The Democratic Party is "firm in its stance" this time, and the U.S. government is "getting closer to a shutdown."

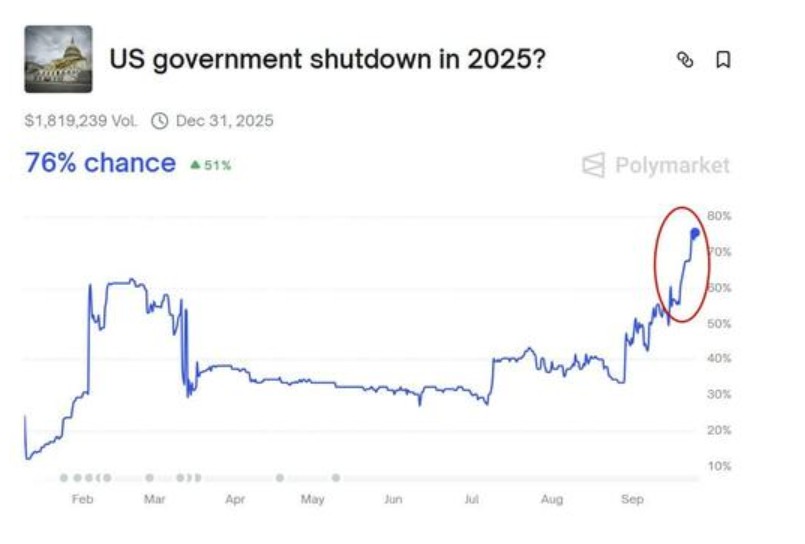

The two parties are in sharp opposition over the temporary spending bill, with the Republicans seeking to reach a funding extension agreement to keep the government running, while the Democrats are pushing for hundreds of billions of dollars in healthcare spending. Data shows that the probability of a U.S. government shutdown has surged to over 75%. The Senate's reconvening on September 29 is the last chance to avoid a shutdown, but Goldman Sachs believes the Democrats may not change their stance. It is expected that for each week the government is shut down, GDP growth for that quarter will decrease by 15 basis points

With less than a week until federal funds run out, the U.S. government is rapidly approaching a shutdown, and there are still no signs of resolution in the political deadlock between the two parties.

According to media reports on September 25, Republican members of the U.S. House of Representatives recently unveiled a temporary spending bill aimed at preventing the federal government from shutting down on October 1. However, this bill does not include the healthcare policies demanded by Democrats, leading to a standoff between the two parties.

As the shutdown crisis looms, tensions have intensified. The latest development is that Republicans are seeking to extend federal funding at current levels for seven weeks to avoid a government shutdown. However, Democrats view this funding as a rare legislative opportunity and are demanding the inclusion of hundreds of billions in healthcare spending. Senate Minority Leader Chuck Schumer has made it clear that this time a tougher stance will be taken.

To exert political pressure, President Trump's budget chief Russ Vought threatened to use the opportunity of a funding interruption to implement deeper cuts to the federal workforce. However, this move, which Democrats see as "extortion," seems to have backfired. Schumer stated that Democrats will not be intimidated by such threats and that many colleagues are "very angry" about it. Trump retaliated by calling Democrats "not serious and ridiculous."

The current fiscal year funding for the U.S. federal government will officially run out on September 30, and without congressional action, a government shutdown will begin on October 1.

According to market data cited by Goldman Sachs trader Thales Arruda, the market believes the likelihood of a U.S. government shutdown has exceeded 75%, and the duration of the shutdown may be similar to the three-week period in 2013. It is estimated that for each week the government is shut down, GDP growth for that quarter will decrease by 15 basis points.

For investors, the most immediate impact will be the "vacuum period" of key economic data. Once the government shuts down, federal agencies responsible for releasing employment and inflation data are likely to suspend operations. This means the market will not receive timely updates on core indicators such as non-farm payrolls and CPI, significantly complicating the Federal Reserve's policy assessments and increasing market uncertainty.

Shutdown Probability Soars to 76%, Final Window Slim

According to data from the prediction market PolyMarket, the probability of a government shutdown has soared to over 75%.

Goldman Sachs chief trader Thales Arruda stated that theoretically, the last chance to avoid a shutdown will occur after the Senate reconvenes on September 29, when if Democrats change their stance, the House-approved extension bill could be passed. However, this scenario is widely regarded as unlikely to happen.

Last week, the Republican "stopgap" — the temporary spending bill — passed the House by a narrow margin but failed to gain approval in the Senate. Since most legislation in the Senate requires 60 votes to pass, Republicans need the support of at least seven Democrats. After the proposal failed, House leaders announced they would return to Washington only after the deadline, effectively issuing a "take it or leave it" ultimatum to Senate Democrats

Stalemate Core: Medical Funding and Political Pressure

The core of this stalemate lies in the fact that Democrats see it as a rare legislative opportunity. Schumer has explicitly put forward demands, including extending the soon-to-expire Affordable Care Act (ACA) subsidies and reversing previous Republican cuts to the Medicaid program.

Unlike in March of this year, when Schumer and some Democrats voted in favor of the Republican plan to avoid a shutdown, which drew sharp criticism from the party's progressive wing. This time, the Democratic stance is clearly much tougher.

The White House's pressure strategy has further intensified the conflict. A memo from Office of Management and Budget (OMB) Director Russ Vought instructs agencies to prepare permanent layoff plans. Democratic Congressman Don Beyer called this move "mob-style extortion." Former OMB Director Shalanda Young pointed out that a government shutdown does not give the executive branch the "magic" to fire employees; at best, it is a "negotiation tactic."

Democratic Senator Cory Booker stated, "If you are not even willing to talk to us, it shows you are determined to push our country into the abyss of a shutdown." Republicans, on the other hand, accuse Democrats of trying to attach unreasonable demands to the short-term spending bill. Georgia Republican Congressman Buddy Carter stated on social media, "If a shutdown occurs, there is no doubt: it will be a 'Schumer-style shutdown'."

Economic Cost: GDP Hit

If the U.S. government shuts down, its direct impact on the economy cannot be ignored. According to Goldman Sachs, for every week the government is shut down, GDP growth for that quarter will decrease by 15 basis points. For example, a three-week shutdown could lead to a 45 basis point reduction in GDP growth, although some losses may be offset in the next quarter as economic activity resumes.

Goldman Sachs noted that the duration of the shutdown can be referenced by the three-week event in 2013. However, it is important to note that the situation at that time also involved a debt ceiling debate, which is not the focus of the current stalemate.

Data "Vacuum Period": Non-Farm Payroll and CPI May Be Delayed, Adding Uncertainty to Federal Reserve Decisions

If a U.S. government shutdown becomes a reality, its impact will quickly transmit to the financial markets. Wall Street Journal reported that a Nomura Securities report warned that the U.S. Department of Labor and its Bureau of Labor Statistics (BLS), responsible for releasing employment and inflation data, are likely to shut down on October 1.

This means the market will not be able to see a series of key data on time, including the employment report on October 4, the CPI report on October 15, and the retail sales report on October 16. The lack of these official data will significantly increase the difficulty for the Federal Reserve to assess economic conditions, greatly reducing the likelihood of deviating from the established policy path in September at its meeting at the end of October Historical experience shows that even if the government resumes operations after a shutdown, it takes a considerable amount of time for data releases to return to normal. For example, the 16-day government shutdown in 2013 resulted in delays in data releases that lasted until the 51st day after the shutdown ended. This uncertainty may trigger unusual market fluctuations in the coming weeks