜合承載平台。CIO 調研顯示,微軟在企業生產力、AI 應用和安全等多個領域均維持市場份額頭部地位,企業用户對 Azure 和 M365 等生態系統的長期投入意願強烈。

企業應用和生產力生態,構築微軟長期壁壘

分析認為,微軟不是單純的雲算力服務商,其生產力應用(M365、Copilot 等)和 “數字辦公 + 知識工作者” 生態圈,是抗擊 Agentic AI 挑戰與維持高客户粘性的關鍵。

智能 Agent 類 AI 新秀不斷湧現,但摩根士丹利調研顯示,CIO 和信息工作者對微軟 M365、Teams、Copilot 等辦公應用的粘性持續提升。2025 年第二季度調研顯示,33% 的企業客户已經將主要 O365 訂閲升級至高階的 E5 版本,並有超半數客户計劃進一步升級;M365 Copilot 等 AI 產品的組織滲透率預計將由當前的 31% 提升至 43%。

歷史經驗亦表明,微軟總能通過併購、集成(如 Teams 對 Slack、O365 對 Google Workspace 的應對)以及生態深化來守住市場主導權,這將同樣適用於 “Agentic AI” 生態的潛在衝擊。