Consumers pursue cost-effectiveness, American middle class loves Costco, last season's revenue exceeded expectations with an increase of over 8% | Earnings report insights

As of the end of August in the fourth fiscal quarter, Costco's revenue grew slightly faster than the previous quarter, with EPS earnings and e-commerce continuing to grow at double digits. Same-store sales growth, excluding gasoline and foreign exchange fluctuations, was 6.4%, exceeding expectations, and membership fees accelerated growth by 14%. The performance reflects the resilience of the warehouse membership retail model in the current economic environment. Update

America's middle class favorite—Costco, the largest membership-based warehouse supermarket in the country, reported a significant increase in both profit and revenue in the last fiscal quarter, reflecting the resilience of the membership warehouse retail model in the current economic environment. Faced with high tariffs and a weak labor market, American consumers maintain strong demand for essentials and seek affordable, high-quality products.

After the earnings report was released, Costco's stock price, which fell about 0.2% on Thursday, briefly turned positive in after-hours trading before returning to a downward trend, with after-hours losses reaching 1%. At the end of last month, it was commented that retail giants Walmart and Costco's valuation levels far exceed reasonable ranges, with Walmart at 34.3 times and Costco at 47 times, both higher than Nvidia's 34 times. In this context, caution is warranted regarding stock price corrections.

On September 25th, Eastern Time, Costco announced its financial data for the fourth quarter of fiscal year 2025 (ending August 31, 2024).

1) Key Financial Data:

