Goldman Sachs trader: Bitcoin's "Monday flash crash" is a "leading signal"

Goldman Sachs trader Paolo Schiavone warned that Monday's Bitcoin flash crash is the first signal of a market shift, with the market's pace slowing down and a wave of stop-loss orders occurring in some consensus trades. He specifically mentioned that nothing good will happen if Bitcoin falls below the 200-day moving average (USD 110,000). Although a "deceleration" is needed in the short term, he expects the market to trend towards a "liquidity-driven" rally, due to factors including peak tariff impacts, preemptive fiscal stimulus, and easing financial conditions, with risk assets being picked up by buyers during the pullback

Goldman Sachs trader Paolo Schiavone warned that Monday's flash crash in Bitcoin is the first signal of an impending market shift, indicating that the risk asset frenzy of the past three weeks may be cooling down.

On September 26, Goldman Sachs trader and strategist Paolo Schiavone stated that risk assets had experienced an absolute sprint over the past three weeks, with momentum trading yielding significant returns, but the pace is changing.

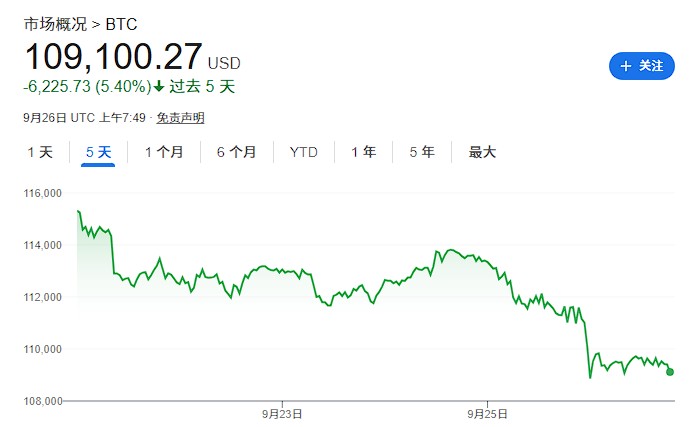

This Monday, Bitcoin experienced a sudden flash crash, which is seen by traders as "the first real signal" — the market's pace is slowing down, and a "deceleration" is needed in the short term.

The cryptocurrency market saw a sharp decline on Monday, with $1.7 billion in long bets being forcibly liquidated, impacting nearly all major cryptocurrencies, including Bitcoin and Ethereum. On Thursday, Bitcoin continued to decline, falling below the $110,000 mark, currently trading around $109,000.

He believes that while the fundamental situation reflects a "month-end effect," some key trends in the market are beginning to appear excessively stretched. For example: the macro environment remains very volatile; consensus trades (shorting the dollar, steepening the yield curve) are under significant pressure.

Despite the short-term adjustment risks, this trader's fundamental judgment is that the market is heading towards a "melt-up" scenario. He believes that the pullback in risk assets will be met with buying interest, due to reasons including that tariff impacts have peaked, fiscal stimulus will be significantly front-loaded, financial conditions are loosening, interest rate cuts are imminent, and the real impact of AI.

Bitcoin Technical Signals Draw Attention

Paolo Schiavone elaborated on the current shift in market conditions.

He stated that the market has experienced an "absolute sprint" over the past three weeks, with momentum trading yielding significant returns. However, the situation is now changing.

The flash crash in Bitcoin on Monday is the first sign of a market shift, occurring in an environment where Bitcoin is leading rather than lagging, meaning Bitcoin is taking a leading role rather than following other assets.

Schiavone specifically mentioned that the area around $110,000 has become an important technical support level for Bitcoin, stating, "Nothing good happens below the 200-day moving average."

He believes this level is more likely to act as support rather than resistance, indicating that Bitcoin's structural significance has transcended the cryptocurrency itself, becoming a symbol of overall risk appetite.

Macro Situation "Volatile," Consensus Trades Under Pressure

Although he views the current market weakness as a manifestation of the "month-end effect," he also acknowledges that some trends in the market have become "clearly overextended."

For example, mainstream consensus trades such as "shorting the dollar" and "going long on a steepening yield curve" are facing ongoing stop-losses, and the macro situation remains "very volatile." Paolo Schiavone pointed out that in a market environment dominated by technological levels and stop-loss behavior, the sharp fluctuations of Bitcoin may still be a prelude to macro risks.

The article states that when he surveyed his client base, he found a 50/50 even distribution in responses regarding whether the greater risk is growth or inflation. This reflects a deep division in the market regarding the economic outlook.

He specifically noted that the market's judgment on the risks of future growth and inflation remains highly divided, with "50% of clients worried about inflation and 50% worried about growth." This itself is a signal of the market's lack of direction.

For the U.S. economy before the end of the year, the trader estimates GDP growth at 2%, core PCE at 3%, and an unemployment rate of 4.5%. The key question is whether restrictive policy rates are needed or if they will remain below neutral levels. He believes the terminal rate may be close to 2.5%.

In the bond market, he stated, "I have always held a pessimistic view on fiscal conditions, but it is now difficult to agree with the so-called 'fiscal dominance' story." He added that the yield on 30-year U.S. Treasuries may settle in the range of 4.25–4.5% by 2025.

"Melt-Up" Logic Chain Takes Shape, Technical Indicators Release Warning Signals

The trader has constructed a complete logic chain supporting the market's move towards "melt-up."

First, the impact of tariffs has peaked, providing a relatively stable policy environment for risk assets.

Second, fiscal stimulus measures will be significantly advanced, providing momentum for economic growth.

At the same time, financial conditions are loosening, supporting market liquidity.

The Federal Reserve's rate-cutting cycle is about to begin, and the trader maintains a prediction of "three insurance rate cuts." If non-farm payroll data continues to be revised down, a 50 basis point cut may even occur in October.

The real impact of AI also supports long-term growth prospects.

He believes that the combination of these factors indicates that any pullback in risk assets will be met with buying interest.

Despite the fundamentals supporting the "melt-up" logic, as a technical analysis trader, Paolo Schiavone still notices some warning signals. Nvidia has failed to effectively break through its highs, the Nasdaq has formed a failed head-and-shoulders pattern, and is brewing an "expansion top."

The trader emphasized, "Tops do not ring a bell—only the accumulation of signals. Bottoms are events, tops are processes."