Goldman Sachs hedge fund manager: Do not confront, do not chase the rise, rationally bullish on US stocks

The head of Goldman Sachs' hedge fund business believes that despite the recent pullback in U.S. stocks, there is still upward momentum for U.S. stocks due to positive capital flows, historical experience support, and the backdrop of Federal Reserve interest rate cuts, with a particular focus on technology stocks and non-essential consumer goods. However, he holds a cautious attitude towards small-cap stocks and the European market, noting that the current environment is a "stock picker's market," where excess returns will rely more on individual stock selection capabilities

As U.S. Stocks Fall for Three Consecutive Days, top Wall Street traders say we should "rationally be bullish" on U.S. stocks.

"Do not fight the market, do not blindly chase highs." Tony Pasquariello, partner in Goldman Sachs' Global Markets Division and head of hedge fund business, emphasized in an internal memo to clients.

So, what supports his "rationally bullish" stance? Pasquariello believes that despite some recent market pullbacks, capital flows, historical experience, and the Federal Reserve's policy direction all provide support for the market. He particularly pointed out that in the context of the Federal Reserve cutting interest rates while the economy continues to grow, technology stocks and the consumer discretionary sector often emerge as winners.

He stressed that the fluctuations in the market due to doubts about AI "have been a characteristic of the past three years, rather than an anomaly." Regarding China, he stated, "This is another area that has shown significant strength."

However, his optimism is not without reservations. Pasquariello is skeptical about the long-term fundamentals of small-cap stocks and shows clear caution towards the European market. He emphasized that the current market environment is no longer a "rising tide lifts all boats" scenario, but rather a "stock picker's market" that tests stock selection abilities.

Pasquariello detailed 18 core themes currently facing the market in the memo, covering everything from capital flows and the U.S. labor market to the performance of stock markets in Europe, Japan, and other regions.

1. Capital Flows and Market Positions

Last week's capital flows were clearly very positive: hedge funds recorded the largest U.S. stock purchases in three months... Long-only funds were also buying, especially in technology stocks... The derivatives market added fuel to the fire, with demand for call options and upward pressure from quarterly expirations.

Looking ahead this week, the activity of chartered brokers has noticeably cooled, and the trading community is focused on the expected supply of about $20 billion at the end of the quarter. With the third-quarter earnings season approaching, share buyback activity is weakening, and the responsibility for supporting the market now falls on U.S. retail investors.

2. U.S. Labor Market

Examining employment data, it is hard not to worry about certain trends, especially with the deepening development of artificial intelligence. While I do not dismiss these concerns, a look back at history reveals an interesting story: the U.S. experienced several negative employment reports from the mid to late 1990s—1995, 1996, 1998, and 1999—and that was certainly not a bearish time for the stock market.

3. Sector Strategy

From this, one can infer which sectors you should hold when the Federal Reserve cuts rates in the context of sustained economic growth. The answer is: technology and consumer discretionary.

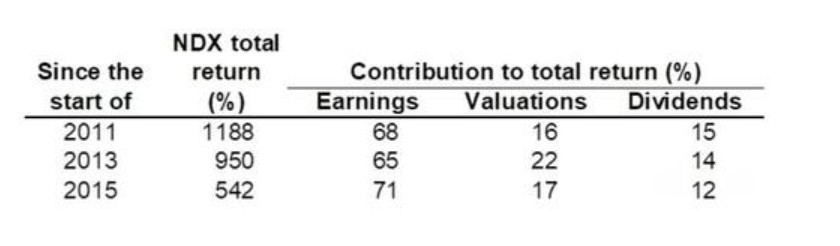

4. Nasdaq 100 Index

A few weeks ago, I mentioned the performance of the Nasdaq 100 Index since early 2009 (while emphasizing that earnings and dividends contributed 90% of the gains). In response, many asked what the situation would be if not calculated from historical lows—this is a reasonable question As you can see, the overall conclusion remains the same— this is not a story of excessive price-to-earnings ratio expansion.

5. Small-cap stocks

Yes, small-cap stocks have performed very well over the past two months. Yes, given what is happening, this makes sense: the Federal Reserve is cutting interest rates in a cyclical acceleration. Yes, there are still short positions feeling the pressure. No, I do not like the fundamentals of this asset. My point is: there is a window of opportunity for over-investing in small-cap stocks—some people I know have predicted this well— but I think it is only temporary. In other words: I will not be tempted to think this is the beginning of an important trend.

