Signals of a late-stage bull market in U.S. stocks are emerging: Investors are worried about missing out

Signals of a late-stage bull market in U.S. stocks are emerging, with investors worried about missing a potential year-end rebound. The derivatives market shows that the cost of call options has risen to its highest level since January, and the S&P 500 index has reached a new all-time high. Despite increasing downside risks, investors continue to pour in funds, particularly in the artificial intelligence sector. Analysts point out that the year-end target of 7,000 points is closer, with some trades betting that the S&P 500 index will rise another 11%. However, the desire to chase gains may expose risks, and investors are advised to maintain downside hedges

Despite concerns about whether the U.S. stock market is in a bubble, investors who had previously hedged against downside risks are now starting to worry about missing out on a potential year-end rally.

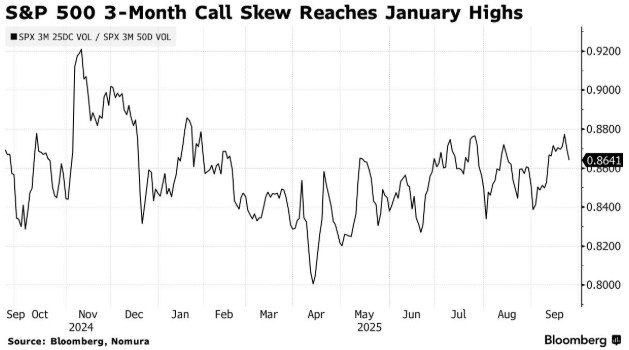

According to Zhitong Finance APP, the derivatives market has signaled that a measure of the relative cost of call options has risen to its highest level since January. As the S&P 500 index continues to hit record highs, the previously rising costs of downside protection have begun to decline.

This behavior appears to be typical late-stage bull market behavior—despite the accumulation of downside risks, the upward momentum is gaining strength. The fourth quarter has historically been one of the strongest periods for the stock market, so with the S&P 500 index breaking through 6,600 points this month, the biggest concern is missing out on the rally.

Joseph Ferrara, an investment strategist at Gateway Investment Advisers, stated, "As we approach year-end, the 7,000-point threshold is much closer than many expected."

The latest upward momentum in the U.S. stock market comes from investors continuously pouring funds into the artificial intelligence sector and the Federal Reserve's interest rate cuts. Meanwhile, the threat of a government shutdown is becoming increasingly apparent, the labor market remains weak, and stock valuations have reached levels seen during previous market bubble periods.

Bullish investors are not backing down. Charlie McElligott, managing director and cross-asset strategist at Nomura Holdings, noted that some recent options trades have placed heavy bets that the S&P 500 index will rise another 11% from current levels.

He stated on a call, "What people are more concerned about is the right-side tail risk: you see trades like the S&P 500 reaching 7,400 or 7,500 points by year-end." He added that traders "are more worried about this breakout rally" than the possibility of a market decline.

However, the desire to chase gains can expose bullish investors to risks. McElligott urged investors to maintain downside hedges, even though the costs of doing so have eroded investment returns over the past four months.

McElligott remarked, "These hedge positions are indeed causing people to bleed to some extent—it's not a good feeling to sacrifice performance when the market is just going up." However, with the Cboe Volatility Index below 17 points—about 3 points lower than the long-term average—any pullback could be faster and deeper due to the behavior of certain automated investment strategies by hedge funds.

He said that even if the stock market drops by 1%, you "will see absolutely imbalanced, non-emotional, mechanical de-risking flows because realized volatility is too low."

McElligott advised, "Don't give up these hedge positions; continue to roll your hedges. You have performance to cover these costs." Additionally, the costs of this downside protection remain low Ferrara stated: "The price of put options is still relatively cheap."

Mike Aligott suggested that bullish investors need to be selective if they want to chase further gains. He recommended buying call option spreads instead of over-allocating to stocks—especially those tech companies with high valuations that are leading the market. A call option spread is a tool that gives investors the right to buy stocks or indices at a specific price; the same investor finances the position by selling a call option with a higher strike price.

He added: "Maintain exposure to upside risk, especially in the semiconductor, artificial intelligence, and big tech sectors, where the skew of call options is very steep." However, for investors who do not want to trade derivatives—or cannot trade due to compliance reasons—there are simpler alternatives. Investors can buy mutual funds and ETFs to hedge against downside losses at the cost of limiting upside potential.

The Gateway company, where Ferrara works (a subsidiary of the French bank Société Générale), offers a mutual fund that sells call options and buys put options on the S&P 500 index. Since early July, the fund has attracted $219 million in capital, indicating that investors are still willing to give up some upside gains in exchange for protection