Using large models to assist investment! Research institutions: By 2029, the scale of AI investment advisory will grow by 600%

AI 投顧市場規模預計將從 2023 年的 617.5 億美元激增至 2029 年的近 4710 億美元,增幅超過 600%。目前約 10% 的散户已使用聊天機器人選股,另有半數散户持開放態度。實驗顯示,ChatGPT 選出的投資組合回報率高達 55%,遠超專業基金。但專家警告,AI 模型存在數據過時、信息錯誤等風險。

從華爾街分析師到普通散户,人工智能正迅速滲透投資領域。

根據研究機構 Research and Markets 的最新預測,全球機器人投顧(robo-advisory)市場規模將從 2023 年的 617.5 億美元,飆升至 2029 年的近 4710 億美元,六年內增長超過 600%。這一預測的背後,是投資者日益增長的興趣。

券商 eToro 的數據顯示,目前已有約十分之一的散户投資者使用聊天機器人來挑選股票,而半數受訪者表示會考慮嘗試。

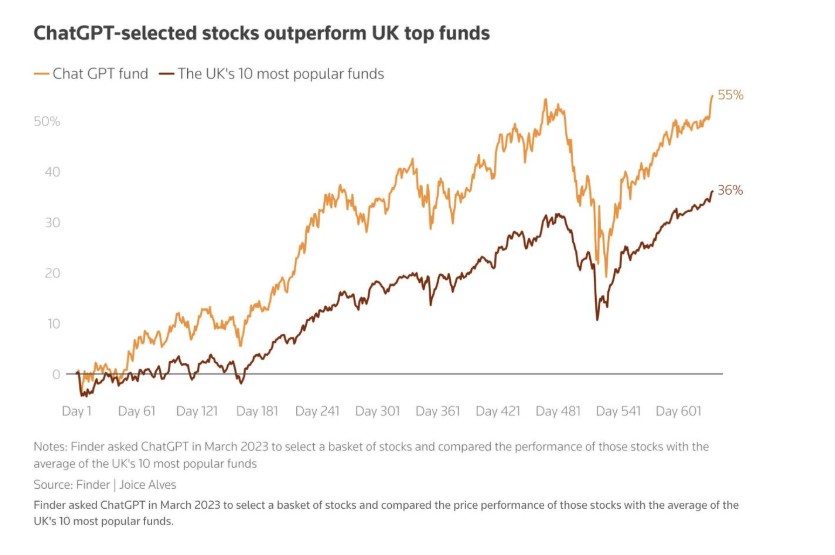

AI 投資的吸引力不僅在於概念。據媒體 Finder 報道,其在 2023 年進行的一項實驗中,由 ChatGPT 挑選的包含英偉達、亞馬遜、寶潔和沃爾瑪等公司在內的股票組合,實現了 55% 的驚人漲幅,表現遠超英國市場上的主流基金。

前瑞銀分析師 Jeremy Leung 也表示,他現在使用 ChatGPT 來指導其投資組合,並稱 “即使是簡單的 ChatGPT 工具也能完成並複製我過去做的許多工作流程”,部分替代了昂貴的彭博終端機功能。

然而,在一片樂觀聲中,行業專家正密集發出風險警示。eToro 的英國負責人 Dan Moczulski 強調:“當人們把 ChatGPT 或 Gemini 這類通用模型當作水晶球時,風險就來了。” 這些模型可能會 “錯誤引用數據和日期,過分依賴既有敍事,並過度依賴過去的價格走勢”,因此專門為投資打造的 AI 工具是更安全的選擇。

專業人士也指出了通用 AI 模型的侷限性。Jeremy Leung 警告稱,由於聊天機器人 “無法訪問付費牆後的數據”,可能會錯過關鍵的分析信息。

他補充説,要想獲得理想結果,用户必須給出非常詳盡的指令,例如 “假設你是一名做空分析師,這隻股票的做空邏輯是什麼?” 或 “僅使用美國證券交易委員會(SEC)文件等可靠來源”。他最後提醒,如果投資者在使用 AI 輕鬆賺錢後變得過於安逸,那麼當市場危機或 下行來臨時,他們可能將無法有效應對。