6. Hedge funds

Among all the intricate factors, I find that the performance of fundamental long-short strategy funds has been very robust year-to-date: total return +12%, with alpha returns exceeding 5%. Please note that this has been achieved while net risk exposure has remained at a moderate level.

7. Options market

One characteristic of the recent rise is that as the market reaches higher highs, implied volatility has remained notably strong. Why? Perhaps history tells us: October, on average, is the month with the highest actual volatility of the year. More practically, I suspect this is due to a surge in demand for exposure to right-tail risk (upside risk), especially for individual stocks.

While it may be annoying, I still believe that when the market cheaply offers gamma, you should seize the opportunity to acquire some.

8. Europe

After an outstanding performance at the beginning of the year, the Euro Stoxx 50 Index (SX5E) has shown almost no performance over the past four months (in fact, the peak was reached in early March).

Here are some reasons for my skepticism: (1) Defense stocks are rising again, with ASML soaring 25% in the past month, but the index remains stagnant; (2) Unlike the U.S., the interest rate cycle in Europe has passed; (3) If there is any impact, the previous point has driven the euro/dollar up, which may pose challenges to EU profits; (4) We see in business that this market is being sold off in multiple ways. Again, I would be happy to hear differing opinions (I may regret saying this).

9. Japan

In contrast to the previous section, the Nikkei 225 Index and the TOPIX are performing well (the charts are very nice). Here are a few points to note: (1) As the October 4th election approaches, remember that the departure of the Liberal Democratic Party is usually a net positive for the domestic stock market; (2) I still focus on the fact that this market is making higher highs, but we have not fully recovered all the ground lost after last summer's sell-off; (3) Note that Goldman Sachs' Global Investment Research has raised its target price

10. China

This is another area that has shown significant strength. I maintain an open tactical stance—such as Alibaba's recent stock price movements—but remain cautious in the long term.

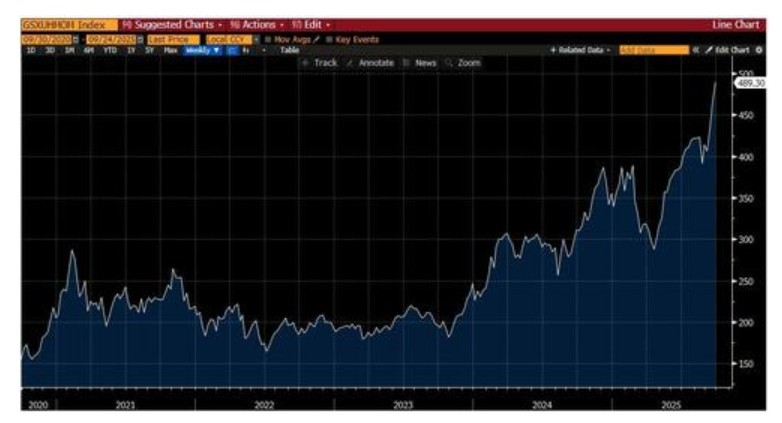

11. Momentum Stocks

As part of the recent rise in certain high-volatility segments of the market, this is the price trend of one of our momentum stock baskets. I am unsure what to make of this—I tend to believe that the momentum factor is a structural long opportunity, but there are reasons to question the sustainability of this rally.

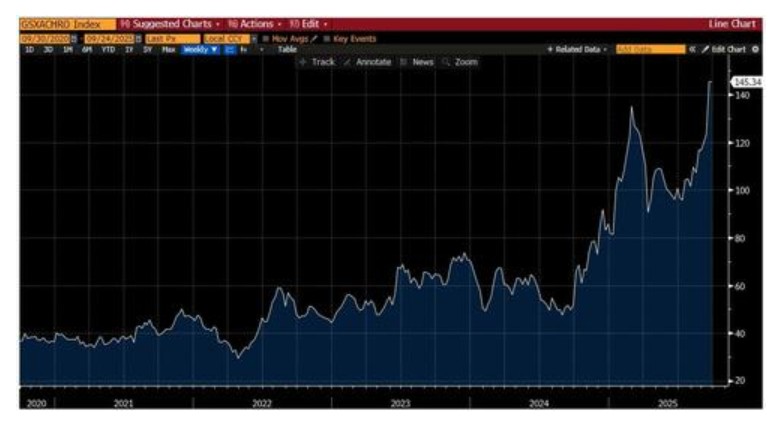

12. Robotics

You've seen this before—the Goldman Sachs China Bionic Robotics basket. Here I share Rich Privorotsky's perspective... The U.S. and China are currently engaged in a technological "space race." (Here is the chart for the China Bionic Robotics stock basket)

