Why is the US stock market on the rise? JP Morgan strategists say this factor may be the key driver

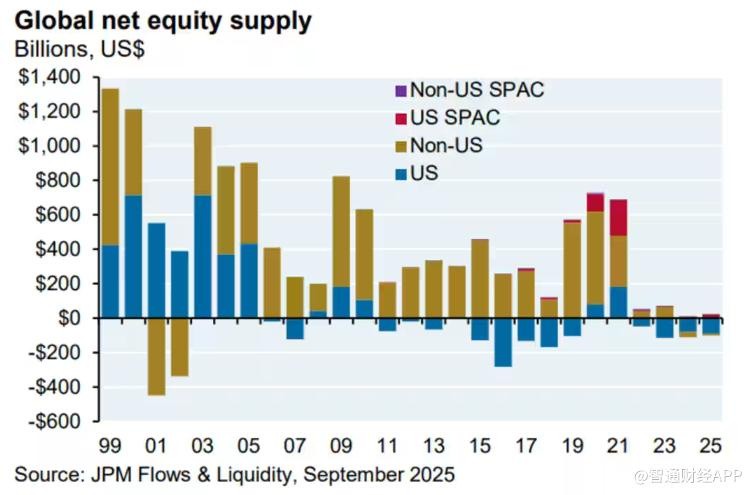

JP Morgan strategist Michael Cembalest pointed out that a key factor behind the continuous rise of the U.S. stock market since the 2008 financial crisis may be the imbalance between supply and demand in the stock market. Since 2011, the net supply of the U.S. stock market has decreased, with corporate stock buybacks and inflows from pension funds providing support for the market. Despite experiencing multiple sell-offs, the market has shown resilience, with only two instances evolving into a full-blown bear market

According to Zhitong Finance APP, since the global financial crisis in 2008, the U.S. stock market has continued to rise steadily. The profit margins of large American companies have been expanding, and earnings volatility has significantly decreased, providing solid support for the stock market's rise. The global research team at Bank of America pointed out that the companies in the S&P 500 index have almost completely eliminated floating-rate debt, resulting in healthier balance sheets. Meanwhile, technology giants represented by Microsoft (MSFT.US) and Apple (AAPL.US) have not only profoundly changed the global economic landscape but also generated enormous profits.

However, Michael Cembalest, chairman of the Market and Investment Strategy Group at JPMorgan Asset Management, recently pointed out in a report that a more overlooked factor may be driving the long-term rise of the U.S. stock market: the imbalance of supply and demand in the stock market.

Cembalest stated that since 2011, the net supply of the U.S. stock market has been continuously declining, and this trend has provided a "buffer" for the stock market during multiple market shocks. Cembalest said, "If you believe that supply and demand relationships affect the prices of goods and labor, then you should also believe that supply and demand conditions similarly affect the prices of financial assets."

According to the report data, since 2011, the overall supply of U.S. stocks, measured by market capitalization, has shown a contraction trend. The only exception was the brief increase in stock supply during the IPO boom in 2020 due to the pandemic. Cembalest pointed out that large-scale stock buybacks by companies are one of the main factors driving the decline in supply. At the same time, the continuous inflow of funds from pension plans (including fixed income and fixed contribution plans) has also provided stable buying support for the stock market. Although the proportion of these fund inflows relative to the total market capitalization of the S&P 500 has decreased in recent years, approximately $1.5 trillion still needs to find investment targets each year.

Under the dual effects of stable demand and declining supply, the U.S. stock market has shown unexpected resilience. Although investors have experienced multiple sell-offs since 2011, only two have truly evolved into a full-blown bear market: the crash triggered by the COVID-19 pandemic in March 2020, which was quickly recovered by the end of that summer, and the bear market in 2022, which led to the S&P 500 recording its worst annual performance since 2008.

On Thursday, all three major U.S. stock indices closed lower, with the S&P 500 index down 0.50%, the Dow Jones Industrial Average down 0.38%, and the Nasdaq Composite down 0.50%. This marks the first time since March of this year that all three indices have experienced three consecutive days of decline, indicating that short-term market sentiment remains cautious