Beware of the "volatile October" in the US stock market! Goldman Sachs warns: history shows it is more turbulent than other months

Goldman Sachs warns that volatility in the U.S. stock market will increase in October, with historical data showing that the S&P 500 index's volatility in this month is about 20% higher than in other months. The market is focused on the Federal Reserve's interest rate adjustments and the upcoming earnings season, while the threat of a government shutdown in the U.S. is also rising. Goldman Sachs recommends buying short-term options on days with catalysts to prepare for the impending market turmoil. Despite recent losses, the S&P 500 index has still risen 2.4% this month

According to the Zhitong Finance APP, the market is closely watching the Federal Reserve's upcoming interest rate adjustment measures, while an important earnings season is also approaching, and the threat of a government shutdown in the United States is becoming increasingly severe. Against this backdrop, U.S. stocks will face another risk factor. According to Goldman Sachs' derivatives team, the historical price volatility of the S&P 500 index in October is about 20% higher than in other months. The Goldman Sachs team prefers to buy short-term options on days with catalysts while avoiding purchasing volatility contracts during non-event periods to take advantage of the turbulent market during this earnings season.

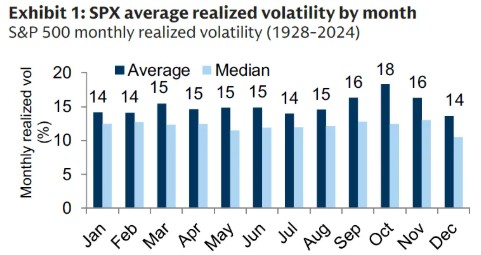

Goldman Sachs' derivatives team stated that since 1928, the historical price volatility of the S&P 500 index in October has been about 20% higher than in other months. In recent decades, this figure has been even higher, as the fourth quarter typically sees a large number of favorable corporate announcements. Additionally, historical data from the bank's derivatives team shows that from August to October, the actual volatility of the S&P 500 index increased by 26%.

John Marshall, head of Goldman Sachs' derivatives research department, stated: "The market volatility in October is no coincidence. For many investors and companies that need to assess performance at the end of the year, this is a critical period. These pressures will drive increased trading volume and volatility, as investors focus on corporate earnings reports, analyst meetings, and management's forecasts for next year's performance."

As options traders begin to prepare for a year-end market rally and gradually abandon bearish hedging strategies (due to market optimism about further rate cuts), the risk of increased price volatility also arises. Despite losses in the past three trading days, the S&P 500 index has still risen 2.4% this month, on track for its best September performance since 2013.

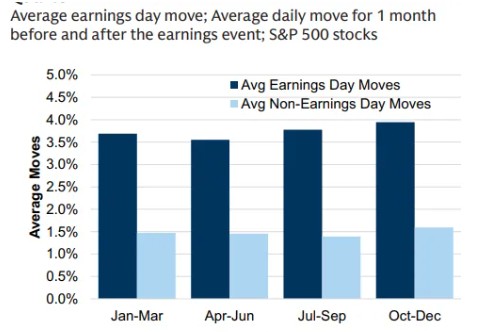

However, given that the U.S. economy is still steadily developing, it does not guarantee that the Federal Reserve will further ease policies. To cope with the current market volatility, Goldman Sachs prefers to buy short-term options on days with significant events while avoiding purchasing volatility products on trading days without major events. Goldman Sachs data shows that the upcoming earnings season is typically the period with the largest price volatility of the entire year.

The team has planned over 450 significant events in the next four months, aside from earnings releases, which could have a major impact on the stock markets in the U.S., Europe, and Asia. This list includes Victoria's Secret lingerie show in mid-October, LVMH's Dior fashion show during Paris Fashion Week, and Tesla (TSLA.US) annual shareholder meeting Activities of companies such as Home Depot (HD.US) are also included. The earnings reports of healthcare stocks make up a significant portion of this list. Their summary report focuses more on companies within the scope of the Goldman Sachs team that have tradable options.

Marshall wrote: "We believe that each of these events has the potential to create volatility opportunities. This list primarily highlights the significant events we will focus on, which are key when we look for directional option buying opportunities."