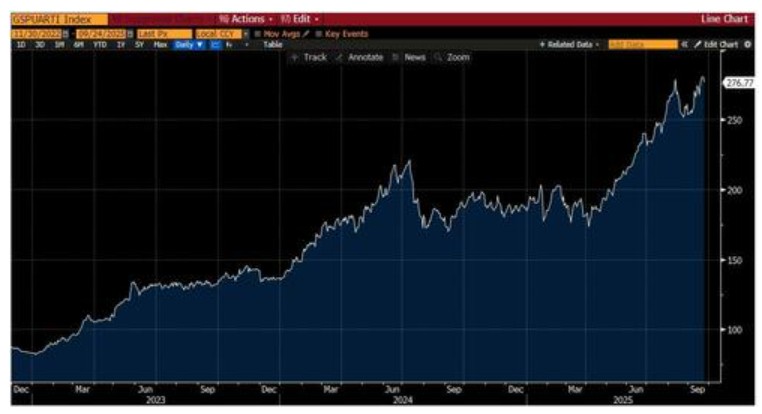

13. Artificial Intelligence

At a time when the current AI narrative is under some scrutiny, Pasquariello showcases the development trajectory of this field through Goldman Sachs' U.S. AI leaders and laggards pair trading. He emphasizes: "I highlight this now—at a time when the AI narrative is somewhat questioned—to illustrate that these fluctuations have been a feature of the past three years, rather than an anomaly."

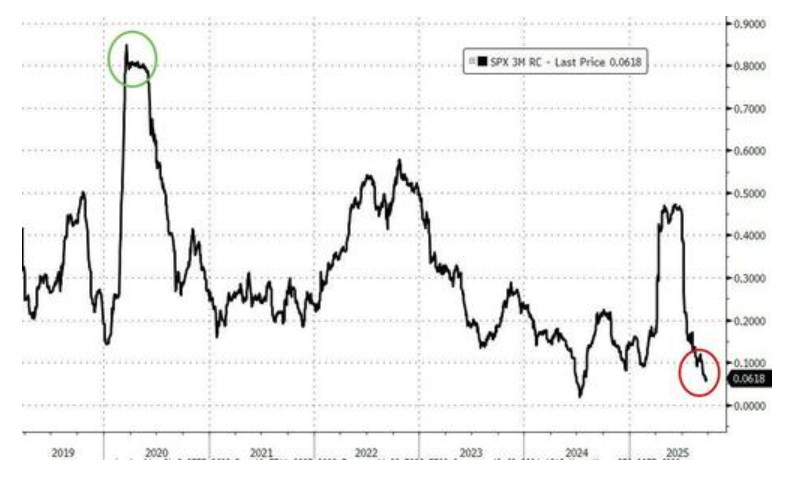

14. "Stock Picker's Market"

This is the chart of the S&P 500's 3-month actual correlation. "This is a stock picker’s market," which provides more alpha opportunities for professional investors.

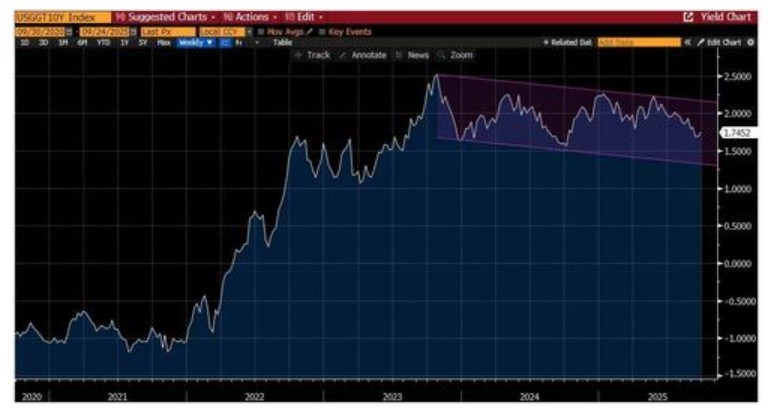

15. Real Interest Rates

Despite the tumultuous events of the past few years—and the accompanying narrative fluctuations—please note that U.S. real interest rates have remained in a range-bound state. The compression of real interest rates year-to-date is favorable for the stock market. (Here is the chart for the range-bound fluctuations of real interest rates)

