市场最大 “黑天鹅”:AI 资本支出放缓,三大 “巨雷” 会是美股噩梦

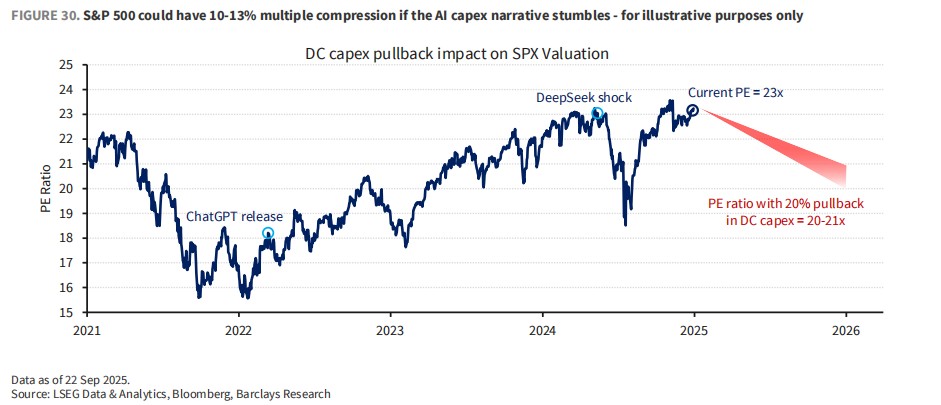

The Barclays stock strategy team pointed out that if capital expenditures for data centers decline by 20% over the next two years, the S&P 500 index will face a 3-4% downward pressure on earnings, and more seriously, valuations may drop by 10-13%. The report identifies three major risks: the efficiency improvement of AI models may lead to overbuilding of computing facilities; power shortages become a physical constraint on data center construction; and financing pressure when capital expenditure growth exceeds cash flow generation capacity

Despite the solid foundation of the AI investment theme, Barclays pointed out that the slowdown in capital expenditure for data centers could become the biggest systemic risk for U.S. stocks.

According to Hard AI, on September 25, Barclays' equity strategy team published a research report stating that if capital expenditure for data centers declines by 20% over the next two years, the S&P 500 index will face a 3-4% downward pressure on earnings, and more seriously, valuations could drop by 10-13%.

The report identified three potential "landmines" that could trigger this crisis:

- Technology and Efficiency Risk: The rapid improvement in AI model efficiency may lead to existing computing facilities being "overbuilt," reminiscent of the "dark fiber" tragedy during the dot-com bubble.

- Physical Limitation Risk: The increasingly severe power shortages are becoming an insurmountable "hard wall" for data center construction, potentially forcing a cooling of capital expenditure.

- Liquidity Risk: When capital expenditure growth begins to exceed cash flow generation capacity, financing pressures and depleted VC capital could become the last straw that breaks the camel's back.

The AI Boom is Solid, but Not Without Flaws

First, the report affirmed the solid foundation of the AI investment theme.

Even under a forecast of hundreds of billions of dollars in capital expenditure expected to grow by 30% annually, the market demand for computing power still far exceeds supply.

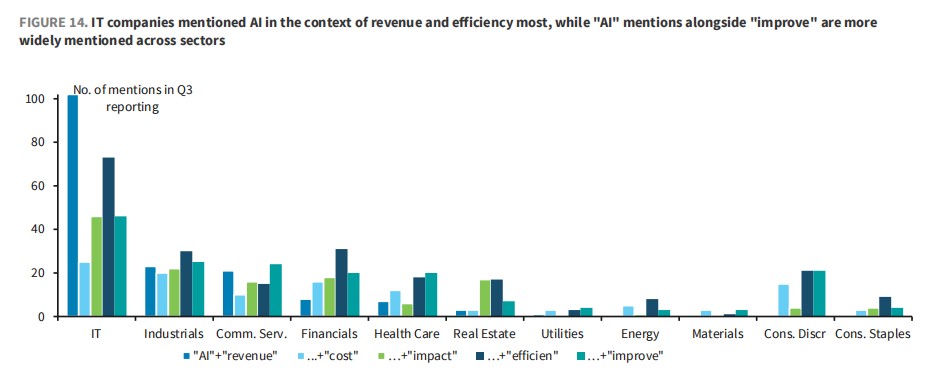

The proliferation of advanced reasoning models and AI agents has further pushed up the demand ceiling. Data shows that one in ten companies in the S&P 1500 index mentioned efficiency improvements brought by AI in their earnings reports.

The report compared the current capital expenditure/sales ratio of today's super giants (about 25%) with that of telecom companies during the dot-com bubble (over 40%), concluding that the current situation is relatively prudent.

Moreover, today's tech giants have a leverage ratio, with a debt/EBITDA ratio typically below 0.25, far lower than the heavily indebted telecom operators of the past, and their strong core business cash flow provides a solid backing for AI investments.

However, it is precisely this fervent pace of investment that has analysts beginning to examine potential "black swans"—what would happen if the growth engine of capital expenditure for data centers suddenly stalled?

The First "Landmine": Model Efficiency Improvement and the "Dark Fiber" Moment

The first bear market scenario envisioned in the report is that the development of AI itself may erode its infrastructure demand.

As model pre-training reaches data bottlenecks, incremental performance improvements become increasingly expensive, and AI labs may slow down their investments in new foundational models.