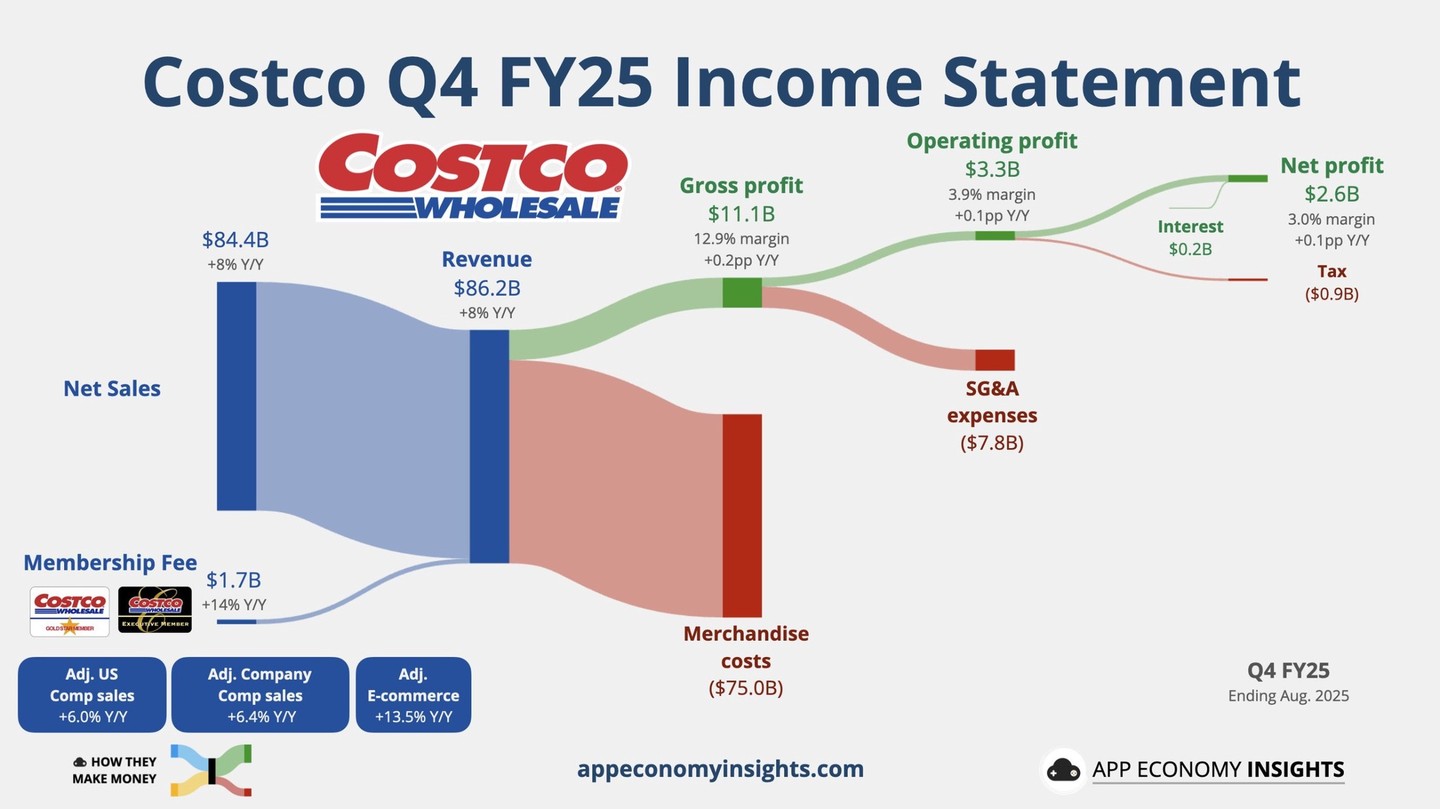

Revenue: Total operating revenue for the fourth quarter was approximately $86.16 billion, a year-on-year increase of 8.1%, compared to analyst expectations of $86.03 billion, and a year-on-year increase of about 8% in the previous quarter.

EPS: Diluted earnings per share (EPS) were $5.87, a nearly 11% year-on-year increase, compared to analyst expectations of $5.80 and a year-on-year increase of 13.2% in the previous quarter.

Same-store Sales: Including the impact of gasoline prices and foreign exchange factors, same-store sales grew by 5.7% in the fourth quarter, compared to analyst expectations of 5.85% and a growth of 5.7% in the previous quarter; excluding these impacts, same-store sales grew by 6.4%, compared to analyst expectations of 6.21% and a growth of 8.0% in the previous quarter.

2) Segment Business Data:

Net Sales: Net sales for the fourth quarter were approximately $84.43 billion, a year-on-year increase of about 8%, consistent with the previous quarter's growth of 8%.

Membership Fees: Membership fees for the fourth quarter were $1.724 billion, a year-on-year increase of 14%, compared to a growth of 10.4% in the previous quarter.

E-commerce: Excluding the impact of gasoline and foreign exchange fluctuations, e-commerce grew by 13.5% in the fourth quarter, compared to a growth of 15.7% in the previous quarter.

Fourth Quarter Revenue Growth Slightly Accelerates, EPS and E-commerce Continue Double-Digit Growth

The earnings report shows that Costco's revenue grew by 8.1% year-on-year in the fourth quarter, slightly higher than the previous quarter and above analyst expectations of nearly 8%, consistent with the growth rate for the entire fiscal year. Revenue for fiscal year 2025 is projected to be $269.9 billion, an increase of about 8.1% from the previous year In the fourth quarter, Costco's EPS earnings maintained double-digit growth, while analysts expected growth to be less than 10%, a slowdown from over 13% in the previous quarter.

Excluding the impact of gasoline prices and foreign exchange fluctuations, Costco's same-store sales growth in the fourth quarter slowed to 6.4% from 8% in the previous quarter, but was still slightly above analysts' expectations. In the fourth quarter, Costco's membership fees again grew in double digits, accelerating to 14% from the previous quarter, while net sales growth remained flat compared to the previous quarter. Costco's e-commerce growth slowed compared to the previous quarter but still exceeded 10%.

Membership Model Shows Resilience to Economic Fluctuations

Costco has seen strong sales growth in recent years, attracting consumers with competitive prices, a constantly changing product mix, and the popular Kirkland private label. Compared to other companies, Costco is more resilient to macroeconomic fluctuations because its customers must pay a membership fee to shop, and they tend to be wealthier and more loyal than competitors' customers.

Media reports indicate that many retail giants have recently announced better-than-expected results, benefiting from stable consumer spending patterns. However, this trend will face challenges in the coming months as inflation driven by increased tariffs begins to take hold. Growing concerns about the job market are also undermining consumer confidence.

Strategies to Address Rising Costs

In response to rising costs, Costco previously stated that it would maintain stable prices on certain products or stop selling items that become too expensive. The company has increased sourcing of locally produced goods, including mattresses and pillows. Additionally, the company is enhancing in-store services, such as extending operating hours for premium members to stimulate more spending.

Costco's competitor, Sam's Club under Walmart, has also achieved healthy sales growth. Sam's Club CEO Chris Nicholas stated this week that consumers are spending in a stable and rational manner, still willing to open their wallets when they find discounted products.

Although some product prices have increased due to tariffs, Sam's Club is working closely with suppliers to maintain low prices. Nicholas cited that the company still sources roses from Ecuador but packages them in the U.S. to reduce costs. Since warehouse membership stores offer a limited variety of products, they are also more flexible in product selection