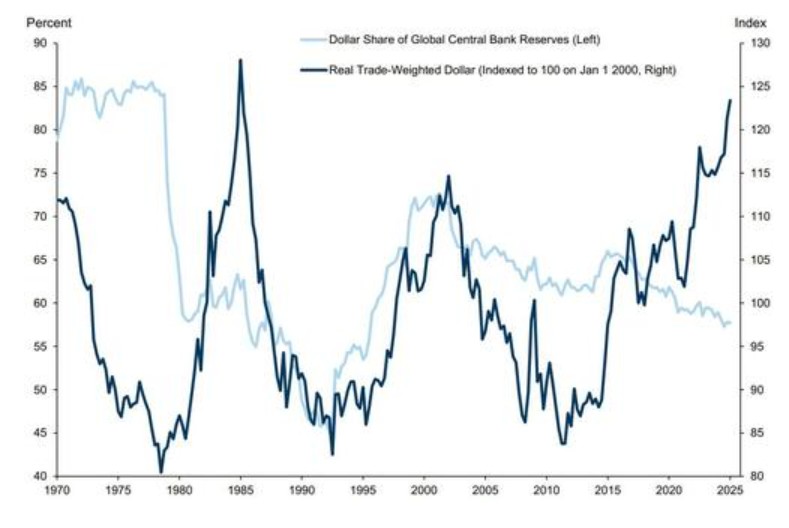

16. Dollar Weakness

I think this is an interesting overlay comparison chart. On one hand, I assume that the dollar holdings of central banks around the world will continue to trend downward. But that said, this does not necessarily mean that the performance of the dollar will be overwhelmingly negative. (Here is the overlay chart of the dollar index and central bank dollar reserve trends)

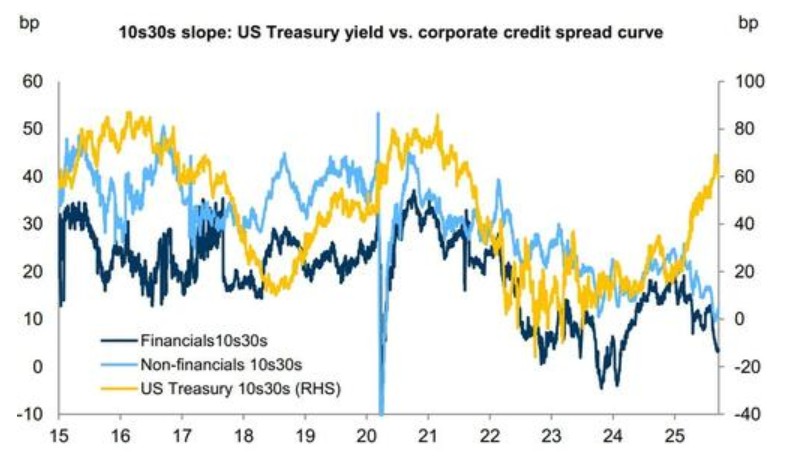

17. Yield Curve vs Credit Spread

It is clear that the trend of the U.S. Treasury yield curve steepening is very obvious—however, the trend of credit spreads for various corporate bonds is exactly the opposite.

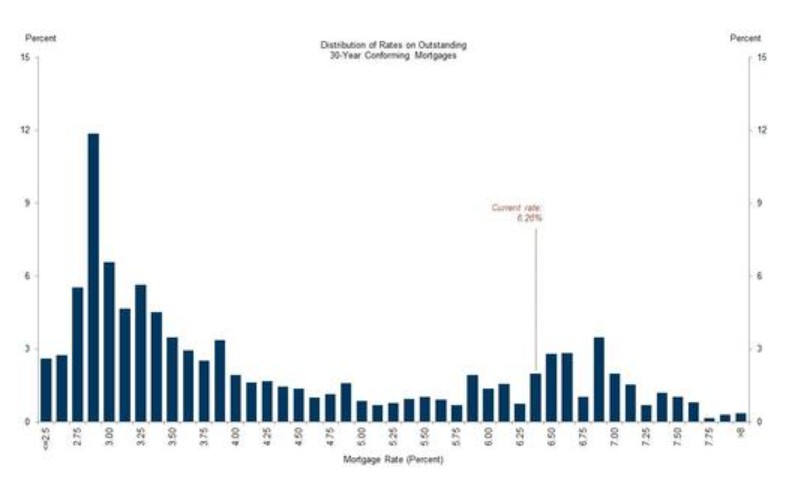

18. Mortgage Spiral

The last chart: the distribution of outstanding 30-year mortgage rates (credit = Jessica Rindels). One could argue that homeowners who bought in recent years should quickly refinance as rates decline—but the fact is that 80% of mortgage borrowers have rates below the current level.

I am not saying that lower mortgage rates are not a good thing—I am saying that we still have a way to go before this becomes a universal story