Federal Reserve's Logan: Should consider changing the interest rate tool benchmark, the federal funds rate benchmark is outdated

Dallas Federal Reserve President Logan proposed that the Federal Reserve should consider changing the benchmark interest rate indicator, arguing that the federal funds rate is outdated. She pointed out that the current market environment is more suitable for using the repo rate as a policy target to enhance the effectiveness of monetary policy. Logan emphasized that updating the monetary policy implementation mechanism is an important part of achieving efficient central bank functions and called for such changes to be made when the market is stable

In a speech delivered on Tuesday and an accompanying commentary, Dallas Federal Reserve President Lorie Logan proposed replacing the Federal Reserve's benchmark federal funds rate (the primary tool the Fed has used to regulate the national economy since the 1980s) with a more widely used market indicator.

Market participants believe this debate has long been overdue. Mark Cabana, head of interest rate strategy at Bank of America, stated, "We have long argued that the Fed should shift its policy target from the federal funds rate to the repo rate, which is a step in the right direction. Why is Logan doing this? Because no one is taking action on it right now. She needs to push this forward. She has already done that with this speech."

The key issue is whether the central bank will link the benchmark rate to a sufficiently significant market that can reflect the fluctuations in short-term funding demand across the entire financial system. The federal funds market, which used to be a venue for overnight lending between banks, has significantly shrunk. Over the past 15 years, it has been largely replaced by the repo market, which is also a form of short-term borrowing.

This market is open to a broader range of financial participants and offers more attractive rates. This means that abandoning the federal funds rate would allow the Fed to operate in a more stable and mature market, potentially enhancing the effectiveness of monetary policy.

Logan stated in prepared remarks at an event at the Richmond Fed on Thursday, "The Federal Open Market Committee (the Fed's decision-making body) should now begin preparing to set a different short-term interest rate target."

Logan believes that the federal funds rate target is outdated and that the connections between the rarely used interbank market and the overnight money market are very weak and could suddenly break. She indicated that updating the mechanism by which the Fed implements monetary policy would be part of achieving efficient and effective central bank functions.

Preemptive Action

For years, market participants have called for the Fed to abandon the federal funds rate in favor of other benchmark rates. Fed officials have also considered doing so in the past, including during a review of its monetary policy implementation tools in 2018. Logan pointed out that the best time to make such changes is when the market is stable.

Logan said, "Some might argue that since everything is normal right now, there is no need to take action. But if the transmission mechanism between the federal funds rate and other money markets were to break down, we would need to quickly find a new reference indicator. And I believe making significant decisions under time pressure is not the best way to promote a strong economy and financial system."

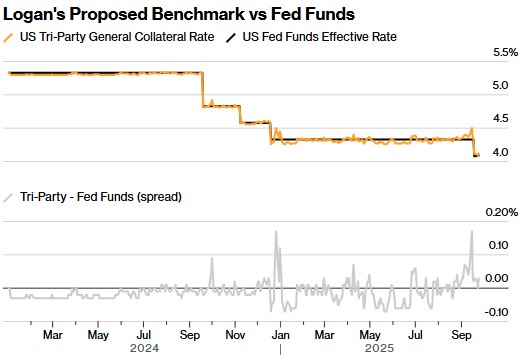

Before becoming president of the Dallas Fed in 2022, Logan worked for over twenty years in the financial markets department of the New York Fed, ultimately managing the central bank's balance sheet. She frequently comments on issues related to financial markets, including stability and liquidity, and is regarded as an authoritative voice on such topics within the Fed Logan listed various ways the Federal Reserve ensures interest rates remain within the specified range, but he stated that the Tri-Party General Collateral Rate (TGCR) may provide the greatest benefits.

TGCR is one of three rates associated with overnight repurchase agreements (in addition to the widely used Secured Overnight Financing Rate (SOFR)), regulated by the New York Fed. Market participants believe that TGCR would be an ideal alternative to the federal funds rate, as it represents a more robust lending market.

Federal Funds Rate Outdated

Logan pointed out that the daily trading volume covered by TGCR exceeds $1 trillion, so any changes can smoothly transmit through the money market. Currently, the average trading volume of federal funds is less than $100 billion.

The federal funds market was once the primary venue for overnight loans between financial institutions. Therefore, changes reflected in this market's financing conditions can affect long-term loan rates for businesses and consumers.

However, during the financial crisis and the pandemic, the U.S. government implemented massive monetary stimulus measures, which flooded the country's banking system with a large amount of dollars, most of which were deposited at the Federal Reserve. This largely eliminated the need for banks to lend to each other, as they needed to maintain minimum reserve requirements.

Cabana stated, "Currently, the federal funds rate market is primarily dominated by a small number of participants, so it does not accurately reflect the conditions of the entire market."

Logan remarked, "The trend of private activity shifting to a secured market, from my perspective, suggests that the ultimate target rate may need to be adjusted. If the target rate must be adjusted, the best timing for that adjustment should be when the market is operating smoothly and market participants can be fully informed in advance."

Logan also emphasized that the process of adjusting the federal funds rate would not affect the Federal Reserve's current plan to reduce its balance sheet, nor would it have a broad impact on its monetary policy strategy.

Federal Reserve observers view this benchmark as a tool for regulating the flow of credit in the economy. However, the real "valve" currently controlling the situation is a set of rates determined by policymakers, known as "managed rates," which include the Interest on Reserve Balances (IORB).

TD Securities strategist Jan Nehruzi stated, "Shifting from the federal funds market to the repo market makes a lot of sense because the latter is much larger. The day-to-day fluctuations in the repo market are greater but are still valuable for reference. The federal funds rate will remain stable until it no longer has stability."

The design goal of the federal funds rate is to fluctuate within a range of 25 basis points, but until this week, it had hardly fluctuated over the past two years unless the Federal Reserve itself adjusted its rate policy.

In contrast, TGCR changes daily. Logan stated that as long as its fluctuation remains within the 25 basis points range set by the Federal Reserve (if it becomes the primary policy tool), this manner of fluctuation is acceptable.

Logan said, "We can tolerate moderate market fluctuations. This way, we can utilize existing simple and efficient tools to maintain interest rate control without large-scale, frequent, or complex operations." Other Federal Reserve officials have also pointed out the issues present in the federal funds market. Roberto Perli, who succeeded Logan as the manager of the securities portfolio at the New York Federal Reserve Bank, had previously viewed the federal funds rate as one of many indicators reflecting the state of the money market, which also includes domestic lending conditions and banks' intraday overdrafts. However, at an event in March, Perli acknowledged that this rate does not change with the daily fluctuations of reserves.

Beth Hammack, who worked at Goldman Sachs for thirty years and became the president of the Cleveland Fed last year, has also stated that policymakers should question the rationale of setting the federal funds rate as a target.

Darrell Duffie, a finance professor at Stanford University, stated, "It is clear that the federal funds rate is not an appropriate indicator for setting U.S. monetary policy, as this rate is not used frequently. The reality is that the tail is wagging the dog. We should follow Logan's suggestion and adopt a more robust and significant indicator that can more comprehensively reflect the lending conditions in the wholesale financial market."