At the same time, the efficiency of models during the inference phase is becoming increasingly high and costs are decreasing. This "scissors gap" could lead to a fatal outcome: the massive computing power facilities that have been built face severe underutilization This is a replay of the "dark fiber" moment during the dot-com bubble—a large number of fiber optic networks laid to meet anticipated demand ultimately lay idle, dragging down the companies that built them.

The market sell-off triggered by the release of the open-source model DeepSeek-R1 in January has already previewed the market's deep concerns about this "efficiency stifling demand."

The Second "Giant Thunder": Hard Constraints of Power Shortages

More physically tangible than technological risks is the power crisis.

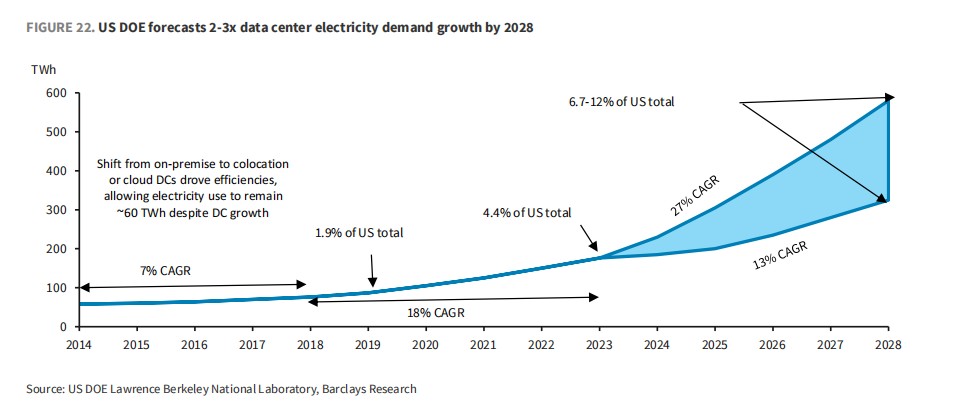

Data centers are well-known "power hogs," and their astonishing power consumption is putting immense pressure on the aging power grid in the United States.

The report cites predictions from the U.S. Department of Energy, stating that by 2028, data centers could account for 12% of the total electricity consumption in the U.S., nearly three times the level in 2023.

The pace of grid expansion simply cannot keep up with the growth in demand. Some regions are already showing signs of soaring electricity prices; for example, the grid supplying "Data Center Alley" in Northern Virginia has seen electricity prices soar by 22% for the 2026-27 fiscal year.

To address this issue, data centers are beginning to turn to self-built natural gas power generation and off-grid electricity, but this has led to a surge in gas turbine orders, with orders already booked through 2028.

Barclays emphasizes that we should not rule out the possibility of data center investments being passively slowed down due to "lack of available power."

The Third "Giant Thunder": Funding Exhaustion and Financing Pressure

The third risk comes from the funding aspect.

So far, the operating cash flow growth of tech giants has still been able to cover capital expenditures, but the gap between the two is narrowing.

Barclays believes that if capital expenditures begin to consistently exceed internal cash generation capabilities, future investment commitments will increasingly rely on external financing, thereby weakening the financial robustness of AI infrastructure construction.

In the private equity market, AI "unicorn" companies have locked in a value of up to $4.9 trillion, but due to limited exit channels, follow-up funding from venture capital is drying up.

Some giants like Oracle and Meta have conducted billion-dollar private credit transactions this year, also indicating a continued demand for external funding. Once the funding chain tightens, high capital expenditures will become difficult to sustain.

Barclays further emphasizes that investors should not underestimate the impact of a slowdown in AI capital expenditures on the overall U.S. economy.

According to estimates from Barclays economists, in the 1.4% GDP growth of the U.S. in the first half of 2025, investments related to data centers (computers, software, and data center construction) contributed about 1 percentage point.

This means that AI investment has become a key engine driving U.S. economic growth. If the U.S. economy falls into recession for other reasons (such as a deteriorating labor market), the synchronized slowdown in AI capital spending will act as an "accelerator," exacerbating the situation.

This means that AI investment has become a key engine driving U.S. economic growth. If the U.S. economy falls into recession for other reasons (such as a deteriorating labor market), the synchronized slowdown in AI capital spending will act as an "accelerator," exacerbating the situation.

The report believes that this negative resonance between macro and industry poses a much greater threat to the stock market than a single industry adjustment.

Limited Earnings Impact, Huge Valuation Risk

Analysts point out that the significant rise in AI-related stocks from 2023 to 2025 is primarily driven by valuation expansion. Once the growth story shows cracks, valuations will retract first.

Barclays conducted stress testing, simulating a scenario where total capital expenditures for data centers decline by 20% over the next two years:

Impact on Earnings (EPS) is relatively mild:

- It is expected to drag down the S&P 500 index's EPS for the fiscal year 2026 by 3-4%. This is because, apart from a few industries like semiconductors, data center business still accounts for a small proportion of revenue in most companies.

Impact on Valuation (P/E) is extremely severe:

- This situation will lead to a 10-13% compression in the overall valuation of the S&P 500 index.

- For industries that directly benefit from AI infrastructure construction, the average compression in P/E ratios could be as high as 15-20%.

Barclays emphasizes that investors need to closely monitor the development of these three major risk factors and consider appropriate hedging strategies to manage potential downside risks